Q3 2021 Small Business Growth Index

NBC’s quarterly report on small business-related economic trends. This report covers small business trends and findings for Q3 2021.

Executive Summary

The National Business Capital Small Business Index Growth Report is a quarterly report on small business-related economic trends. This report covers small business trends and findings for Q3 2021. Research was conducted utilizing open-source intelligence, public databases, and sources such as the Small Businesses Administration, NAICS Association, U.S. Census Bureau, and other sources.

Insights From Joe Camberato, CEO of National Business Capital

Small Business Insights & Trends

Small Business Optimism Index

Loans in 2021

Small Business Administration Loans

Payment Protection Plan (PPP) Loans in 2021

Total Amount of Businesses in 2021

Unemployment in Q3 2021

Number of Firms By Industry

Sources

Insights From Joe Camberato, CEO of National Business Capital

Insights From Joe Camberato, CEO of National Business Capital

At National Business Capital, we’re seeing mixed optimism from the thousands of businesses we work with every month. A lot depends on specific industries – but on one hand, confidence levels are increasing as businesses look to spend, reinvest, and take on new employees.

The pandemic accelerated technological adaptation and innovative practices. This has had a tremendously positive impact on many small businesses – and contributed to a faster-than-expected recovery. Many businesses are now at or above their pre-pandemic revenue levels.

Nevertheless, challenges remain – particularly around hiring and supply chain issues. We’re finding that the businesses that have taken an out-of-the-box approach to attracting new hires – by focusing on company culture or other perks – have been the most successful.

And when it comes to supply chain disruptions, it’s critical to plan ahead. Businesses that pre-order and plan about 6 to 12 months out are seeing the most promising results. Everyone is dealing with these same challenges – and those who implement creative solutions are in a stronger position to win over the competition.

Most significantly, we’re currently in one of the best times to secure financing. We initially thought it would take years for lending to reach pre-pandemic levels, but the bounce back has been faster and stronger than expected. Lenders are offering some of the best rates we’ve ever seen. Funding amounts and terms are also higher and more flexible. It’s a great time to borrow and invest in growth, new hires, and other initiatives.

Small Business Insights & Trends

Small Business Insights & Trends

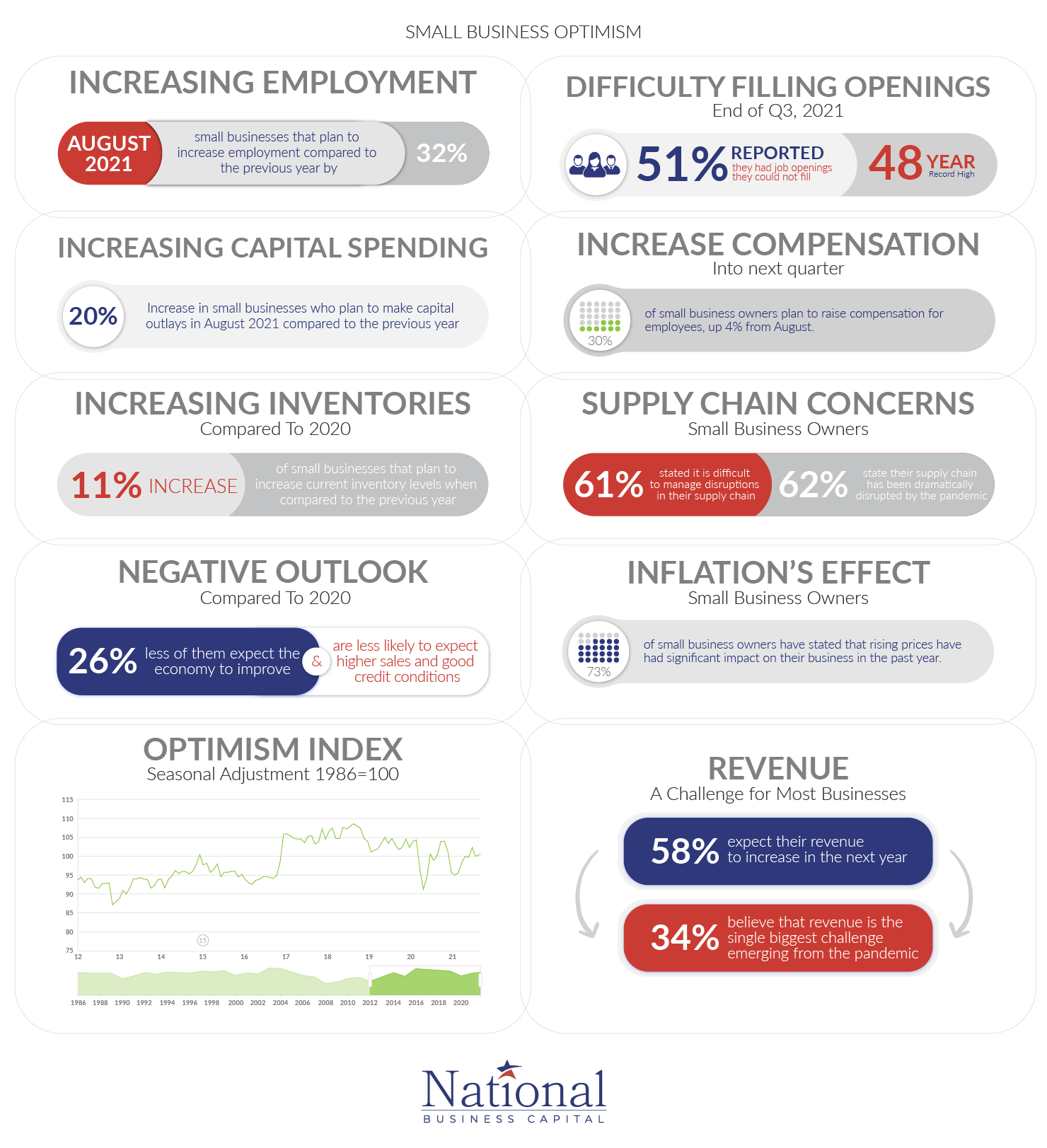

Small Business Optimism

As the Covid-19 pandemic subsides and markets reopens, businesses are looking to hire new workers and expand inventory to meet surging consumer demand. However, new challenges abound. As of now, the post-pandemic economy is categorized by inflation, labor scarcity, supply shortages, and other concerns. These factors have taken a toll on small business optimism.

Companies Are Increasing Employment

In August 2021, 32% more small businesses compared to last year said they plan to increase employment. (1) However, even as hiring picks up, many businesses are struggling to attract new hires.

For much of 2020, households were able to build up savings due to robust economic stimulus benefits and pandemic-related lockdowns that curtailed spending. Now, it appears many don’t have any urgency to return to work. A lack of skilled workers, aging demographics, and greater demand for increased pay are also fueling a tight labor market.

Small Businesses Increasing Capital Spending

In August 2021, 20% more small businesses than last year plan to make capital expenditures to maintain, upgrade, acquire, or repair existing machinery or assets. (1) The uptick is likely fueled by inflationary concerns as well as expectations that the Federal Reserve will raise interest rates in the coming months.

Increasing Inventories Compared to 2020

In response to supply shortages and rising consumer demand, an 11% uptick in small businesses from last year say they plan to increase current inventory levels. (1)

Businesses Generally Have a Pessimistic Outlook

Small businesses are significantly less optimistic about future economic conditions than they were last year. Compared to the same time period in 2020, 26% fewer businesses expect the economy to improve in the coming months. Businesses are also less likely to anticipate higher sales and good credit conditions. (1)

Inflationary concerns, supply shortages, and tight labor markets are causing business optimism to fall. Many business owners are also expecting the Federal Reserve to raise rates sooner than expected – which may impact credit conditions and interest rates.

Small Business Optimism Index

Small Business Optimism Index

Companies Are Having Difficulty Filling Open Positions

Labor constraints are affecting companies – both large and small – across various sectors of the economy. Small businesses are especially struggling. By the end of Q3 2021, a 48-year record high number of small business owners – 51% – reported an inability to fill job openings. (2)

Owners Planning to Increase Compensation

In response to labor constraints, small businesses are looking for ways to incentivize new hires. Heading into the next quarter, a net 30% of small business owners plan to raise employee wages. This figure represents a 4% increase from the August 2021 levels. (2)

Businesses are also looking into offering or improving company health coverage, increasing benefits, and even shifting company culture to allow more employees to work remotely.

Supply Chain Concerns Growing

The Covid-19 pandemic halted global production lines and created worldwide supply shortages. Even as factories reopen and manufacturing steadily picks up, small businesses continue to feel pressure.

As many as 62% have had their supply chains dramatically disrupted by the pandemic, and another 61% are finding it difficult to currently manage these supply chain disruptions. (3)

Inflation Affecting Small Businesses

Waves of economic stimulus in response to the Covid-19 pandemic, along with supply shortages, have fueled inflation. Prices are rising, and businesses are taking notice. Nearly three-quarters (73%) of small business owners have stated that rising prices had a significant impact on their business in the past year. (3)

In response to inflationary pressures, many businesses are transferring their costs over to consumers by charging more for the same products and services.

Many Businesses Continue to Face Revenue Challenges

Supply-side constraints and labor shortages are creating revenue challenges for many small businesses. The majority (58%) expect revenue levels to increase in the next year. However, a large percentage (34%) are finding revenue to be the single biggest challenge emerging from the pandemic. (4)

Loans in 2021

Loans in 2021

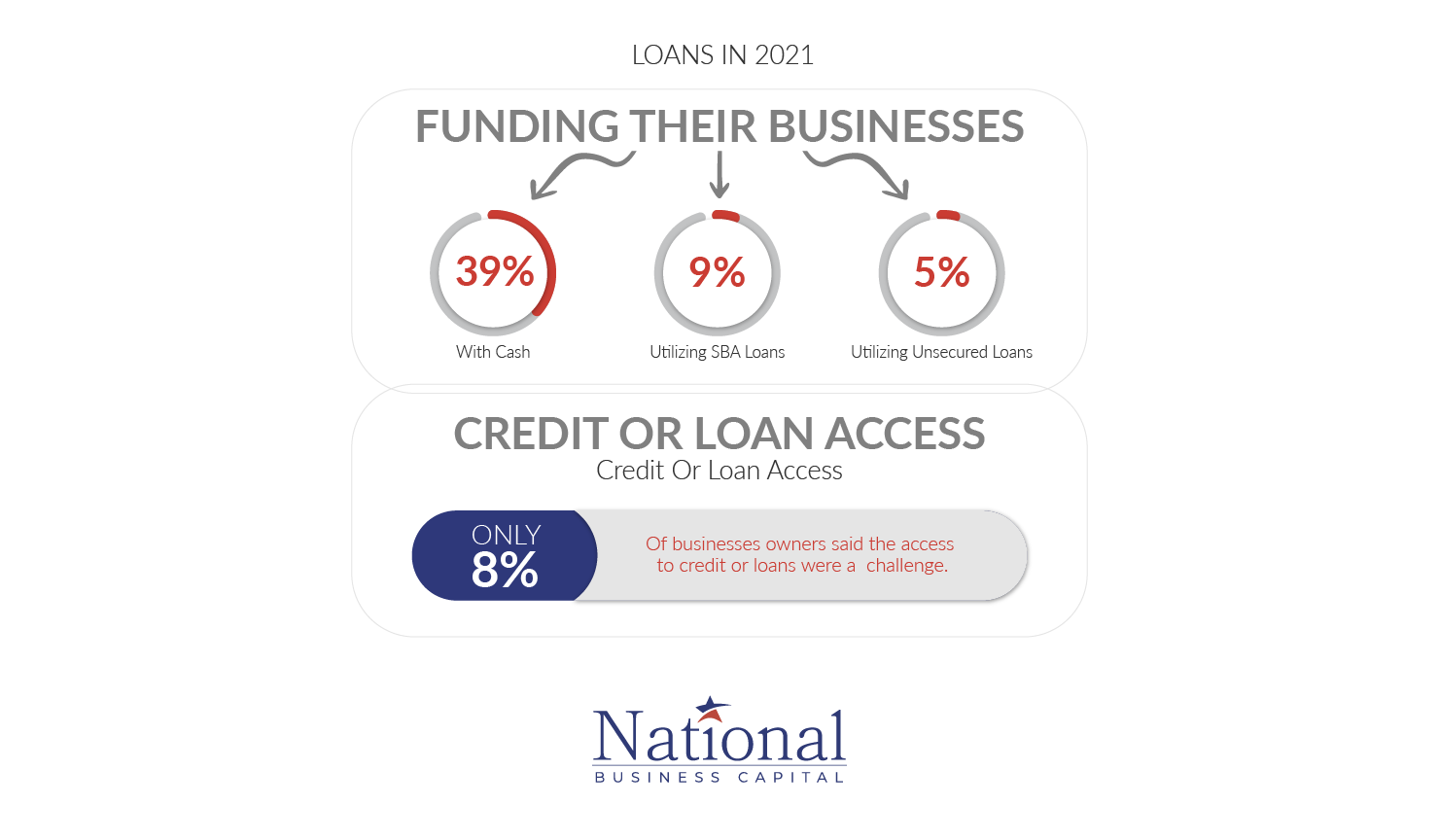

Business loans were a lifeline for many firms during the height of the Covid-19 pandemic – helping them stay afloat and manage cash flow disruptions. They continue to act as critical resources for working capital.

How Small Businesses are Funding Their Businesses in 2021

The majority (39%) of small business owners are funding their businesses with cash. Only 9% are using SBA loans, and another 5% are using unsecured loans to launch their business. (5)

Businesses commonly cite tight requirements, barriers throughout the screening process, and low approval rates as reasons why they’re unable to obtain financing. Small business financing can also be difficult to obtain in the early startup stages – especially with limited business history.

Loans and Credit Opportunities Remain Accessible

Businesses looking to obtain financing will benefit from a favorable lending environment. For Q3 2021, a mere 8% of small business owners reported access to credit or loans was a challenge.

Small Business Administration Loans

Small Business Administration Loans

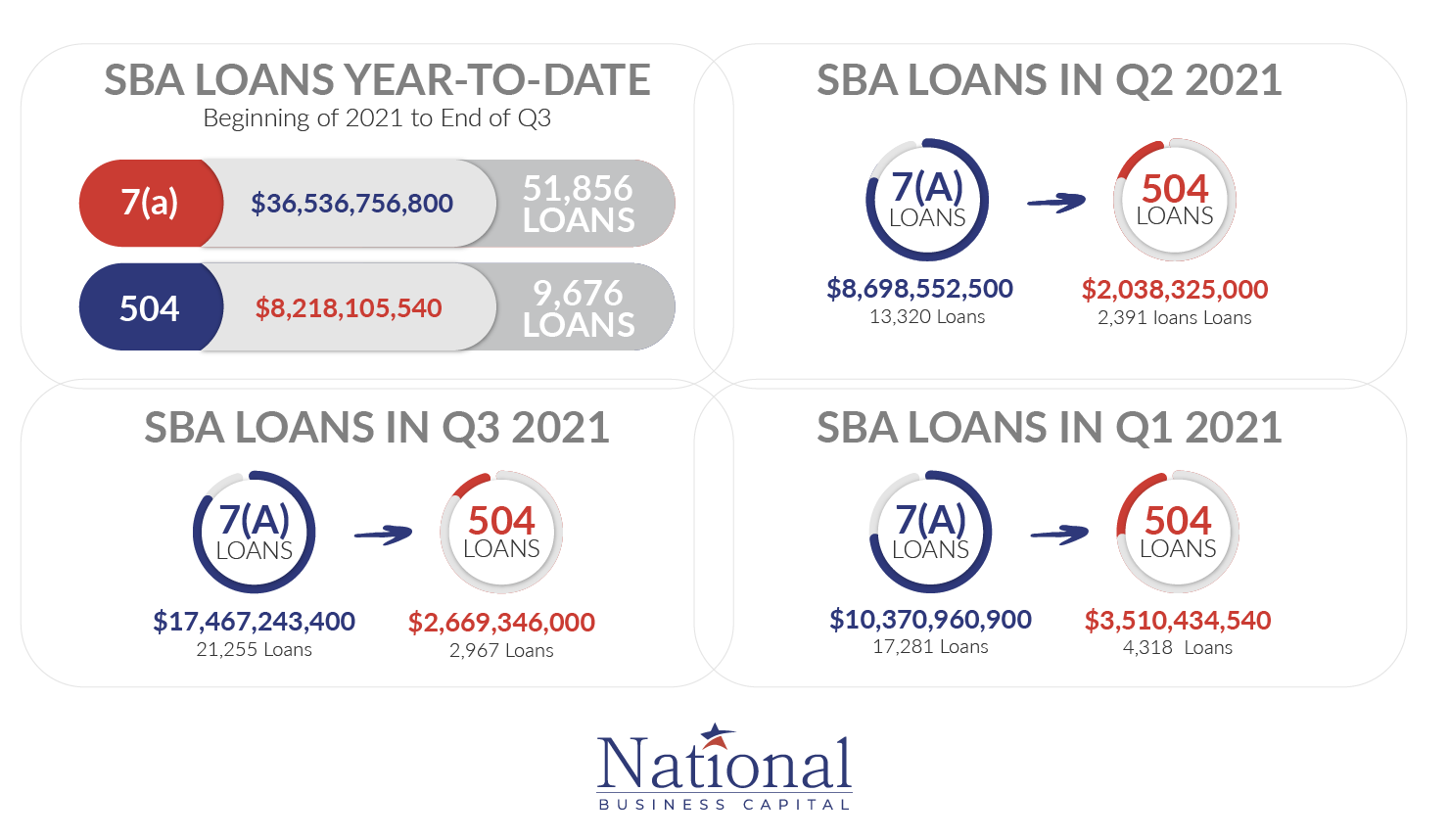

Small Business Administration (SBA) loans are a top financing choice for small businesses because of low-interest rates, long repayment terms, and inherent flexibility.

There are different types of SBA loans. 7(a) loans are the most popular and feature a wide range of qualifying expenses, high funding amounts (up to $5 million), and repayment terms of up to 25 years. 504 loans are another sought-after product. They share a similar structure to 7(a) loans but are primarily used for major fixed assets – such as real estate or machinery.

Amount of SBA Loans Year-to-Date

From the beginning of 2021 to the end of Q3, the SBA 7(a) program had guaranteed 51,856 loans – amounting to a total value of $36.5 billion. Businesses tend to use these loans to pursue growth opportunities, finance marketing initiatives, incentive new hires, and refinance debt. Many businesses also use SBA 7(a) loans to purchase or restore real estate or equipment. (7)

By the end of Q3, the SBA 504 program had guaranteed a total of 9,676 loans – amounting to a total value of $8.2 billion. Businesses use SBA 504 loans to purchase or construct new and existing buildings, facilities, land, machinery, and equipment. (7)

Amount of SBA Loans in Q3 2021

In the third quarter of 2021, the SBA 7(a) program guaranteed 21,255 loans – amounting to a total value of $17.5 billion. (7)

Throughout this time, the SBA 504 program also guaranteed 2,967 loans – amounting to a total value of $2.7 billion. (7)

Amount of SBA Loans in Q2 2021

In the second quarter of 2021, the SBA 7(a) program guaranteed 13,320 loans – amounting to a total value of $8.7 billion. (7)

Throughout this time, the SBA 504 program also guaranteed 2,391 loans – amounting to a total value of $2 billion. (7)

Amount of SBA Loans in Q1 2021

In the first quarter of 2021, the SBA 7(a) program guaranteed 17,281 loans – amounting to a total value of $10.4 billion. (7)

Throughout this time, the SBA 504 program also guaranteed 4,318 loans – amounting to a total value of $3.5 billion. (7)

Payment Protection Plan (PPP) Loans in 2021

Payment Protection Plan (PPP) Loans in 2021

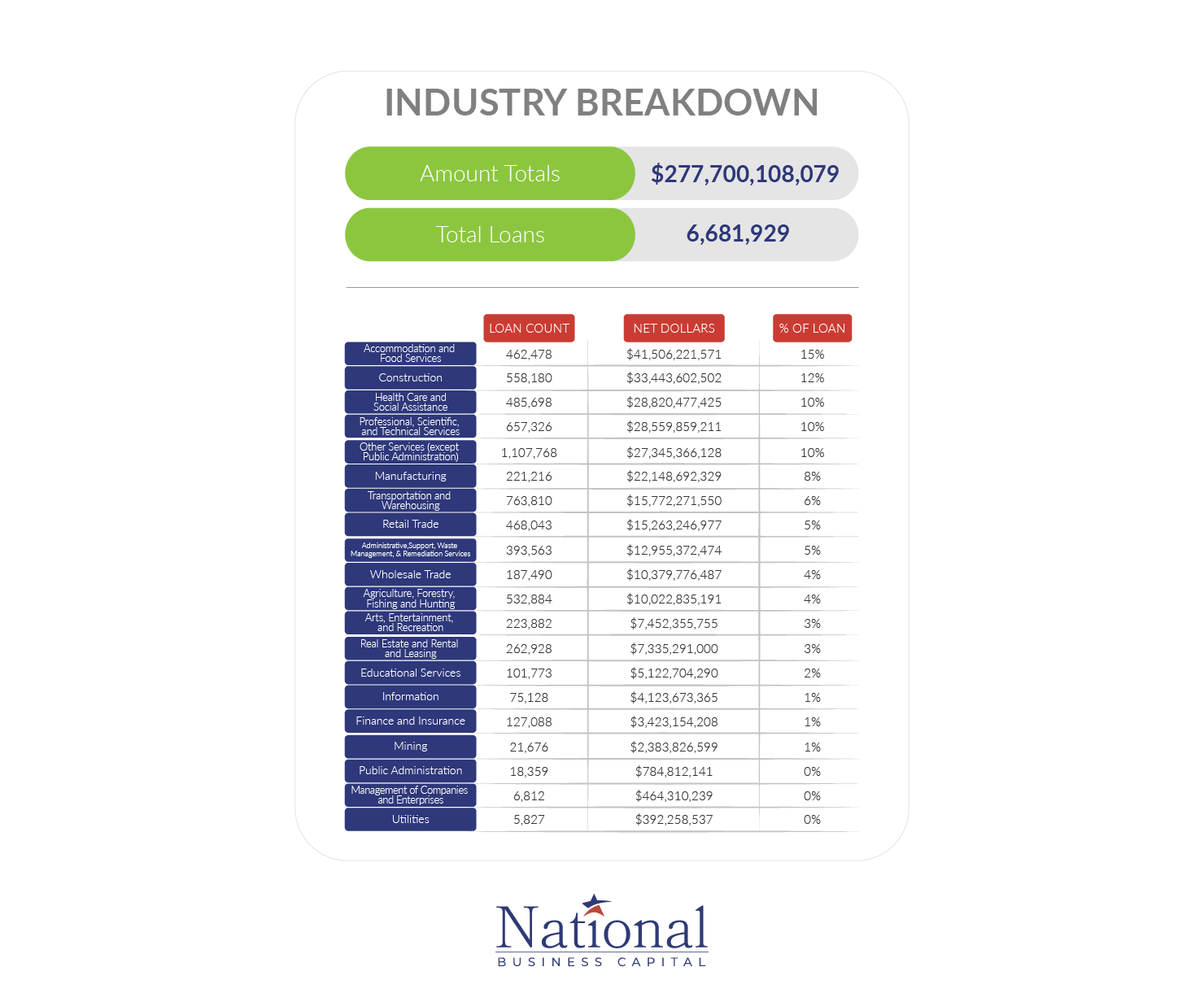

The SBA’s PPP loans provide critical economic relief for small businesses impacted by the COVID-19 crisis. Even as the economy moved towards recovery in 2021, many businesses still relied on PPP loans for assistance.

Although businesses were still being issued PPP loans up until Q3 2021, the total value borrowed is remarkably lower than 2020 levels.

A total of 6,681,929 loans, amounting to $277.7 billion, have been issued in 2021 so far. For comparison, 10.9 million PPP loans amounting to $782.2 billion were approved in 2020. (7)

PPP Loans by Industry

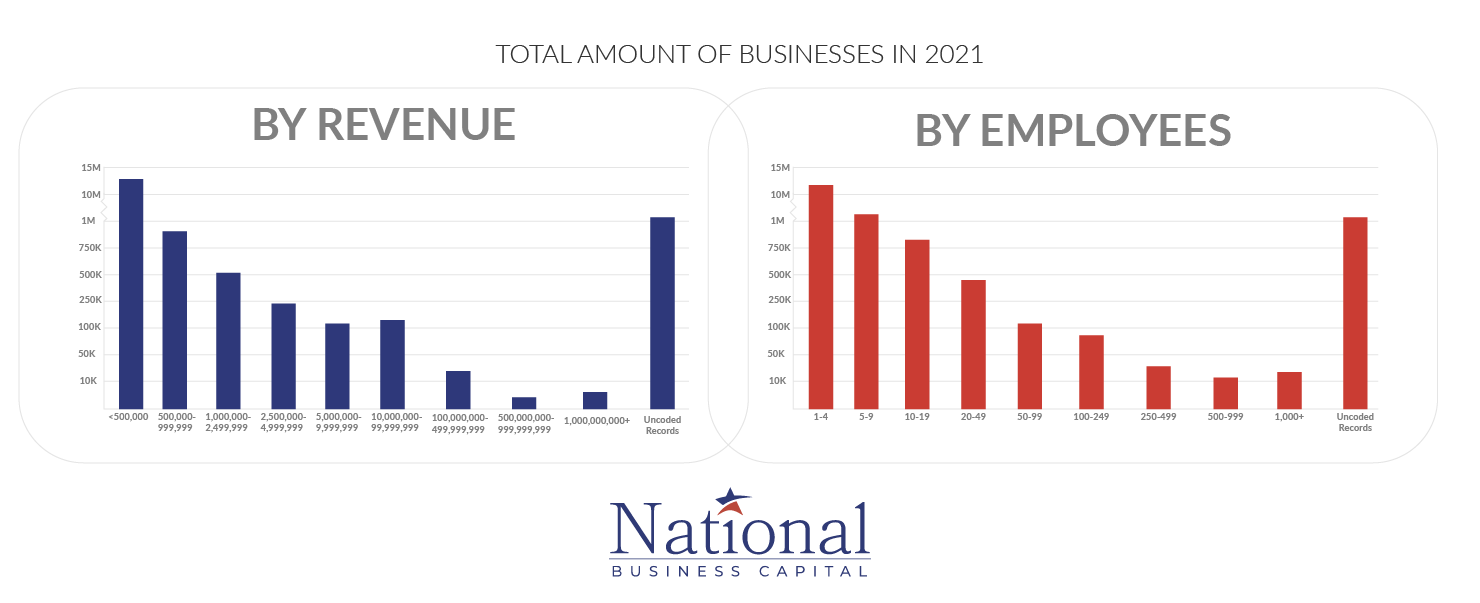

Total Amount of Businesses in 2021

Total Amount of Businesses in 2021

By Revenue & Number of Employees

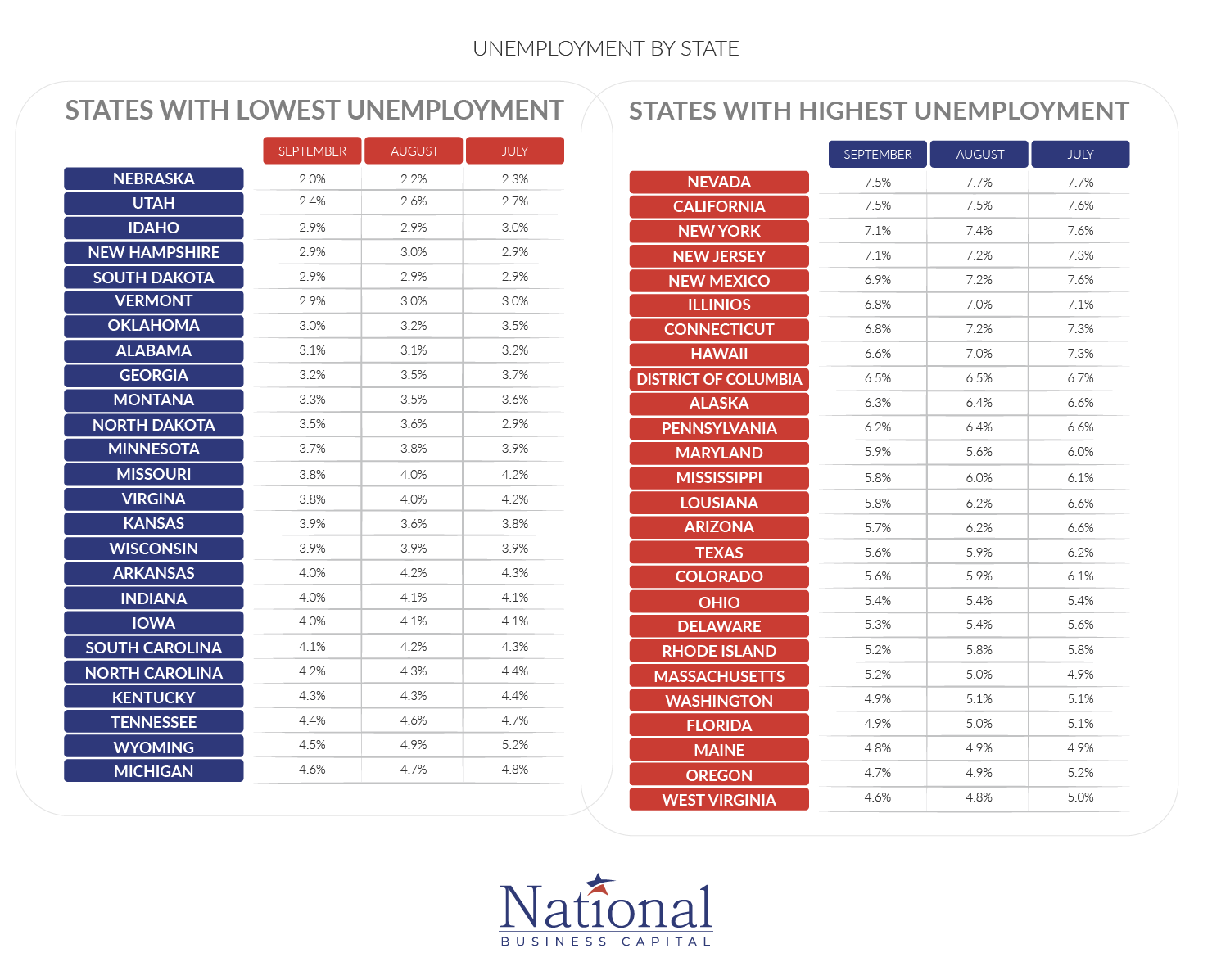

Unemployment in Q3 2021

Unemployment in Q3 2021

The number of unemployed Americans continues to fall as businesses struggle to find new hires and hold onto existing employees. Unemployment levels are expected to continuously drop throughout the end of 2021 and into 2022.

For Q3 2021, the U.S. unemployment rate stood at 4.8%. Although this figure is higher than what it was before the pandemic, it’s nonetheless lower than the pandemic high of 14.8% in April 2020.

Top States With Lowest Unemployment

States that reported the lowest unemployment levels in Q3 2021 were Nebraska, Utah, Idaho, New Hampshire, and South Dakota – respectively. Nebraska, Utah, and Idaho saw gradual decreases in unemployment levels over time. New Hampshire and South Dakota both started and ended the quarter with unemployment levels at 2.9%. (9) (10)

Top States With Highest Unemployment

Nevada, California, New York, New Jersey, and New Mexico had the highest levels of unemployment in Q3 2021 – respectively. All 5 states have unemployment rates above the national average. Nevertheless, unemployment levels in these states appear to drop over time. New Mexico saw the largest drop in unemployment levels over the 3 months, falling from 7.6% to 6.9%. (9) (10)

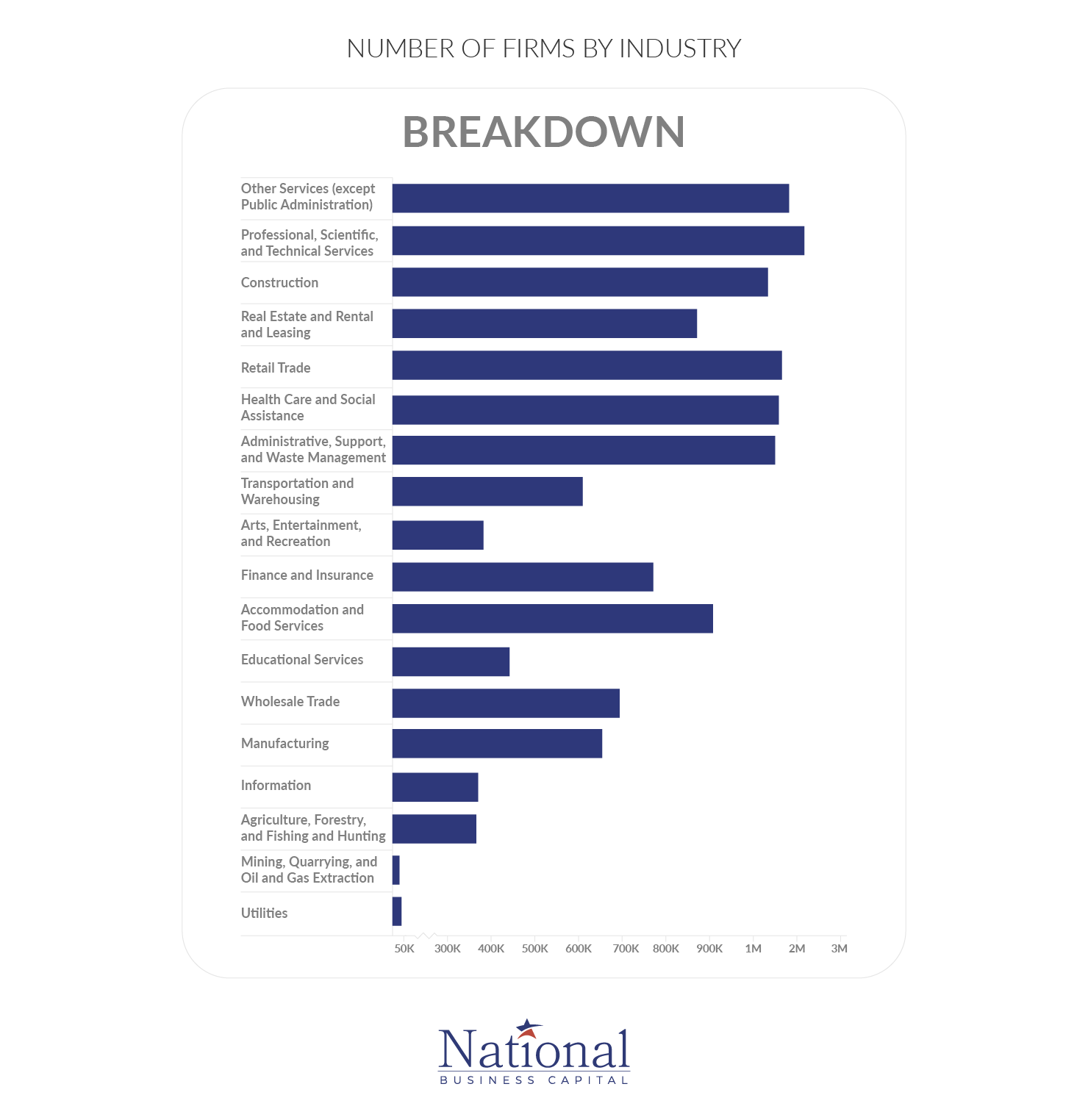

Number of Firms By Industry

Number of Firms By Industry

Throughout 2021, an increasing number of industries moved towards recovery and resumed growth. Educational services, transportation, manufacturing, healthcare, and accommodation and food services industry saw some of the biggest revenue recoveries in 2021 compared to 2020 levels.

Technology continues to hold a very positive growth outlook. The Covid-19 pandemic prompted businesses to use technology on a wider scale than ever before. Businesses will continue to adapt technology in the coming years as a means to improve productivity and cut costs. Automation tools also hold significant potential for mitigating labor scarcities.

Sources

Sources

- https://www.nfib-sbet.org

- https://www.nfib.com/surveys/small-business-economic-trends/

- https://www.uschamber.com/sbindex/summary

- https://www.uschamber.com/sbindex/quarterly-spotlight

- https://www.guidantfinancial.com/small-business-trends

- https://www.uschamber.com/sbindex/uploads/sbi_2021_q3.pdf

- https://www.sba.gov/

- https://www.naics.com/

- https://www.bls.gov/web/laus/laumstrk.htm

- https://www.ncsl.org/research/labor-and-employment/state-unemployment-update.aspx

National Business Capital

Accelerate your success with frictionless financing and expert advice that breaks down the barriers to growth for every entrepreneur.

Thrive with access to a business lending marketplace that’s built for entrepreneurs, by entrepreneurs. Experience a time-saving machine that cuts approval times from months to hours. Leverage an extensive network of over 75 lenders and teams of expert financing advisors to ensure you’ll always have access to the capital that best fits your business.

Working with NBC, gain a financing partner for the future, ensuring your business has the capital it needs to seize every opportunity and grow without limits.

National Business Capital. Grow to Greatness.

Hear From Our Customers

Ready to See Your Options?

Go from application to approval in hours, not days, with a streamlined process that merges high-tech with human-touch for high-efficiency financing.