Table of contents

Our monthly construction industry trend report combines the latest industry data with our internal findings from National Business Capital’s award-winning team. With extensive experience in the construction industry since 2007, we are thrilled to share these findings and expand on them through our unique expertise. Our goal is to provide business leaders and decision-makers with the necessary information and data to make well-informed decisions in their business endeavors.

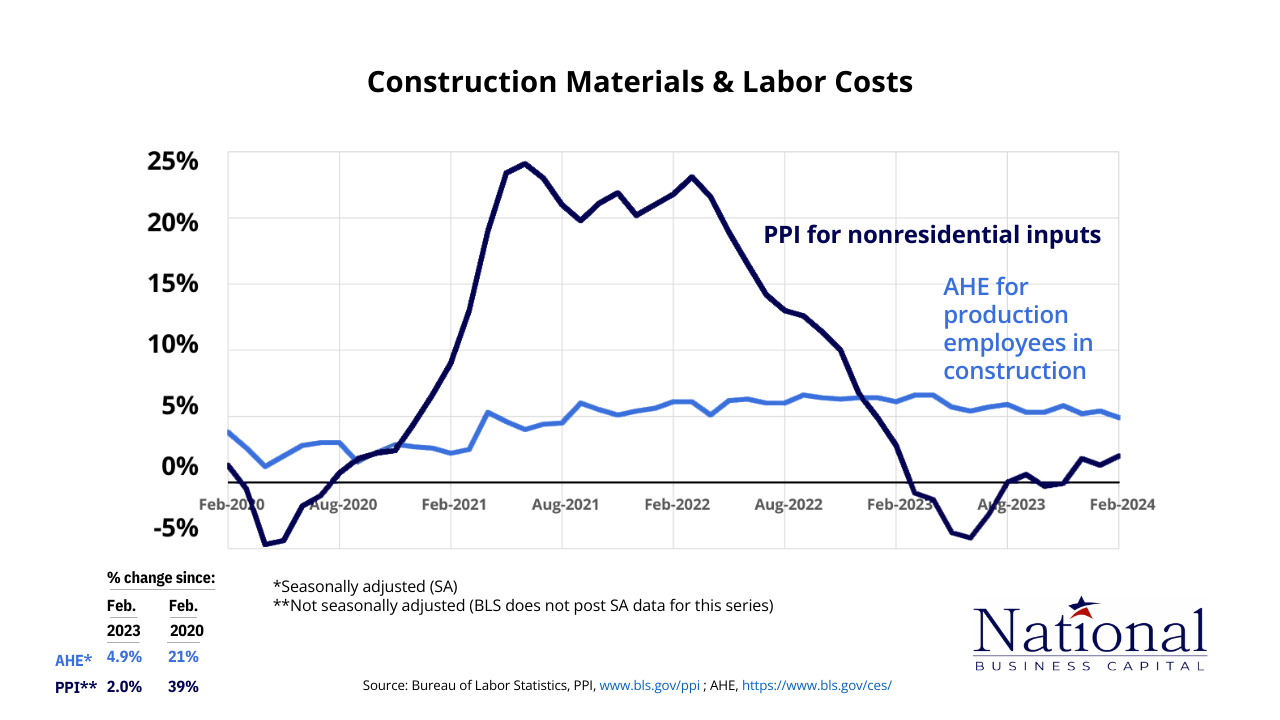

Construction Materials & Labor Costs

The producer price index (PPI) shows how the prices that domestic producers pay for their goods change over time, on average. Compared to the average hourly earnings (AHE), a representation of the average hourly wage for construction workers, you gain a birds-eye view of labor and material trends. April 2024 – Incoming applications to National Business Capital’s team confirm the trends above. Throughout Q1 2024, we’ve seen a 65% increase in construction companies applying for expansion-related capital needs, including material and supply purchases, compared to the same time last year.

April 2024 – Incoming applications to National Business Capital’s team confirm the trends above. Throughout Q1 2024, we’ve seen a 65% increase in construction companies applying for expansion-related capital needs, including material and supply purchases, compared to the same time last year.

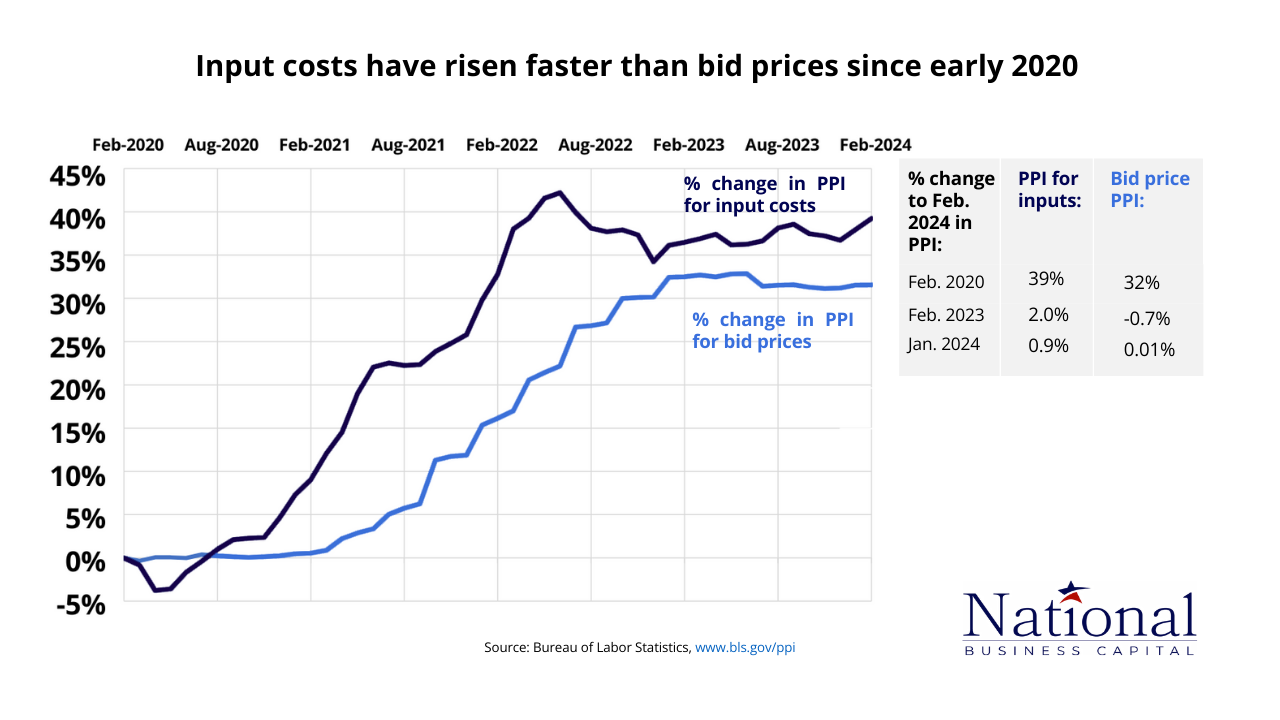

Cumulative Change in Producer Price Index (PPI) For Inputs and Bid Prices for Nonresidential Construction

Bid prices generally follow the trends of input costs, although they may lag behind the trend. April 2024 – Fluctuations in input costs haven’t led to a rise in bid pricing. Between August 2023 and February 2023, we even saw bid prices fall as input costs inflated by a few percent.

This relationship speaks to the construction industry’s profitability. Times when bid pricing and input costs are closer signal higher profits, whereas the opposite suggests that construction companies aren’t making as much as they can be.

April 2024 – Fluctuations in input costs haven’t led to a rise in bid pricing. Between August 2023 and February 2023, we even saw bid prices fall as input costs inflated by a few percent.

This relationship speaks to the construction industry’s profitability. Times when bid pricing and input costs are closer signal higher profits, whereas the opposite suggests that construction companies aren’t making as much as they can be.

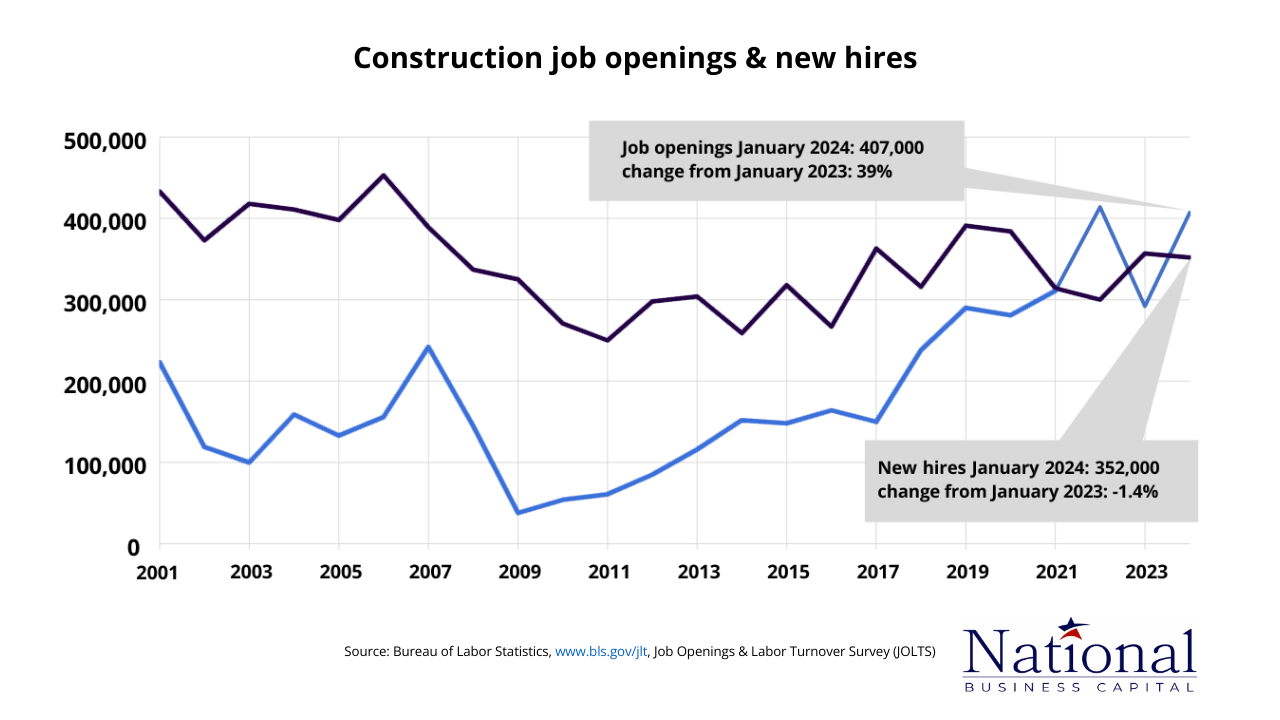

Construction Job Openings & New Hires

The relationship between construction job openings and new hires speaks to the industry’s operational capability. April 2024 – A rise in job openings signals the construction industry’s preparing for a high workload. Positive trends in new hires speak to the industry’s overall capability, meaning the construction industry is gearing up for a busy year.

The general sentiment from clients confirms that construction companies are looking to hire and handle a higher workload. Confidence has returned as well, which will fuel the industry as it works to break records in 2024.

April 2024 – A rise in job openings signals the construction industry’s preparing for a high workload. Positive trends in new hires speak to the industry’s overall capability, meaning the construction industry is gearing up for a busy year.

The general sentiment from clients confirms that construction companies are looking to hire and handle a higher workload. Confidence has returned as well, which will fuel the industry as it works to break records in 2024.

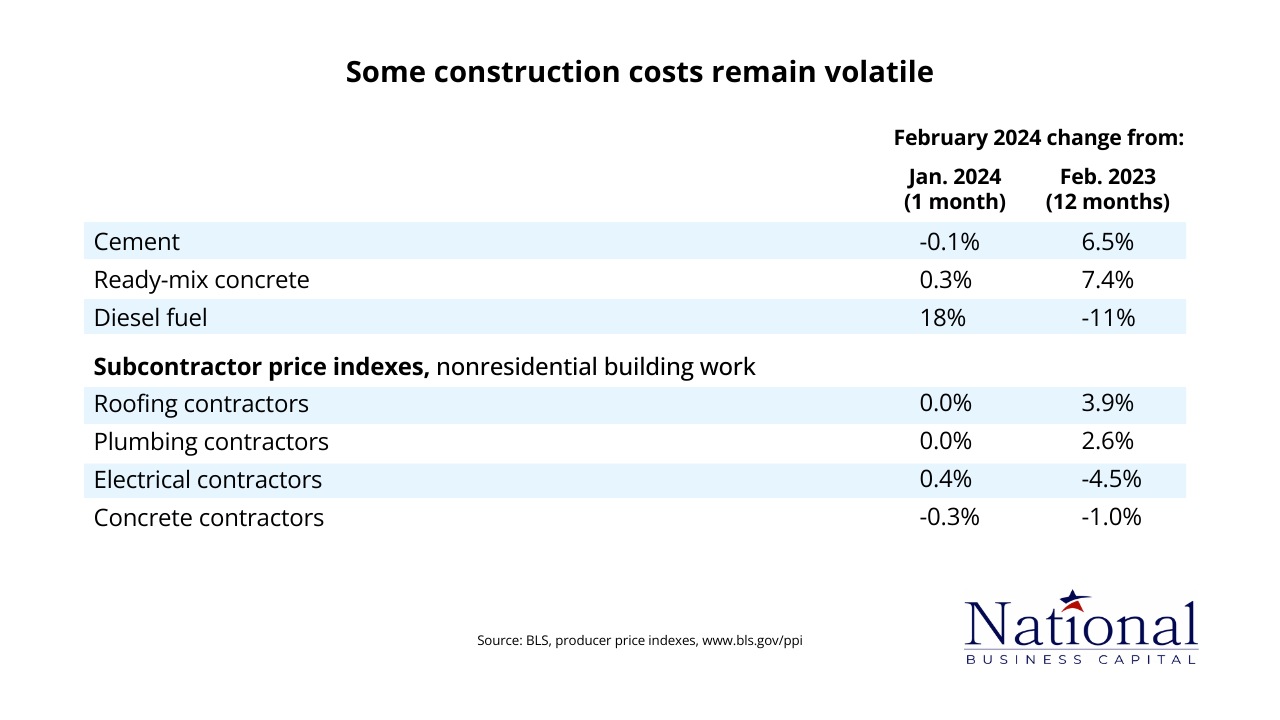

Volatility in Construction Material Costs (PPI Changes, Not Seasonally Adjusted)

Even minor fluctuations in material pricing have major implications for the construction industry. A lower cost of goods allows construction businesses to increase their ROI, whereas a higher cost of goods can erode profitability and, ultimately, deter growth and innovation. April 2024 – Inflation has continued to push the price of raw materials to record highs. It’s important that construction companies use this information when pricing their bids.

In April 2024, the average transaction size for construction companies at National Business Capital was 3X that of April 2023. A higher cost of materials likely contributed to this increase.

April 2024 – Inflation has continued to push the price of raw materials to record highs. It’s important that construction companies use this information when pricing their bids.

In April 2024, the average transaction size for construction companies at National Business Capital was 3X that of April 2023. A higher cost of materials likely contributed to this increase.

Net % Expecting 2024 Project Value to Be Higher/Lower Than 2023’s Value

Projects within emerging industries are valued higher than those within declining sectors. Based on AGC’s survey, the construction industry expects the most value in water/sewer, transportation, and bridge/highway projects. April 2024 – Government incentives have focused on highways, roads, and manufacturing, which explains the sentiment of higher valued projects within those areas. Private offices are seeing the most significant decline because of the challenges in commercial real estate.

April 2024 – Government incentives have focused on highways, roads, and manufacturing, which explains the sentiment of higher valued projects within those areas. Private offices are seeing the most significant decline because of the challenges in commercial real estate.

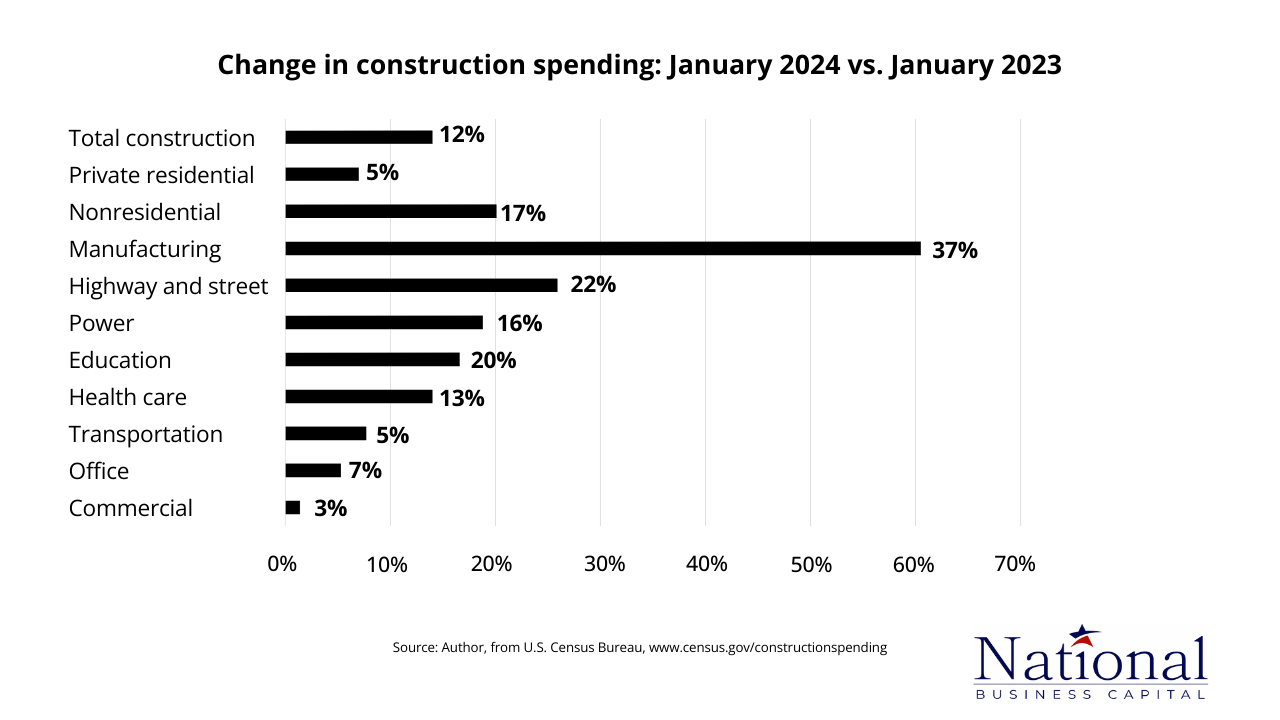

Change in Construction Spending: Jan 2024 vs Jan 2023

A higher degree of construction activity signals an industry primed for growth. On the other hand, diminished activity can be evidence of an industry-wide pullback. April 2024 – The manufacturing industry is busy. On top of an active construction industry, incoming applications from the manufacturing sector all carry one similarity – expansion goals. (7.69% in 2023 vs 28.57% in 2024, a 271% Increase)

April 2024 – The manufacturing industry is busy. On top of an active construction industry, incoming applications from the manufacturing sector all carry one similarity – expansion goals. (7.69% in 2023 vs 28.57% in 2024, a 271% Increase)

National Business Capital's Construction Recap (April 2024)

Each month, we’ll offer our unique viewpoint on the construction industry’s short to mid-term outlook. Our insights come from a combination of available industry statistics, internal data, and the general sentiment of the construction clients we work with daily.- Significant Increase in Construction Fundings (April 2023 vs 2024): April 2024 saw a 139% increase in construction fundings compared to the same time last year. Considering the rise in government incentives for the construction community (Highways, roads, chip manufacturing) and a higher number of job openings, the rise in construction fundings mirrors the boom in the industry.

- Of All Construction Fundings, the Average Transaction Size Was 3X Than March 2023: A cash-intensive industry commonly leverages National Business Capital to purchase materials/supplies and bridge cash flow gaps created by those purchases. Construction material costs have risen throughout the last year and stagnated only recently, which has raised the overall loan size for the community.

- Approval Rates Are 2X Higher for Construction Companies: National Business Capital uncovered that approval rates for construction companies are double what they were in April 2023. Lenders are more open to working with the construction industry because of higher-quality financials and a more favorable industry-wide outlook.

- Expansion-Related Capital Needs Are 65% Higher Than Last Year: As illustrated by the higher number of job openings, expansion is at the forefront of the industry’s mind. Applications for financing at National Business Capital focused on expansion-related capital needs, which confirms the trend and, more importantly, signals that the industry is actively pushing forward for greater gains.

- 30% More Clients Moved Forward with an Approval: After an uncertain 2023, confidence and optimism have returned to the construction industry. Clients were more eager to move forward with their financing this year compared to last year when almost every business was apprehensive about the economic climate.