Table of contents

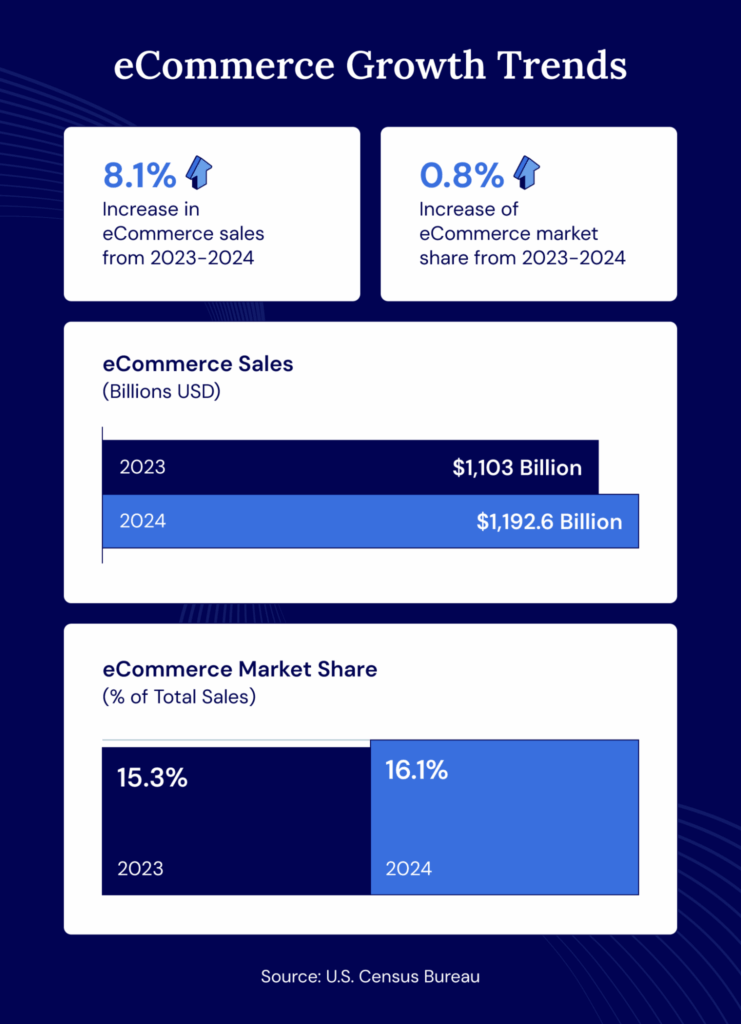

According to the Census Bureau, in 2024, eCommerce companies made a total of $1,192.6 billion in sales, an 8.1 percent increase compared with 2023. eCommerce sales last year accounted for 16.1 percent of total sales of goods and services, up from 15.3 percent the year prior.

eCommerce is clearly a fast-growing sector with ample competition. As a result, any company that hopes to be successful in this industry will need to be able to finance business growth. eCommerce loans can help make that happen.

These loans are a type of small business loan catered towards sellers operating in the online retail space. They can be an important resource if a business needs to upgrade its eCommerce platform, pay for inventory on credit, or otherwise access flexible capital to meet any company needs.

In this article, we'll explain what eCommerce loans are and some common types of eCommerce loans your business may need. You'll also learn how eCommerce financing works and how to compare loan offerings to find the loan that's right for you.

What Are eCommerce Loans?

eCommerce loans are a type of business financing that provides funding for companies offering products or services for sale online.

Some eCommerce business loans specifically help sellers offering products on a certain platform. For example, the Amazon Next lending platform caters to sellers who offer their products through Amazon's marketplace.

In other situations, eCommerce companies can apply for a general business loan that is available to any company that needs access to cash to support its operations or enable growth. These loans can be secured or unsecured, and businesses can use them for almost any purpose.

How eCommerce Financing Works

eCommerce businesses that need capital to fund or expand their operations may decide to apply for a loan. The business will decide:

- How much it must borrow

- What type of loan it's interested in

This may include a line of credit to draw from as needed or a working capital loan allowing quick access to funds for a short period to cover day-to-day expenses. Companies looking to borrow should shop around to find a lender offering the desired loan amount at a fair rate.

Lenders set the cost of borrowing based on many factors, including current interest rates and the level of risk the buyer presents. Comparing rates is important because there's often substantial variation in borrowing costs from one lender to another.

Once an eCommerce company finds the right lender, the company will submit a formal application for a loan. If approved, the lender will distribute the funds to the borrower, who can use them as needed. The borrower will begin making payments and repay the loan with interest.

The lender and borrower will agree upfront on a set repayment schedule, which could involve paying the loan back quickly or over several years.

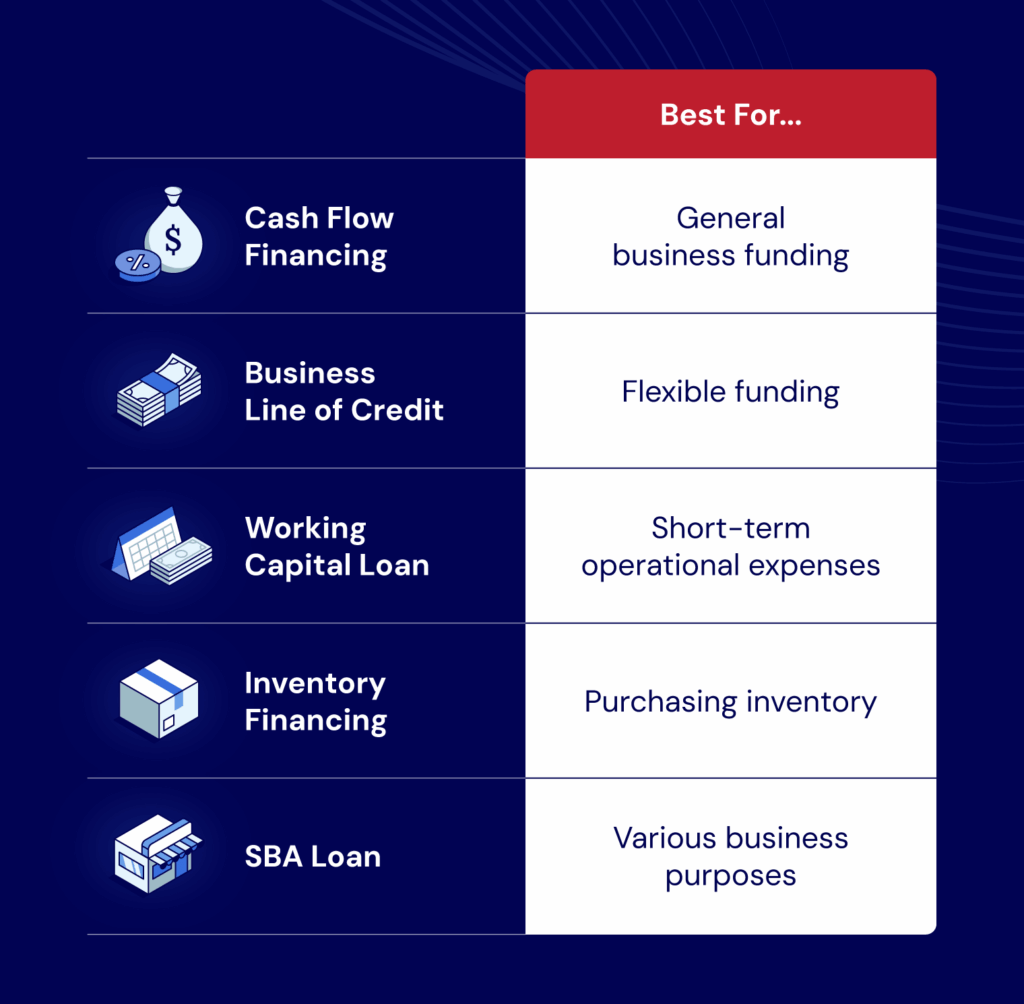

Types of eCommerce Loans

There are a few different types of loans for eCommerce businesses, so anyone borrowing should know what financial arrangement they're agreeing to as they pursue the loan. Each type of financing has its own purpose.

Here are some of the most common loan types.

Cash Flow Financing

Cash flow financing allows companies to borrow capital that will be repaid based on a percentage of future revenue. For example, a company might agree to pay the lender 5% of revenue each month until the loan is paid back in full.

The higher the company's revenue, the faster it will repay the debt – and the more likely the lender will issue the loan. Lenders offering revenue-based financing review the borrower's recurring revenue to decide how much capital to lend. And revenue is key to qualifying for a loan, according to Matt Presta, Business Advisor at National Business Capital:

“If a business has stable cash flow with multiple monthly deposits, it may qualify for more funding.”

Business Line of Credit

Business lines of credit are flexible borrowing options that work very similarly to credit cards. The lender decides how large a line of credit to extend based on the company's financial credentials – including credit history and revenue – and the borrowers can use the funds as needed.

A borrower can use the capital available to them, pay it back, and then borrow again over and over. However, depending on the lender, eCommerce companies accessing a business line of credit may be required to pay a set minimum payment each month based on how much the company has currently borrowed.

Working Capital Loans

Working capital loans are short-term loans that allow an eCommerce business to temporarily pay for routine expenses, such as payroll or other operational costs.

Working capital loans are often secured loans, with company assets acting as collateral. Repayment terms are determined at the time of borrowing, and companies often access funds quickly when they need capital.

Inventory Financing

Inventory financing allows eCommerce sites to leverage the value of their inventory for immediate capital. This makes it possible for eCommerce companies to plan ahead to meet customer demand.

Inventory financing is a simple form of financing because the inventory acts as collateral to secure the loan – lenders provide a percentage of the inventory’s value. That percentage is based on factors like the inventory’s value, condition, liquidity, and more. Lenders may offer a lump sum or a line of credit, and the process of gaining loan approval is typically quick and simple.

SBA Loans

SBA loans are generally guaranteed by the Small Business Administration and offered by private lenders. There are different kinds of SBA loans, including 7(a) loans offering long-term financing and microloans offering $50,000 in funding or less.

Different SBA loan programs have different qualifying requirements, but these loans are generally available to for-profit companies doing business in the United States with good credit histories.

Loan funding can pay for equipment or help individuals or businesses fund acquisitions.

How to Apply for an eCommerce Loan

The process of applying for an eCommerce loan can vary by loan type and lender. However, most companies can expect to take the following steps.

1. Evaluate Your Financing Needs and Select a Loan Type

Since there is more than one type of eCommerce loan, companies must carefully consider what type of financing makes sense so they can find the best commercial loans for their specific situation.

To decide on what type of financing, businesses should:

- Determine if they need a lump sum or access to a line of credit.

- Decide whether they want to use assets as collateral or pursue an unsecured loan.

- Consider what they'll be using the funds for to decide whether it makes sense to take a specific type of loan, such as a working capital or inventory loan.

- Evaluate their budget to determine whether they want a loan with a longer or shorter payoff period.

2. Understand Lender Requirements

Next, companies should research the different lender requirements to apply for loans, as it is usually difficult to get a business loan with no capital or collateral.

Lenders typically look at a few key traits when deciding whether to offer a loan, including:

- Credit score: Businesses earn a credit score when they borrow. Lenders review their scores to determine if they've been responsible borrowers. Higher credit scores, earned by making on-time payments, can make it easier to qualify for affordable financing.

- Revenue and profitability: Lenders want to know how much revenue a company collects and how profitable it is after accounting for expenses. A more profitable company is less likely to default on loans, so it is more likely to be allowed to borrow.

- Time in business: Newer companies present a greater risk as many businesses fail initially. Established businesses are safer bets for lenders because they already have a proven business model, can provide proof of profits, and may have already demonstrated responsible borrowing behavior.

Sometimes, a business will not qualify for a loan unless an owner or other official makes a personal guarantee. This means they put their personal assets on the line and could lose them if anything goes wrong.

3. Compare and Choose a Lender

Since there are many eCommerce business loans available, borrowers will likely have their choice of lender – especially if the business is well-qualified to borrow.

Businesses should evaluate loan options carefully to pick the right loan provider. This includes looking at the:

- Interest rate: A lower cost to borrow is best, but companies should also consider whether the loan has a fixed rate that won't change or a variable rate that could fluctuate with time. Variable-rate loans are riskier, while fixed rates mean the payment and total borrowing costs will stay steady during the life of the loan.

- Loan limits: Companies must consider minimum and maximum loan limits to ensure they can receive the appropriate amount of funding.

- Repayment timeline: Shorter loan terms come with higher monthly payments but lower total borrowing costs over time.

The goal should be to get the best value from a lender with a solid reputation for providing good customer service to borrowers.

4. Prepare Your Application

Most lenders require specific documentation when a company borrows, and the business will be required to fill out an application to secure funds.

Some of the documents that an eCommerce business may need to get approved for a loan include the following:

- Business plan: A business plan shows the company's goals and its roadmap to success. The plan should include details about how the loan funding will enable the company to better meet its objectives going forward.

- Financial statements: Financial statements can show a company's past successes and provide proof of its ability to repay the loan. While the types of required financial statements vary, income statements and balance sheets are almost always required.

- Growth projections: The borrowing company should be able to provide projections for future growth, ideally enabled by the financing the borrower is applying for.

Lenders will provide guidance on the specific documents and information necessary to apply for each type of eCommerce loan the lender makes available.

5. Submit Your Application

You can easily apply for your eCommerce loan with National Business Capital and our team of expert business advisors. We’re a private credit lender that can help you find the best possible financing solution based on your business qualifications.

If a loan is approved, we will disburse the funds on the agreed-upon terms, which you can use for your eCommerce business.

How to Manage Your Loan for Maximum Impact

Borrowing capital is a big commitment because it requires promising future income to repay past debt. Unless the funds grow the business, it will be harder to make a profit once a company has gone into debt.

That's why any eCommerce business that borrows must manage its borrowed capital as wisely as possible. Here's how.

Allocate Your Funds Wisely

The first key step after being approved for a loan is to decide where the funds can make the most impact. This could include buying inventory to deliver on customer orders or platform expansion to offer more products or reach new potential buyers.

Consider the profit each option is likely to generate and the risk involved to maximize returns with the borrowed funds.

Monitor and Measure Its Impact

Finally, the last step is establishing benchmarks for success and regularly reviewing whether you’re meeting those benchmarks. This way, the company can determine if the loan is being used effectively to achieve the desired company goal.

Careful record-keeping is always helpful in measuring impact, although the process will vary depending on the loan's purpose. To determine if a loan used to purchase inventory is effective, for example, the company would need to determine how much inventory was purchased and sold to decide whether the transaction was a success.

Explore eCommerce Business Loan Options With National Business Capital

eCommerce businesses seeking a trusted lender can turn to National Business Capital.

National Business Capital offers a variety of loan types and expert business advisors to meet the needs of companies looking for eCommerce financing. Fast, efficient funding is available so companies can take swift action when new opportunities arise.

Apply now and lean on expert Business Financial Advisors to compare offers and help you understand your options. That way, you stand to find a financing solution that’s a perfect fit for your eCommerce business.