Table of contents

Navigating the world of business financing can get complicated fast, especially if you’re exploring alternatives to OnDeck. Whether you’re in retail, e-commerce, construction, or any industry that runs on tight margins and quick decisions, finding a lender that actually fits your needs (and your pace) matters.

This quick guide breaks down some of OnDeck’s top competitors, what they offer, and which type of business each lender tends to serve.

Understanding your business financing needs

Before you start comparing lenders, it helps to be clear on what your business really needs. Companies in the $2M–$50M range often run into the same few challenges, and those pain points usually decide what kind of financing makes sense.

Cash flow gaps: Maybe it’s seasonal slowdowns, delayed payments, or rapid growth that’s outpacing your working capital.

Growth goals: Expanding companies need lenders who understand speed and flexibility, not just paperwork.

Operational needs: Whether it’s new equipment, extra inventory, or launching a new service line, smooth operations take cash at the right time.

It also pays to look at your financial profile: things like your credit score, existing debt, and lifetime funding needs, to make sure you’re matching with the right kind of lender from the start.

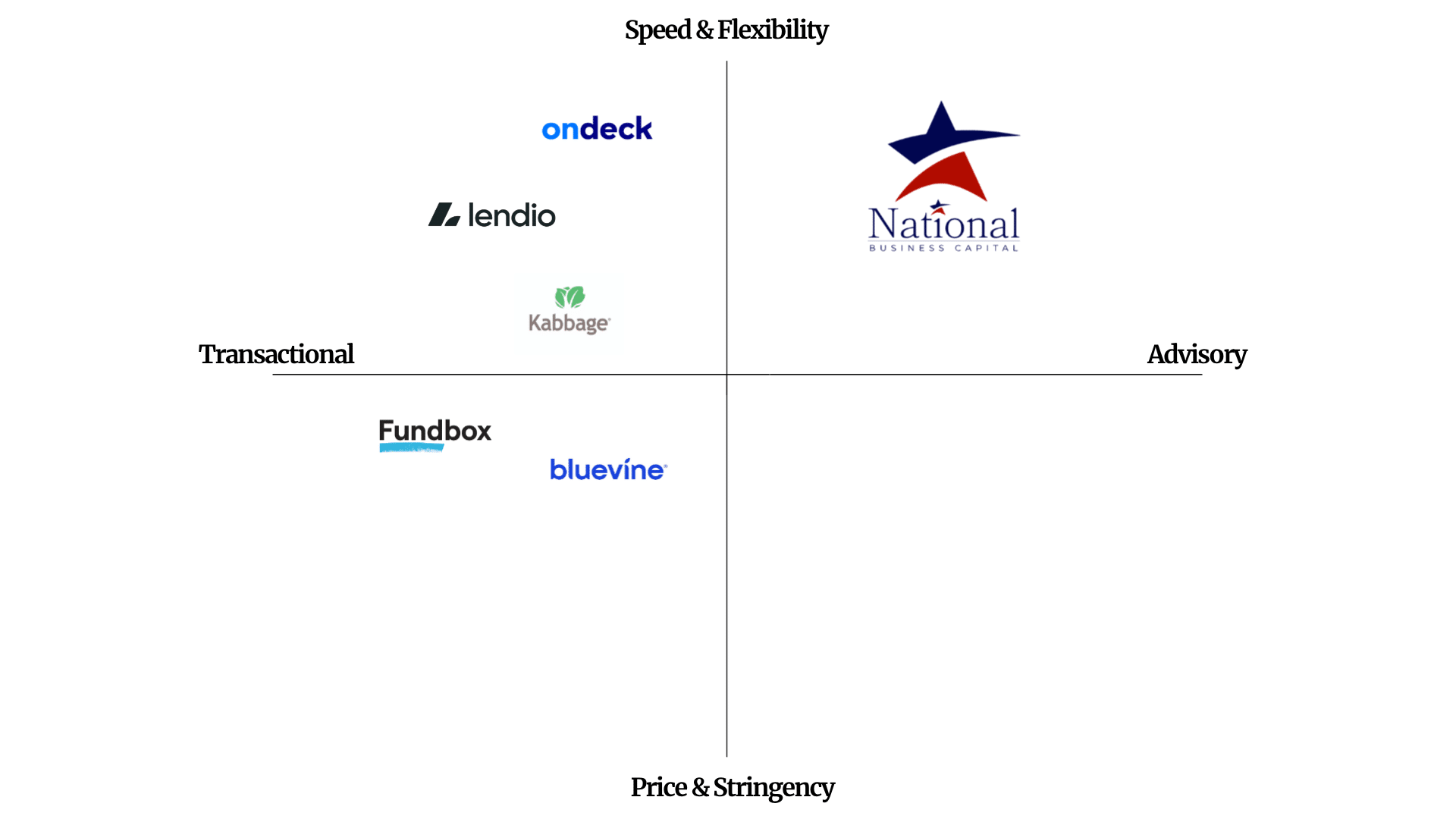

OnDeck Capital competitors: A quick look

Understanding the alternatives to OnDeck

1. National Business Capital

National Business Capital stands out as one of the strongest alternatives to OnDeck, especially for business owners looking for more than just funding. NBC acts as a true capital partner, helping you think strategically about growth, not just getting through the next payroll cycle. Here’s what sets us apart:

Key features

NBC offers a variety of financing options that include:

- Fast approvals: Get a decision as quickly as the same day you apply. Quick access to capital means you can act on new contracts, cover short-term needs, or jump on time-sensitive opportunities.

- Term loans: Choose from flexible repayment periods with competitive rates designed to work with your cash flow, not against it. Whether you’re refinancing debt, managing expansion costs, or stabilizing operations, these loans move with your business rhythm.

- Equipment financing: Upgrade or add new equipment without gutting your reserves. From heavy machinery to technology upgrades, equipment financing helps you stay efficient and competitive while keeping your cash free for day-to-day operations.

| PROS | CONS |

|---|---|

| Customized solutions: Tailors financing options to specific business needs. Is a direct lender with diverse lending partners. | Qualification criteria: Some options may have stringent qualifications. |

| Diverse loan portfolio: Varied financial products for a wide range of business industries. | Rates: As a private credit lender, rates are typically higher than banks as most loans are non-secured and cash flow-based. |

Best for

National Business Capital works extensively with companies in construction, manufacturing, transportation, and wholesale. Whether it’s fueling day-to-day operations or funding the next phase of growth, NBC helps business owners access capital that matches their pace and ambition.

2. Lendio

Lendio is a lending marketplace that lets business owners compare offers from multiple lenders side by side, saving time, hassle, and guesswork.

Financial products

- Merchant cash advances: Based on future revenue expectations.

- Multiple loan options: Includes SBA loans, short-term loans, and more.

| PROS | CONS |

|---|---|

| Comprehensive overview: Allows comparison of multiple offers at once. | Varying rates and terms: Terms can vary significantly by lender. |

| Diverse network: Access to a wide range of financial providers. | Third-party dependence: Relies on external partners for loan fulfillment. |

Best for

Ideal for some business owners unsure of which loan types are best for them, offering a broad overview of potential lenders.

3. Kabbage

Kabbage offers lines of credit that are administered through American Express, meant mostly for cash flow needs.

Key features

- Fast funding: Access to lines of credit with a quick approval process.

- Integration with business accounts: Seamlessly connects to your business checking account, making it easier to move money, manage cash flow, and stay on top of day-to-day finances.

| PROS | CONS |

|---|---|

| Globally recognized brand: Backed by American Express's reputational strength. | Higher fees compared to traditional loans: The convenience fee structure may be higher than conventional financing. |

| Integration with business accounts: Seamlessly links to business checking for efficient money management. | Limited to credit lines: Focused on specific financing needs only. |

Best for

Kabbage suits tech-savvy business owners and those with shifting short-term cash flow needs.

4. Bluevine

Bluevine offers both business banking and small‑business financing (lines of credit and term loans).

Key Features

- Business line of credit: up to about $250,000.

- Shorter term financing: many programs with 6‑ or 12‑month repayment terms.

| PROS | CONS |

|---|---|

| Relatively low barrier to entry compared to traditional banks. | Suited for smaller loan amounts. |

| Business checking account features are strong. | Not available in all states for certain products (e.g., line of credit). |

Best for

Businesses with moderate, but not perfect, credit who may not qualify easily for traditional bank loans.

5. Fundbox

Fundbox is an online lender offering quick, short-term funding to help small businesses smooth out cash flow and stay moving.

Key Features

- Loan amounts: Fundbox offers business lines of credit up to $150,000.

- Repayment terms: Typically, 12 or 24-week repayment terms, which is relatively short compared to traditional loans.

| PROS | CONS |

|---|---|

| Fundbox typically doesn’t require a personal guarantee for smaller credit lines, which means that your personal assets aren’t at risk if your business cannot repay the loan. | Fundbox offers up to $150,000, which might be too small for larger businesses that need significant capital for expansion. |

| There are no penalties for paying off your loan or line of credit early. | Fundbox focuses mostly on lines of credit and invoice financing, so if you need long-term loans or larger loans, this may not be the best fit. |

Best for

Fundbox is suited for businesses that hit cash flow bumps but expect things to level out soon.

Making an informed decision

Finding the right funding partner can completely change the game, especially in markets like California, Texas, New York, and Florida. While lenders like OnDeck, Bluevine, and Fundbox have their place, exploring the sort of options provided by National Business Capital helps you find business financing that truly fits your goals, not just your immediate needs.

When you compare lenders, think beyond the next few months. The best funding isn’t just about getting approved. It’s about setting your business up for long-term momentum.

With the right capital strategy, you’re not just covering costs, you’re building resilience, flexibility, and room to grow.

See what you’re approved for today and start funding your next move.