Table of contents

At some point, your business will likely need financial help to scale to the next level. You might be preparing to capitalize on a market opportunity, expanding your team to meet growing demand, investing in new equipment or technology, or launching a new product line that requires upfront capital.

Whatever the case, most lenders are more than willing to work with your small business to provide funding. But even though you’ve got plenty of choices, that doesn’t mean they’re the right option for your company. This guide will look at some of the best small business lenders and how they can help your business grow and expand.

Top small business lenders at a glance

Here’s an overview of the seven best small business lenders, who they’re best for, their maximum loan amounts, and more:

| Lender | Max loan amount | Minimum credit score | Term length | Best for |

|---|---|---|---|---|

| National Business Capital | $15M | 620 | Up to 2 years | Advisor-service & flexibility |

| Bluevine | $500K | 625 | Up to 2 years | Larger loan amounts |

| Fora Financial | $1.5M | 570 | Up to 1.5 years | Low credit scores |

| Rapid Finance | $1M | Undisclosed | Up to 5 years | Fast funding |

| Wells Fargo | $3M | 680 | Up to 3 years | Lines of credit |

| TD Bank | $1M | Undisclosed | Up to 5 years | Online applications |

| AltLINE | $15M | None | Undisclosed | Best for startups |

National Business Capital

Best for advisor-service & flexibility

- Max loan amount: $15M

- Minimum credit score: 620

- Term length: Up to 2 years

National Business Capital is known to offer some of the best small business loans based on its quality advisor service and loan flexibility. The company offers high lending amounts up to $15M with a wide range of secured, unsecured, and cash-flow funding options. With 17 years in business, NBC is an established lender that has provided more than $3B in funding since 2007.

| Pros | Cons |

|---|---|

| • Well-trained advisors • High loan amounts | • Shorter loan terms • Higher revenue requirements |

Bluevine

Best for large loan amounts

- Max loan amount: $500K

- Minimum credit score: 625

- Term length: Up to 2 years

Bluevine has a large network of lenders who help provide loans to small businesses. With ten years of experience in the industry, you can expect a wide range of lenders that offer different funding amounts with different credit score requirements.

| Pros | Cons |

|---|---|

| • High loan amounts available through lending partners • Lower credit score requirements | • Loans not offered through Bluevine • Terms and requirements can vary widely based on the lending partner |

Fora Financial

Best for low credit scores

- Max loan amount: $1.5M

- Minimum credit score: 570

- Term length: Up to 1.5 years

Fora Financial has provided billions in funding to businesses since 2008. The lender is willing to work with risky borrowers with credit scores as low as 570. Its higher maximum funding amount of $1.5M is countered by shorter term lengths of up to 1.5 years.

| Pros | Cons |

|---|---|

| • Ideal for businesses with poor credit • Approval within 4 hours | • Short loan terms • Only two loan options |

Rapid Finance

Best for fast funding

- Max loan amount: $1M

- Minimum credit score: Undisclosed

- Term length: Up to 5 years

Rapid Finance offers loans with term limits from three months to five years. The company doesn’t disclose its credit requirements, but if a business meets them, it will provide funding up to $1M.

| Pros | Cons |

|---|---|

| • Same-day funding • Many loan options | • Doesn’t disclose credit score requirements • Website provides limited information |

Wells Fargo

Best for business lines of credit

- Max loan amount: $3M

- Minimum credit score: 680

- Term length: Up to 3 years

Wells Fargo’s lending options include a secured and unsecured business line of credit, but it does not offer term loans. The large banking lender provides a range of potential loan amounts – between $5K and $150K for unsecured loans and $250K to $3M on secured loans.

| Pros | Cons |

|---|---|

| • High loan amounts available • Includes rewards program | • No term loan options • High credit score requirements |

TD Bank

Best for East Coast businesses

- Max loan amount: $1M

- Minimum credit score: Undisclosed

- Term length: Up to 5 years

TD Bank operates in 15 states on the East Coast and Washington, D.C. The lender offers an online application process with flexible terms of one to five years and maximum loan amounts of $1M. Note that TD Bank will provide a maximum funding amount of $250K for online applications.

| Pros | Cons |

|---|---|

| • Fast online applications • Multiple loan options | • Loans more than $250K must be applied for in person • Lack of transparency on credit score requirements |

AltLINE

Best for startups

- Max loan amount: $15M

- Minimum credit score: None

- Term length: Undisclosed

Altline is an online lender that focuses on helping new businesses and startups acquire funding to get off their feet and grow. The lender provides high loan amounts – as much as $15M – and doesn’t require a minimum credit score.

| Pros | Cons |

|---|---|

| • No credit score minimum • Funding within two days | • Term lengths not disclosed • Charges origination fee |

Types of small business loan lenders

When it comes to the types of lenders who offer small business loans, your choices come down to just a few options.

- Private credit lenders: Private business lenders work outside the traditional bank setting and can provide funds to businesses with more favorable and flexible terms. This potentially includes lengthier term limits, lower credit qualifications, and less annual revenue.

- Traditional banks and credit unions: Traditional banks and credit unions can also provide small business loans and help with refinancing a loan. However, their loan terms and qualifications are typicallyn’t as flexible as those of private lenders, which may make them less appealing, especially to newer businesses.

- Government small business lenders: Government-backed loans, typically called Small Business Administration (SBA) loans, provide guarantees to lenders who, in turn, offer more favorable terms to small businesses.

Now that you know the types of lenders, let’s examine how to choose the best one for your business.

How to choose the best small business lender

Deciding on a lender will involve a mix of factors, and your task is to decide which of these factors is most important to you.

| What’s most important to you? | Which lender should you choose? |

|---|---|

| Funding speed | Because they have fewer lending requirements, private credit lenders can provide faster funding – typically within a few hours up to a few days. |

| Cost of capital | Typically, traditional banks offer lower interest rates than private credit lenders. However, these lower rates usually come with stricter qualifications. |

| Flexible terms | Private credit lenders can also offer more flexible terms up to several years that are customizable and more beneficial to small businesses. |

| Expertise and transparency | While newer to the lending industry than traditional banks, private credit lenders typically have been operating since the early 2000s. They are generally more upfront about terms and requirements. |

Matthew Auletta, Business Finance Advisor with National Capital, notes that small businesses can benefit from expert guidance when matching with the best lender.

“Many SMB owners are so used to long-term financing like car notes or mortgages that when they look at the shorter turnaround of business lending, it may cause them to hesitate and not invest in their business.”

That’s where National Business Capital’s advisors' expertise comes into play. Our expert team can help you understand the best financing options to help you meet your expansion goals.

Alternatives to small business lenders

If you’re looking for alternatives to small business lenders, you do have other options. Some examples include:

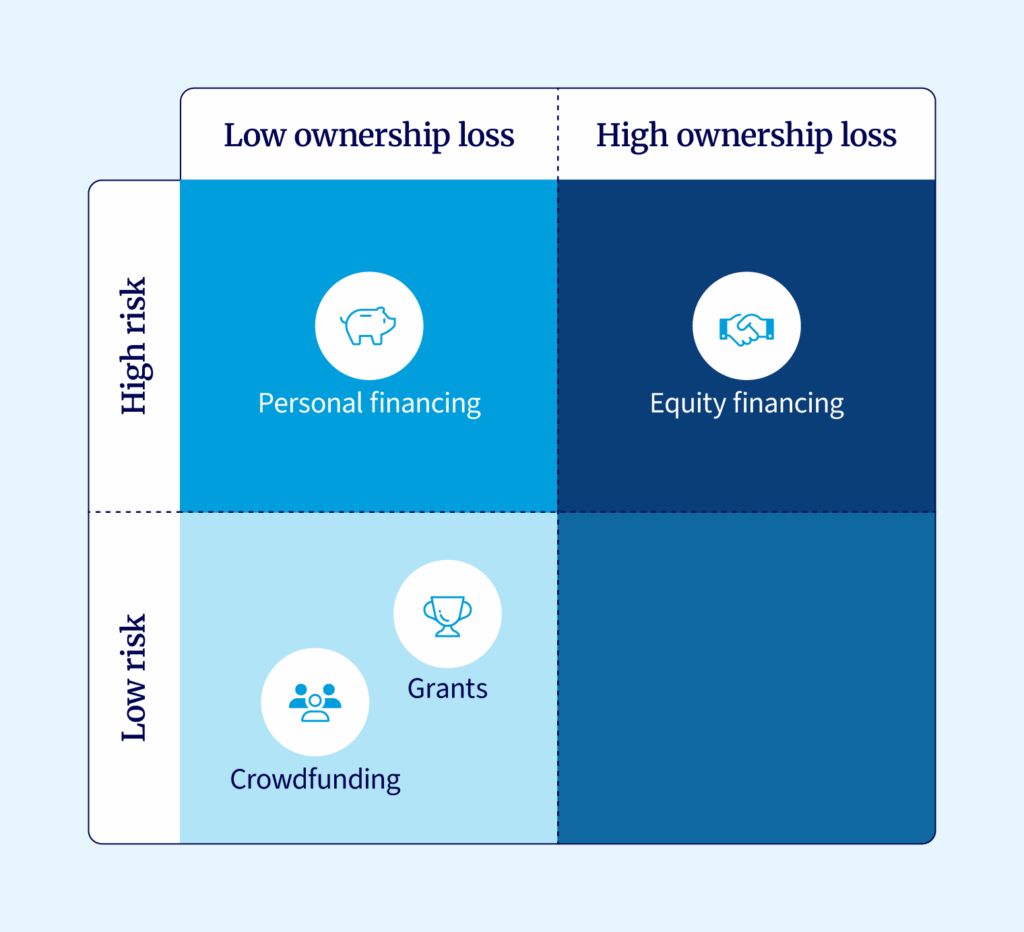

- Small business grants: A method of acquiring a debt-free financing option, but the application process can be lengthy.

- Equity financing: Provided by angel investors or venture capitalists, though it comes with the risk of giving up too much control of your business.

- Personal financing: Funding through your own personal or retirement savings is another possibility, though certainly less desirable because it can risk your future financial well-being.

Crowdfunding: A helpful possibility if you already have a decent customer base and a supportive group of friends and family.

Each offers different benefits, particularly for startups that don’t qualify for traditional or private credit lending.

| Quick tip: Before pursuing an alternative, ask yourself: Are you comfortable sacrificing ownership? Do you have time for complex applications? Is your idea “crowdfundable?” The best alternative matches both your immediate needs and your long-term goals. |

|---|

Choose a flexible small business lender like National Business Capital

The lending industry is saturated with options, and the choices can be a bit overwhelming. That’s why it’s vital to find the best small business lenders, to find the lender that isn’t just flexible and has your best interests in mind.

National Business Capital is known for providing flexible terms while providing you access to expert advisors who are more than happy to help you get a business loan or other kinds of funding. If you’re ready to take the next step toward a small business loan, apply today, and we’ll be in touch.