Cash flow statements are an extremely useful but often overlooked tool among business owners.

If calculated properly, and implemented correctly, the information you learn from a cash flow statement (CFS) can show in detail the steps that need to be taken in order to boost efficiency, increase sales, and cut costs down dramatically.

What is a Cash Flow Statement?

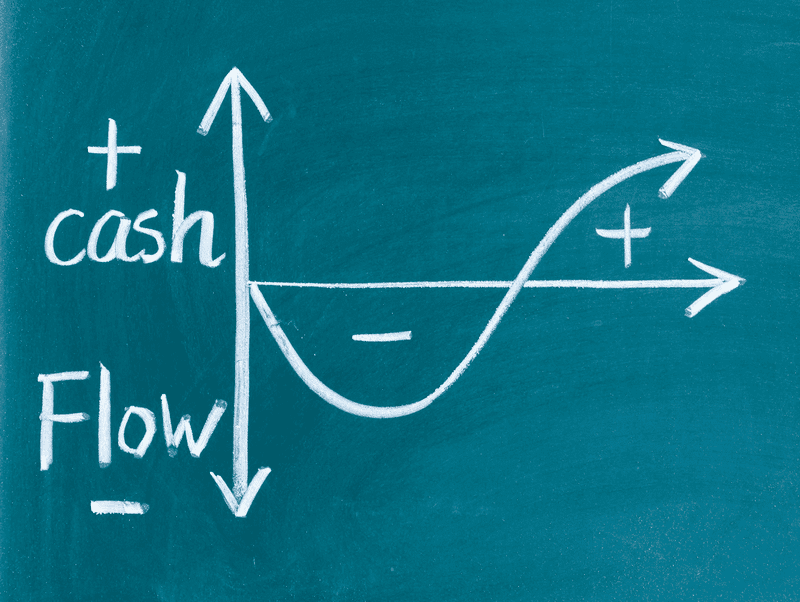

A cash flow statement is a detailed record of how much capital is flowing in and out of a business. The types of capital accounted for in the statement include both cash, and cash equivalents such as assets and investments, which will be explored later on.

The most effective cash flow statements detail exactly where and how much specific streams of capital is flowing to or away from. The information gathered in this report will show clearly how your business can save thousands, increase profits, and boost the efficiency of your core operations and management strategies.

3 Main Uses of a CFS:

- Reveal Your Company’s Financial Health. Information learned from cash flow statements gives you an excellent analysis of the efficiency and effectiveness of how your business handles capital. CFS’s make it easy to take immediate action in patching up the parts of your business that are bleeding money, and discover how other operations may be generating you more money than you think.

- Predict Future Cash Flow. Can cash flow statements help business owners see into the future? In a way, yes – a CFS is the closest most business owners get to owning a crystal ball. You can get a very accurate idea as to how much your business will lose or generate based on the detailed patterns of cash flow into and away from specific operations in your business’s history.Want to know how much that new product launch will cost you, vs. generate long-term? Thinking about whether or not that new equipment will be worth the investment? Take a close look at how your business faced similar business ventures in the past with your CFS to learn from past mistakes, capitalize on your successes, take out the guess work, and most of all – maximize your cash flow!

- Trim Fat, and Cut Costs! Determining which operations need to be streamlined, boosted, adjusted or cut altogether is one of the most common uses of cash flow statements.Since the record shows exactly where a business is gaining or losing capital, investments in each core department – or even individual jobs – are easily audited to determine whether or not specific functions, tasks and strategies are working as best as they could be.Cash flow statements are used by businesses ranging from the smallest mom-and-pop shops, to the largest corporations to help business owners save thousands to millions of dollars each year.

How to Make a Cash Flow Statement: 3 Easy Steps

The flow of cash in and out of a company is most accurately calculated after taking into account capital lost and generated through through three main channels: core operations, investments, and financing. Each must be broken down and separated into many individual parts in order for an accurate calculation can be made.

Here are the calculations that need to be made within these three components in order to get the most accurate cash flow statement possible:

- Investments: Investment calculations are only “cash-out” expenses, as cash is flowing out from your company in order to purchase/invest in new equipment, assets and other business ventures. This is an extremely crucial component to every cash flow statement that shows if and where a business is getting a return on their investments, and which investments show losses.

- Financing: This includes any activities such as borrowing from a bank or business financing company. Any debts or money owed to pay off, for example an SBA loan, small business loan or business line of credit must be accounted for to show:

- A) How conducive your financing activities have been to business growth.

- B) How fast you got a return on your funding investment.

- C) Whether or not the financing option you obtained is truly the best fit for you.

- D) What terms would fit the model of your business even better next time you borrow?

- Core Operations: This component is all about how much your business makes and/or loses from each individual product and service you offer. It also takes into account any changes in cash involving accounts receivables, depreciation, and inventory. The end total of course will be your net income. A fast and simple way to calculate this is to add or subtract differences in revenue, expenses, and credit transactions. Core operations calculations should also include expenses involving non-cash items, such as the value of any assets and liabilities. For the most accurate information, any assets involved should be re-evaluated as close to the time of calculation as possible. Keeping close attention to depreciating costs of equipment is extremely important when auditing the necessity and money-generating power of each revenue stream. Any amount deducted from the total value of an asset should be added back into your net sales channel when creating your CFS.

Once all these calculations are put together and put into standard CFS format like this example here, money gained and lost from each component will be immediately clear, with the end result being your business’s ending cash balance, which is the amount of “free cash” your business has after all types of expenses and assets are audited.

Does Your Cash Flow Need a Boost?

Every business needs help smoothing over cash flow issues at some point. Maybe it’s due to seasonal fluctuations. Or maybe your cash flow needs a boost in order to capitalize on a once-in-a-lifetime opportunity. Whatever your needs may be, National Business Capital has all the financing options and business services you need to cut costs, increase profits, and maximize cash flow!

Whether you need cash to fill in gaps between slow payments, ride out downturns in customer volumes, or fund the growth and expansion of your business, our vast variety of funding options and services are specialized to get small businesses the cash they need in as little as 24 hours, regardless of credit score and extensive financial history.

All you have to do is fill out this free, 1-minute application online. A Business Financing Advisor will call you in seconds to ask you what exactly you need, and how you wish to grow your business. Or, give them a call yourself at (877) 482-3008, and get the ball rolling immediately!