Table of contents

As you know, growing and strengthening your business takes savvy financial moves at the right times. Discovering the best commercial loans available today can be your ticket to that important next growth step.

With so many financing options available, from traditional bank loans to private credit, and so many lenders, it can be tough to know where to begin. Here’s a breakdown of the nine best lenders out there for commercial loans, the types of commercial loans to consider, and how to make your best choice.

Best commercial loans at a glance

Here’s an overview of the nine best commercial lenders, who they’re best for, their maximum loan amounts, and more:

| Lender | Best for | Max loan amount | Term length | Minimum credit score |

|---|---|---|---|---|

| National Business Capital | Advisor-service | $15M | Up to 10 years | 620 |

| U.S. Bank | Longer term lenghs | $12.375M | Up to 25 years | 700 |

| Bank of America | Existing customers | $15M | Up to 5 years | 700 |

| Lendio | Comparing lenders | $2M | Up to 10 years | 650 |

| RCN Capital | Flexible real estate loans | $20M | Up to 25 years | Varies |

| TAB Bank | Competitive interest rates | $15M | Up to 25 years | 700 |

| Clarify Capital | Fast funding | $15M | Up to 25 years | 640 |

| JPMorgan Chase | Experienced real estate investors | $25M+ | Up to 25 years | Varies |

| U.S. Small Business Administration | Small businesses | $5.5M | Up to 25 years | 650 |

The 9 best commercial loans

Now we’ll take a deep dive into each lender and break down their pros and cons.

- National Business Capital: Best for advisor-service

- U.S. Bank: Best for flexible terms

- Bank of America: Best for existing customers

- Lendio: Best for comparing lenders

- RCN Capital: Best for flexible real estate loans

- TAB Bank: Best for competitive interest rates

- Clarify Capital: Best for fast financing

- JPMorgan Chase: Best for experienced real estate investors

- U.S. Small Business Administration: Best for small businesses

1. National Business Capital

| Best for | Advisor-service |

|---|---|

| Max loan amount | $15M |

| Starting interest rate | 12% |

| Term length | Up to 10 years |

| Minimum credit score | 620 |

When your business needs strategic financing solutions through cash flow funding, asset-based lending, or another commercial loan, National Business Capital's experienced team of business financing advisors leverages their deep industry expertise to identify and secure the optimal funding strategy tailored to your unique growth objectives.

| Pros | Cons |

|---|---|

| • No tax returns required • Convenient online application • Team of expert business advisors • Fast funding • No minimum credit score • No collateral required | • Interest rates and terms vary |

2. U.S. Bank

| Best for | Longer term lengths |

|---|---|

| Max loan amount | $12.375M |

| Starting interest rate | ~6.99% |

| Term length | Up to 25 years |

| Minimum credit score | 700 |

U.S. Bank is a traditional financial institution offering various financing options, including lines of credit, term loans, asset-based loans, and more. It offers guidance from a business banker to help you find competitive rates and flexible terms suited to your needs.

| Pros | Cons |

|---|---|

| • SBA Preferred Lender | • Strict qualification requirements |

3. Bank of America

| Best for | Existing customers |

|---|---|

| Max loan amount | $15M |

| Starting interest rate | Varies |

| Term length | Up to 25 years |

| Minimum credit score | 700 |

Bank of America is a traditional financial institution that offers lines of credit and business loans with competitive rates and terms. However, they tend to favor existing banking relationships and well-established businesses with strong financials.

| Pros | Cons |

|---|---|

| • Competitive interest rates • Potential for personalized service for existing customers | • Stringent eligibility requirements • May be less flexible than private credit lenders • Longer application process |

4. Lendio

| Best for | Comparing lenders |

|---|---|

| Max loan amount | $2M |

| Starting interest rate | 8.49% |

| Term length | Up to 10 years |

| Minimum credit score | Varies |

Lendio is an online marketplace connecting small businesses with its network of over 75 lenders. They allow businesses to compare multiple lenders’ offers all in one place and work to match you with the right lender for your needs, and provide funding in as little as 24 hours.

| Pros | Cons |

|---|---|

| • Comparison shopping from multiple lenders • Streamlined application process | • Interest rates and terms vary widely |

5. RCN Capital

| Best for | Flexible real estate investments |

|---|---|

| Max loan amount | $20M |

| Starting interest rate | 6.50% |

| Term length | 30 years |

| Minimum credit score | Varies |

RCN Capital is a commercial real estate lender offering short-term financing for fix-and-flips and construction projects, long-term financing for long-term rentals, and short and long-term financing for multifamily (5+ unit) apartments. They lend to developers, small business owners, commercial contractors, and real estate professionals.

| Pros | Cons |

|---|---|

| • Low starting rates • Long repayment terms • No standard upfront fees for approval | • Loans must be backed by non-owner-occupied or commercial properties |

6. TAB Bank

| Best for | Competitive interest rates |

|---|---|

| Max loan amount | $15M |

| Starting interest rate | Varies |

| Term length | Up to 25 years |

| Minimum credit score | 700 |

TAB Bank is an online bank offering financing for small—to medium-sized businesses. It offers a wide variety of loan options for industries ranging from B2B to B2C and boasts competitive interest rates, flexible terms, and a quick underwriting process.

| Pros | Cons |

|---|---|

| • Competitive interest rates • Flexible terms • Variety of loan options | • Strict qualification requirements • Slower application process |

7. Clarify Capital

| Best for | Fast funding |

|---|---|

| Max loan amount | $15M |

| Starting interest rate | 6% |

| Term length | Up to 25 years |

| Minimum credit score | 550 |

Clarify Capital offers small business loans, focusing on low rates and same-day approval. After completing an application, a dedicated adviser pairs you with their pool of 75+ lenders to get you the best rates and loans that you’re eligible for.

| Pros | Cons |

|---|---|

| • Dedicated advisor works with you • Low rates • Same-day approval | • Interest rates and terms vary widely • Strict minimum requirements |

8. JPMorgan Chase

| Best for | Experienced real estate investors |

|---|---|

| Max loan amount | $25M+ |

| Starting interest rate | Varies |

| Term length | Up to 25 years |

| Minimum credit score | Varies |

JPMorgan Chase offers various credit and financing options, including asset-based lending, equipment financing, employee stock ownership plans, and syndicated financing. They are also an established leader in the commercial real estate financing industry.

| Pros | Cons |

|---|---|

| • Wide network of resources | • Not available in every state |

9. U.S. Small Business Administration

| Best for | Small businesses |

|---|---|

| Max loan amount | $5.5M |

| Starting interest rate | Varies |

| Term length | Up to 25 years |

| Minimum credit score | 650 |

U.S. Small Business Administration (SBA) loans are government-backed loans that support small businesses that may not meet traditional bank loan requirements. They reduce risk to lenders through government backing, often offering competitive interest rates and longer repayment terms. SBA loans can be important for a small business’s cash flow and support long-term growth.

| Pros | Cons |

|---|---|

| • Government-backed • Longer repayment terms • Competitive interest rates | • Lengthy application process • Often comes with usage restrictions |

What are the different types of commercial loans?

There are different types of commercial loans to be familiar with. These include:

- Term loans: Term loans provide a lump sum that is repaid over a fixed term with interest. Businesses often use them for large, one-time expenditures.

- Lines of credit: Lines of credit offer businesses flexible access to funds up to a predetermined limit, allowing them to borrow and repay as needed while only paying interest on the amount used.

- Cash flow financing: Cash flow financing provides businesses with immediate capital based on their accounts receivable or future cash flows, helping bridge timing gaps between expenses and incoming revenue.

- Traditional bank loans: Traditional bank loans are provided by a bank to a company.

- SBA 7(a) loans: SBA 7(a) loans are best for purchasing or expanding businesses, refinancing existing debt, and getting working capital. This is the most common type of SBA loan.

- SBA 504 loans: SBA 504 loans are better if you want to purchase equipment, real estate, other major fixed assets, or fund construction.

Familiarizing yourself with these commercial loan types will help you pick a lender that offers exactly what you’re looking for.

How to choose the right commercial loan lender for your needs

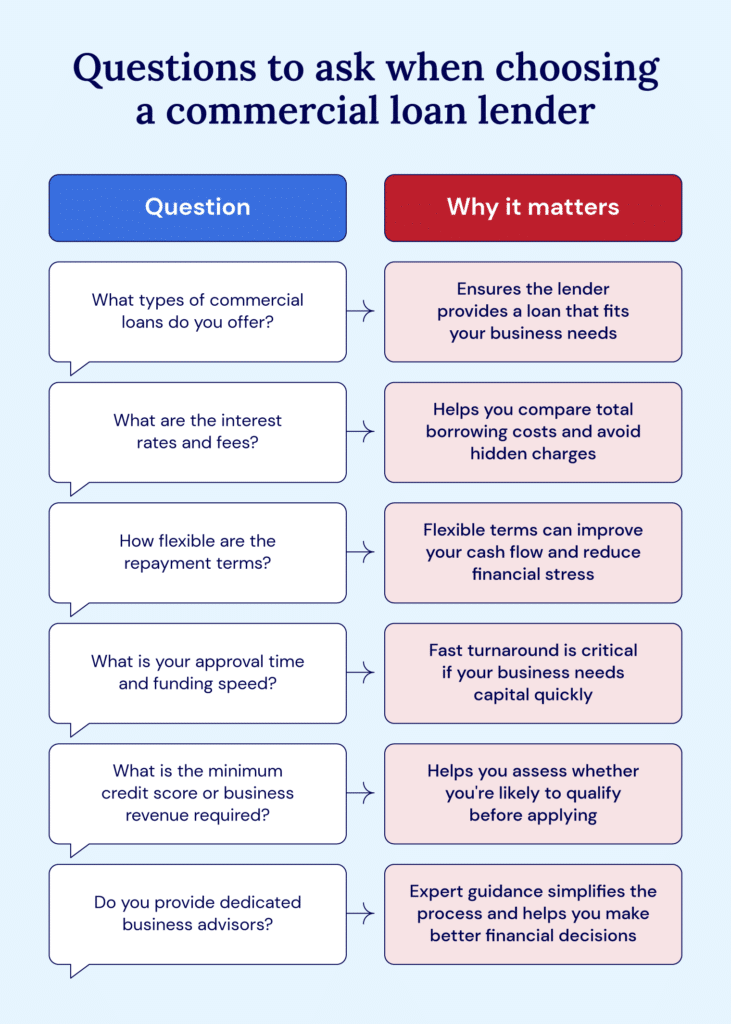

Finding the right provider comes with commercial financing challenges like high qualification standards and complicated application processes. Here are some steps to get started:

- Weigh your goals. Determine exactly what you’ll use the loan for and how that will help you reach the next phase of growth. Do you need to obtain new equipment or cover new operational costs? Consider that some types of loans will have longer repayment terms than others.

- Consider your investment type. Decide what lending product fits your needs best, whether it’s a term loan, line of credit, equipment financing, or a real estate loan.

- Compare terms. Compare interest rates, repayment terms, and any collateral requirements. Pay attention to repayment flexibility and catch any hidden fees before you sign.

Make sure to weigh all your options or get help from a financial expert before jumping on the first loan opportunity you find.

Commercial loan alternatives

Alternatives to commercial loans exist for some businesses that need additional options due to factors like credit challenges or growth stage considerations. Here are several to know:

- Equity financing: This involves selling ownership stakes in the business to investors in exchange for capital, but requires giving up partial control and future profits to shareholders.

- Fundraising: Fundraising encompasses various methods of raising capital from investors through formal campaigns, but can be extremely time-consuming and often results in rejection from multiple sources before securing funding.

- Crowdsourcing: Also called crowdfunding, this method allows businesses to raise small amounts of money from many individual contributors through online platforms, but success is not guaranteed, and failed campaigns can damage brand reputation while providing no funding.

- Invoice factoring: Invoice factoring enables businesses to sell their outstanding invoices to a third party for immediate cash at a discount, but reduces overall revenue since the factoring company takes a percentage of the invoice value as its fee.

It’s important to know that these alternatives often require either giving up ownership or control, accepting reduced revenue, or facing significant uncertainty about successfully obtaining the needed funding. Know your alternative options, but understand the risks as well.

Secure a commercial loan with National Business Capital

Now that you’ve reviewed the best commercial loans above, you’ve got your ticket to growth in hand. Whether you need to purchase equipment, hire new staff, or expand your operations, now is the time to make a smart financing decision to fuel your success.

Especially for first-time applicants, having a trusted expert at your side is important to help you make the most informed choice. For personalized advice and to explore specific financing options, contact our National Business Capital experts. We’ll explain how your company fits into capital markets, advise you on the options your business qualifies for, and advocate for the most competitive contract within our lender network.

Apply now to get started and put your business on the fast track to growth.