Table of contents

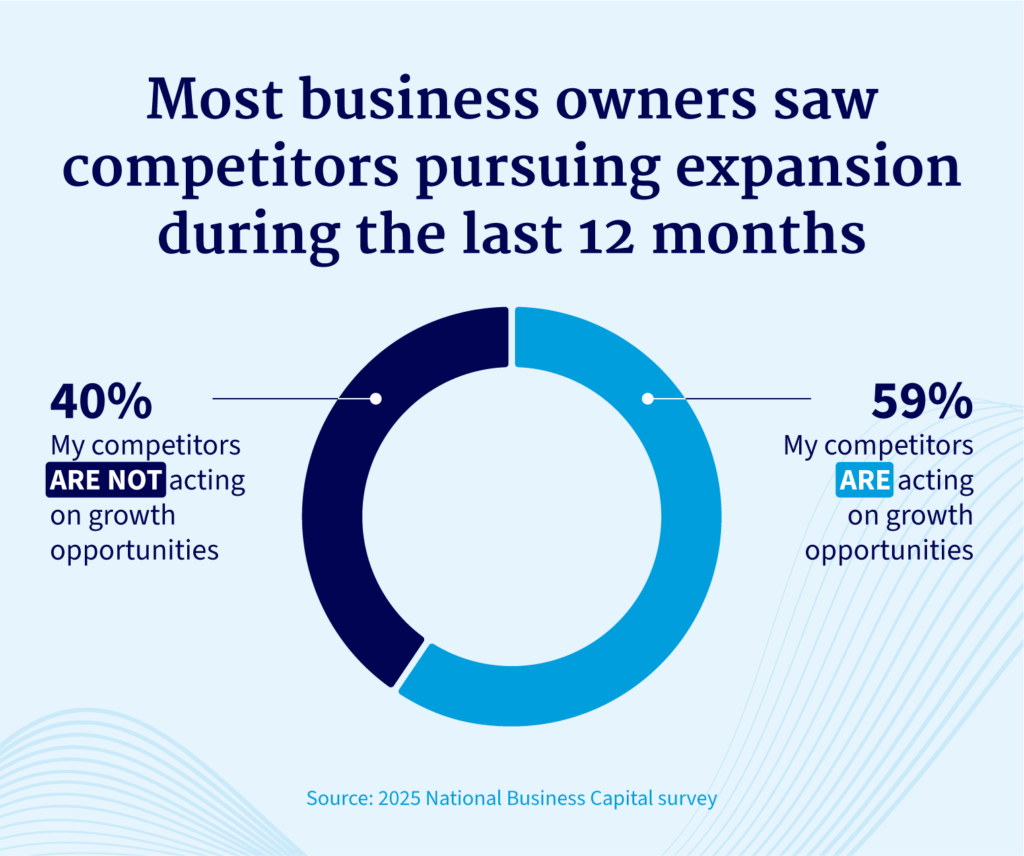

The market in 2025 is a study in contradictions—and it's creating winners and losers in real time. While headlines debate economic uncertainty, nearly 60% of business owners are watching competitors make bold growth moves, capturing market share and strategic positions that may be impossible to reclaim later.

Our recent survey of 503 small- to medium-sized business owners reveals a costly paradox: Nearly 40% believe wealth can be built in any market, recognizing that opportunity doesn't vanish when the economy wobbles. Yet most are taking a cautious approach to expansion, essentially choosing to observe from the sidelines as more decisive competitors advance.

This hesitation comes with a hidden price tag. Every quarter spent waiting for an “all clear” signal that may never come is a quarter where market share shifts, valuable partnerships get claimed, and industry leadership positions solidify, often in favor of businesses willing to act strategically during uncertainty.

The real question isn't whether opportunities exist during turbulent times. It's whether business owners can afford to let hesitation cost them their competitive edge. Understanding this is crucial for owners looking to use business financing to grow, invest, and scale through the currency economy, not into it, no matter the market.

Key takeaways

- Nearly 40% of business owners believe it's possible to build wealth in any market, viewing opportunity as constant regardless of market uncertainty.

- Most business leaders observe competitors seizing growth opportunities in the past year, yet 4 in 5 are not making bold investments themselves, revealing a major opportunity gap.

- Despite stable small business sentiment, leaders are prioritizing defensive strategies over growth investments, with capital spending hitting its lowest level since August 2020, even as sales improve.

- 69% of business owners say faster access to capital would change their growth strategy, indicating that funding speed and accessibility are primary barriers to expansion rather than a lack of ambition.

Business leaders are split, but many see growth opportunities across market cycles

Conventional wisdom says to wait for clarity before investing. But what if that clarity never comes?

Our survey reveals a shift in how business leaders think about opportunities to grow their businesses. After being asked when businesses create the most wealth, the respondents' answers bucked the old narrative:

- 37% still point to economic growth periods

- 26% believe periods of uncertainty and market volatility create the best wealth-building opportunities

- 37% say it happens no matter what

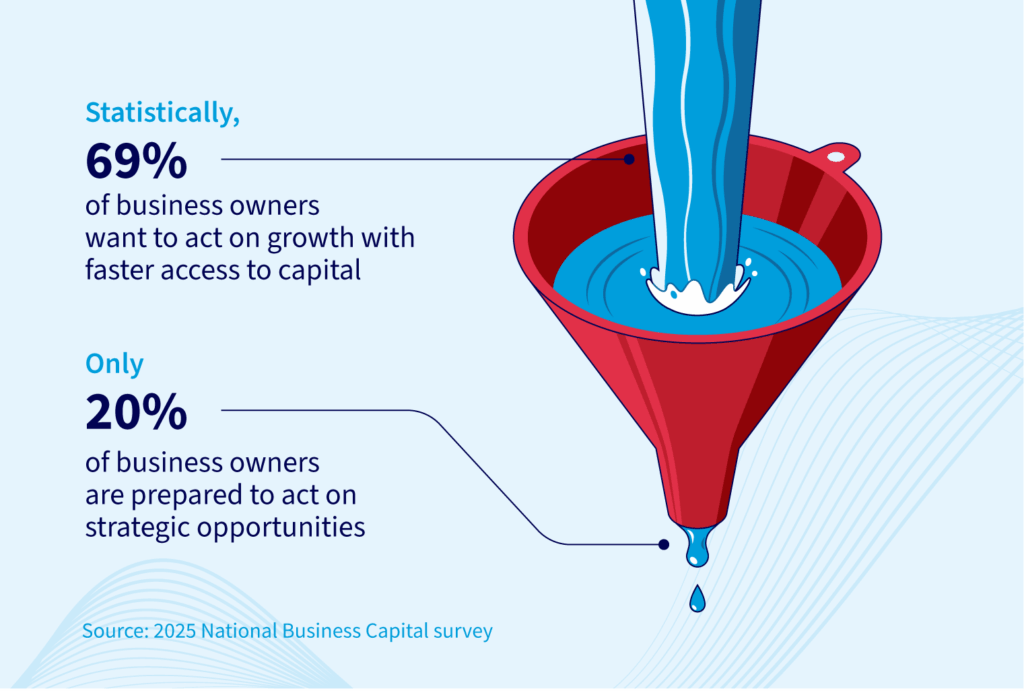

Add those last two up, and 63% of business owners see potential in uncertain times or any season. Yet only 20% are currently making bold growth moves – a 43% gap between belief and action.

This split between perception and action aligns with broader market indicators. The Chicago Board Options Exchange Volatility Index (VIX) slipped from a high of more than 50 in April 2025 to below the long-term average of about 20 in June. While markets appear relatively calm, this low VIX environment can indicate market complacency, precisely when evidence suggests it might be the perfect time to strategically invest. Yet businesses are still hesitating to act on growth opportunities.

Opportunity truly doesn’t sleep, and successful businesses have learned to capitalize on this opportunity gap through dynamic markets with inflation and supply-chain disruptions. This means periods of uncertainty or mixed market signals can be prime opportunities to act while others pause their growth plans.

This shift marks a change in how business leaders think. Those who recognize and act on soft markets and hesitant competition position themselves for significant gains when markets eventually recover

Competitors are forging ahead with opportunities

The reality is that periods of uncertainty may be the new normal. Rather than waiting for an “all clear” signal that may never come, successful businesses are learning to thrive amid an unclear economic environment.

Nearly 60% of business owners have watched competitors make bold growth moves in the past 12 months alone, in real time, across several industries. Now, the 43% opportunity gap between business owners who recognize potential and those who boldly act on it seems even more critical.

This cautious approach from businesses that are holding back is reflected in broader data from the National Federation of Independent Businesses (NFIB) June 2025 Small Business Economic Trends Report. 50% of business owners surveyed reported capital outlays in the past month – 6% fewer than May, and the lowest level since August 2020 – suggesting many are watching competitors advance while maintaining defensive positions themselves.

If so many recognize this momentum but more aren’t acting on it, the opportunity gap could stem from limited access to key resources that hold businesses back. Companies moving forward during uncertain times are likely gaining significant competitive advantages by:

- Capturing market share from hesitant competitors

- Securing valuable partnerships and talent at competitive rates

- Positioning themselves as industry leaders ahead of market recovery

Meanwhile, those observing from the sidelines risk falling further behind with each passing quarter.

Behind the scenes, businesses are opportunistic on growth, but strategy isn’t one-size-fits-all

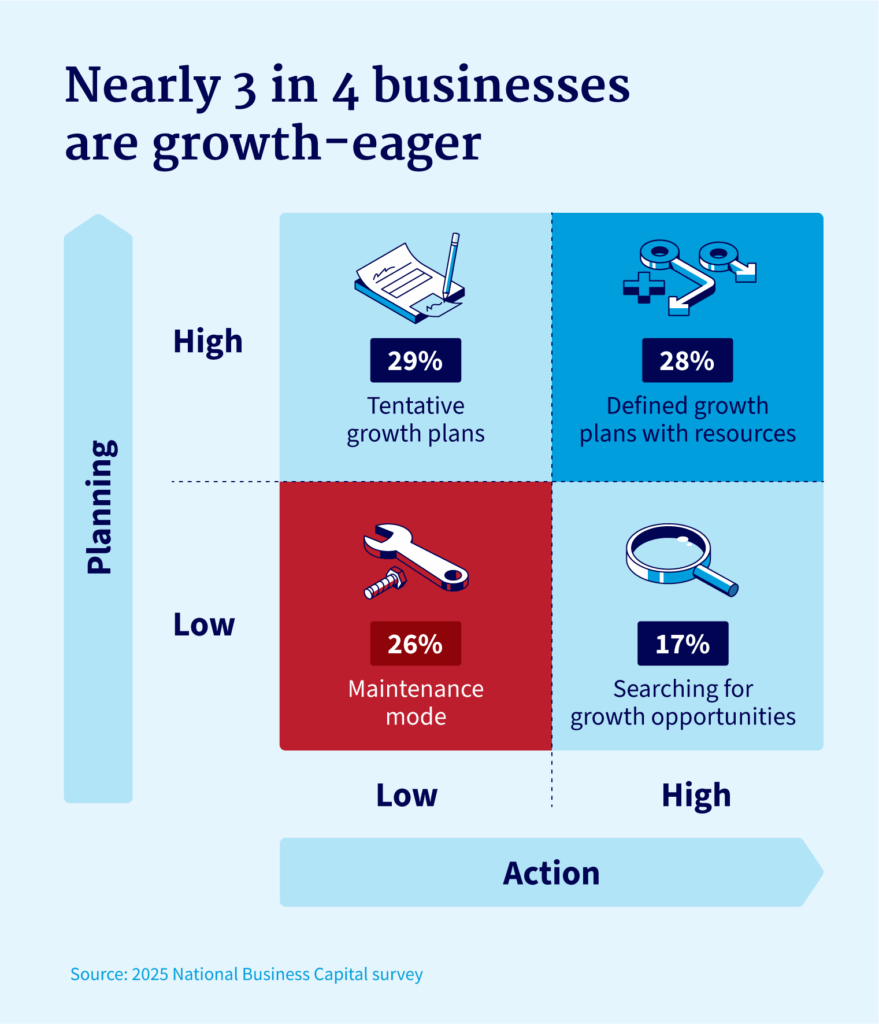

Growth planning defies simple labels like “aggressive” or “conservative.” While only 20% of respondents are pursuing bold, large-scale investments, most are taking a more measured – yet still active – approach.

Together, nearly three-quarters of business owners are developing specific growth plans:

- 28% have defined strategies with committed resources

- 29% are refining tentative road maps

- 17% are actively searching for opportunities

But a preference for agile growth requires the right lending partners to match flexibility, speed, and partnership needs. Business owners might make conservative growth estimates and need flexible capital solutions like cash flow financing that match their dynamic approach to growth.

Business owners see funding speed as a roadblock

Business owners see the expansion opportunities in front of them. They’ve built the plans. Yet for many, the biggest obstacle is access to flexible financing.

The data reveals a disconnect: While 20% of companies are ready to implement bold growth plans, a whopping 69% of business owners surveyed say faster capital access would fundamentally alter their 2025 plans.

Funding velocity and flexibility are potential bottlenecks to growth. Traditional lending, with its weeks-to-months-long approvals and inflexible requirements, is too rigid to keep pace with fleeting growth opportunities. To avoid being held back at the exact moment they need to move, businesses can opt for an alternative, like a private credit lender, to help quickly secure a $1M business line of credit that prioritizes funding speed and flexibility.

While no single priority dominated, the combined emphasis on flexibility, support, and speed points to a broader theme: urgency and adaptability in funding relationships.

- 21% said flexible terms

- 18% said networking

- 16% said strategic guidance

- 14% said fast capital

Businesses have the advantage when they secure agile funding relationships. They can turn opportunity into action before the window closes. National Business Capital goes beyond offering flexible, fast access to capital – our team of expert business advisors is on-call to help businesses align their funding needs with their growth goals.

Market uncertainty redistributes competitive advantage

While headlines debate economic conditions, smart businesses are discovering that uncertainty itself has become their competitive edge. The key isn't waiting for clarity; it's learning to expand strategically when others hesitate.

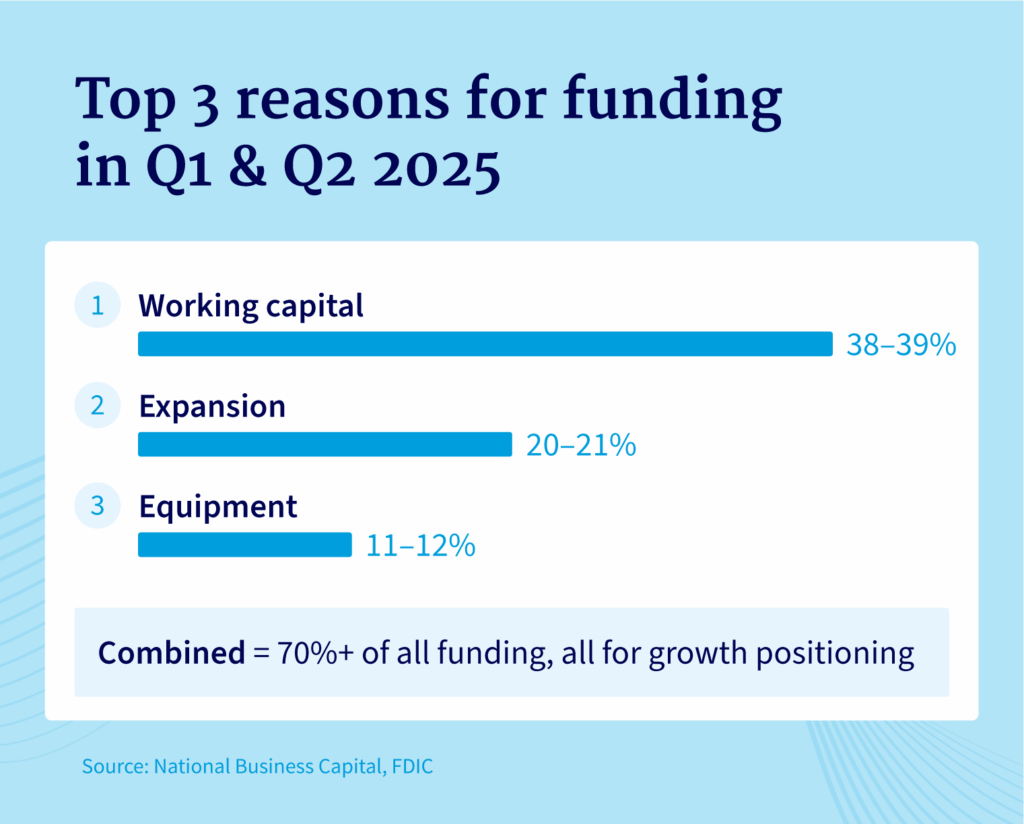

While market uncertainty creates hesitation for many, savvy business leaders recognize these moments as prime opportunities for strategic expansion and competitive advantage. The data from National Business Capital reveals a clear pattern: businesses are seeking funding not just to maintain operations, but to accelerate growth initiatives that position them ahead of the competition.

National Business Capital saw an increase of 94.5% in funding demands in Q1 2025, demonstrating robust demand from businesses ready to seize expansion opportunities despite economic headwinds. Between working capital, expansion, and equipment, these three growth-oriented categories represent over 70% of all National Business Capital funding requests – clear evidence that businesses are moving beyond survival mode and actively investing in strategies that will compound their market position when economic conditions stabilize.

The most successful businesses are leveraging uncertainty in three key ways:

- Optimizing their capital structure while competitors hesitate

- Making strategic acquisitions at favorable terms

- Expanding into industries with sustained demand regardless of broader economic sentiment

National Business Capital's expert advisors know that businesses willing to act during unclear times often capture market share and strategic positions that would be impossible during periods of economic certainty. Unlike traditional banks that often become more conservative or slower to lend toward growth during volatile periods, our advisors look beyond the spreadsheets.

We assess capital needs through the lens of opportunity readiness: real-time timing, operational capacity, and strategic intent.

Because we don’t override risk, we see it differently. And when growing businesses are ready to bet on their next leap, we’re ready to bet with them.

Methodology

The survey was conducted via SurveyMonkey Audience for National Business Capital on May 27, 2025. The results are based on 503 completed surveys. In order to qualify, respondents were census-balanced for gender and age, and screened to be residents of the United States, over 18 years of age, and to own or manage a small- to medium-sized business (up to 500 employees). Data is unweighted, and the margin of error is approximately +/-4.46% for the overall sample with a 95% confidence level.

Trust National Business Capital for flexible funding options and expert advice

Growth opportunities abound, competitors are advancing, and business owners see the potential to act. When markets are uncertain, hesitation can quickly become an escalating opportunity cost where every delay from slow-moving capital chips away at competitive advantage.

National Business Capital can end that hesitation with partnership, flexibility, and strategic guidance to growth and scale through stable and dynamic market environments. Our expert business advisors understand that every business situation is unique, and we work to provide flexible funding options that match your specific growth timeline and strategic needs.

Apply now to discover how our streamlined digital application process can help you access the capital you need to turn strategic opportunities into competitive advantages.