Table of contents

Cash runway refers to how long your business can continue operating using its existing capital reserves. It's a strategic window for growth that allows you to make decisions based on opportunity.

With a long runway, your company can pursue its long-term business vision and act from a position of strength instead of short-term necessity because you're not forced into hasty decisions that compromise your values or strategic direction. During this period, you and your leadership team can expand into new markets, buy a competitor, or invest in equipment to increase your capacity because you’re unencumbered by capital-based restrictions.

In this article, we’ll explain the relationship between your cash runway and burn rate. We'll also show how to extend your cash runway while targeting growth, how to take control of your cash runway, and why burn rates change from month to month.

Cash runway vs burn rate: How they coexist

A cash runway is a measure of how long your company can operate with the capital it has available. This calculation incorporates several key financial components:

- Current cash reserves (money in bank accounts)

- Accounts receivable (money owed to you by customers)

- Other liquid assets that can be quickly converted to cash, minus your monthly burn rate (how much cash you spend each month on operations, salaries, rent, and other expenses)

Some businesses also factor in predictable monthly revenue streams when calculating their runway, though this should be done conservatively to account for potential fluctuations in income.

A shorter runway increases the risk of a setback turning into a crisis. The good news is that you can extend it by improving your cash flow or implementing a liquidity management plan.

On the other hand, a long runway means your business can effectively manage challenges it didn’t anticipate, sometimes turning them into growth opportunities. However, an excessively long runway can signal that a business is being too conservative with its capital allocation. It could be missing out on valuable growth investments like product development or market expansion that could accelerate revenue and competitive positioning.

To give yourself more time, you need to understand how your strategic decisions impact your burn rate and, by extension, your timeline for sustainable growth.

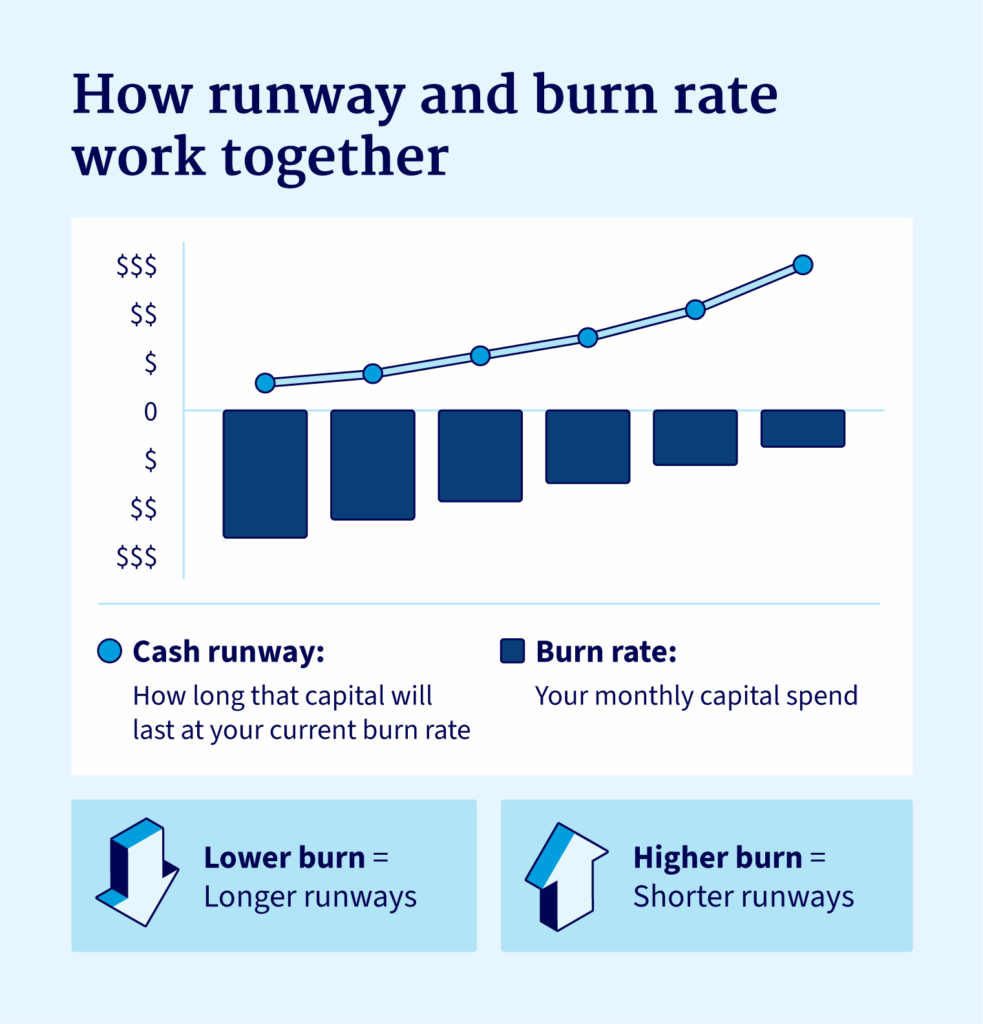

Burn rate is a measure of speed: how fast you’re getting through that capital each month, reflected in net negative cash flow.

Naturally, cash runway and burn rates go hand in hand; he higher your burn rate, the shorter your runway. The lower your burn rate, the longer your runway.

How to calculate cash runway and burn rate

You can apply two simple formulas to get a clear view of where your company’s financial position is. First, here's how to calculate cash runway:

| Cash runway formula = Cash balance ÷ cash burn rate |

|---|

Your “cash balance” is the capital you have available now, plus any cash equivalents (assets you can convert to cash quickly). Divide it by your monthly burn rate, and the result is your cash runway measured in months.

For example, a Texan manufacturer might have $1.2M in the bank. If it spends $250k a month on payroll, materials, and standard operating overheads, its runway is 12 months.

In this period, they can automate their production to increase output and boost efficiency or land a larger distribution contract before they achieve positive cash flow or need to raise new capital. With 12 months, they have time to properly research automation options, install equipment, and build distributor relationships – strategic moves that take months to execute and aren't possible with only a short runway.

The second formula you'll need to know how to calculate is the cash burn rate:

| Cash burn rate formula = Cash received – cash paid out |

|---|

Burn rates track how your cash flow changes over a set period, normally a month. A high burn rate indicates that your operational spending is a large portion of your expenses, which isn’t inherently bad if it’s tied to growth.

For example, a wholesale distributor stocking up ahead of a very busy season or a construction company onboarding new crews for a major contract is spending to drive future revenue.

Conversely, a drop in your burn rate isn’t always good news – it could mean stalled growth or cutbacks.

Monitoring both metrics provides leaders with key insights on when it’s the right time to invest, slow down, or bring in additional capital before it becomes necessary.

How to accelerate your runway without slowing growth

To extend your runway without slowing growth, you can manage your cash flow tightly while also seeking outside funding. This gives you the financial flexibility to pursue growth opportunities without worrying about covering your basic operating costs.

These are three advantages this approach delivers:

Secure capital before you need it

Waiting until just before you need capital limits your options and can force you to compromise on terms you otherwise wouldn't have. It's important to secure access to capital when your financial position is strong, not when you need to cover a shortfall.

With a private credit lender like National Business Capital, you apply for flexible funding options, like business lines of credit. We can provide you with the financial headroom to say "yes" to new contracts, invest in new equipment, or expand operations without waiting for cash flow to catch up.

Look for insights behind the numbers

Many businesses miss easy ways to free up cash by fixing inefficiencies.

Your money might be tied up in inventory that's not selling, equipment you're not using, or work you've finished but haven't billed yet. Finding these problems can put more cash back in your business.

For example, a construction company could ask suppliers for longer payment terms. Instead of paying for materials in 30 days, they might get 60 days, which gives them more breathing room with their cash.

In this case, investing in inventory management software could also help by improving material flow, reducing holding costs, and accelerating the cash conversion cycle.

Pro Tip: Invoice financing can help free up funds when clients are late on payments. A factoring company provides upfront payment for your receivables, helping you to bridge cash flow gaps and turning future revenue into immediate cash flow.

Capitalize on intelligent timing

Burn rates constantly change, which creates windows of opportunity when you can apply for funding from a position of strength – before you actually need it.

For example, a construction company spends the most during heavy build phases for crews and materials, while a wholesaler ties up cash filling warehouses before the busy season. The key is securing capital access during your slower periods, so you're ready when these high-spend phases arrive.

Flexible private credit adapts to the pace of your business, letting you capitalize on opportunities during temporary cash crunches. Many companies secure bridge loans ahead of time to cover predictable expenses, like large material orders, without waiting for client payments to clear.

Gaining control of your cash runway

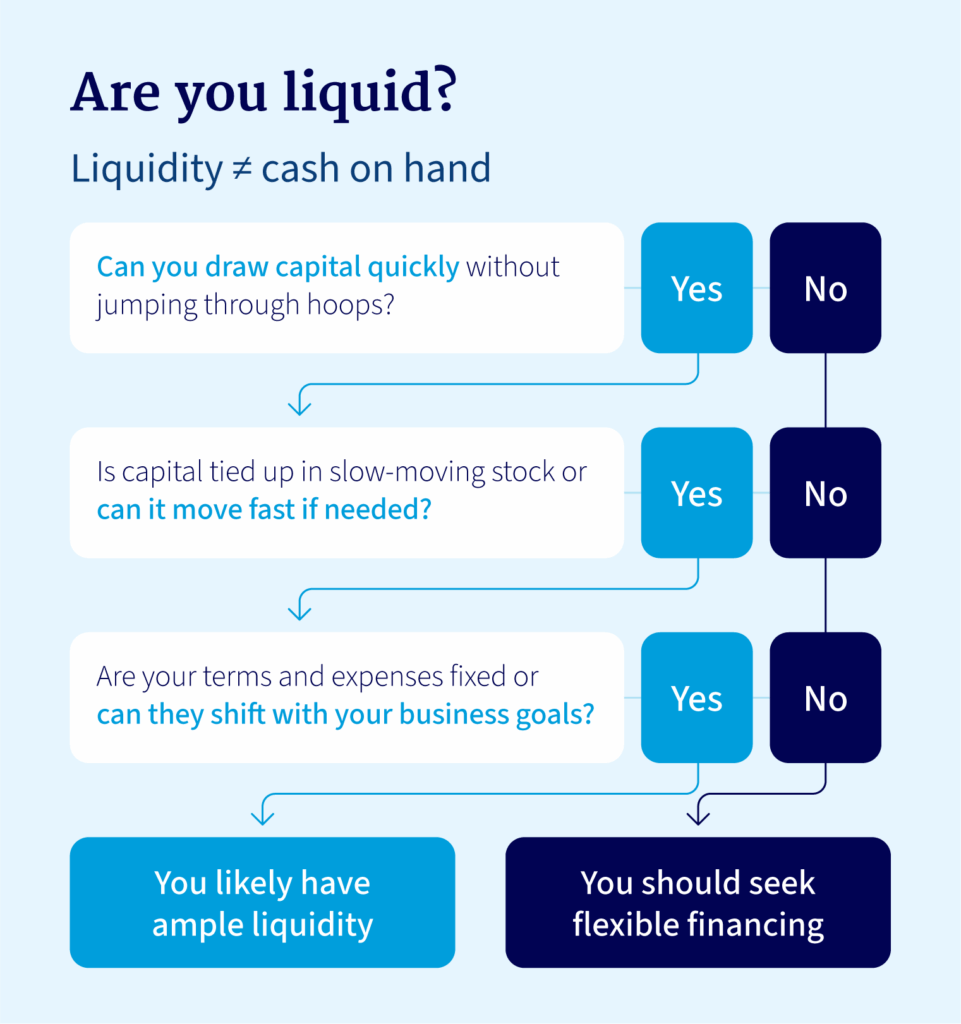

Runway posture refers to how much financial breathing room your business has to make decisions. When you're operating from a position of strength with ample time and capital, your runway posture is healthier and you have greater liquidity to invest in growth.

Understanding what your runway posture says about your business generally comes down to following the 30/90/180 rule of thumb:

- 30-day runway: With a month of operating capital left, you have minimal buffer against drops in revenue or expenditure spikes, so you need to focus on optimizing cash flow or securing new capital fast.

- 90-day runway: You have more room for maneuver and can absorb minor challenges, but there are commercial merits to examining your expenditure and increasing revenue generation to extend your runway.

- 180-day runway: A six-month financial runway is quite lengthy. It could indicate overcautious management, not making capital work hard enough for growth.

If you consistently monitor and adjust your capital level, a strong runway posture shows how ready you are for new opportunities or market turbulence.

Why burn rate changes from month to month (and how to steady it)

You’ll notice that your burn rate varies; it’s never a flat, predictable line. Burn rates rise and subside due to factors like seasonality, inventory loading, growth investment decisions, and late customer payments.

Fluctuating burn rates are standard in these industries:

- Manufacturing: Burn rates often accelerate in Q2 to build inventory for strong Q4 sales, creating a period of cash compression (when capital is intentionally tied up in non-liquid assets).

- Construction: Contractors may see seasonal, weather-influenced slowdowns and ramp-ups for major projects. This variability requires strategic planning to match capital and funding with project-related expense cycles, like mobilization costs.

- Wholesale and distribution: Businesses in this industry frequently front-load purchases before major holiday seasons. This is liquidity pull-forward, where businesses seek capital earlier so they’re ready for high-demand periods.

Understanding what your burn rate is and why it varies helps you control capital better and time when you seek business financing.

Look to National Business Capital to help expand your runway

Many founders and CFOs learn this universal truth the hard way: Growth almost always costs more and takes longer than you plan for.

Mastering your burn rate puts you in control and lets you drive business growth without your bank balance and capital levels dictating your strategy. This is key to extending your runway, preserving capital, and securing funding before your options are limited.

At National Business Capital, our advisors look beyond the numbers to find the right financing for your unique business needs. Apply today to see how we can help you find a solution that extends your runway and fuels your next growth phase.