Q2 2022 Small Business Growth Index Report

National’s quarterly report on small business-related economic trends. This report covers small business trends and findings for Q2 2022.

Executive Summary

The National Business Capital Small Business Index Growth Report is a quarterly report on small business-related economic trends. This report covers small business trends and findings for Q2 2022. Research was conducted utilizing open-source intelligence, public databases, and sources such as the Small Businesses Administration, NAICS Association, and U.S. Census Bureau, among other sources.

Insights from Joe Camberato, CEO of National Business Capital

Small Business Insights & Trends

Uncertainty Index

Business Loans in 2022 - Q2

Unemployment by State - Q2 2022

Number of Firms by Industry

Total Amount of Businesses 2022

Sources

Insights from Joe Camberato, CEO of National Business Capital

Insights from Joe Camberato, CEO of National Business Capital

“We’re still in this ever-changing economy, with rate increases becoming more and more common.

Right now, we’re dealing with a tight job market, inflation, and lingering talks of a recession, plus the added uncertainty stemming from war overseas. There are a lot of weird things happening, but as an owner, you need to protect yourself and look forward. We all have to be prepared for anything, especially because credit will continue to tighten up as we move closer to the end of the year. It’s super important that you’re actively planning for the future and know exactly how much you’ll need to run your business through Q4 and into the start of 2023. If you haven’t already, you should get your capital sources in line and start a growth plan, complete with fallback measures, to ensure you’re able to weather through a potential economic downturn.

Inflation might be slowing slightly, but its effects are still very evident across all our industries. Wages will continue to increase in correlation to inflation, as will the cost of materials, creating a costly situation for anyone who hasn’t prepared. Every business should strategize to grow both sales and profit to keep up with the rising costs. Those who don’t can potentially find themselves without the cash they need to pay their expenses in a few months if the bottom falls out. The rigid job market only furthers this issue, which makes it that much more important for entrepreneurs to stay competitive until we reach the other side of the tunnel. You really have to dial into your business and focus on sales, profit, and the origin of your revenue sources to ensure you have an accurate and complete picture of your business capabilities moving forward.

My point is: Everything is getting more expensive. You should be focused on doing more with less in your business. A lot of companies will get pulverized by inflation, the job market, and the potential recession, but you can protect yourself from the pressure with some forethought into what challenges your operation might face in the future. Ask yourself, “Can I automate processes or add technology to reduce some of these costs?” and “What can I do to drive more sales and revenue?” to get yourself in the right mindset.

It’s time to be laser-focused on every aspect of your business. If there’s an opportunity to save money for a rainy day, take advantage of it. The entrepreneur with the most capital will perform better than the person who tightened up their operation to shield themselves from changes in the economy.

Best advice? Eyes wide open right now.”

Small Business Insights & Trends

Small Business Sentiment

Job Openings Higher Than Average

Small businesses have been struggling to attract and retain talent since the beginning of 2021. Although 26% of surveyed employees regretted participating in the so-called “Great Resignation,” the tide has yet to shift in favor of small businesses.

Many small businesses, as much as 50% in June, reported struggling to fill open positions. This figure is significant as it’s 20 percentage points higher compared to the historical average. (1)

Small Businesses Spent Less and are Planning to Spend Less

As prices rise and fears of a recession loom, many businesses are tightening their belts and shifting away from additional expenses or investments. This is especially true when it comes to upgrading or acquiring new equipment or company assets, as measured by capital outlay statistics.

Only 51% of businesses surveyed reported spending on capital outlays in the past six months, representing a two percentage points decrease from May figures. Going forward, only 23% of small businesses plan to make capital outlays in the next few months. (1)

Small Business Owners Have Little Confidence in the Federal Reserve

Many businesses have lost trust in the government’s ability to manage inflation. Looking back on the height of the pandemic, many believe that quantitative easing measures went too far, with experts even admitting that the threat posed by inflation was largely misjudged.

It appears that distrust is still evident. Out of small business owners surveyed, only 27% of them stated that they are confident in the Federal Reserve’s ability to control inflation. (2)

Supply Costs Still Increasing

Supply chain disruptions, rebounding demand, and rising prices across the board have contributed to greater supply costs for small businesses throughout the past year. Unfortunately, this trend doesn’t appear to be reversing anytime soon.

Most recent estimates report that 75% of business owners stated they are currently experiencing rising costs of supplies— a figure that has been consistent for the past two quarters. Another 56% of small business owners also reported experiencing supply chain disruptions currently. (2)

Higher Interest Rates Expected to Have a Negative Impact

As the Fed is set to continue raising interest rates in order to combat rising inflation, small businesses are increasingly worried about the aftermath. When surveyed, 70% of small business owners expect higher interest rates to have a net negative impact on their business (2).

Dampening consumer demand, tightening financing markets, and the rising cost of debt are just some of the ways higher rates could hit small businesses.

Rising Costs Blamed for Lower Profits

In line with recession fears, many small businesses are reporting lower profits this quarter in comparison to last year.

Out of small businesses that reported lower profits, 30% blamed the rising costs of materials, 16% cited weaker sales, and 14% blamed labor costs. Many also chalked up lower profits to seasonal changes, taxes, and regulatory costs. (1)

Business Owners Expect Regulations to Have a Negative Impact

Many small business owners are not confident in the government’s ability to support their needs. This is especially true on the federal level, as President Biden’s approval rating remains low among entrepreneurs.

Out of small business owners surveyed, 55% believe that changes in government regulations will have a negative effect on their business, while only 11% believe those changes will have a positive effect. (2)

Inflation Poses the Biggest Risk to Small Business

U.S. inflation hit a 40-year high of 9.1% in June 2022. The increased prices have tightened consumer wallets, which have largely translated to dampening profits for small businesses. Rising costs also made it more expensive for businesses to buy materials, inventory, and manage other expenses.

Out of all current major concerns, 38% of small business owners stated that inflation is the biggest risk to their business right now, followed by supply chain disruptions at 19%. (2)

Business Owners Expect Tax Policy to Have a Negative Effect

With rising costs across the board, many businesses feel apprehensive about their ability to keep generating profits in the face of a possible tax hike.

59% percent of business owners expressed that they expect any change in tax policy to have a negative impact on their business, with only 9% of small business owners believing that changing tax policies will bring about a positive outcome. (2)

Loans & Financing a Low Priority

Many business owners were able to secure financing at record low-interest rates throughout 2020 and 2021. It’s likely that the benefits are still being felt up until now, with 27% of small businesses stating that all their credit needs were met. Another 61% of small businesses reported not being interested in a loan at all.

With interest rates on the rise, business financing is becoming more expensive and harder to obtain. Nonetheless, it’s not a major concern for most, as only 1% of businesses stated that financing was their top business problem. This figure is consistent with the results from the last quarter. (1)

Optimism Drops to All-Time Low

Inflationary pressures, rising interest rates, and fears of a looming recession are significantly eating into business optimism. The difficulty associated with finding quality workers continues to be a cause for concern. Business owners are also increasingly worried that new tax hikes and tightening regulatory policies will come into play and damage performance levels.

Optimism dropped to a 48-year record low in June 2022, with a net negative of only 61% of business owners anticipating better business conditions over the next six months.In contrast, by the end of the 2nd quarter of 2022, the NFIB Small Business Optimism Index decreased by 3.6 points to 89.5—representing six consecutive months of declining expectations about the economy. (1)

Uncertainty Index

Uncertainty Index

Uncertainty refers to the inability of businesses to anticipate the outcomes of future events. High uncertainty prevents businesses from being able to accurately plan ahead or forecast scenarios. Businesses unable to navigate the future are more likely to be unprepared when opportunities or adverse events strike. Uncertainty may also cause businesses to operate conservatively or put growth plans on hold.

The NFIB’s Uncertainty Index shows a rise in uncertainty levels for business owners. This is measured by their responses to six questions from the monthly Small Business Economic Trends survey – specifically on the frequency of “don’t know” and “uncertain” answers.

Business Loans in 2022 - Q2

Business Loans in 2022 - Q2

Small Business Administration Loans FY22 Totals, End of Q2

Small Business Administration (SBA) loans are a highly-sought after financing solution by many small businesses. They carry unique benefits such as low-interest rates, high funding amounts, long repayment terms, as well as inherent flexibility.

Businesses must show good credit, two years of business history, and meet the SBA’s size standards in order to qualify for SBA funding. By the end of the 2nd quarter in 2022, a total of 41,892 SBA loans were approved. (3)

SBA 7(a) loans

Sba 7(a) loans are one of the most popular financing products offered by the SBA. They feature funding amounts of up to $5 million and terms as long as 25 years. SBA 7(a) loans are ideal for financing real estate purchases, equipment purchases, short and long-term working capital needs, refinancing business debt, expansionary plans, buying materials, and more.

By the end of the 2nd quarter of 2022, the SBA approved a total of 34,057 7(a) loans amounting to $18.1 billion in 7(a) loans for the fiscal year. (3)

SBA 504 loans

SBA 504 loans are another popular SBA loan offering long-term, fixed-rate financing up to $5 million. 504 loans can be used to purchase major assets that promote business growth and job creation, such as real estate or equipment purchases.

By the end of the 2nd quarter of 2022, the SBA approved a total of 7,330,504 loans amounting to $7.3 billion. (3)

Community Advantage

The SBA’s Community Advantage program provides assistance to small businesses in underserved markets, especially low to moderate-income communities. At the end of the 2nd quarter of 2022, the SBA granted a total of 505 Community Advantage loans totaling $77.5 million. (3)

Unemployment by State - Q2 2022

Unemployment by State - Q2 2022

Unemployment rates continued to drop nationwide throughout 2022. By July 2022, unemployment was measured at 3.5% – nearing pre-pandemic lows. (4)

Low unemployment levels have meant that businesses are struggling to find and retain workers. A net 48% of business owners have resorted to raising compensation levels, while a net 28% of owners plan to raise compensation in the near future. (1)

Businesses are also offering other incentives, such as hybrid-remote work and increased flexibility. Nonetheless, hiring remains a challenge.

Number of Firms by Industry

Number of Firms by Industry

Professional Services, Retail Trade, Construction, Healthcare, Waste Management, and Service Industries continue to attract the most number of firms. (5)

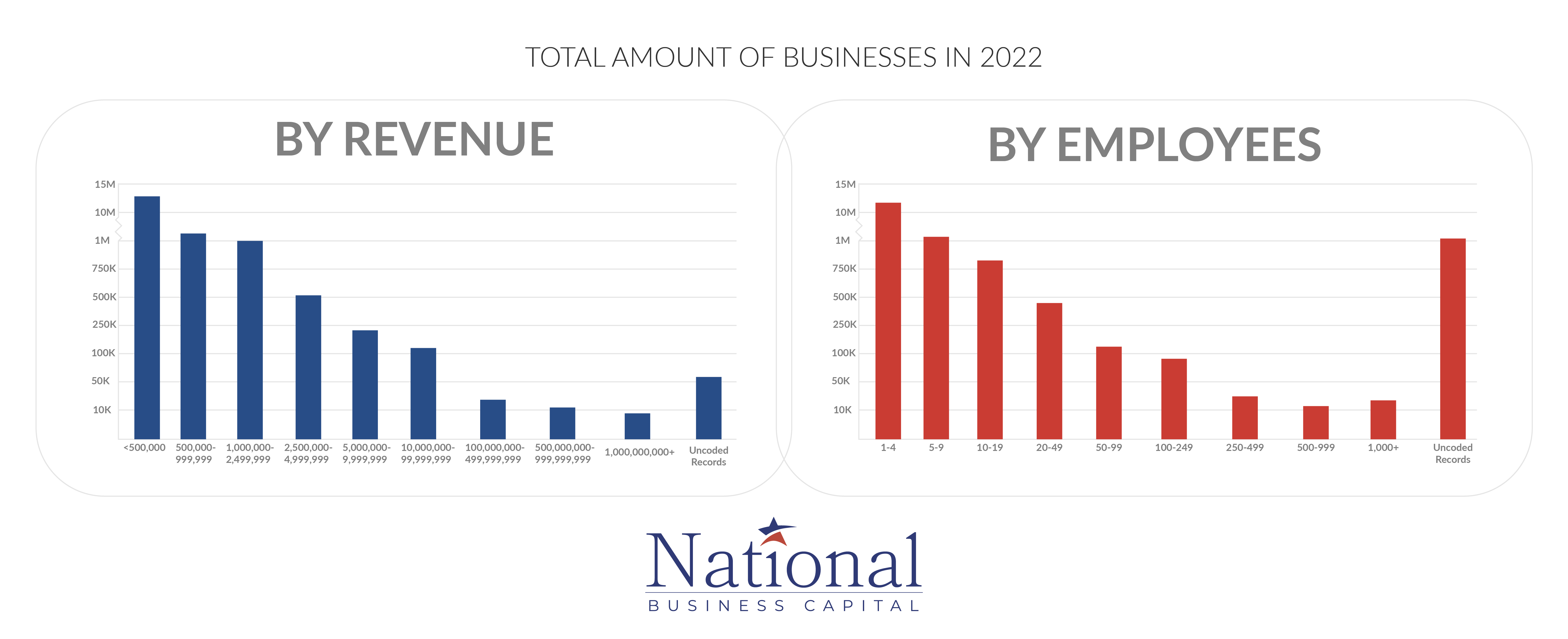

Total Amount of Businesses 2022

Total Amount of Businesses 2022

The U.S. economy shrank by 0.9% year-over-year in Q2 2022, for the second consecutive quarter in a row. By comparison, the U.S. economy shrank by 1.5% in Q1 2022. Many economists identify a recession as two consecutive quarters of negative growth.

However, experts remain split on whether the economy is currently in a recession or not, considering strong employment levels. Consumer spending, although slowing, nonetheless grew by 1% in the past quarter amid inflationary pressures.

Whether or not economic growth will continue to decline remains unclear. What is certain, however, is that businesses will face increased levels of uncertainty in the coming months, especially as new regulations and rising interest rates loom.

National Business Capital

Accelerate your success with frictionless financing and expert advice that breaks down the barriers to growth for every entrepreneur.

Thrive with access to a business lending marketplace that’s built for entrepreneurs, by entrepreneurs. Experience a time-saving machine that cuts approval times from months to hours. Leverage an extensive network of over 75 lenders and teams of expert financing advisors to ensure you’ll always have access to the capital that best fits your business.

Working with NBC, gain a financing partner for the future, ensuring your business has the capital it needs to seize every opportunity and grow without limits.

National Business Capital. Grow to Greatness.

Hear From Our Customers

Ready to See Your Options?

Go from application to approval in hours, not days, with a streamlined process that merges high-tech with human-touch for high-efficiency financing.