Table of contents

You're expanding your fleet, hiring new drivers, and growing fast with new contracts. When the next growth step is outside your cash flow's capabilities, a trucking business loan can inject liquidity into your operations, giving you the power to say yes to more opportunities.

In this article, you’ll learn what trucking business loans are, what benefits they offer, and why you should choose National Business Capital for trucking business finance.

What is a trucking business loan?

A trucking business loan is a type of commercial finance best suited to help freight and transportation companies manage their cash flow, meet day-to-day expenses, and fund longer-term expansion plans. Trucking firms use these loans to bridge invoice payment delays, cover unexpected vehicle repair bills, and upgrade their vehicles and facilities.

Common types of loans for trucking businesses:

- Term loans

- Business lines of credit

- Cash flow financing

- Equipment financing

- SBA loans

How do trucking business loans work?

Depending on the type of trucking business loan you take out, you either:

- Receive an upfront lump sum payment of capital directly into your business checking account

- Gain access to a credit line you can draw on when needed

You start repaying the loan soon after, in one of the following two ways:

- Predictable fixed payments collected at regular intervals (great for budgeting)

- Payments that scale up or down based on your actual sales volume (excellent for managing cash flow)

One reason trucking business finance is popular is how fast lenders approve loan applications.

Traditional banks can take up to 90 days to decide. While waiting, you may have to delay essential maintenance, keep a vehicle off the road, or miss out on profitable but time-sensitive opportunities like buying specialist trailers to secure a high-margin deal.

But with National Business Capital, you can get the funding you need to achieve your goals with the expert guidance of a professional business advisor.

Types of commercial truck loans

Several types of loans are available for freight and transportation firms. The right loan for your company depends on what you need the funds for, like covering bills, maintaining your fleet, or expanding your firm.

Five of the most popular types of trucking business loans are:

1. Term loans

When you take out a term loan, you receive the capital from your lender as one upfront payment.

You then repay your lender in regular, fixed installments over a set period. The repayments stay the same, so it’s easier to plan your finances and keep track of exactly how much capital you have available.

There are two types of term loans:

| Short-term loans | Long-term loans |

|---|---|

| Short-term financing (six months to three years) is ideal for handling urgent bills so you don’t have to turn work away. | Longer-term loans (three to 25 years) are better for bigger, more strategic purchases like buying new vehicles and trailers for your fleet and expanding your storage and maintenance facilities. |

2. Business line of credit

A business line of credit is flexible funding that lets you borrow up to a set limit. You repay only the funds you draw on, plus interest.

Lines of credit work very much like credit cards; however, the limits you get on a line of credit are often far higher. Just like with a credit card:

- Your “limit” is the maximum amount you can borrow.

- Your “balance” is the amount you owe.

- When you repay, your balance goes down, freeing up funds you can borrow again.

You typically have one to three years to settle the balance on a line of credit in full.

Trucking firms choose business credit lines because they get instant access to capital. This capital can be used to meet expenses like unexpected repair bills, quickly replace essential equipment (like tyres or trailer parts), or deal with compliance and regulatory costs.

3. Cash flow financing

With cash flow financing, you receive a lump sum payment upfront, paid into your checking account. You then pay back a percentage of your daily or weekly sales until you clear the balance. So you pay more when your sales are higher and less during slower periods, meaning your repayments stay affordable, even when business is quieter.

Trucking companies often use cash flow financing to see them through off-peak periods.

| Example |

|---|

| ABC Trucking was struggling to expand its fleet during a freight boom because traditional banks required lengthy approval processes and extensive collateral. Through cash flow financing via invoice factoring, they converted their outstanding receivables into capital. This allowed them to purchase three additional semi-trucks and hire new drivers to meet surging demand from a major retail client. Within six months, ABC Trucking was able to: • Increase their monthly revenue from $180,000 to $320,000 • Maintain steady cash flow during seasonal dips • Elimintate the feast-or-famine cycle that had previously limited their growth Cash flow financing worked perfectly for their business model because it was based on their strong customer payment history rather than traditional credit requirements, and payments automatically adjusted with their revenue fluctuations. |

4. Equipment financing

You can use equipment financing to spread the cost of business equipment, machinery, and tools over time.

There are two types of equipment financing:

| Equipment loans | Equipment leases |

|---|---|

| You own the asset outright at the end of the repayment period. Loans are better for long-term investments like trucks, trailers, or loading and storage equipment for your depot. | You never own the equipment and must return it to your lender at the end of the lease. Leases are better for equipment that becomes outdated quickly, like GPS units and telematics devices. |

5. SBA loans

For major investments like buying new premises, upgrading your entire fleet, or refinancing existing debts to lower your monthly repayments, consider an SBA loan or line of credit.

The U.S. Small Business Administration (SBA) partly underwrites these loans. This guarantee provides extra security for the banks, which means you can secure funding at lower rates and over longer repayment periods than traditional bank financing.

Benefits of trucking business loans

Trucking business loans give owners more control over their companies and more freedom to make strategic decisions about the future. Here’s how:

Use your trucking loan to expand straight away. Don’t wait years to build up enough capital reserves. Put your expansion plans into action now and give your firm a competitive edge – and there’s no time better than now.

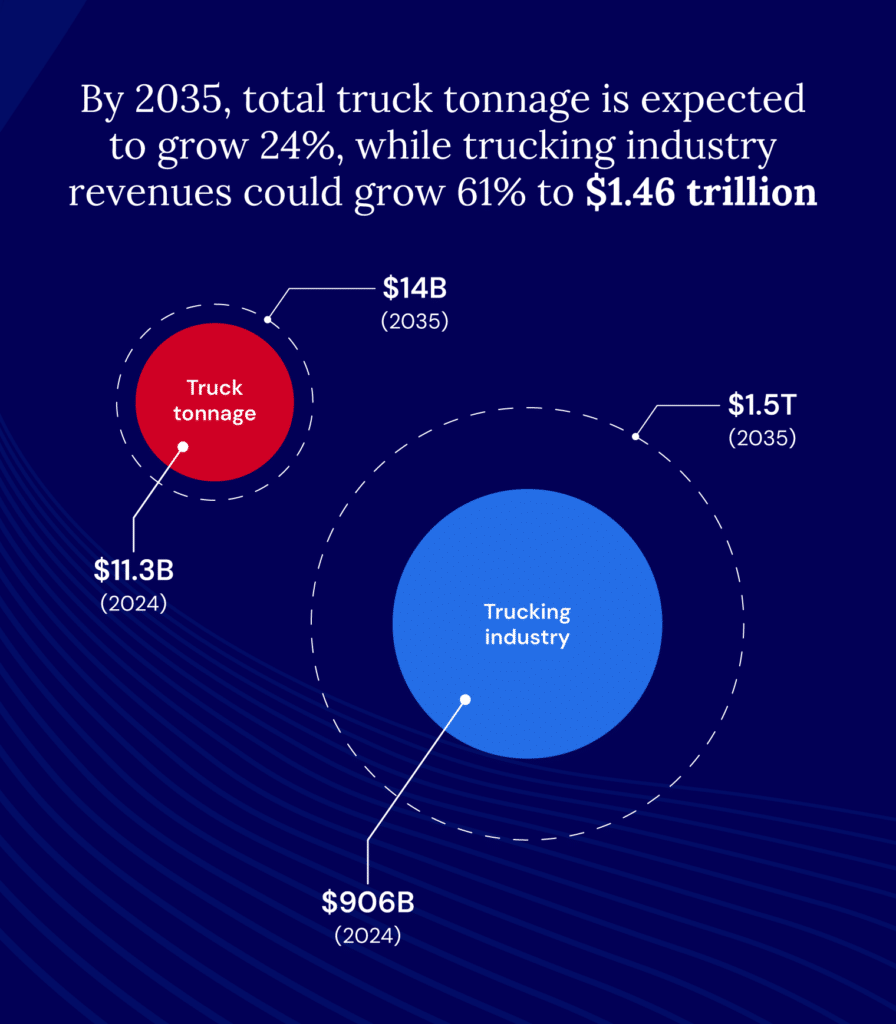

The American Trucking Association projects trucking industry revenues to skyrocket from an estimated $906 billion in 2024 to $1.46 trillion in 2035. By that time, it would account for more than three-quarters of the freight market.

Growth looks different for every trucking business. You might need to hire dedicated salespeople to pitch your services directly to manufacturers or logistics brokers so you win more contracts. Or, you might open a new hub in a thriving locale like Texas, where another manufacturing boom is creating fresh demand for regional carriers.

Cash flow support

The immediate access to capital you get from a trucking business loan helps you smooth out cash flow during revenue peaks and troughs.

With a trucking loan, you can protect your company’s capital reserves and still comfortably cover operational expenses, even if you’re hit with sudden fuel price rises, vehicle repair costs, or late customer payments.

Flexible financing options

Traditional bank and credit union finance doesn’t always work for trucking companies. Banks can be frustratingly slow, rigid on lending terms, and often just don’t get how trucking firms really operate.

Instead, choose to work with lenders who take the time to understand your business. They can build a lending solution that matches your firm’s exact needs, so you get the right funding to respond quickly when both opportunities and challenges arise.

To find out more about flexible funding for your business, contact National Business Capital. We’ve secured over $3B in financing for business owners, and we’d value the opportunity to work with you.

How can a company use a trucking business loan?

Commercial truck financing helps company owners solve practical problems and unlock new opportunities. Here are four common ways trucking firms put this funding to work:

Expanding the business

Be the first to act on new opportunities when they arise, like:

- Invest in your premises: Add storage, warehousing, or distribution facilities so you can offer value-added, higher-margin services like inventory management, picking and packing, or freight repackaging.

- Growth through acquisition: Buy one of your local competitors and add their vehicles, established routes, and experienced drivers to your portfolio. Or open up in a growing hub like the Port of Houston by purchasing an existing firm in the area instead of setting up a new location and spending years building it up from scratch.

The more revenue streams your business has, the more resilient it is when core freight volumes dip and customer demands shift.

Financing equipment

Commercial truck loans help you keep your fleet modern, reliable, and ready for the road. Improve on-site maintenance by investing in equipment like vehicle inspection pits and brake-testing systems, so trucks spend less time in the yard and more time out earning you profit.

You can also add specialised trailers or vehicles to target profitable niche markets. For example, invest in refrigerated trailers to win contracts for transporting temperature-controlled goods, like pharmaceuticals or food.

Refinancing debt

Trucking is a capital-intensive business, so most firms seek funding at different times to help them expand and smooth out their cash flow. Many companies end up servicing multiple loans, trucking business lines of credit, credit cards, and more, each with its own interest rate and repayment date.

Simplify your finances by consolidating all your existing facilities into a single monthly payment. This also frees up capital each month, which you can reinvest directly back into your business or even use to give yourself a pay rise.

Covering fuel costs

Secure lower prices by buying fuel in bulk from your suppliers, so you’re paying wholesale rates while your competitors are paying retail. This is a great way to price aggressively while protecting your profit margin.

If you have your own fuel storage facility, you can lock in those savings for longer by fixing your rate for an extended period. Do this by negotiating a guaranteed volume and delivery schedule with your supplier.

How to get a trucking business loan

To help speed up your application for a trucking business loan, follow these three tips:

Tip #1: Prepare your documents

Your lender may ask you to provide certain financial and business documents along with your application, including:

- Business bank statements (going back at least one year)

- Business plan

- Business credit report

- Personal and business tax returns

- Relevant licenses and registrations

- Articles of incorporation

- Balance sheet

- Income statements

- Cash flow statements

Depending on your lender, you might not need all these documents to get a trucking business loan. But having everything ready upfront helps your lender review your application quickly, meaning you get approved and funded sooner.

Tip #2: Strengthen your financial profile

Take practical steps now to boost your credit score. The higher your credit score, the more likely a lender will approve your application. Better still, they might also offer you a more competitive interest rate, lowering your credit costs.

Here are four quick ways you can boost your credit score:

- Pay your bills on time (including credit accounts with your suppliers)

- Limit the number of applications for finance you make

- Get a DUNS number from Dun & Bradstreet

- Keep your personal and business finances separate

Improving your credit profile doesn't just help you with your current application. It also makes securing funding easier and cheaper in the future.

Tip #3: Find a long-term lending partner

Look for a lender that can help you with financing now and in the future. Partner with a firm that genuinely understands the trucking sector, like National Business Capital.

Rely on us to:

- Explain what options are available to you to help you choose the right type of funding

- Negotiate directly with lenders to secure better rates, lower fees, and more flexible repayment terms

- Guide you through each stage of the process, handling paperwork and dealing with lenders, so you stay focused on running your fleet

We know the trucking sector values speedy decision-making. With National Business Capital, you can secure financing of $15 Million or more on a schedule tailored to your business’s needs. Think of our expert business advisors as your in-house financial team, always here with straightforward advice and practical solutions.

Choose National Business Capital for trucking business loans

Trucking business loans help firms grow by boosting cash flow and giving them the capital to respond quickly to market opportunities and challenges. From specialist trucking business lines of credit to commercial truck financing, National Business Capital can provide the right solution for your company.

Talk to one of our Business Finance Advisors today about our flexible solutions for trucking businesses. Tell us about your firm and goals, and we’ll explain how we can help. Start your application now, and let’s get you funded.