Table of contents

As a natural phase of growing, your business will likely need more capital to quickly capitalize on lucrative opportunities like a new product line or a physical location in a new state. A business loan probably makes sense, but what are the best small business loans available? And what types of qualifications will you need?

In this article, we’ll give you an overview of a small business loan comparison between some of the more popular lenders. These factors will include term lengths, credit qualifications, funding amounts, and more.

Best small business loans at a glance

The market has various options with many banks and lenders willing to provide business financing. But, as with any other industry, not all are created equal. Let’s look at nine of the top small business lenders and the types of terms and qualifications they offer.

| Lender | Max loan amount | Minimum credit score | Term length | Best for |

|---|---|---|---|---|

| National Business Capital | $15M | 620 | Up to 2 years | Advisor-service & flexibility |

| Bluevine | $500K | 625 | Up to 2 years | Larger loans |

| Bank of America | $250K (secured) | 700 | Up to 5 years | Long-term loans |

| QuickBridge | $500K | Undisclosed | Up to 1.5 years | Short-term loans |

| U.S. Bank | $250K | Undisclosed | Up to 7 years | Fast funding |

| Wells Fargo | $3M | 680 | Up to 3 years | Lines of credit |

| Kapitus | $15M | 650 | Up to 2 years | Multiple financing options |

| OnDeck | $250K | 625 | Up to 2 years | Lower credit scores |

| PayPal | $250K | Undisclosed | Up to 1 year | Low revenue businesses |

National Business Capital

Best for advisor-service & flexibility

- Max loan amount: $15M

- Minimum credit score: 620

- Term length: Up to 2 years

National Business Capital is known as one of the best small business lenders based on its quality advisor service and loan flexibility. The lender also offers some of the highest funding amounts available – up to $15M.

With 17 years in business and having provided more than $3B in funding, National Business Capital is an established lender that offers unsecured, cash-flow funding, and asset-based options.

| Pros | Cons |

|---|---|

| • Well-trained advisors • High loan amounts | • Shorter loan terms • Higher revenue requirements |

Bluevine

Best for larger loans

- Max loan amount: $500K

- Minimum credit score: 625

- Term length: Up to 2 years

Bluevine uses a network of lenders to help provide loans to small businesses. Because Bluevine acts as a marketplace connecting borrowers with multiple third-party lenders rather than funding loans directly, you can expect a wide range of funding amounts and credit score requirements that vary based on each individual lender's criteria and underwriting standards.

| Pros | Cons |

|---|---|

| • High loan amounts available through lending partners • Lower credit score requirements | • Loans not offered through Bluevine • Terms and requirements can vary widely based on the lending partner |

Bank of America

Best for long-term loans

- Max loan amount: $250K

- Minimum credit score: 700

- Term length: Up to 5 years

Bank of America (BOA) is one of the largest banks in the United States. BOA has more strict credit and business history requirements than its competitors, but they offer longer terms and a wide range of loan amounts – between $10K and $250K.

| Pros | Cons |

|---|---|

| • Term loans up to 5 years • Small loan amounts available | • Higher credit score requirements • Need multiple years in business to qualify |

QuickBridge

Best for short-term loans

- Max loan amount: $500K

- Minimum credit score: Not disclosed

- Term length: Up to 1.5 years

QuickBridge provides small business loan options with high amounts over fairly short terms – up to 18 months. The lender also works with its clients to create customized loan and repayment plans to fit their specific needs.

| Pros | Cons |

|---|---|

| • Wide range of loans available • Customizable loans | • Credit score terms not disclosed • $250K in annual sales required |

U.S. Bank

Best for fast funding

- Max loan amount: $250K

- Minimum credit score: Undisclosed

- Term length: Up to 7 years

As one of the largest commercial lenders in the country, U.S. Bank has years of experience helping small businesses with funding. While the bank typically requires strong credit profiles and established business financials for approval, it offers reasonable loan amounts – $5K to $250K – over longer terms up to seven years. The lender also features a "quick loan" option that can potentially provide funding within minutes for well-qualified applicants.

| Pros | Cons |

|---|---|

| • Approval and funding within minutes • Loan options as low as $5K | • Doesn’t share credit score requirements • Interest rates and revenue requirements are not disclosed |

Wells Fargo

Best for lines of credit

- Max loan amount: $3M

- Minimum credit score: 680

- Term length: Up to 3 years

Wells Fargo doesn’t offer term loans but provides a business line of credit – both secured and unsecured. It does have stricter credit requirements, but they provide a wide range of potential loan amounts – between $5K and $150K for unsecured loans and $250K to $3M on secured loans.

| Pros | Cons |

|---|---|

| • High loan amounts available • Includes a rewards program | • No term loan options • High credit score requirements |

Kapitus

Best for multiple financing options

- Max loan amount: $15M

- Minimum credit score: 650

- Term length: Up to 2 years

Kapitus has provided various funding solutions, including six potential small business loan offers: standard business loans, equipment financing, lines of credit, revenue-based financing, invoice factoring, and SBA loans. Because of the higher funding amounts, Kapitus requires annual revenues of at least $250K and a minimum of two years in business.

| Pros | Cons |

|---|---|

| • Six potential funding options with each loan • Daily, weekly, and monthly payment options | • High annual revenue requirements • Short-term loans only |

OnDeck

Best for lower credit scores

- Max loan amount: $250K

- Minimum credit score: 625

- Term length: Up to 2 years

OnDeck might be ideal for less established businesses because of its more relaxed requirements related to years in business, annual revenue, and credit score. Term loans have a wide range of potential amounts – between $5K to $250K.

| Pros | Cons |

|---|---|

| • Potential same-day funding • Low revenue and credit score requirements | • No loan options beyond 2 years • Difficult to find interest rates online |

PayPal

Best for low-revenue businesses

- Max loan amount: $250K

- Minimum credit score: Undisclosed

- Term length: Up to 1 year

PayPal has designed a loan program ideal for low-revenue and startup businesses. Requirements include only nine months in business and a minimum annual revenue of $33K. PayPal provides fast funding times but does require a PayPal business account in order to access its loans.

| Pros | Cons |

|---|---|

| • Relaxed revenue requirements • Low term limits and loan amounts available | • PayPal business account required • Unclear credit score requirements |

Types of small business loans

Small business loans come in all shapes and sizes. You’ll have many options when looking for the best loans for small businesses. Here are the most common types of small business loans.

| Loan type | Description |

|---|---|

| Business lines of credit | Allows a business to borrow as needed (up to a specific maximum) while only paying interest on the total amount borrowed |

| Cash flow financing | Provides financing to a business with amounts based on the business’s past and projected cash flow trends |

| Business term loans | Provides a specific amount of financing to a business expected to be repaid over a set amount of time – typically between one and seven years |

| Equipment financing | Provides a loan or lease to a business to acquire equipment, including vehicles, office furniture, production and medical equipment, manufacturing loans, and more |

| SBA loans | Provided to businesses with financing that the U.S. government backs. These loans offer more favorable conditions to firms, like longer terms and less stringent credit requirements |

Tips for choosing the best small business loan

Choosing the best small business loan is fairly straightforward once you know each lender's criteria. Do your research to find the loan that is most favorable to you.

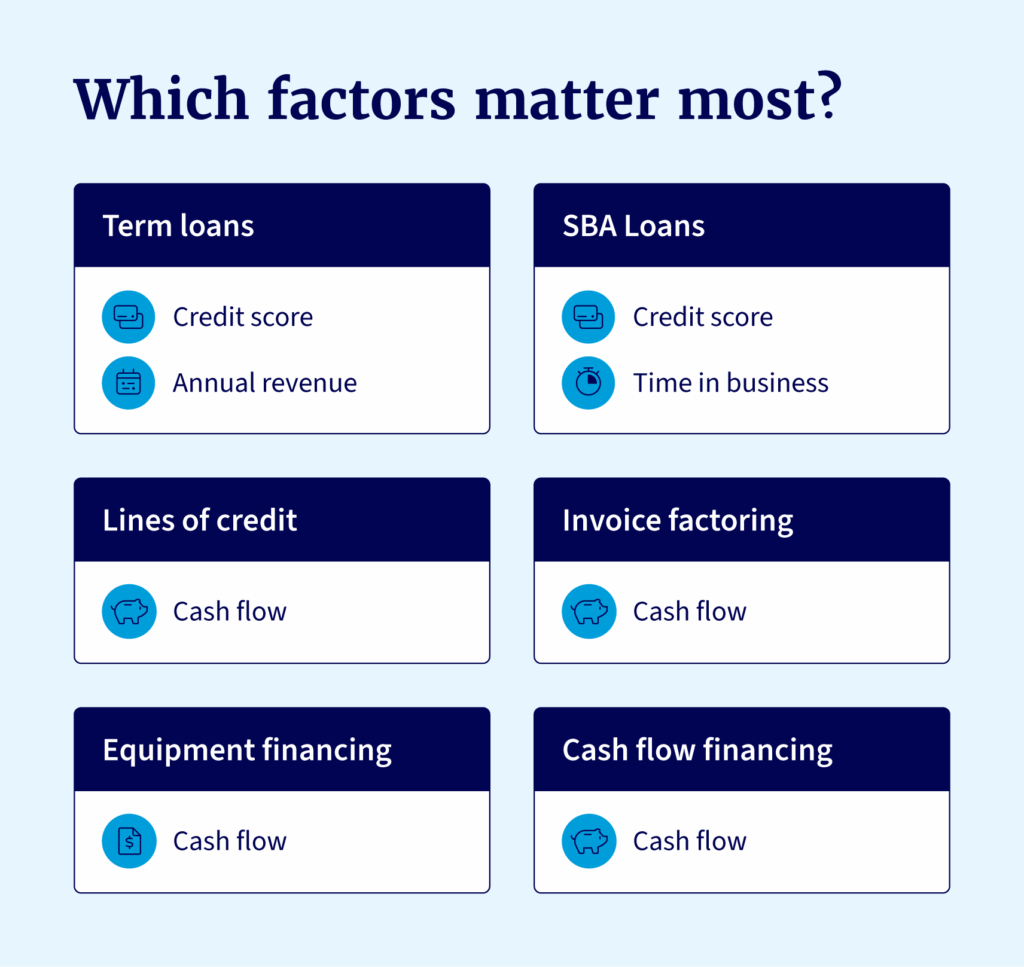

- Verify credit score criteria: Credit score requirements can vary from 600 to 700. Though a lower credit score might hurt your potential to acquire a small business loan, some lenders will provide more relaxed requirements.

- Assess monthly revenue minimums: Lenders will definitely consider your business’s annual and monthly revenue as part of their approval process. Revenue requirements can range from $33K to $500K.

- Confirm time in business requirements: The longer you’ve been in business, the better your chance of securing a business loan. Typical requirements are around two years in business, though some lenders may provide loans to businesses in operation for as little as 9 months.

- Evaluate annual percentage rates (APR): Annual percentage rates will greatly affect how much interest you pay throughout the loan. Read the fine print to learn the types of APR ranges and understand the lenders that provide the best small business loan rates.

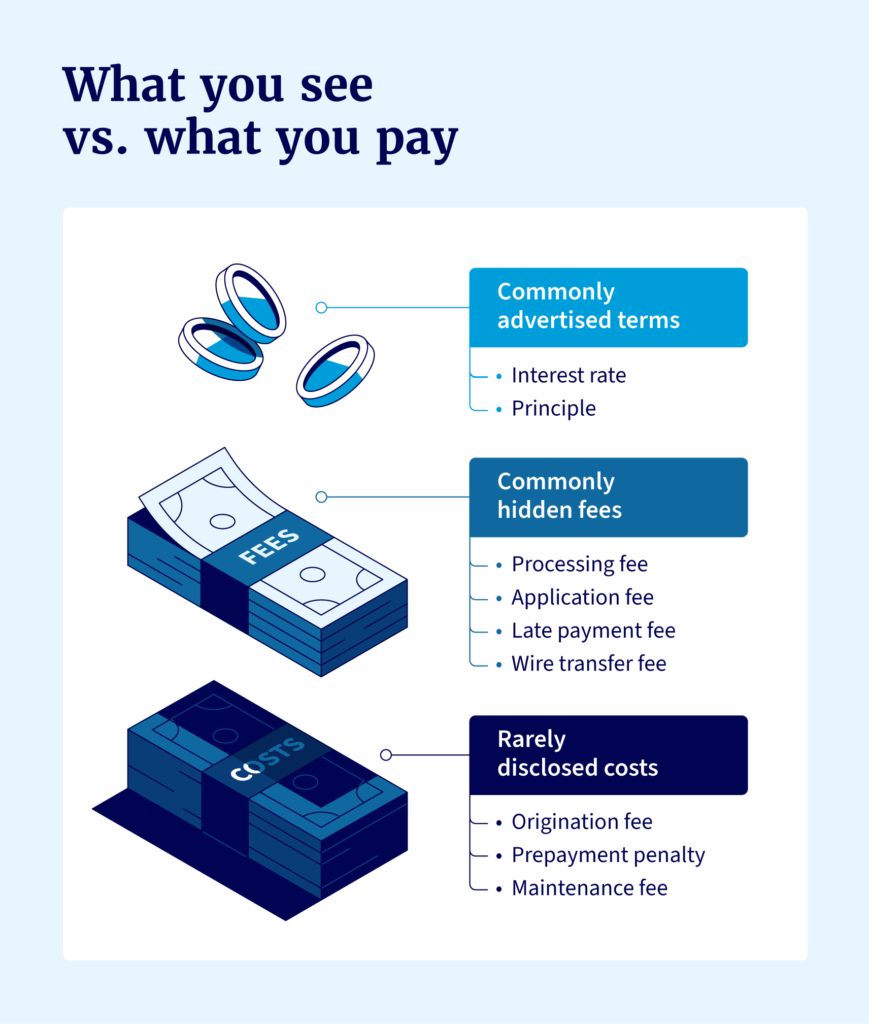

- Look for any hidden charges: Not every lender has hidden fees, but some will try to sneak in a few charges. These types of charges are typically prepayment penalties, late payment penalties, and origination and underwriting fees.

- Analyze repayment terms: With traditional business loans, term lengths can range from a few months to seven years. If you need longer terms, consider an SBA loan backed by the government.

Know the time to funding: Some lenders provide fast funding options – from within minutes to the same day. Others might take a little longer to process funds in your account, so know what you need and when before applying with lenders.

Now that you understand how to choose the best small business loans, let’s examine how to get this type of loan and the process.

How to get a small business loan

The world of small business loans can sometimes be confusing with all the options available. That said, understanding the steps of applying for one helps simplify the process.

Check your eligibility

A lot of factors go into being eligible for a loan. Your credit score, time in business, annual revenue, and overall financial profile. Some lenders will give weight to certain factors over others.

One of the best aspects of a lender will be their willingness to understand your situation and provide proven advice based on what you need, and that’s where you can trust National Business Capital and its team of expert business advisors to shine.

Research and compare lenders

The loan process can be complicated; some lenders will point you to an application and let you go. National Business Capital pairs you with an expert business advisor who can help you better understand the options you have available and how each will fit into your long-term business goals.

Gather documentation, apply, and receive funds

Get together as much documentation as you can before you apply. These will be items such as:

- Balance sheets

- Tax returns

- Bank statements

- Credit reports

- Cash flow projections

- Driver’s license

That’s just an example of some of the documentation you might need. Once you have the right information, apply for your small business loan – keeping in mind that lenders who are more flexible and provide faster funding will help you reach your goals faster.

Find flexible small business funding options with National Business Capital

National Business Capital isn’t going to hang you out to dry during the loan process. We offer some of the industry's most flexible, best small business loans. We’ll show you how to get a business loan and provide an advisor to work with you throughout the process. We'd love to discuss our flexible funding options if you’re ready to find out how National Business Capital can help you reach your business goals. Apply today to get started and put your business on the fast track to growth.