Things don’t always go according to plan for most business entrepreneurs. Sometimes, when everything seems to be going according to plan, a tidal wave of unpredictability hits you.

Equipment malfunction may have necessitated a repair or replacement. Or one of your most important clients may be past due on an invoice. It’s also possible that your cash flow takes a hit because business is slower than normal.

This is where your emergency fund comes into play. If your firm is in danger of sinking due to unanticipated costs, you can lean on it for support.

To make it through tough economic times or to expand the firm, companies often face a major challenge: an inadequate supply of cash.

Many small company owners still face financial difficulties, with 38% failing as a result of poor cash flow.

When times are tough, a small business that doesn’t have enough cash on hand may be forced to shut its doors for good.

What Is a Business Emergency Fund?

Do you remember putting away some money in case of an unexpected personal expense? That idea is just as applicable to a business.

Your company’s emergency fund is its cash reserves. It is funds that you’ve put away for emergencies, and it’s available to you whenever you need it.

The expression “emergency fund” conjures images of a savings account or a box beneath your mattress full of bills, but it doesn’t have to be made up entirely of cash.

Your reserves can also include short-term, liquid assets such as money market funds that can be swiftly converted to cash.

Whether you provide an online telephone service or run a small convenience store, businesses of all sizes should have an emergency fund in place. Such funds can keep the company afloat during trying times by:

- Giving you a financial buffer to cover costs in the event of recessions or market downturns

- Avoiding debt if you need to pay unexpected or unavoidable bills

- Ensuring you don’t eat into savings amidst cash flow struggles

- Protecting the business’ credit rating and business owner’s personal financial standing

What Are the Advantages of Having a Business Emergency Fund?

Our dreams for the future may not always go according to plan, no matter how hard we try. In the event of an emergency or natural calamity, there is no way to foresee what would happen. Even so, you can prepare for it.

The advantages of having an emergency fund speak to its importance. Here are some of the benefits to look forward to:

Financial security

Having an emergency fund on hand will help you sleep better at night and concentrate on your day-to-day tasks, like comparing DocuSign vs Adobe. Keep in mind that crises can take many forms, ranging from sudden sickness to fire outbreaks or a pandemic.

These examples and any other disaster will need different responses, but the fact that you have an emergency fund to fall back on will remain constant. Remember this when preparing for your next emergency.

Rainy day spending

Even amid a crisis, life continues. As a result, you’ll have to continue paying for necessities like food, rent or mortgage, and utility bills like electricity and gas, as well as internet access.

You’ll still have to keep your professional organization membership current, too. You can accomplish all of this and still run your business if you have an emergency fund as part of your IT business continuity plan.

Avoid dipping into savings

Small company owners may have to dip into their own pockets in times of crisis to keep their companies afloat. Having an emergency fund might help you avoid emptying your personal savings accounts.

Having an emergency reserve helps you prevent late payments to employees, among other expenses.

How to Estimate Your Emergency Fund Size

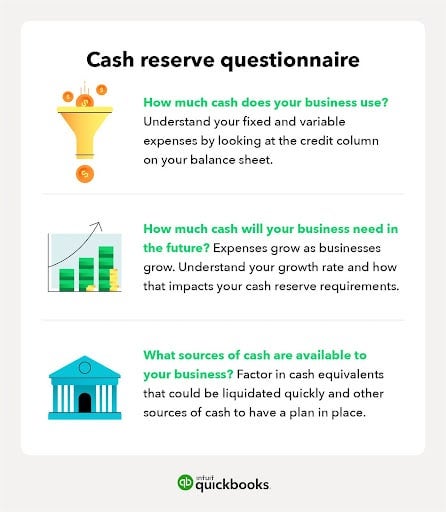

The amount of money you should maintain in reserve depends heavily on the other elements that impact your organization, as well as your operational expenses.

Consider the following when evaluating how much money to save in case of an emergency:

Inventory and receivables

Businesses with slow-moving receivables or inventories should maintain a larger account for emergency funds.

The fund will provide cover for operation costs and other expenses in cases of late customer payment or cash being tied up in slow-moving inventories.

Using platforms that allow customers to add free e-signatures to documents can act as an additional buffer. By giving vendors a quick and easy way to sign contracts and invoices from anywhere, you can speed up the payment process and reduce the chances of needing to dip into your emergency fund.

Your personal status

Is it possible for you to go without a paycheck for a period of time? Is your business a full-time job or a side activity? You may not require as much money in reserve if it is the latter.

Seasonality

If your business practices rely heavily on cyclical or seasonal revenue, you may want to consider increasing your emergency reserve. The more volatile the firm, the more emergency funds it should hold.

Building an Emergency Fund for Your Business

The most difficult part of putting together a business emergency fund is deciding where the money will come from. If you’re a lone entrepreneur or a small firm with a slim profit margin, this might be very challenging.

Regardless of your situation, you can nearly always find a method to save money and add it to your emergency fund. You may never need to tap into your business’s emergency fund, which is the best-case scenario.

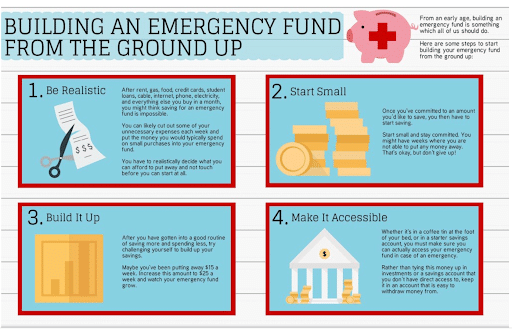

Here are a few recommendations to guide your emergency fund creation strategy.

Calculate the amount required

How much operating capital would you need to keep your company running if it couldn’t operate for a month?

Whatever your response, you should save for that eventuality now. Keep saving even if you hit your savings target in a short period. Don’t count on your funds always being sufficient in the event of an emergency or disaster because they are unpredictable.

Maximize your savings

The same credit union or bank where you currently have a business account can be used to set up a separate one for your emergency fund.

As your funds increase, you should consider placing part of it in a money market account. Or try another account that offers a higher rate of return than a typical savings account.

However, make sure you have enough money in your regular account so that you can access it quickly in the event of an emergency.

Schedule your payments

Maintain a regular deposit schedule and stick to it. Decide on a deposit plan that works for your business, whether weekly, biweekly, or monthly.

Don’t be afraid to start small

If you can only spare a small amount a month to begin, save it. Though there is never a perfect moment to start a savings account for unexpected expenses, even a small sum might add up. You can raise that amount if sales pick up or you have extra money lying around.

Start by looking at your business processes and expenditures and see if there are ways to save money. Look around for another provider if costs for services such as domain names keep rising and switch to a basic internet service.

As a business, it’s natural to want to invest in the best electronic signature software, payroll platforms, automated tools, and communication solutions. While these can save your business money in the long-run, it’s important to consider whether you’re paying for unnecessary features. You may easily be able to switch plans or even use free software that still gets the job done.

If you rent your business premises, you may also want to explore a less expensive facility or try remote working. Taking advantage of these cost-cutting strategies can rapidly result in savings that you can stash away for later

Deposit part of your revenue

By setting aside a certain amount of your monthly earnings, you can easily link your savings to revenue. Your savings will rise in line with revenue and fall in tandem with a decline in revenue.

Seasonal companies can benefit from this, as it is normal for income to rise or fall at a specific time of year.

When Should You Use Your Emergency Fund?

There are a wide variety of unexpected situations that require immediate attention. A well-managed cash flow forecast example can assist you in identifying the appropriate time to use your rainy-day reserve.

Some occurrences that may signal that you need to use your emergency fund include:

- Natural disasters — This is an excellent time to use your emergency fund. It could be cases such as a flood, fire, hurricane, tornado, or other weather-related events.

- Economic slump — An economic recession or decline in interest in your products or industry.

- Losing a key employee — Loss of a valuable staff member that can negatively affect sales or demand a considerable investment of time and resources to replace.

- Illnesses — Sickness or other personal challenges that prevent the business owner or a key employee from doing their job.

- Lawsuits — These are rare but not unheard of occurrences brought on by several situations like workplace accidents.

- Losing a key customer — Lack of a customer-friendly culture can lead to the departure of a key client who is responsible for a large chunk of your company’s revenue. Creating a strong, consistent brand using your email style guide can help prevent this.

- Special circumstances — If your income isn’t enough to cover expenses and you are unable to make up the shortfall.

Protect Your Future With an Emergency Fund

A business’s emergency fund serves the same goal as a personal emergency fund. Having a reserve of cash can make the difference between a few months of hard times and the end of your firm. For those who rely on their business as their sole source of income, having an emergency fund is as essential as an enterprise security system.

It’s fantastic if you already have a business emergency fund. But if you haven’t already, now is the best time to get started.

Looking for access to business funding? National Business Capital’s award-winning team can help you find the most amount of money you qualify for, then assist in reviewing your lending options. You can focus on running your business, while our team does the heavy lifting. Apply now to get started!

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.