AI is no longer a futuristic concept—it’s a current priority. According to a new survey from National Business Capital, 64% of business owners say AI is essential to remain competitive in the next 3-5 years. Despite this growing interest, only a quarter of businesses are actively using AI across multiple areas, and another 25% haven’t started at all.

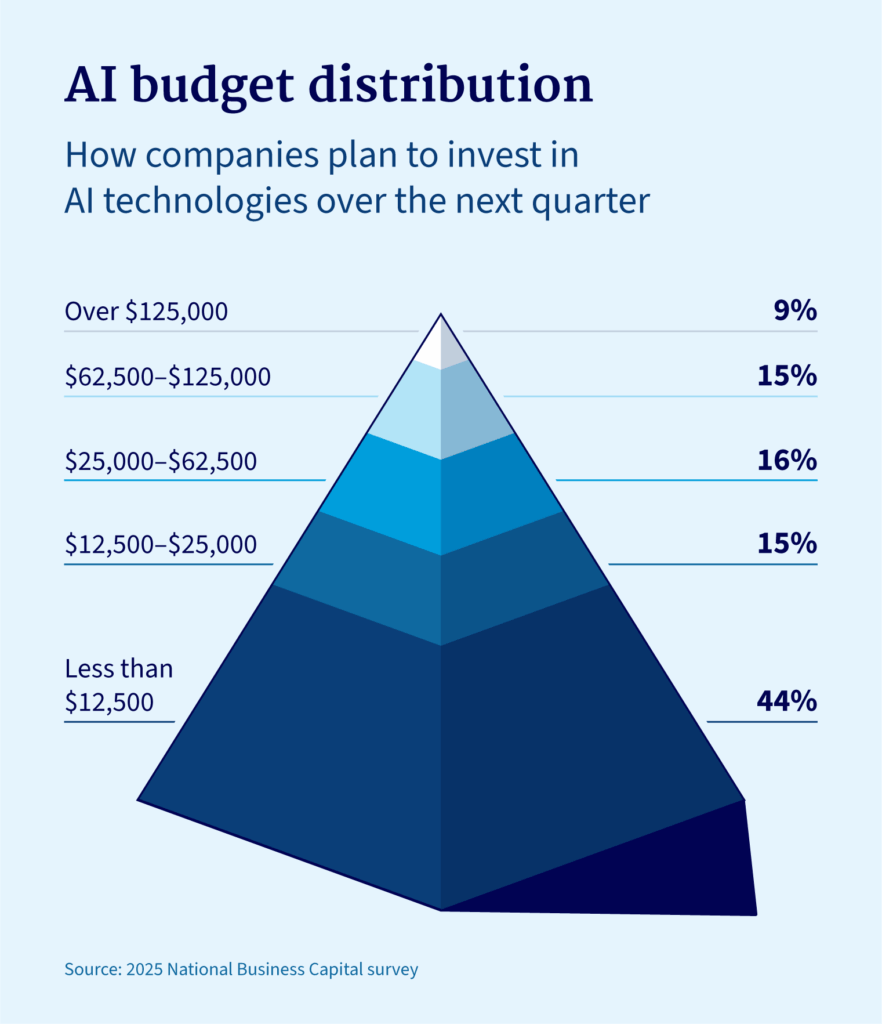

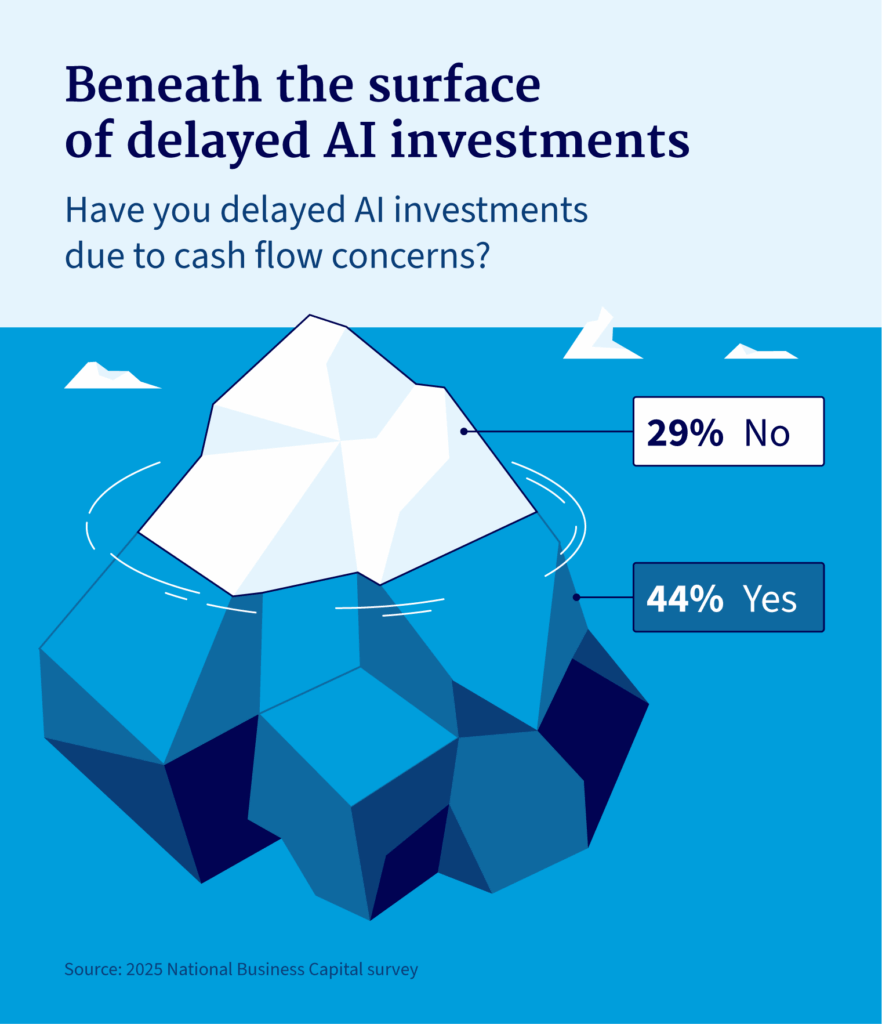

What’s holding them back? The biggest barriers are cost and access to capital, with 44% saying that cash flow concerns have already delayed adoption. These financial constraints may also explain why nearly half plan to invest less than $12,500 in AI this quarter.

Key takeaways

- AI is essential: 64% of business owners believe AI is necessary to stay competitive over the next 3-5 years.

- Cash flow is a top barrier: 44% have delayed AI investments due to cash concerns, and limited capital is one of the biggest implementation challenges.

- Efficiency is the main goal: 34% of business owners say improving operational efficiency is their top objective for adopting AI.

- Adoption is still at an early stage: Only 26% are actively using AI in multiple areas; most businesses are still researching or testing solutions.

AI as a growth lever for business owners

AI is quickly becoming a key part of long-term growth strategies for small and mid-sized businesses. Over 40% of business owners say it’s “very” or “extremely” important to their company’s future, indicating that they view AI as more than a passing trend.

For many, the focus is on doing more with less. A full 34% of owners say their primary goal with AI is improving operational efficiency. Another 15% point to revenue growth, showing AI’s role in both streamlining and scaling, especially when combined with access to fast business loans that support quick expansion.

Industry-specific paths to AI adoption and growth

The way businesses apply AI often depends on their industry and capital. Several common industries embracing adoption include:

- Manufacturing: AI is helping manufacturers build on years of automation by enhancing predictive maintenance, optimizing production schedules, and improving supply chain planning—often supported by financing options to offset high upfront costs.

- Services: Service-based businesses are prioritizing AI for customer communication and support, reflecting the 32% of survey respondents focused on this area, while also streamlining backend tasks like billing and scheduling.

- Healthcare: Providers are adopting AI for clinical decision support and patient engagement, though progress is slower due to regulatory challenges and strict data privacy requirements.

As adoption increases across every industry, businesses that wait may fall behind. Those embracing AI now are building an edge through smarter operations, faster insights, and more competitive strategies.

Leaps forward or careful steps: Business attitudes toward AI

AI adoption is underway, but most businesses are still early in the journey. Only 26% say they’re actively using AI in multiple areas, while 50% are either testing or piloting (26%) or researching/planning for AI integration (24%).

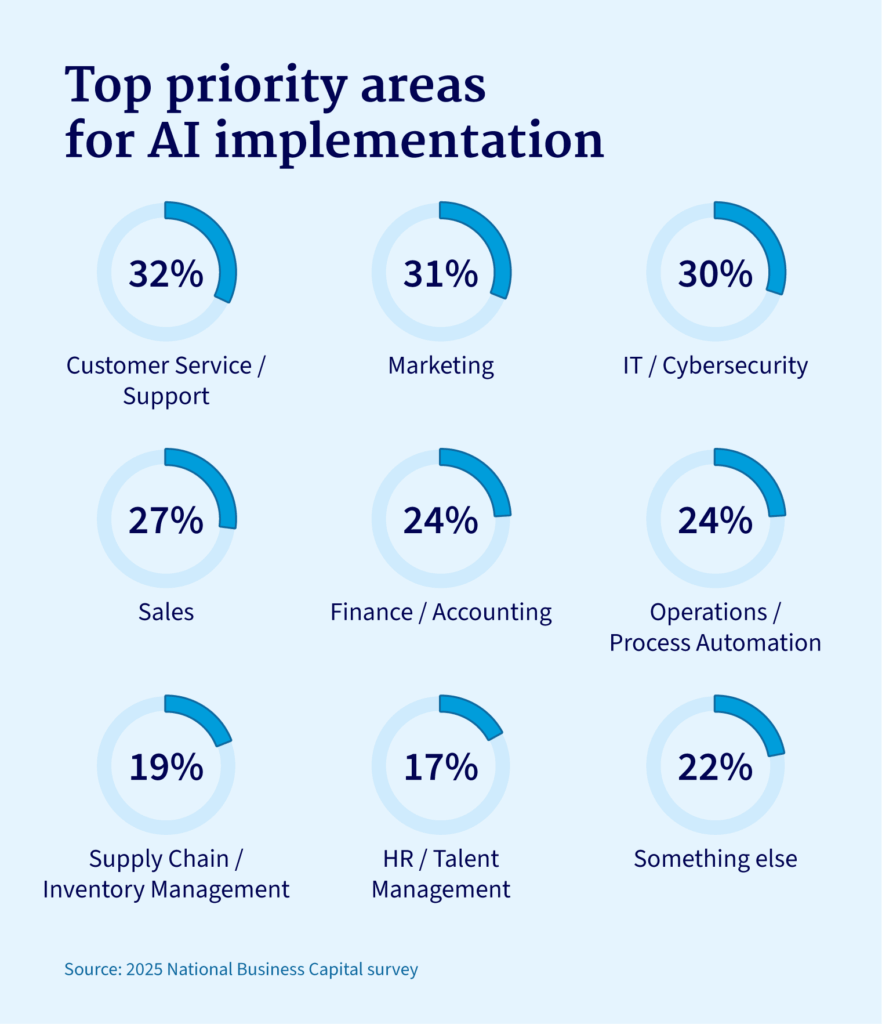

So, where are businesses starting? They’re prioritizing practical uses where AI can deliver immediate value. The top four areas include:

- Customer service/support (32%)

- Marketing (31%)

- IT/security (30%)

- Sales (27%)

This suggests that businesses are adopting AI for efficiency and productivity rather than for novelty or trendiness.

However, business owners are cautiously optimistic. 31% see AI as a strategic growth driver. Others are more hesitant: 20% say it’s nice to have, 17% are still watching from the sidelines, and 15% think it’s overhyped.

What’s standing in the way of AI adoption?

Despite growing interest in AI, many businesses face roadblocks. However, most of the challenges fall into two main categories: structural and financial. Business owners point to several key challenges, including:

- Security/compliance concerns (19%)

- Lack of in-house expertise (17%)

- Integration with existing systems (16%)

- Limited time or resources (15%)

- Uncertainty about ROI (12%)

- Limited capital (12%)

- Lack of leadership buy-in (9%)

Notably, 41% of respondents said access to flexible financing would make them “extremely likely” or “very likely” to invest in AI this year, proof that capital could be the key to unlocking real innovation.

As a trusted financing partner, National Business Capital helps business owners overcome these funding hurdles with flexible lending solutions, expert business advisors, and different types of loans tailored for growth.

When businesses do invest, their AI budgets tend to skew conservative. This budget distribution emphasizes how financial constraints continue to shape the scope and speed of AI adoption across industries.

Don’t let capital be the bottleneck

This survey makes one thing clear: The race to adopt AI is already underway, and waiting too long could mean falling behind. Many are already testing, piloting, and preparing AI strategies that could redefine their operations.

AI isn’t just a buzzword. It’s a tool for survival in a fast-changing market. But for too many businesses, limited funding stands in the way.

Nearly half of businesses have already delayed AI investments due to cash flow concerns, highlighting the importance of accessible short-term financing options to bridge funding gaps and support technology adoption.

If capital is holding back your AI adoption, now’s the time to act. Explore flexible financing solutions with National Business Capital and move your strategy forward with confidence.

Find flexible funding and expert advice you can trust with National Business Capital

AI has become a defining growth tool for small and mid-sized businesses, but without the right support, adoption can stall before it starts. National Business Capital is a trusted partner in your success. Our expert business advisors help you navigate your funding options and build a financing strategy tailored to your goals.

Whether you’re testing AI or ready to scale, National Business Capital gives you the right resources to move forward faster. From providing you with a business line of credit to one-on-one guidance, we’re here to help you turn big ideas into real impact.

Don’t let limited funding slow your momentum. Apply now and take the next step toward smarter, faster growth.

Methodology

The survey was conducted by National Business Capital via SurveyMonkey in May 2025. The results are based on 504 completed surveys from U.S.-based small-to-medium business owners, up to 500 employees. Respondents were screened to be over the age of 18 and actively involved in business operations. Data is unweighted, and the margin of error is approximately +/-4% at a 95% confidence level.