Table of contents

Smart business owners are exploring a new world of financing beyond the bank lobby. Private credit lenders and alternative financial companies make access to capital a more frictionless experience, with faster decisions, more flexible requirements, and funding solutions tailored to modern business needs.

An alternative business loan can be a powerful solution, especially if you’re part of the 46% of businesses seeking capital for growth and expansion.

Let’s take a look at the top eight alternative business lenders, explore what type of lending products are available, and walk through the steps you can take to apply for alternative business financing.

What is alternative financing?

Alternative financing opens doors that traditional banks often keep locked. These innovative lenders provide all the funding solutions you'd expect, plus creative options like cash flow financing and specialized programs designed around how your business actually operates, not just how it looks on paper.

Compared to banks, alternative lenders offer more efficient underwriting processes, faster funding times, and looser eligibility requirements.

However, these less-restrictive qualifications create a risky scenario for the lender, so they may impose higher interest rates. For example, the interest rate on a business line of credit ranges from 8% to 60% or higher.

You can use alternative financing for nearly any business purpose, from covering daily expenses and stocking up on inventory to upgrading equipment and expanding your business. Refinancing a business loan with alternative financing can also be useful when you want to borrow additional funds or secure better terms.

Alternative business lending at a glance

Whether you’re looking for a small short-term loan or need funding for a large capital expenditure, there are various alternative business financing options. Here is a quick look at eight of the top alternative lenders:

| Lender | Best for | Max loan amount | Term length | Minimum interest rate |

|---|---|---|---|---|

| National Business Capital | Advisor service | $15M | Up to 10 years | 12% |

| Bluevine | Lines of credit | $250,000 | Up to 12 months | 7.8% *for a 6-month term |

| OnDeck | Short-term needs | $250,000 | Up to 24 months | 27.3% |

| Fundbox | Newer businesses | $150,000 | 12-24 weeks | 4.99% *for a 12-week term |

| Lendio | Comparing lenders | $2M | Up to 10 years | 8.49% |

| Prosper | Below-average credit | $3 million | Up to 5 years | Not disclosed |

| Fora Financial | High-revenue businesses | $1.5M | Up to 18 months | 1.11 factor rate |

| Fundera | Fast funding | $15M | Up to 7 years | Varies |

Best alternative business funding

Finding the best alternative business loan for your company is crucial. Each lender has their own eligibility requirements, term limits, funding speed, and more. Let’s look at the top eight alternative lenders and their business funding solutions.

1. National Business Capital

- Best for: Advisor service

- Max loan amount: $15M

- Starting interest rate: 12%

- Term length: Up to 10 years

- Trustpilot rating: 5 stars

As a private credit lender, National Business Capital offers multiple lending options from loans and lines of credit to cash flow financing and asset-based lending. We pair each applicant with a business advisor who works to obtain the best funding offers for you through direct lending.

With a 90% approval rate, National Business Capital helps all businesses regardless of credit, revenue, or time spent in business. Perhaps that’s why we have a perfect five-star rating from Trustpilot.

| Pros | Cons |

|---|---|

| • Loans up to $15 Million • Interest rates starting at 6% • Personalized financing guidance • Fast funding • No tax returns required | • Interest rates and terms vary • Not designed for startups |

2. Bluevine

- Best for: Lines of credit

- Max loan amount: $500K for term loans and $250K for credit lines

- Starting interest rate: 7.8% for a 6-month term

- Term length: Up to 12 months

- Trustpilot rating: 4.3 stars

Bluevine is a business-focused lender that offers various services, from loans and lines of credit to credit cards and checking accounts. One application qualifies you for both Bluevine business lines of credit and partner-issued business loans. The downside is that loan values max out at $500,000, and you’ll have a maximum of two years to pay it back.

| Pros | Cons |

|---|---|

| • Multiple funding options • One application for all products • Rate discounts for checking account holders | • $500,000 max loan value • Short-term lengths • Financing is not available to businesses in Nevada, North Dakota, or South Dakota |

3. OnDeck

- Best for: Short-term needs

- Max loan amount: $250K loan, $250K credit line

- Starting interest rate: 27.3%

- Term length: Up to 2 years

- Trustpilot rating: 4.6 stars

Fast funding is what OnDeck is known for, with same-day funding on loans and instant access on business lines of credit. However, this convenience comes at several costs. For one, OnDeck has high APRs, lower borrowing amounts, and a substantial origination fee. Additionally, OnDeck’s services are autonomous and don’t include the assistance or expertise of a real advisor.

| Pros | Cons |

|---|---|

| • Get instant access when approved for a credit line • Same-day funding on business loans • Quick application process | • Average loan APRs of 57.9% • $250,000 max loan amount • Requires 1+ years in business |

4. Fundbox

- Best for: new businesses

- Max loan amount: $150K line of credit

- Starting interest rate: 4.99% for 12 weeks, 6.99% for 24 weeks

- Term length: Up to 6 months

- Trustpilot rating: 4.7 stars

Fundbox offers a line of credit that is ideal for newer businesses. The minimum revenue requirement is only $30K annually, and the minimum time in business is just three months.

Unfortunately, the repayment period maxes out at six months, making Fundbox a decent solution when building credit but a poor lender choice in the long term.

| Pros | Cons |

|---|---|

| • Low eligibility requirements • Fast approval decision • No early repayment penalties | • Only lines of credit are available • Repayment periods are short • Interest charged weekly |

5. Lendio

- Best for: Comparing lenders

- Max loan amount: $2M

- Starting interest rate: 8.49%

- Term length: Up to 10 years

- Trustpilot rating: 4.7 stars

While the interest rate you receive depends on your unique situation, Lendio has reasonable starting rates for each product they support. Accounts receivable financing starts at 3%, business lines of credit start at 8%, and term loans start at 6%. However, you’ll need at least $8,000 in monthly revenue and great credit to qualify for these rates.

| Pros | Cons |

|---|---|

| • Low starting interest rates • Loans up to $7M • A large variety of funding options | • $8K monthly revenue minimum requirement • No direct loans or lines of credit |

6. Prosper

- Best for: Businesses with below-average credit

- Max loan amount: $3M

- Starting interest rate: Not disclosed

- Term length: Up to 5 years

- Trustpilot rating: 4.5 stars

Prosper is a consumer lending and investing platform that offers business financing through BusinessLoans.com. Financing products include loans, lines of credit, invoice factoring, and more. BusinessLoans.com has no minimum credit score, and you can get a loan for as little as $5,000, making it a good choice for business owners who don’t have great credit.

The downside is that there is very little transparency, and you won’t have access to any information until after you fill out a full application.

| Pros | Cons |

|---|---|

| • Loan values up to $3M • No stated credit requirements | • Lack of transparency • Business products are not through Prosper |

7. Fora Financial

- Best for: High-revenue businesses

- Max loan amount: $1.5M

- Starting interest rate: 1.11 factor rate

- Term length: Up to 18 months

- Trustpilot rating: 4.5 stars

Fora Financial is a direct lender that offers business loans and lines of credit up to $1.5M. With a $20K/month revenue requirement, Fora Financial is best for larger, well-established businesses and may not be the best resource for small businesses.

| Pros | Cons |

|---|---|

| • Borrow up to $1.5M • Direct lender • Offers prepayment discounts | • $20K/month revenue requirement • Limited to business loans and lines of credit |

8. Fundera

- Best for: Fast funding

- Max loan amount: $15M

- Starting interest rate: Varies

- Term length: Up to 7 years

- Trustpilot rating: 4.3 stars

Fundera is a division of NerdWallet that offers a variety of business financing products, from lines of credit to cash flow financing. When you fill out an application, you are assigned an advisor who works with you to find the best business financing solutions. While an advisor can be helpful, it comes at the cost of transparency.

| Pros | Cons |

|---|---|

| • Borrow up to $15M • Multiple funding options are available • An advisor guides you through the process | • No transparency on APRs • Lack of control over the process |

Traditional lending vs. alternative lending: Top differences

Getting a business loan through a traditional lender versus an alternative lender looks very different. Everything from eligibility requirements and loan amounts to funding speed is different. Here’s an overview of the differences you can expect when choosing between an alternative and a traditional lender.

| Traditional lending | Alternative lending | |

|---|---|---|

| Qualifications | Strict requirements, including a good credit score and multiple years in business | Lower credit, revenue, and time in business requirements |

| Loan amounts | Large loans, often $1 million plus | Usually smaller loan amounts starting at $250,000 |

| Funding speed | Slow, often taking weeks or even months to receive funds | Quick turnaround, including same-day funding |

| Funding types | Loans and lines of credit | Flexible options including loans, lines of credit, invoice factoring, equipment financing, and more |

Types of alternative business lending

Companies can leverage a variety of alternative lending options to grow their business. Let’s take a look at some of the most popular alternative funding options.

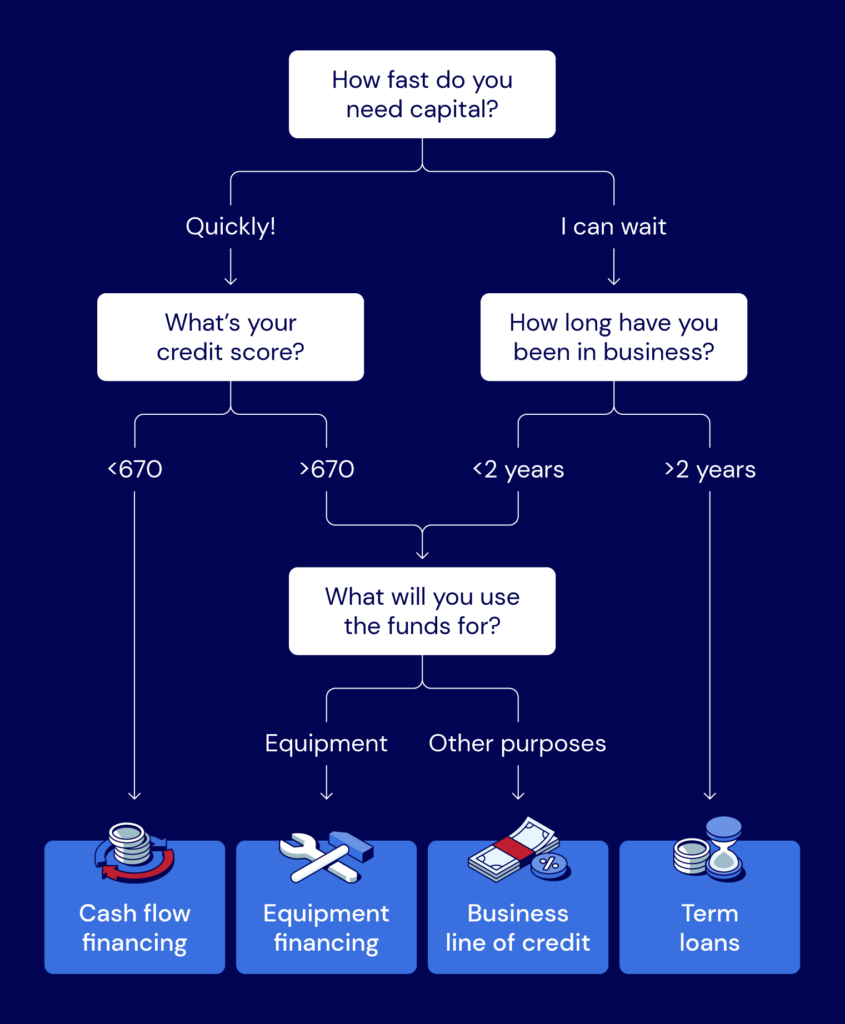

Cash flow financing

With cash flow financing, your repayment schedule moves with your business rhythm. Lenders advance capital based on your revenue history and projections, then collect repayment as a small percentage of your daily or weekly sales, creating a flexible funding solution that better suits your needs.

Term loans

Term loans are what most people think of when they hear “business loans.” You receive funds in a one-time, lump-sum payment that you’ll repay over a preset term. While traditional lenders offer term loans, alternative lenders offer a wider range of term loans, like inventory financing and microloans (small loans with short repayment periods).

Business lines of credit

A business line of credit is one of the most popular alternatives to a traditional term loan. Once you establish a business line of credit, you can draw funds as needed. And you’ll only pay interest on the amount borrowed, not the total credit line. Plus, as you pay off what you’ve borrowed, that total is added back to your available credit line.

Equipment financing

Equipment financing is a way for you to break down a sizable equipment purchase into more manageable payments. Alternative lenders for small businesses tend to carry higher equipment financing interest rates than traditional banks, but there are very few restrictions on the types of equipment you can finance.

Invoice factoring

Invoice factoring is a short-term business financing option that lets you leverage your existing invoices. You can sell these invoices to a 3rd party company that collects payment directly from your customers. Invoice factoring immediately gives you access to capital instead of waiting for your customers to pay.

Pros and cons of alternative business financing

Nonbank credit options for small business lending are growing in popularity. According to the Federal Reserve, 43% of businesses sought alternative lenders in 2024. While this is becoming standard, it’s important to weigh the benefits along with the challenges.

| Alternative financing pros | Alternative financing cons |

|---|---|

| Flexible financing optionsQuick fundingLess restrictive eligibility requirements | Higher interest ratesLower borrowing amountsIncreased potential for hidden fees |

How to know if alternative lending is right for your business

Every business is different, each with unique characteristics that will make one type of funding more attractive. When researching your funding options, it's important to consider a variety of factors, such as:

Funding times

The application-to-funding-in-hand speed is one of the most important things to consider. Banks and credit unions tend to have longer funding, often taking weeks or even months to complete the application and funding process.

Alternatively, alternative lenders offer same-day approvals in many cases, with funding times as short as 24 hours. This makes alternative business lending a better option for those who need capital fast.

Interest rates

As discussed previously, banks and credit unions tend to offer lower interest rates compared to alternative lending organizations. Your business’s financial background determines interest rates, your time in business, and the lender. Shopping around is the only way to ensure you’re getting the best possible rate.

Available lending options

Compared to bank loans and financing, alternative business lending options are more available. Alternative lenders can offer traditional options like loans and lines of credit, cash flow financing, purchase order financing, and other flexible funding options.

These are just a few of the most important factors to explore. Consider other factors, such as your long-term financial goals, company reputation, and financing preferences.

How to get an alternative business loan

Searching for an alternative lender is as easy as typing “alternative business loans” into your search bar. The hard part, however, is choosing the right one for your specific situation. You’ll need to research each option carefully, noting eligibility requirements, loan amounts, and funding times.

You can start filling out applications once you have a few top choices. While every organization has a different application procedure, most alternative leaders follow this five-step process:

- Fill out the lending application

- Connect with a Business Advisor to review and compare loan offers

- Select the best fit, accept the offer, and finalize agreements

- Receive funds quickly

With alternative lenders, this process can often be accomplished in as little as 24 hours, and you won’t have as many documentation requirements as you would with a traditional lender.

Find better financing options with National Business Capital

Finding the best alternative business loans starts with assessing your needs. What are your business goals, and how can financing help you achieve them?

National Business Capital can help find funding that aligns with your goals and expectations. Our business advisors can guide you in selecting the best loan option. Whether you need a quick influx of capital or have a detailed expansion plan, our online application is the first step in getting you the financing you need.