Table of contents

Your business is growing fast; new clients are coming on board, and you're landing bigger contracts more often. But managing cash flow when you're expanding that quickly is a real challenge, especially when growth opportunities require immediate capital. Taking out the right type of business loans gives you the liquidity you need to move the business forward so you can take advantage of profit opportunities today.

Read on to learn about 11 business loan types, how they work, an example of them in action, and how to choose the right one for your company’s growth plan.

1. Short-term business loans

Best for: Businesses that need fast access to capital to take advantage of time-sensitive opportunities or meet urgent costs.

Short-term financing provides a lump sum of capital that you repay over three months to 1.5 years, plus interest and fees. You can choose between:

- Fixed interest rates: These are fixed monthly payments that remain the same throughout the term.

- Variable interest rates: Your repayments rise when general interest rates increase and fall when they decrease.

Use case: A restaurant chain CEO spots a prime location in an up-and-coming city center, but the landlord wants a non-refundable deposit of $120,000 within 30 days.

The chain wants to borrow $300,000 to secure the site and pay for a total fit-out. Short-term financing is ideal in this situation because lenders often pay out within 24 to 72 hours. Once the new restaurant opens, the company will repay the loan from the revenue the restaurant generates.

| Pros | Cons |

|---|---|

| • Access capital in 24 to 72 hours to move quickly on time-sensitive opportunities • Most short-term options don’t require collateral • Cheaper than business credit cards | • Short-term loans tend to have higher interest rates than long-term options • Borrowing limits are usually lower than with long-term loans • Repayments can put pressure on your cash flow during quieter periods |

2. Long-term business loans

Best for: Larger investments that take time to show a return, like funding major growth or buying another business.

Businesses use long-term business loans to access larger amounts of capital that they repay over three to 10 years, sometimes longer. To secure these loans, lenders usually ask for collateral, such as vehicles, equipment, or other assets, like investments.

These deals take longer to arrange, and you may need to provide a detailed business plan, along with substantial documentation. Long-term financing suits both small business owners and established companies looking to invest in strategic growth because it provides lower monthly payments and extended repayment periods that preserve cash flow.

Use case: A medical device manufacturer in Texas wants to buy a rival company with strong recurring contracts and a patented product line in North Carolina, where the sector is booming.

They borrow $4M over 15 years to complete the deal. The boost in sales and their larger market share cover the repayments as the company continues to grow.

| Pros | Cons |

|---|---|

| • Pay lower interest rates than short-term funding • Make repayments more affordable by spreading the cost over a longer term • Fund large purchases without draining your capital reserves | • These loans take longer to arrange and involve more paperwork • They’re harder to qualify for, as lenders usually require both strong credit and collateral • The total interest cost is often higher due to the longer repayment term |

3. Equipment loans

Best for: Buying vehicles, technology, or machinery without draining working capital

Businesses can use equipment financing to buy physical and fixed assets, like vehicles, manufacturing machinery, office equipment, or commercial kitchen gear. Lenders like these deals because the equipment acts as collateral, which lowers their risk.

That usually means better rates and faster lender approval, especially if the asset has a long useful life and holds its value over a longer term.

Use case: A construction company wants to take on a series of earthworks contracts but doesn’t want to dip into reserves to cover a $200,000 excavator. Instead, they take out an equipment loan.

The machine pays for itself through the revenue it generates on those jobs while protecting working capital to cover business expenses like payroll, fuel, and materials. Once the company has cleared the balance, the asset stays on the balance sheet.

| Pros | Cons |

|---|---|

| • The asset covers its own costs on the jobs it enables • Equipment financing is easier to qualify for than unsecured business loans • There's no requirement to provide personal or business collateral | • Equipment loans can only be used on tangible, business-related purchases • The lender can repossess the asset if you miss your repayments • You’ll need to factor in maintenance and insurance fees, which push the cost up |

4. Cash flow financing

Best for: Companies that experience cash flow fluctuations caused by events like seasonal dips or unexpected expenses

Cash flow financing helps businesses prioritize growth consistently to avoid letting go of opportunities during slower periods. Instead of assessing your assets, lenders look at your sales history, profit margins, and forward projections to determine how much you can borrow.

With this type of short-term business loan, your repayments adjust with your income, rising when revenues are up and falling when they're down.

Use case: A Miami Beach retailer expects much lower footfall in January and February after the holiday tourist season ends, but they know sales will bounce back in March when spring breakers and early summer visitors arrive. However, they don't want to fall behind on payments to resort wear suppliers or risk losing their prime Lincoln Road or Ocean Drive lease terms.

Cash flow financing helps them hold onto their working capital during the seasonal lull – covering high South Beach rent, maintaining swimwear and resort fashion inventory, and retaining bilingual sales staff – then pay down the loan faster once the spring tourism surge begins.

| Pros | Cons |

|---|---|

| • Borrow based on the strength of your sales, not how much your assets are worth • Get a lump sum to cover the costs of scaling your business | • If revenue recovery is slow, it takes longer to clear the facility • Rates are typically higher than other types of financing |

5. Bridge loans

Best for: Companies needing short-term capital to cover a gap in funding

Bridge loans let companies move ahead with their plans when the funding they need isn't ready yet but is on its way. That could be a commercial mortgage, equipment financing, or incoming investor capital.

When the funds arrive from the permanent financing source, the company pays off the bridge loan in full, completing the temporary funding cycle.

Bridge loans do come with trade-offs to consider. Interest rates are often much higher than traditional financing, and there are usually additional fees on top of the principal amount. However, the speed of approval and additional flexibility these loans provide give a business the breathing room it needs to act quickly on time-sensitive opportunities.

It's important to note that loan terms are very short, rarely exceeding 12 months, making them unsuitable for long-term financing needs.

Use case: A tech company preparing for an IPO might need $1M to cover legal costs, regulatory filings, and investor roadshows. They take out a bridge loan to fund the upfront costs, then repay it in full when the IPO closes and the capital lands in their account.

| Pros | Cons |

|---|---|

| • Get fast access to capital when time is of the essence • Used to cover various business needs, as bridge lenders tend to be very flexible • Plug the gap in capital while you wait for your funds to land | • Interest rates are higher than with traditional loans • You’ll need a clear and credible exit strategy to be approved • Bridge loans aren’t suitable for ongoing or long-term business needs |

6. Business lines of credit

Best for: Businesses wanting flexible, repeat access to funding without reapplying every time

A business line of credit shares a lot in common with a business credit card. Both have a limit (the maximum amount you can borrow) and a balance (how much you've actually borrowed). You pay interest only on the funds you use, and when you make a repayment, you get access to those funds again.

You decide how much and when you pay back, subject to a minimum monthly payment. It’s a flexible way to manage short-term cash flow or act on unexpected opportunities. It's also a popular alternative to inventory financing.

Use case: An e-commerce platform draws $200,000 from its credit line to book pay-per-click adverts and stock up on the items its CRM forecasts will be its best sellers during the holiday season.

When sales come in, the company can pay down the line of credit in part or in full and reuse the funds on the next big push. It’s fast and repeatable.

| Pros | Cons |

|---|---|

| • Access pre-approved capital when you need it • Pay interest only on the amount you draw, not your total credit limit • Use for short-term investments that offer a fast return | • Can be harder to qualify for than a standard small business loan • Companies may become dependent on their credit line if they don't practice good cash flow management • You’ll need to repay the full balance by a set date or reapply for an extension if the line isn’t revolving |

7. Invoice factoring

Best for: Companies that want to convert unpaid customer invoices into capital straight away

Invoice factoring is one of the most popular small business financing options for B2B companies. The factoring company buys your outstanding invoices and pays you a certain percentage (up to 95%) of their value. When your customer pays, you get the remainder minus the factoring fee.

Each customer goes through a credit approval process where the factoring company evaluates their creditworthiness and payment history. Approved customers are assigned a credit limit that determines how much of their invoices can be factored.

Use case: A trade counter uses invoice factoring to offer 30-day terms to builders and subcontractors. This gives customers time to complete the job, get paid, and settle the invoice. For the trade counter, this type of business financing means they have the capital they need to restock and cover immediate expenses like payroll and rent.

| Pros | Cons |

|---|---|

| • Turn outstanding invoices into working capital within 24 hours • Avoid adding debt to your balance sheet | • Factoring fees reduce your profit margin on each invoice • You only receive payment when a job is fully complete, not at earlier project milestones • Factoring only works with B2B customers who pass the factor’s credit checks |

8. Construction business loans

Best for: Contractors, subcontractors, and suppliers

Construction business loans give contractors the capital they need to move on a job before the client's payment comes in. You can use the funding to pay your crew, buy materials, hire subs, or keep work progressing when you're waiting for payment.

Some lenders fund projects up front, while others release the capital at defined milestones, matching the pace of your drawdowns to the pace of the project.

Use case: California is spending $180B on infrastructure in the next 10 years. Let's say a civil engineering company wins a new $1.5M contract but needs $300,000 up front to cover materials, initial staffing, and site mobilization on electrifying part of the new high-speed railroad.

The California High-Speed Rail Authority (CHSRA) will pay the first invoice 45 days after work begins. The contractor can fill that gap with a loan, so they have the capital they need to get underway without dipping into their working capital.

| Pros | Cons |

|---|---|

| • Cover upfront contract, labor, and material costs before customers pay yo • Choose between a one-time lump sum or milestone-based payouts • Preserve working capital available to cover unexpected project costs | • Repayments may begin before the project is complete • You might hit significant cash flow issues if you exceed your contingency budget • Some lenders only offer funding to bonded contractors |

9. Manufacturing financing

Best for: Manufacturers that need to scale their production, upgrade their equipment, or buy raw materials in very large quantities

With manufacturing financing, like a manufacturing loan, you can get the capital you need to increase capacity and improve efficiency. You can also buy the new machinery, hire the expert staff you need, and fulfill large orders before your customers pay you.

You have multiple business loan options, including term loans, equipment financing, or lines of credit, depending on what you're funding.

Use case: A manufacturer in the booming dental 3D printing market secures distribution deals with several large dental labs. To meet demand, they need more trained personnel and more printers to cope with the new volume.

They also want to buy resin in bulk to increase their profit margin per unit. Manufacturing finance gives them the capital to scale output quickly, improve turnaround times, and keep their existing customers on schedule.

| Pros | Cons |

|---|---|

| • Pay for capital expenses that fuel long-term growth • Meet rising demand without using day-to-day operating capital • Use funds to hire staff, purchase equipment, or boost production | • Lenders often require detailed forecasts and business plans, so expect a drawn-out application process • Your repayments may start before you begin to receive revenue from customers • Some loans may require collateral or a personal guarantee, depending on the type and size |

10. Subordinated debt loans

Best for: Businesses with a senior loan in place needing extra capital to grow, but don't want to refinance or give up equity

Subordinated debt is debt that's underneath your existing loan on a balance sheet. You keep your existing debt (the senior debt) and add a second loan behind it. If anything goes wrong, your senior lender gets paid first.

For that reason, the subordinated lender charges more. It's an effective way of raising capital without refinancing your original loan or handing over part of your company.

Use case: A wholesale distributor wants to open a second site to service a new grocery chain contract. However, there's already a senior loan on their current facility, and the lender won’t extend terms or lend more. To circumvent this, they raise $750,000 in subordinated debt. This keeps their standing with the senior lender intact while unlocking new capital to grow.

| Pros | Cons |

|---|---|

| • Add extra capital to your account without breaching the terms of your existing loan • Avoid giving up shares or equity in your company • Raise funding even after reaching your senior debt limit | • More expensive than senior debt • Can be hard to qualify for this type of funding, especially if your business or credit score isn’t strong • Some deals may include an equity kicker, meaning you could still end up giving up some of your shares |

11. Small Business Administration (SBA) loans

Best for: Business owners with moderate or bad credit

The U.S. Small Business Administration backs the SBA loan program. You access business financing through institutions like banks, credit unions, or online lenders that would otherwise reject your application because of your credit score.

| Pros | Cons |

|---|---|

| • Access funding when mainstream lenders won’t work with you • Use for working capital, refinancing debt, property purchases, and more • Get favorable interest rates on some SBA-backed loan types | • The application-to-payout timeline can stretch to 120 days or more • The process involves full financials, personal guarantees, and a detailed business plan • You’ll still need a reasonably strong credit profile to qualify |

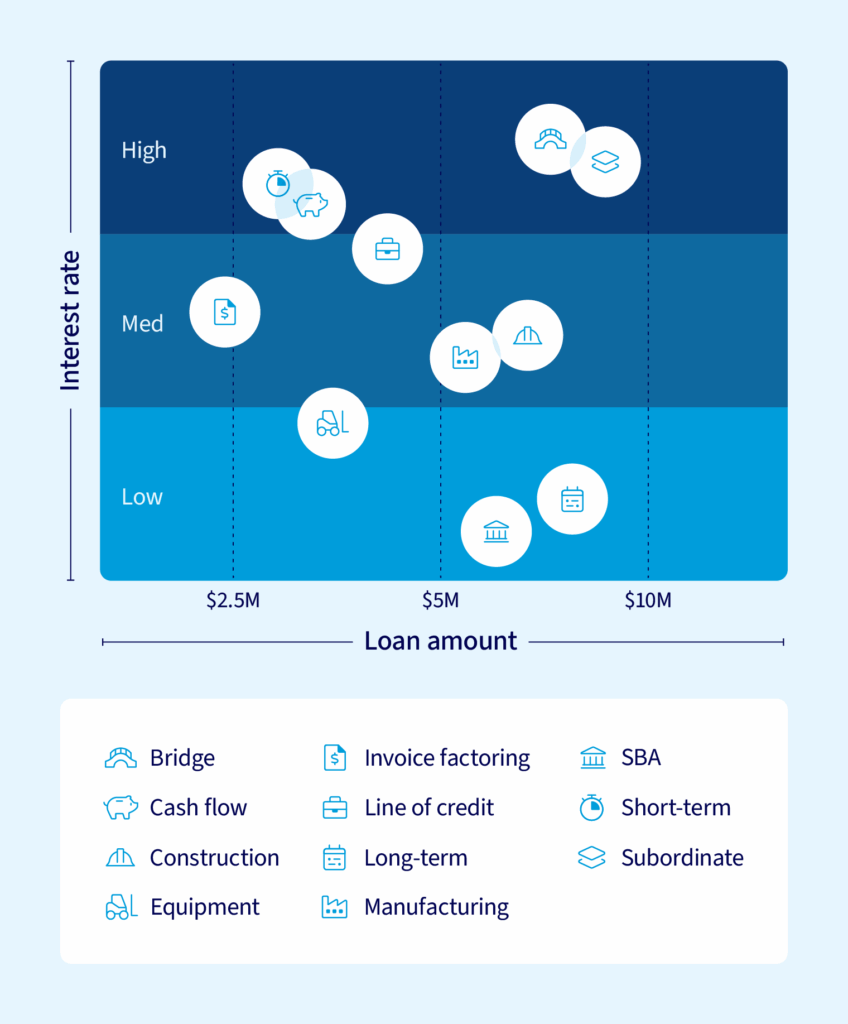

Key differences between these loan types

Different loans unlock different opportunities. Not every option will suit your needs, and some may not be available because of your credit score.

Below, compare each of the loan types from our review above to help you decide which one might be right for you:

| Loan Type | Interest rate | Repayment schedule | Collateral | Best for | |

|---|---|---|---|---|---|

| Short-term loan | Up to $15M / 3–36 months | Higher | Weekly or monthly | Often unsecured or backed by personal guarantee | Urgent costs, one-off opportunities, deposit deadlines |

| Long-term loan | Up to $15M / 5–20 years | Lower | Monthly or quarterly | Significant collateral often required | Property purchases, acquisitions, large-scale expansion |

| Business equipment loan | Up to $15M / 3–10 years | Lower | Monthly – matched to equipment lifespan | The equipment you're buying or leasing | Buying vehicles, machinery, or specialised technology |

| Cash flow financing | Up to $15M / 6–18 months | Higher | Daily or weekly – adjusts with income | Based on business revenue, not assets | Covering gaps during seasonal dips or slow receivables |

| Bridge loan | Up to $15M / 1–6 months | High | Lump sum on maturity | May require assets or be unsecured | Buying time before long-term funding or delayed payment arrives |

| Line of credit | $50K–$1M+ / Revolving (ongoing access) | Higher | Flexible – draw and repay as needed | Based on business history and financials | Inventory builds, marketing spend, managing cyclical cash flow |

| Invoice financing | Up to $15M / Terms: 30–90 days | Fees typically 1%–5% of invoice value | Customer pays factoring company directly | Invoices serve as collateral | Turning unpaid B2B invoices into fast-access working capital |

| Construction loan | Up to $15M / 6 months to 3 years (project-based) | Varies | Often tied to milestones or monthly drawdowns | May be tied to contracts or secured with assets | Upfront project costs – labor, permits, materials |

| Manufacturing financing | Up to $15M / 1–7 years | Moderate to low, depending on structure | Monthly or milestone-based | Varies – equipment, invoices, contracts | Expanding capacity, bulk materials, or investing in automation |

| Subordinated debt | Up to $15M / 2–5 years | High | Structured repayments, often with covenants | Often unsecured, sometimes personal guarantee | Raising capital beneath an existing senior loan without refinancing |

| SBA loan (7a / 504) | $50K–$15M / 7–25 years | Low to medium | Monthly – long repayment terms | May require property, assets, or personal guarantee | Real estate, expansion, partner buyouts, or refinancing high-cost debt |

Tips for choosing the right business loan

It's easy to find a lender. What’s harder is deciding whether the finance package they’re offering fits your financial situation and future business growth plans.

The right choice gives you breathing space and protects your working capital. The wrong one pulls too much capital from your bank account and makes managing your business finances day to day a lot harder.

Here's how to check you're applying for the best loan for your business:

- Loan type: Opt for a loan with a term that either far exceeds the asset's lifespan or concludes before a reasonable return is achieved.

- Loan size: Check and double-check that the loan amount you want is accurate. Don't go for too little because getting more from the same lender six months later is a challenge.

- Loan terms: Look past the interest rates and check the T&Cs for other charges, such as origination fees and prepayment penalties. Ask for the full repayment schedule, not just the monthly number.

- Loan disbursements and repayments: Know for certain how much you're getting and when. Also, be aware of how often you'll be making repayments and check that it won't cause cash flow problems.

Don’t take the first offer if it doesn’t make sense. Ask your accountant to check for red flags, and base how much you can afford on your quiet months, not your busy months, because that'll protect you from shortfalls.

Access the funding to meet your needs with National Business Capital

Getting a business loan solves a problem, and it opens a door at the same time. The key for businesses is selecting the option that presents the highest upside and the lowest downside. Making the right choice depends on understanding what you need, when you need it, and the value of the opportunity cost. Done right, business financing is a profitable opportunity, not a burden.

National Business Capital is a key growth partner for thousands of American companies. Whether they need a short-term loan or manufacturing financing, our lending specialists work to help them find the right package for their company.

We’re a market leader in funding $250K-$15M+ transactions and have secured over $3B+ for clients. Complete our digital application form and let’s get you funded.