Table of contents

Every successful business owner understands that growth requires strategic financial planning and the right tools to seize opportunities when they arise. Whether you're expanding operations, investing in new equipment, or taking advantage of market opportunities, having strong business credit opens doors to possibilities.

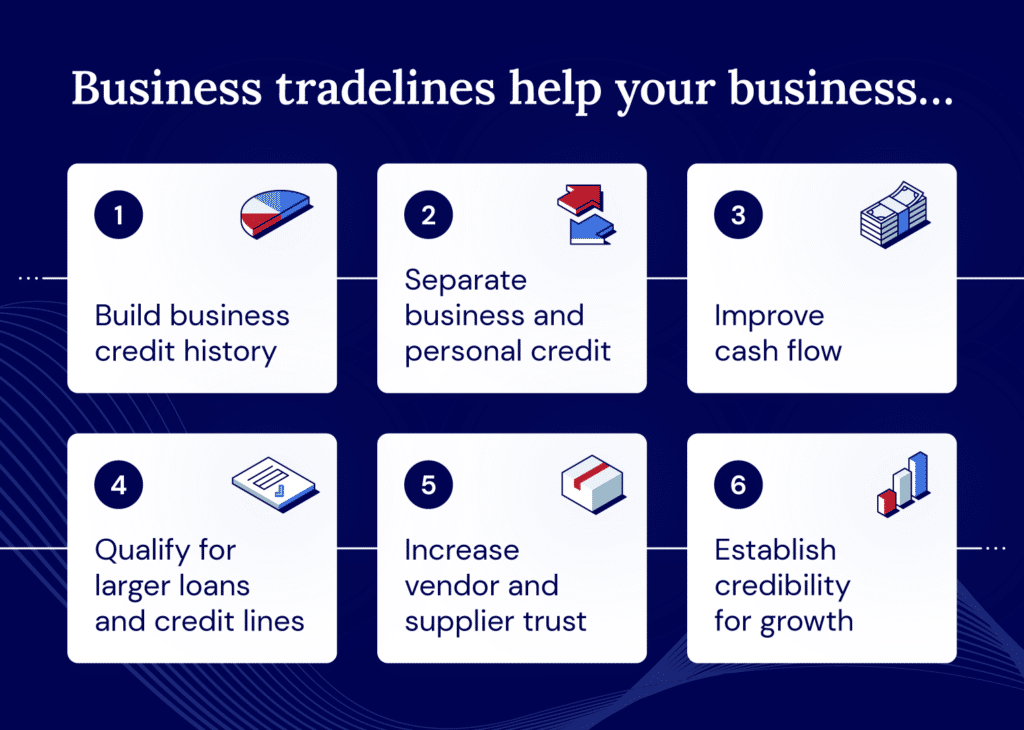

Business tradelines offer enhanced cash flow and sustainable growth. With established trade credit, businesses gain access to better financing terms and the financial foundation needed to scale confidently. A tradeline serves as both a growth accelerator and a safety net, ensuring you're prepared for whatever opportunities or challenges come your way. We'll explore how they work and if they suit your growth goals.

What are business tradelines?

A business tradeline is a credit account that your business establishes with a vendor that reports back to a major credit bureau. A similar account, but not always the same, is a net-30, which is an account with a vendor that is limited to a 30-day repayment period.

Since the tradelines are a form of credit, they are reported to the main credit bureaus, like Experian and Equifax. Not only does the tradeline help your business build credit, but it also helps the company obtain immediate cash flow funding. Remember that a business line of credit will reflect your company’s creditworthiness and history, and is unrelated to your own personal credit profile.

Why are business tradelines important?

Business tradelines are important because they provide companies with immediate access to goods and services without requiring upfront cash payments, significantly improving cash flow management and operational flexibility. These established trade accounts with suppliers and vendors allow businesses to purchase inventory, equipment, or materials on favorable payment terms, freeing up working capital for other critical growth-focused investments like marketing, hiring, or expansion.

By extending payment cycles and creating predictable cash outflows, tradelines allow businesses to better align their expenses with revenue cycles and maintain optimal cash reserves. This enhanced liquidity management means companies can respond more quickly to unexpected opportunities or challenges without depleting their cash reserves or seeking emergency financing.

For growing businesses, tradelines create a financial buffer that enables strategic decision-making rather than reactive scrambling, allowing companies to take advantage of market opportunities, manage seasonal fluctuations, and maintain steady operations even during temporary cash flow challenges.

Key information about business tradelines

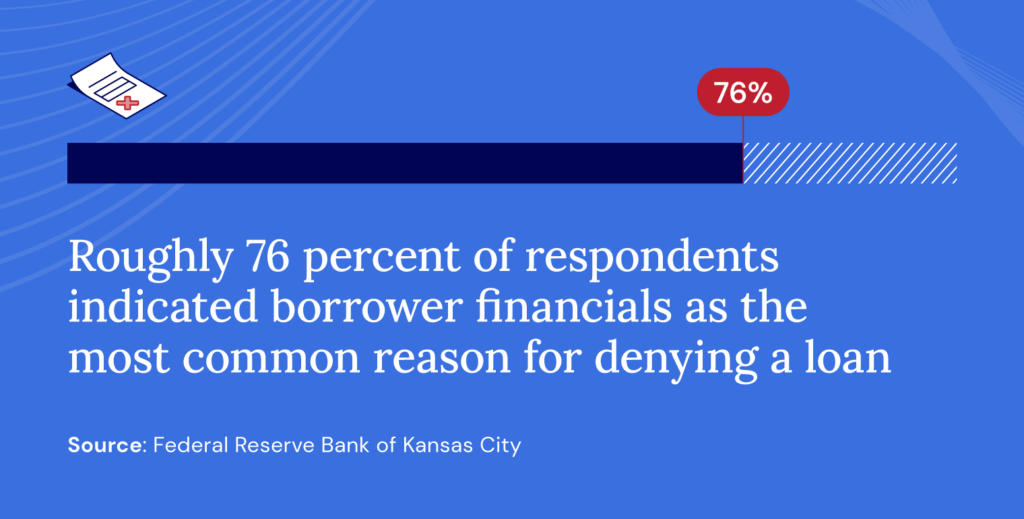

Like any other type of financing, such as a line of credit, business tradelines don’t come without some type of risk. You need to know what you’re stepping into before deciding on getting a tradeline for your company.

Here are some of the pros and cons to consider:

Pros

- Quick way to improve cash flow

- Easier to qualify for than a traditional small business loan

- Lower interest rates

- An easy way to build a credit history and score

Cons

- Small credit limits to start

- Loan fees are part of the deal

- Short repayment terms

- Can lead to a continuous cycle of debt without proactive repayment

How do you get a business tradeline?

If you’ve weighed the pros and cons of tradelines for business credit and decided it's right for you, here’s what you’ll need to get one.

- Open a credit account with at least one company that reports to a major credit bureau.

- Make sure you meet the company’s credit requirements, which will most likely involve your credit score, credit history, and length of time in business.

- Be prepared to offer pertinent information such as your employee identification number (EIN), business bank account, business registration, and licensing.

Once you’ve established one revolving business line of credit, you should have an easier time getting the next one.

How many tradelines should you have?

If you want to build your credit score in a shorter amount of time, it’s not a bad idea to have at least two vendor tradelines, if not more. Keeping these accounts active and using them on a semi-regular basis will help establish your credit. The more of these types of transactions you have on your record, your score will slowly increase, and lenders will be more willing to offer new business tradelines in the future.

| Important to remember: |

|---|

| Maintaining multiple open tradelines requires careful management. Overextending across too many credit accounts can strain your ability to meet payment obligations and damage relationships with key suppliers. Additionally, juggling numerous tradeline payments can create cash flow complexity and increase the risk of missed payments, which could result in reduced credit limits, less favorable terms, or even account closures that hurt your business. |

How to build business tradeline activity

Once you’ve got a base of business credit tradelines, you can start building your activity and improving your credit. Make sure you’re managing your accounts in a smart way so you’ll stay in good standing with your lenders and credit bureaus.

The best ways to do this include keeping your balances low, making payments on time, keeping regular activity (like easy, small purchases), and being smart about what other forms of credit you use. If you open too many accounts at once, this can be a red flag to creditors.

One easy way to stay on top of your credit is through a credit monitoring service. These services will update you regularly about your credit score, monitor your credit activity, and alert you about actions that might affect your score or overall profile. These services are very affordable and eliminate a lot of the stress associated with tracking your credit on your own.

Secure a credit line with National Business Capital

Advancing your credit profile, building capital, and progressing toward your growth plans are all key advantages of business tradelines. If you think business credit is a good solution for you, National Business Capital has expert business advisors who can help you understand your options.

If you still have questions, we can walk you through the application process so you feel comfortable before you make a final decision.