In typical cycles, the playbook is easier to read. Boom-and-bust cycles offer a kind of clarity. In a boom, momentum can reward quick action. If it’s missed, another opportunity usually follows. In a downturn, wait-and-hold is often what’s appropriate. Buffering for disruption is a time-proven play.

But 2025 hasn’t given us either.

It’s given us fog — uncertainty, volatility.

Opportunity doesn’t disappear in fog, it just gets harder to spot.

For 2025, the businesses taking bold initiatives aren’t hovering over headlines. They’re responding to moments unique to their circumstance. Moments when, with vigilance, they can see just enough to hit harder on the gas and go.

For advisors and partners working with these firms, it’s less about fueling urgency and more about helping clients interpret foggy imprints with clarity and care.

Inside the mid-market mindset…

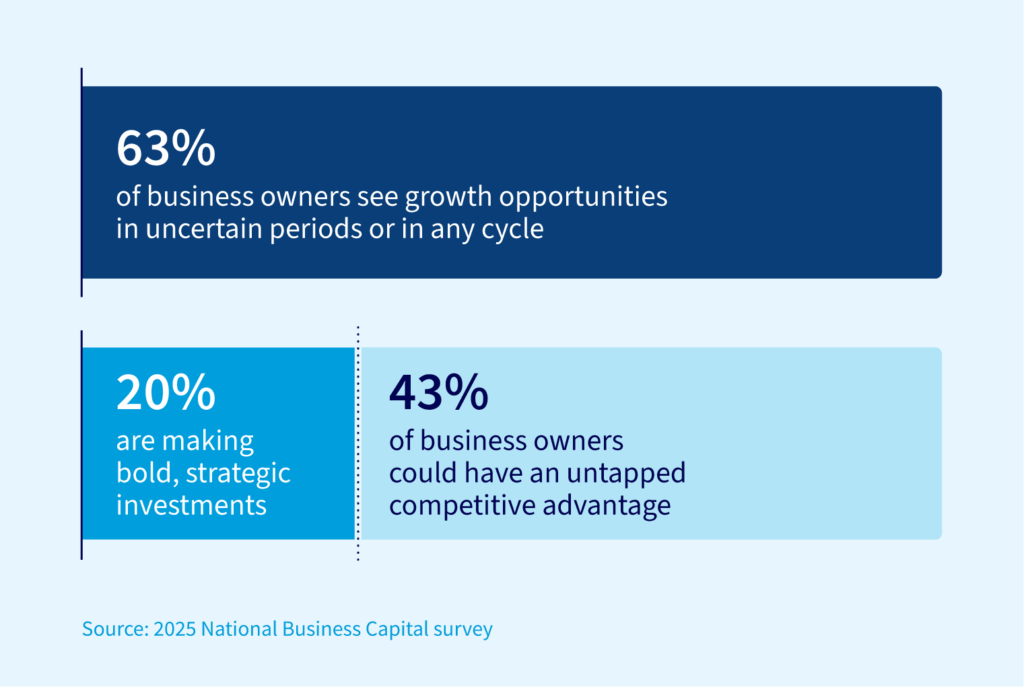

In May 2025, we asked over 500 business owners, from construction to education, from manufacturing to retail to transportation: how they perceive the current economy and how that perception shapes behavior.

The results show a striking but unsurprising gap:

- 63% of business owners believe growth is possible, even in volatile or uncertain conditions.

- But only 20% are actually making bold, strategic moves to pursue that growth.

This is more than a hesitation gap. It’s a 43-point opportunity gap tucked between belief and action.

Strategic vulnerability veiled in fog, where belief is held but visibility is not.

Many of these business owners still believe in the possibilities of growth but lack the visibility to say yes with confidence. Without clarity on ROI windows, or certainty around growth scenarios, execution stalls strategy. Belief remains present, but action can’t translate into initiatives, investments, or operational expansion.

Opportunities may call. Desire for growth may be sincere. But without foundational relationships of teams, advisors, partners, or even vendors, it becomes harder for any business leader to discern which risks will pay off with expansion… and what might misfire.

When action needs orientation, not just confidence…

While many businesses are waiting for news headlines to forecast the “all clear,” a smaller—and highly strategic—group is already responding to specific opportunities that require decisive capital deployment.

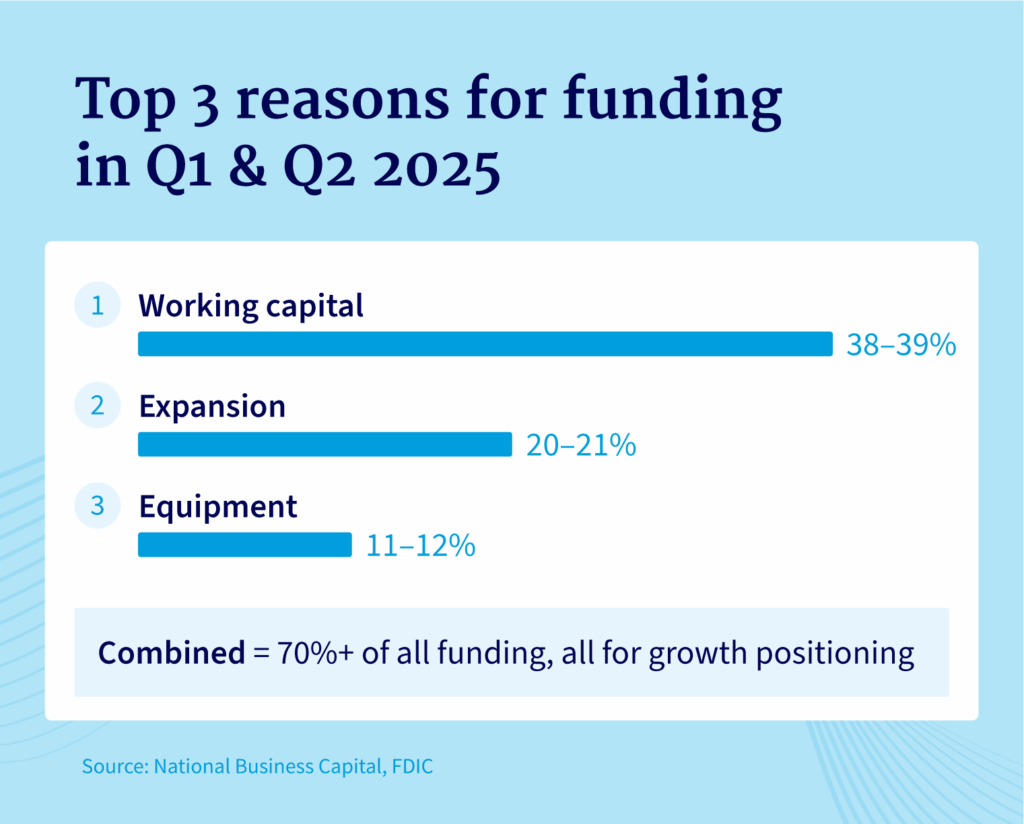

National’s own Q1 – Q2 2025 funding data backs this up.

In Q1 2025, we saw:

- Funding demand rose 94.5% YoY

- Average loan size requests surged 114.8% YoY

- Top 3 use cases: working capital, expansion, and equipment accounted for over 70% of total capital deployed

These aren’t defensive moves, either. They’re targeted growth initiatives made with precise actions, clear forecast ROI window, and contingency plans.

Q2 2025 brought geopolitical tensions, rising tariffs, and international policy shifts that triggered a market dip. But even with that backdrop, momentum on Main Street didn’t stall. Compared to our Q2 of 2024 data, funding demand rose another 40%.

A deceleration from Q1, yes, but no reversal.

This pattern tells us something important: Businesses are doing more than just preparing for what’s next. They’re building into the future, even when the path isn’t perfectly visible.

As our CEO, Joe Camberato, puts it:

“Across Main Street, momentum is building. Business owners are leaning into growth—making moves with clarity, speed, and confidence.”

This is especially clear in higher-value fundings. Among transactions above $650,000, the dominant use cases were all expansion-related—not emergency cash, but capital for new locations, capacity increases, or long-term equipment purchases.

Where growth is taking root even as market hesitation persists.

While our data reflects Main Street (i.e. mid-market industrial firms that don’t report their earnings), the Q2 2025 S&P Earnings Insight Report (FactSet, July 18) showed small signs of growth. Remove the ‘Magnificent 7’ and the report shows how unevenly different sectors are experiencing the current economy.

Among some of the businesses we serve—industrial, logistics, construction, and manufacturing—the growth patterns are too quiet for headlines, but are strong and easy to read for mid-market pulse.

Key Sector Data

On our funding balance sheet, Construction leads with a 40% YoY increase in funding volume requests.

Meanwhile, on Wall Street, Industrial companies posted an average net profit margin of 10.6%, up from a 5-year average of 8.6%.

→ Yet only 44% of Industrials expanded their margins this quarter; 54% experienced compression.

The difference? Often, strategic capital deployment.

Some businesses are using capital to scale and position for long-term advantage.

Others, facing the same uncertainty, are holding still and feeling the margin squeeze.

While industries like healthcare, energy, and consumer staples are flashing red with continued margin compression, the businesses we work with are quietly outperforming.

On Wall Street, while tech and finance make headlines with highlights and lowlights, our clients keep building. They don’t dominate the news cycle. They just keep the parcels delivered, the frames welded, and the orders filled. The economic fog may linger for the duration of H2, or it may lift in the months ahead. Either way, business isn’t slowing down. Our clients and partners are moving forward with plans for growth, and so are we.

*Data based on funding applications made through National Business Capital between 1/1/2025 and 6/30/2025 compared to the previous time period one year ago.

Methodology: The survey was conducted via SurveyMonkey Audience by a third-party on behalf of National Business Capital on May 27, 2025. The results are based on 503 completed surveys. In order to qualify, respondents were census-balanced for gender and age, and screened to be residents of the United States, over 18 years of age, and to own or manage a small- to medium-sized business (up to 500 employees). Data is unweighted, and the margin of error is approximately +/-4.46% for the overall sample with a 95% confidence level.