Table of contents

A large part of growing your business involves tracking metrics like operating and gross margins. They reveal key insights that are essential for managing cash flow and evaluating whether you have enough capital to seize major growth opportunities.

In this article, you’ll learn what operating and gross margins are and how to calculate them. We'll also explain how to use these metrics to decide whether to self-fund your growth or pursue external capital.

Operating margin + how to calculate it

Operating margin shows the profit your business makes after paying all day-to-day costs, like salaries, marketing, rent, and the cost of goods sold (COGS).

For example, a Texan logistics company generating $1.8M in operating profit on $12M in net sales is making a 15% operating margin. Here’s how to calculate operating margin:

| Operating profit margin formula = (Operating profit ÷ Net sales) x 100 |

|---|

Gross margin + how to calculate it

Gross margin is a much narrower metric, showing you what you still have after subtracting COGS from your revenue.

Let’s say a Florida manufacturing plant with $7M in revenue and $4.2M in direct production costs. Its gross profit is $2.8M, or 40%. Here’s how to calculate gross margin:

| Gross profit margin formula = [ ( Revenue - COGS ) ÷ Revenue ] x 100 |

|---|

Operating margin vs. gross margin: Key differences

When comparing gross margin vs. operating margin, the key difference is the amount subtracted from your revenue.

Imagine a construction business in North Carolina. Their gross margin tells you the profit after direct costs, like building materials and the wages for the on-site crew.

The operating margin shows the profit after meeting those expenses and all the other costs of running the company, like office rent, insurance, and marketing costs.

A large gap between the figures suggests that while the business is making a profit on building projects, overhead and admin costs are too high and eating into profitability.

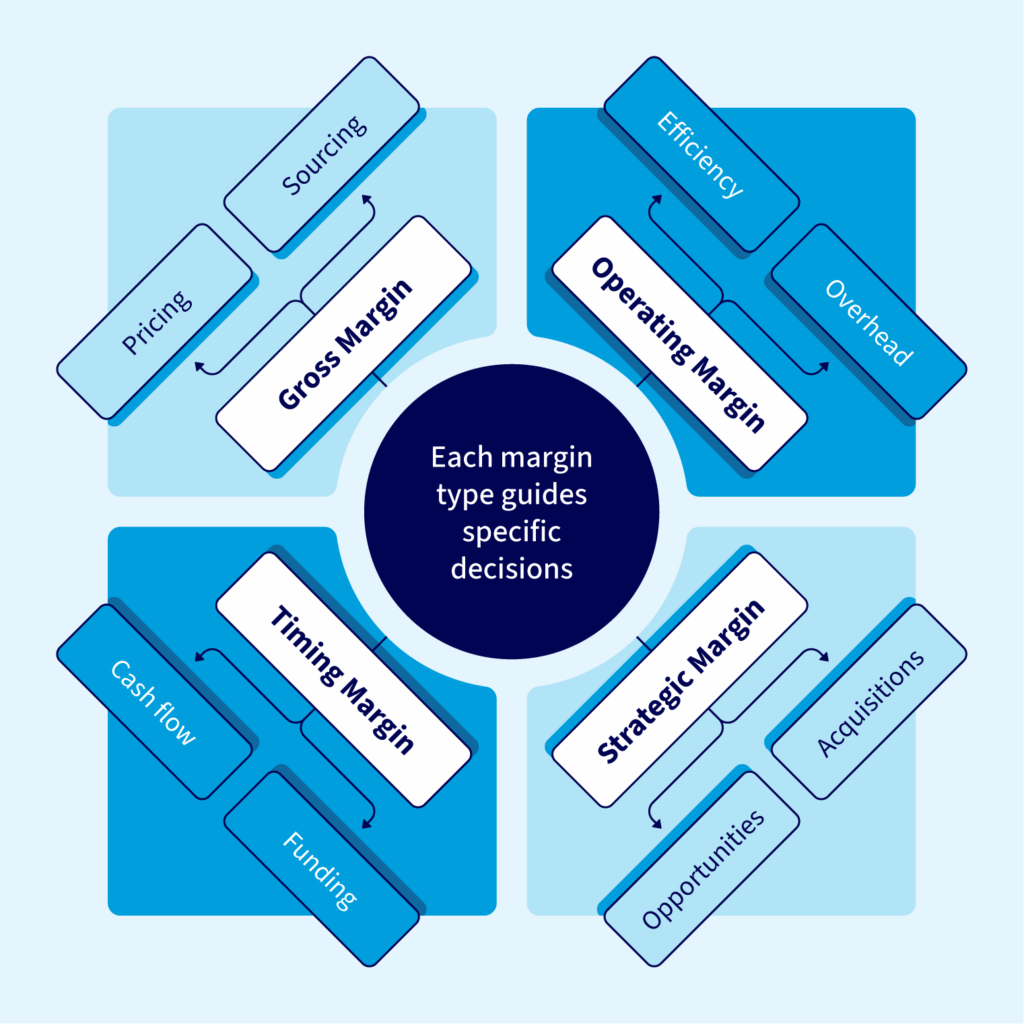

Other working margins every business should know

Operating margin and gross margin are useful on their own, but you can also repurpose them into “working margins” metrics to fuel forecasting and faster decision-making.

These show you how much room you have to maneuver. The most successful companies use margins to grow revenue and market share by strategically reinvesting their margin "room to maneuver" into growth initiatives like marketing, R&D, or competitive pricing.

When companies have healthy margins, they can afford to temporarily reduce prices to capture market share or increase spending on customer acquisition, knowing their underlying profitability can support these investments. This margin-driven approach allows them to scale operations efficiently while maintaining financial flexibility to outmaneuver competitors who operate with thinner margins.

Timing margin

To combat unpredictability, you can analyze your operating and gross margins to pull insights about your cash runway well in advance.

Here’s how:

- Set up a spreadsheet: Connect your accounting software, like QuickBooks or Xero, to a Google Sheet. Set it up to pull in your cash transactions, incoming and outgoing, for the last 90 days.

- Automate rolling averages: Create a formula in your sheet to calculate the average of your last 90 days of inflows and outflows. Because your data feed is live, these numbers will update automatically every day. This rolling average figure lets you know what a typical day for your company looks like.

- Visualize your runway: Every day, the sheet pulls in your bank balance plus your inflows and outflows. Your sheet will start with today's bank balance and then forecast your closing balance for each day over the next three months by applying your average daily inflow and outflow.

This information will reveal whether you have the internal momentum to fund your next growth move on your own or if you’ll need external funding, like short-term financing.

For a manufacturing company, this means knowing with certainty if they can order raw materials for a large production run, or if they need to approach a lender to maintain a healthy cash position. For a construction company, this means understanding if they can commit to a multi-month project with upfront material and labor costs, or if they need to secure financing to bridge the gap between project expenses and milestone payments.

Knowing your timing margin is the difference between reacting to cash flow problems and proactively optimizing capital spending.

| The opex margin, sometimes called operating margin, is how profitable a company is after deducting operating expenses. To work out opex, divide your operating income by your revenue. |

|---|

Strategic margin: Make decisions before others even respond

The strategic margin determines how ready you are to take advantage of a decision that defines your company's future.

There are three parts to calculating your strategic margin:

- Know what you’ve got: Work out your readily available capital (including cash equivalents) plus the full, undrawn amounts of any funding facilities you have, like with a cash flow line of credit. This is the absolute maximum capital amount you can afford to spend on the opportunity.

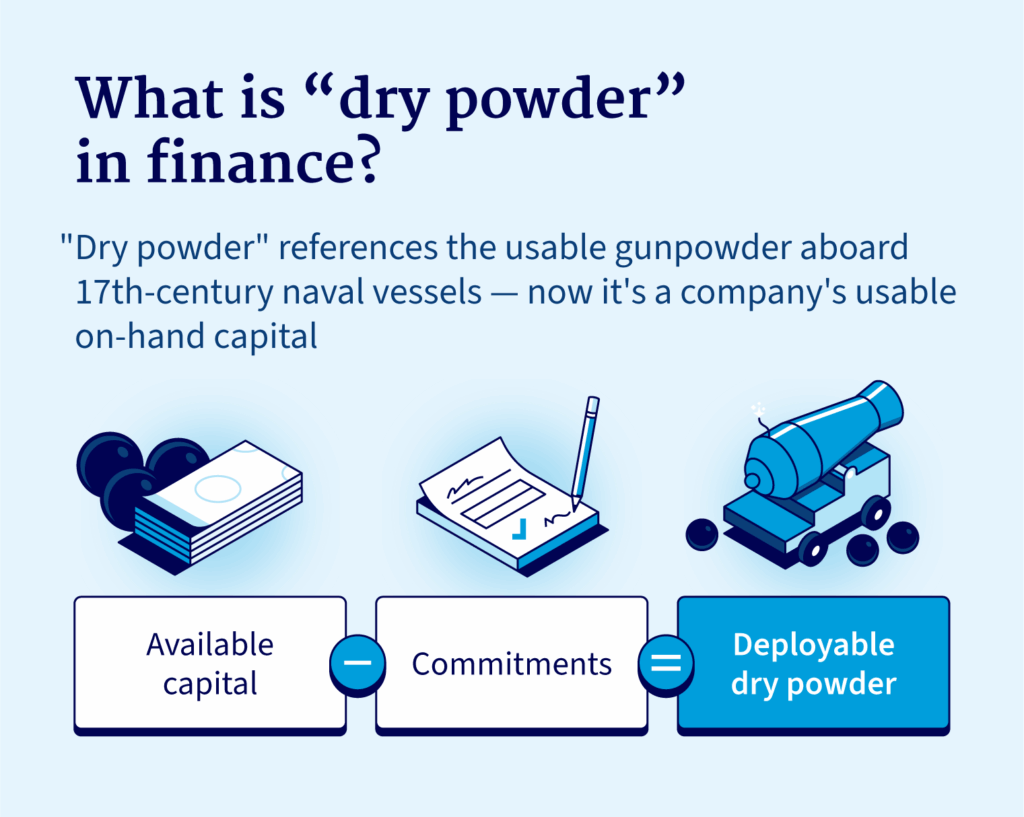

- Determine your “Dry Powder”: There’s always an opportunity to use more capital to reach your goals, so you’ve got to factor that in next. Subtract any funds you're already committed to spending, like debt repayments or significant supplier payments. The figure you’re left with is your true "Dry Powder," the uncommitted capital you are free to deploy.

- Get your lender green light: Speak with all your current lending partners to find out how much additional financing you can take on that won’t breach your agreement with them. This confirms you have a clear runway to make a major move.

Your strategic number transforms you from a spectator into a decision-maker. While rivals drag their feet on growth maneuvers, you’re better positioned to move forward and take action on expansion.

That readiness to act is what makes the difference. And that’s why it’s always worth knowing your strategic margin.

| Another popular metric is the Earnings Before Interest and Tax (EBIT) margin. This is a measure of your profitability before you pay for interest and taxes. The EBIT margin formula is: Divide EBIT by your total revenue and multiply by 100 to come up with a percentage figure. |

|---|

Case study: How margin intelligence can shift funding decisions

“Champion Seats” is a thriving ticket broker. They learned a valuable lesson in the cost of hesitating.

The company had $180K in the bank and received an offer to buy 500 premium NFL playoff tickets for $600K. They had a $150,000 business tradeline open to them, but it wasn’t enough to cover the funding gap.

Even if it were, they would be left with no capital to pay standard operating expenses. They passed up the opportunity, worried more about their cash position than losing the profit on the sales. They did sell tickets that year, but bought them in much smaller volumes, so they paid a lot more per unit, meaning their margins were much smaller.

Next year, they worked out their strategic margin. They had $150K in capital and arranged $750K in a flexible business line of credit. When the same ticket block became available, they drew down $600K from their facility and bought it. They generated $300,000 in profit on those sales, incurring just over $13,000 in interest and fees.

Knowing their strategic margin allowed them to act much faster than their rivals for the ticket, putting them in a healthier capital position than ever.

| Season | Strategic margin | Action taken | Result |

|---|---|---|---|

| Year 1 | $180K cash and $150K tradeline = $330,000 “Dry Powder” | Passed on a block of 500 premium playoff tickets | Forced to pay much higher prices. Lost $287K in potential profit. |

| Year 2 | $150K cash. $150K tradeline and $750K LOC and no other debts = $1M “Dry Powder” | Drew $600K to purchase the same 500 tickets in advance. | Gained $300K in profit before $13K cost of capital. |

*Client name and information has been altered to respect confidentiality.

Leverage flexible capital to increase your margins strategically

Operating and gross margin can help explain your current financial health, but their real value is highlighting how much maneuvering space you truly have. For a businessperson, this knowledge provides a clear roadmap for how to grow your business.

To act on these insights when you're short on capital, partner with a private credit lender like National Business Capital to find the right funding solution.

Our range of flexible standard and alternative business loans and lines of credit delivers the maneuvering space to act confidently and decisively.

Start your digital application with us today.