Find flexible options for asset-based lending that can help you achieve your expansion goals.

Asset-based lending (ABL) is an excellent financing option for profitable, expanding businesses in need of capital. It gives asset-rich companies flexible and easily accessible loan opportunities. Since ABL is secured by collateral, it’s often easier to obtain than traditional bank loans based on cash flow.

Working with an ABL lender can help harness your assets to give you liquidity and grow your business. Let’s walk through asset-based lending, show you how it works, discuss who benefits most from ABL, and shed some light on the qualification process.

What is asset-based lending?

Asset-based lending is a type of business financing in which the lender secures the agreement with an asset or collateral. With this form of financing, the borrower can receive either a loan or an asset-based line of credit.

Collateral for asset-based lending can include:

- Real estate

- Inventory

- Receivables

- Purchase orders

- Machinery and equipment

Asset-based lines of credit and loans help you capitalize on the value of your liquid assets immediately. Instead of waiting for payments, you can get capital to cover expenses like growth, expansion, additional inventory purchases, and more.

Rather than meeting traditional requirements, you can qualify for inventory financing or other asset-based lending based on your receivables, inventory, or other assets, even with a low credit score or no history.

Here are several benefits of asset-based loans:

- You can get capital to grow your business without putting up real estate.

- Asset-based loans and revolving lines of credit are fast and simple to obtain.

- You can qualify as a young or new business owner if you have the required assets.

- Assets lower the lender’s risk, meaning you can generally qualify for lower interest rates.

- Utilizing an asset unlocks your ability to borrow more and qualify for higher funding.

- As long as you can prove your asset ownership, you can receive fast approvals and immediately boost cash flow.

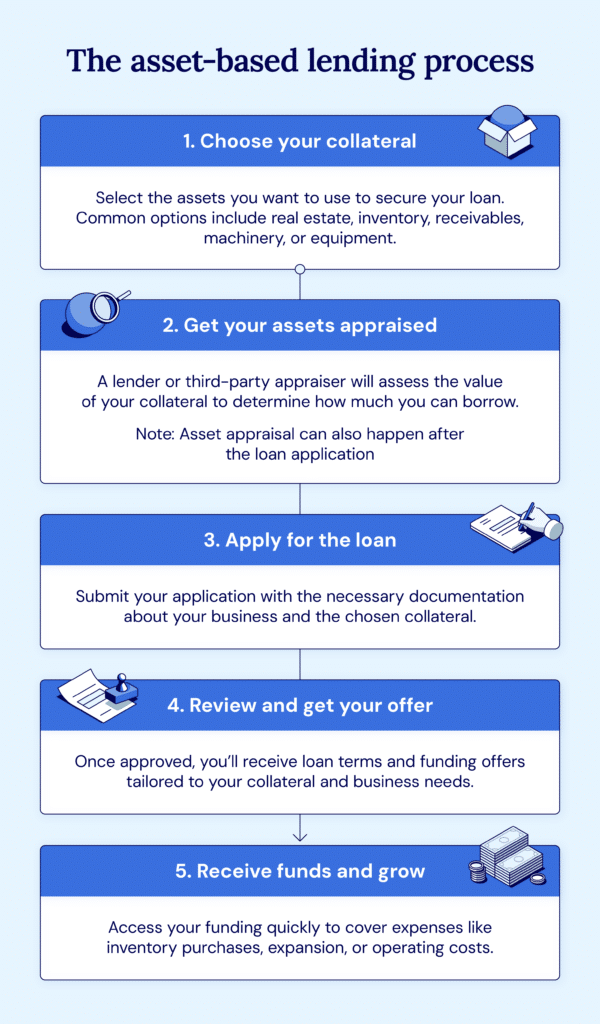

How does asset-based lending work?

As with most other business financing options, you get capital to drive your business growth and pay it back over time. Asset-based lending, however, involves putting up an asset as collateral.

When you put an asset up as collateral, you reduce the lender’s risk and give them confidence because they receive a security interest in the asset. As a result, you may get access to lower interest rates.

Asset-based lenders tend to prefer real estate and strong receivables. However, you can still find great options by putting up one or a combination of other assets, such as machinery and inventory.

It’s not uncommon for new and older businesses to experience cash flow issues due to rapid growth or slow-paying customers. In these situations, asset-based lending helps you unlock instant capital to use immediately by leveraging your assets.

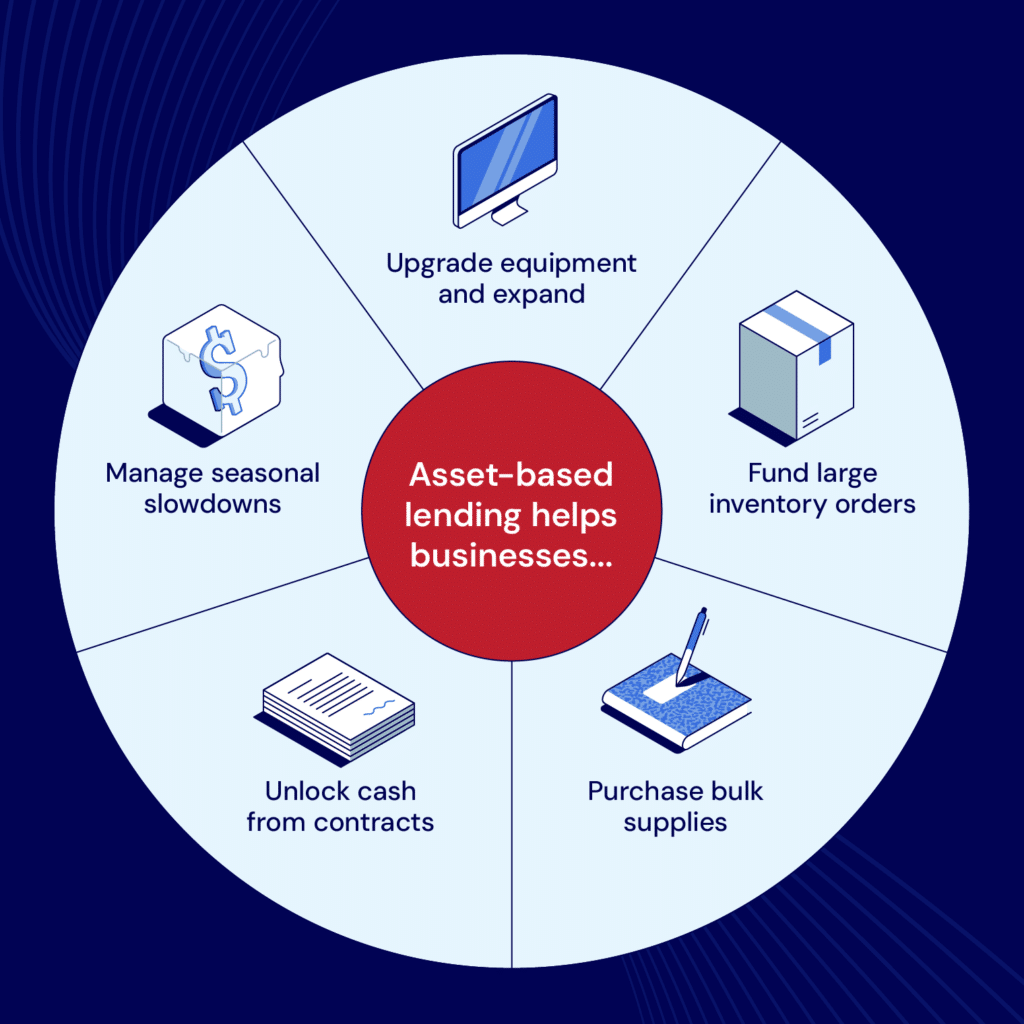

There are generally no restrictions on how you can use the funds. Many businesses utilize ABL for:

- Enduring seasonal slow periods

- Covering slow-paying receivables

- Funding inventory purchases

- Filling new orders with high upfront costs

- Covering rising operating costs

- Building liquidity buffers

- Fueling business growth by opening a new location, expanding offerings, and more

While ABL can unlock myriad possibilities, it may not be a fit for every business. Let’s look at who stands to benefit most.

Which businesses benefit from ABL?

Asset-rich companies with uneven cash flow looking to grow with a significant capital boost are prime candidates for ABL.

Say a construction business in North Carolina owns a large amount of heavy equipment, like excavators and bulldozers, but works with big contracts with long billing cycles. Plus, projects tend to stall in the wintertime.

The business may establish an ABL line of credit using its equipment as collateral to cover slow seasonal stretches and times between payments.

Plenty of other industries also benefit from ABL loans, from small retail stores needing to weather rough periods to sizable wholesale companies looking for large business lines of credit. Here are some examples:

| Type of business | ABL use case | Typical assets |

| Technology | With more clients on the books, technology companies can sell agreements to tap into additional capital and fuel growth. | A/R (software subscriptions, service contracts)Equipment (servers, computers)IP (patents, trademarks) |

| Wholesale | ABL ensures wholesalers have the capital they need for high-ticket transactions that yield substantial returns, especially while getting things off the ground. | Large inventory holdingsA/R from retail customersDelivery vehicles |

| Medical supply | Distributors, especially those selling PPE, tend to utilize asset-based lending to place bulk orders for inventory at the lowest, most cost-effective rate. | A/R from hospitals and other contractsSpecialized refrigeration equipmentRegulatory certifications |

| Manufacturing | Asset-based manufacturing financing gives manufacturers access to capital in order to update their equipment or expand their operations. | Raw materials inventoryWork-in-process and finished goods inventoryManufacturing machinery |

Think your business might be right for ABL? Before you apply for an ABL loan, it’s important to fully understand how it differs from cash flow lending.

Asset-based lending vs. cash flow lending

How does asset-based lending differ from traditional cash flow lending? Cash flow financing can provide unsecured short-term unsecured financing – that is, you don’t have to put up assets as collateral. However, you typically need a strong and predictable cash flow to qualify.

Here’s a detailed overview of the key differences:

| Asset-based lending | Cash flow lending | |

| What it is | Lending based on a business’s assets | Lending based on a business’s projected future earnings and cash flow |

| Interest rates | Usually lower (due to decreased risk to the lender) | Usually higher (due to increased risk to the lender) |

| Approval process time | Usually slower | Usually faster |

| Best for | Asset-rich businesses with uneven cash flow | Businesses with strong cash flow but not as many assets |

| Pros | Easier to get for asset-rich companiesLeverages assets to grow business quickly | No collateral requiredFlexible use of fundsLeverages future earnings to support growth |

| Cons | Available assets limit how much a company can borrowRequires regular field exams and asset monitoringLong funding process | Stability of cash flow limits how much a company can borrowMore thorough financial analysis required for approval |

How ABL qualification works

Typically, you will need to get your inventory appraised to see if you qualify for asset-lending. The lender will approve your company to borrow based on the collateral’s posted value on the balance sheet.

The more valuable your assets, the more the lender will feel comfortable allowing you to borrow. After you secure a loan, there may be regular spot checks or field exams, which you’ll need to be able to pay for.

The terms all depend on where you go. Banks have a long turnaround time and a complicated process, even while your asset lowers its risk. While rates may be slightly lower, you’ll pay for this in extended review processes and potentially smaller loan amounts.

Private credit lenders, on the other hand, have a simpler and easier qualification process that gives you the power to review more options faster. Here are National Business Capital’s qualifications for asset-based loans:

- $500K in current receivables

- Assets or collateral

Leverage your assets for growth with National Business Capital

Asset-based lending offers a viable way to grow your business fast, instead of waiting for working capital to meet your needs. However, since different lenders focus on different classes of assets and deal sizes, it can be confusing to know where to turn.

At National Business Capital, our expert team of advisors can help you sort through all the noise. We’re here to walk you through the asset-based lending process, unlocking the lowest rates, longest terms, and highest amounts you qualify for.

With our team on your side, you’ll be able to compare your best offers and tackle challenges ahead with confidence. Complete your application to get started.