You’ve built a strong food truck operation; Demand is growing, and foot traffic is picking up week by week. A great new location has come up ten blocks away, and you want it, but right now, cash flow’s a bit tight. If this sounds familiar, food truck financing will give you the capital you need to seize the opportunity while protecting your working capital.

Below, find out how other operators use food truck financing and what steps you should take to choose the right funding option for your company.

What are the advantages of financing a food truck?

Food truck financing gives you access to capital at the right time, when it can make a real difference to your business’s future. The goal is to help you reach your potential faster, with lower stress and more control over your capital.

Also, keep in mind that lenders know food trucks can be great businesses – that’s why they’re ready to back them. Skip the credit cards and find a lender who sees your potential and wants to help you grow without putting your own savings on the line.

Here’s how food truck businesses use financing to grow faster, increase profitability, and stay ahead of competitors:

Frees you to act on opportunities

Let’s say you want an extra truck. Waiting 12 months to save up $60,000 to buy it is a false economy. If that delay means you miss out on $10,000 to $20,000 in revenue a month, you’ve lost out on potential income and missed the chance to build your visibility.

Prepares you to take action

Locals and tourists flock to Food Truck Saturdays at Amelia Earhart Park in Miami, looking for the city’s best food. When an opportunity to secure your spot at a similar event in your area appears or you find a pitch with serious footfall, financing allows you to move fast and claim the spot before someone else does.

Allows for lucrative equipment upgrades

Upgrading your fryer, fridge, or POS system cuts your prep time so you can serve more customers every shift. If that means you sell to six more customers at $10 a time during lunch hour, that’s $15,000 in extra revenue a year. Plus, customers return to you more because you don’t keep them waiting.

Unlocks better pricing

Wholesalers reward food truck businesses that place bigger orders with discounts. Use inventory financing to buy key ingredients, disposables, and cooking oil in volume and make higher margins on every sale. Boost your margins without raising menu prices.

What can I use food truck financing for?

When you’re ready to grow, the right funding gives you the capital to back your business instincts and make it happen.

Here’s how successful operators use food trailer financing to give themselves an advantage:

- Expanding your fleet: Add another truck to launch a new route or secure a permanent pitch you’ve lined up. Financing helps you buy the truck, fit it with equipment, wrap it in your brand, hire your crew, and earn it on the road.

- Getting better prep and storage space: Move into a commissary or kitchen facility with enough room to prep, store, and restock for multiple trucks. Give your team the space to work properly and handle the growing demand.

- Buying better kitchen equipment: Give your crew the tools to work consistently, prep faster, and roll out improved menus. Don’t get held up by faulty kit, delays between shifts, or equipment that’s no longer fit for purpose.

- Jumping on time-sensitive pitches: Cover bid fees when a great spot opens up and have funding ready to pay for permits, supplies, and staffing. You’ll have everything in place to start trading straight away.

- Investing in marketing: Refresh your brand with a new wrap, branded packaging, and on-location marketing to drive footfall at existing pitches and build momentum at new ones. That extra visibility helps people recognize your brand and choose you when they’re deciding what to eat.

- Hiring ahead of peak seasons: Bring in full new crews, including line cooks and shift managers, and train them so they’re ready to go from day one. Use funding to cover the initial wages, recruiter fees, and onboarding costs with room to spare.

- Adding more cooking equipment: Install a smoker, pizza oven, or second fryer to expand your menu and handle higher volumes. These setups really pay off at private events, state fairs, and trailer units with the space to run full-scale service.

- Paying for permits in bulk: When you’re expanding, don’t forget to budget for permits across new trucks, service areas, and staff. Sort out the paperwork now so every new unit can start earning on day one.

- Offering door delivery: Set up online ordering, connect to delivery platforms, take pre-bookings so customers can collect without waiting in line, or launch your own drop-off service. That way, you’re making the most of every hour, not just breakfast, lunch, or the post-work rush.

You can take out a loan with more than one goal in mind. The most successful operators aren’t just looking for a business loan for a food truck. They want capital for the truck, the fit-out, the wrapping and branding, hiring and training staff, the permits, and an advertising budget to create a local buzz before launch.

Talk to National Business Capital to fund your entire rollout, not just part of it.

How much do you need to invest in a food truck?

You need around $50,000 to invest in a food truck, with around $30,000 as a minimum for the truck and $20,000 to cover your first six months up and running.

We’ve averaged the numbers on these websites – Postron, Shopify, and CloudKitchens – to estimate the costs of launching and running a food truck.

Here’s how the three most common ways to get a truck compare.

| Purchase method | Cost range | Key benefits |

|---|---|---|

| Buy New | $50,000-$175,000 | • Fully fitted with new appliances (often under warranty) • Minimal maintenance early on |

| Buy Used | $30,000-$100,000 | • Lower entry cost • Faster availability |

| Custom Build (from scratch) | $50,000 + the cost of the vehicle | • Fully tailored layout and spec • Ideal for niche concepts |

Used trucks cut your costs and help you start on a tighter budget while custom trucks give you the spec you want to stand out at premium pitches. Financing lets you choose the right option for the opportunity, not just the one you can afford upfront.

How profitable is a food truck business?

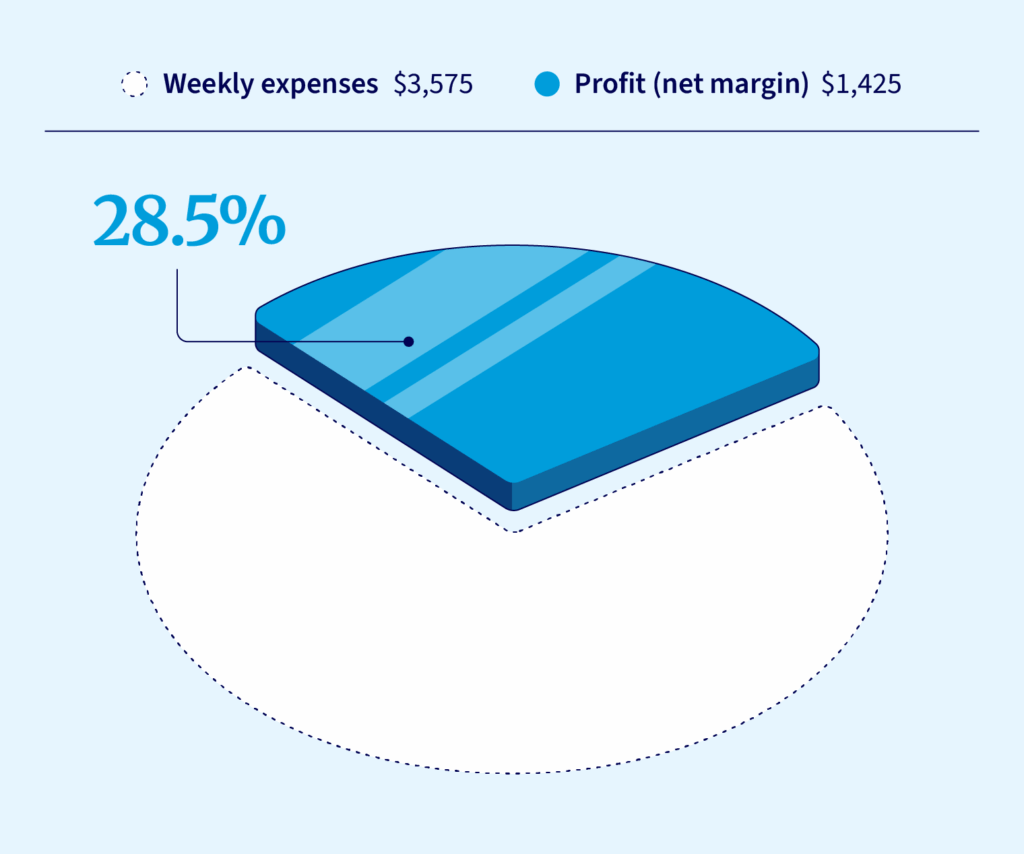

A food truck business can deliver a very healthy margin of 28.5% net margin before loan repayments and maintenance costs. Add in event bookings or private catering, and many trucks push that margin even higher, especially once you’ve paid off the initial truck costs.

Using the same sources, here’s how we worked out that figure, assuming food truck revenue of $5,000 per week:

| Category | Weekly expense | % of revenue | Typical costs |

|---|---|---|---|

| Ingredients | $1,500 | 30% | Raw materials and ingredients |

| Labor | $1,000 | 20% | Two staff at around $15/hr each |

| Fuel & Propane | $150 | 3% | Cooking and driving fuel costs |

| Supplies | $200 | 4% | Takeout containers, napkins, utensils |

| Parking & Commissary | $375 | 7.5% | Based on $1,500/month parking ($375/week) |

| Insurance & Permits | $100 | 2% | Pro-rated annual insurance and permitting |

| Marketing | $250 | 5% | Local ads, truck wraps, promos |

| Total Expenses | $3,575 | 71.5% | |

| Net Weekly Profit | $1,425 | 28.5% |

It’s no surprise that, with margins that strong, business research company Skyquest believes the market will expand from $1.4B in 2023 to $2.29B in 2032. Some of those costs, especially food and parking/commissary fees, may be lower for operations with fewer trucks outside town or city center locations.

What documents do I need to apply for food truck financing?

With most lenders, you need to provide a fair amount of documentation to apply for food truck financing. Expect to be asked for:

- Financial statements: You’ll need bank statements, business tax documents, balance sheets, cash flow statements, profit and loss statements, debt schedules, and accounts receivable and payable. This helps lenders understand how much you can borrow, how you’ll repay it, and how fast you’re growing.

- Legal and ownership documents: This includes proof of ownership for any collateral you offer under the loan terms, your business insurance policy, licenses, permits, articles of incorporation, and registration certificates.

- Business and personal information: Be ready to share personal tax returns, a summary of your personal financial position and a business plan that outlines your idea in detail with marketing plans, staff, management, financial forecasts, and more.

At National Business Capital, you can apply with just six months of business bank statements. If we need anything else, we’ll let you know.

What are the best food truck loans?

The best food truck loan isn’t about finding the lowest rate – it’s about matching the funding to the job. That might mean short-term funding to cover seasonal hires or permits or a longer-term facility to fund expansion, refit a truck, or open a prep kitchen.

If you’re comparing offers, look for options that align with your revenue cycle, give you access to the full amount you need, and leave room to grow. The best lenders will help you weigh the trade-offs between cost, speed, and flexibility so you can choose based on what you’re trying to achieve, not just what you can qualify for.

Why is food truck financing important for growth?

Food trucks are profitable, but it’s a competitive sector, so you need capital at the right time. If you don’t, you’ll spend months, if not years, saving up to open a new pitch or upgrade your equipment. In that time, someone else can take the slot, claim the location, and build the customer base you were aiming for.

When the opportunity is there, funding lets you:

- Carry more capital: Pay for big-ticket items like trucks and kitchen gear while having the capital to meet your operating costs.

- Buy better and faster: Order in volume from your suppliers, and they’ll give you a discount. Do it often, and you’ll lock in better pricing, priority delivery, and more favorable supply terms.

- Test out ideas: Try new menu items, seasonal events, or short-term routes without taking capital away from your day-to-day operations.

- Claim tax advantages: In many cases, you can write off interest or equipment depreciation to reduce your tax bill.

Every business uses debt. The most successful ones use it as leverage to scale and grow their companies. It’s the same in the food trucking sector.

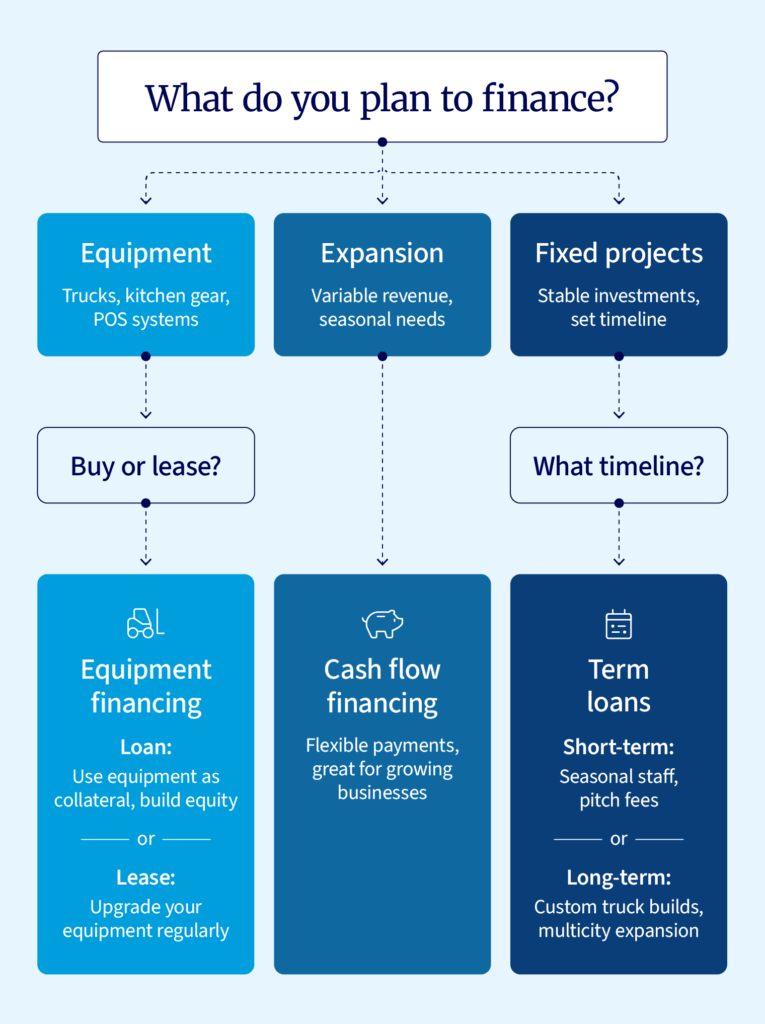

Types of loans to finance a food truck

The right loan is different for every food truck. The one that works for your business depends on what you want to do with the capital, how fast you need it, and how long it takes to see a return on your investment.

Here’s how to finance a food truck:

Equipment financing

Equipment financing is very popular with food truck operators. You can take out a loan to buy the equipment you want or lease what you want and upgrade again later. Here’s how the two options work:

- Equipment loan: Put down a deposit of 10-20%. The equipment is your collateral.

- Equipment lease: Leasing has a lower upfront cost, but the lender owns the equipment. At the end of the lease, they collect it or, if you agree to this at the start, let you buy it outright for a fee. Alternatively, start a new lease with the latest equipment.

Both options help you hold on to your working capital and don’t interfere with any other finance arrangement you have. You get the equipment you need to push your business forward.

Cash flow financing

Get upfront capital based on your cash flow, not your assets. The lender assesses how well your food truck business performs to decide how much you can borrow. Repayments are weekly or monthly.

Cash flow financing is a great choice for growing operators who want to maintain momentum. The funding can be used to cover expansion costs, take on larger catering contracts, and lock in new pitches without touching your savings.

The best part is that payments flex with your revenue. If the event you booked didn’t go ahead, foot traffic dropped due to bad weather, or one of your trucks was out for repair, your repayments adjust so you have extra room to cover your costs and keep trading without stress.

Business term loans

With a term loan, you borrow a fixed amount and repay it in equal installments over a set period. Term loans are flexible; you can use them for just about anything, from hiring staff and expanding into a commissary to paying off older, more expensive debt.

Types of term loans include:

- Short-term loan (six to 18 months): These are best for investments that’ll return capital faster like investing in seasonal staff or pitch fees.

- Intermediate term loan (one to three years): Go mid-term on equipment upgrades, the deposit on and kitting out of a commissary kitchen, or refurbishing an existing truck. Your repayments are lower, but you won’t be paying out after you’ve gotten the full value out of the investment.

- Long-term loan (three to 10 years): Spread the costs out as long as possible on big expenditures like custom truck builds, buying your own prep space, or expanding into different cities. Lower repayments take the pressure off your cash flow.

How to choose the right food truck loan for your business

The right loan isn’t the one with the lowest rate. It’s the one that helps you get the job done and doesn’t lock you into repayments long after you’ve seen the value.

Operators tend to favor these financing options:

- Buying equipment: If you’re buying a truck, a grill, or a freezer, go for equipment financing. Every day, you use your assets, and the revenue you make from your food takes care of the payment. Choose leasing for the latest gear and loans for assets that hold their value over time. Both options keep your working capital free to run the business.

- Feeding growth: If you’re growing your business, cash flow financing is best. Payments flex with your revenue, so you hang onto more of your capital in quieter weeks. That flexibility makes it ideal for operators in tourist destinations or locations where your best weeks are festivals, markets, and local events.

- Long-term investment: Term loans make sense when you’re building lasting value in your business, like scaling into multiple cities. They can be useful, but only if the project delivers high returns over time. Stress-test your numbers to check that your project earns enough to justify the full cost of the loan.

Lending criteria for food truck financing

National Business Capital works with established operators with at least one existing restaurant location. You’ll need to have been in business for at least one year and produce $500K+ in annual revenue. As well as food truck financing, find out about our restaurant financing options.

What makes us different is the long-term partnerships we build with established and growing companies. We’re here to support you with expert advice through your expansion and in any market. We’ve built our company around working with business owners who rely on us to find the right funding solution as they expand, add locations, or take on bigger contracts.

Explore options to finance your food truck with National Business Capital

Whether you’re expanding your fleet, upgrading your kitchen gear, or locking in a profitable new pitch, the right loan structure makes the difference. Apply securely for food trucking business loans with National Business Capital, and grow your food truck business to greatness with our assistance.

National Business Capital is a market leader in funding $100K-$5M+ transactions. We’ve secured over $2.5B in financing for business owners, and one of our specialist areas is hospitality financing. If you’re not sure which option fits best, speak to our expert business advisors, who know the food truck sector and can tailor a plan to your goals. Apply now to get started today.

Frequently asked questions

Most lenders ask for tax returns, bank statements, a business plan, and proof of licenses, permits, and ownership. You may also need to provide a profit and loss statement, balance sheet, or proof of collateral. National Business Capital only needs a completed application and six months of bank statements to get started.

Yes, you can use personal assets like real estate as collateral, but you don’t have to. Many food truck lenders offer unsecured loans based on your revenue, not your home or savings. Contact National Business Capital to find lenders that can fund your business without requiring collateral.

You need a credit score of at least 550 to finance a food truck. Every lender is different, but most require a higher score. Businesses with stronger credit can access better rates, more affordable repayment terms, and higher borrowing limits. National Business Capital requires a minimum score of 700 for food truck financing.

If your credit score is under 600, it’s helpful to show strong cash flow and active contracts or bring on a co-signer with excellent credit. Look for lenders open to funding applicants with mixed or limited credit histories.

To buy a food truck with no funds, you first need a plan to determine how much you need to launch your venture. Once you have a firm budget, consider approaching the following sources:

- Friends and family: Make sure you agree on repayment terms upfront. If you offer equity, everyone should understand their share and what rights they’re entitled to.

- Credit cards: Some cards offer 0% APR for the first 12–18 months. However, when the 0% rate ends, you’ll pay much higher interest rates than on standard commercial financing like a term loan.

- Renting a food truck: You may be able to rent a fully fitted truck with no down payment. But most rental firms won’t let you buy the vehicle later, so you’ll always be paying for something you don’t own.