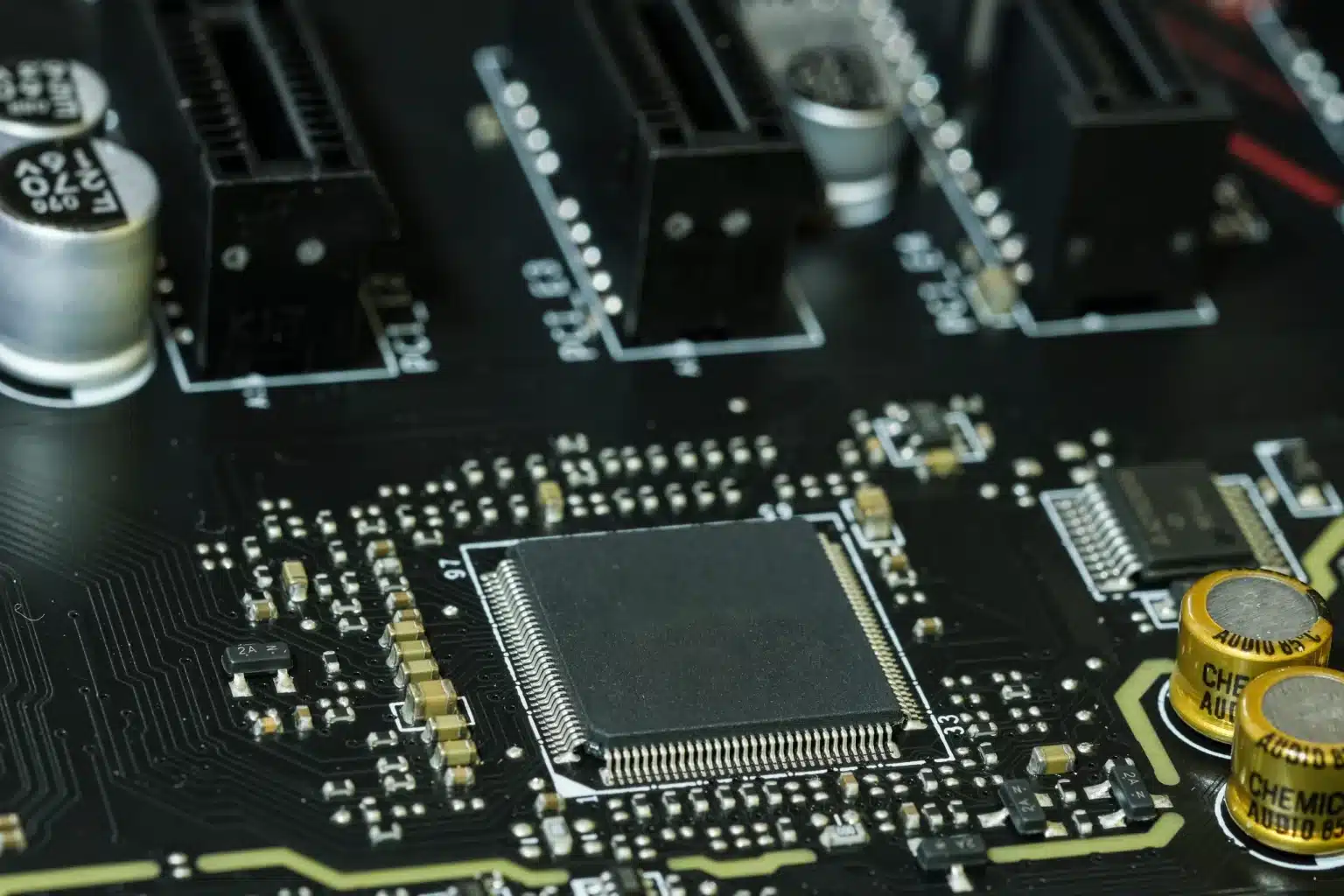

The chip shortage has been causing problems for businesses across different industries, and it may not be over anytime soon. Semiconductor chips are commonly used for items like cars, appliances, and computers.

And according to the CEO of Marvell Technology, the problem could continue well into 2022. “If it stays business as usual, and everything’s up and to the right, this is going to be a very painful period, including in 2022 for the duration of the year,” Matt Murphy said during an interview with CNBC.

Fortunately, not everyone in the industry shares this view of the chip shortage. But given the shortage and the increasing demand for semiconductor chips, what can businesses do in the meantime?

Chip shortage causes problems across industries

Semiconductor chips power products across a variety of industries, including cars, household appliances, and smartphones. And right now, the demand is higher than the supply, so many popular products are out of stock. Automakers like General Motors and Ford have had to slow or halt production due to shortages. Apple CEO Tim Cook warned that chip shortages could affect iPhone sales. And video game consoles have been in short supply as well. Many companies are warning consumers that the problem will only worsen as the holiday season approaches. Buyers have been advised to do their Christmas shopping now before many products are out of stock. The chip industry has always gone through these kinds of ups and downs in supply and demand. But according to Lisa Su, CEO of AMD, the current chip shortage is unique, and that the first half of 2022 will be “tight.”How to handle the chip shortage

Some chip companies have made plans to expand factory capacity. Intel announced its investing $20 billion in two new chip factories, and Marvell is building a $12 billion factory. But these efforts will take time to put in place. According to Su, it can take 18 to 24 months to put in a new plant, and sometimes it can take longer than that. So what should businesses do in the meantime? Here are a few tips to help you navigate the chip shortage:- Use cloud-based solutions: Wherever possible, try to rely on cloud-based solutions instead of hardware. Many cloud-based software solutions can support a wide range of services.

- Buy in advance: Right now, the only way to ensure you have the items you need is to purchase them in advance. Make a plan to buy the products you need well in advance so your business isn’t at risk of shutting down.

- Focus on your most popular products: If you rely heavily on semiconductor chips, you’re going to have to adjust your priorities. For example, General Motors is using the chips it does have solely for its most popular and profitable products.

- Be flexible: The bottom line is that no one knows when the semiconductor shortage will end, and it won’t be business as usual for a while. Being flexible and finding workarounds wherever possible is going to be vital to getting through it.