A business line of credit gives companies flexible access to funds when growth opportunities arise, whether that’s purchasing inventory for a big order, expanding into new markets, or upgrading heavy machinery. This financial tool helps manage cash flow and build credit, though you’ll need to meet certain credit requirements to qualify.

In this article, we’ll outline those requirements, explore the pros and cons of a business line of credit, and explain how to determine whether this type of funding is right for you.

What is a business line of credit?

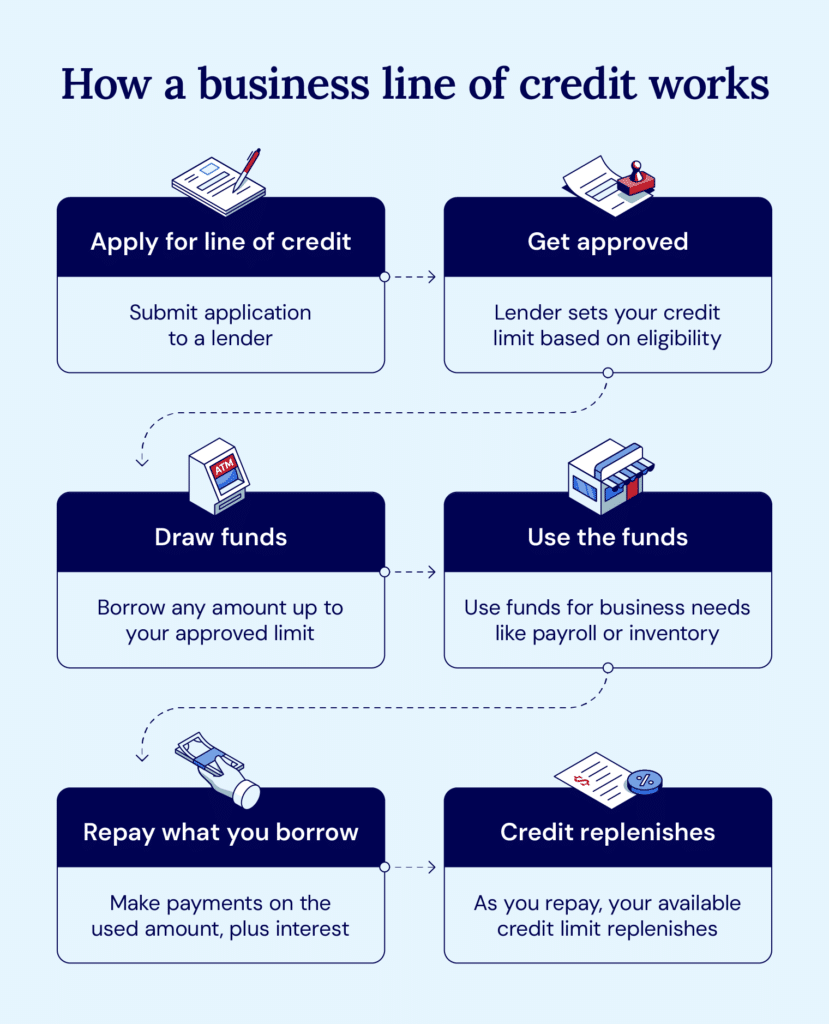

A business line of credit is a line of credit that companies can use to access funding. It’s a popular method because you can access capital as you need it, only paying interest on the amount you use. There’s no penalty for the unused portion.

The line of credit is often revolving, meaning you can take as much (up to the credit limit) or as little as you like. Once you pay back the debt, the line of credit replenishes, and you have access to the full amount again.

What are the requirements for a business line of credit?

Business line of credit requirements can vary based on whether you use a private credit lender or a traditional bank. Private credit lenders tend to be more lenient and willing to approve a wider range of credit scores.

Generally, here are some of the guidelines you’ll need to meet.

- Business credit score: Most lenders will require a minimum of 700, though collateral could lower this requirement.

- Personal credit score: This is also a minimum of 700, especially if you don’t have well-established business credit.

- Business financials: You should be able to provide balance sheets, personal and business bank statements, tax returns, and P&L statements.

- Time in business: Lenders usually need to see at least two years of business history, but some non-bank lenders will only require as few as three months.

- Annual revenue: You’ll likely need at least $120,000 in annual revenue to qualify for most financing programs. Personal loans might help if you don’t meet this requirement.

- Debt-to-income: Lenders typically want to see a debt-to-income ratio below 40%, meaning your total monthly debt payments shouldn’t exceed 40% of your monthly income. This shows you can manage additional debt responsibly.

- Industry: Some industries are riskier than others. You should be able to provide insight to your lender if they are well-versed in your target market.

If you don’t meet all of these business lines of credit terms, you may consider seeking a credit card as an alternative.

Cash flow vs. asset-based line of credit

Both cash flow loans and asset-based lines of credit can boost a business’s available capital, but they have some key differences.

With cash flow loans, lenders look at your business’s ability to earn in the future. On the flip side, asset-based loans are based on your current assets.

Let’s take a look at some of the key differences between cash flow and asset-based lending.

| Cash flow lending | Asset-based lending | |

|---|---|---|

| Description | Based on future earning potential and ability to repay | Based on collateral and current assets |

| Best for | For companies with proven cash flow | For companies with limited cash flow or poor credit |

| Credit requirements | Easier to qualify | More requirements related to the credit score |

| Approval process time | Fast turnaround | Longer approval due to asset appraisal |

How to use a business line of credit

A business loc can be used in many ways to help get your company off the ground or help it continue to grow. If you meet the requirements we’ve listed above, here are some typical ways businesses use these types of loans.

- Short-term financing: You can use a line of credit to meet some immediate needs with funding you expect to pay back quickly. This could be for anything from a small building renovation to a large marketing campaign.

- Equipment or seasonal financing: You can use the loan to help you purchase new equipment or for upcoming inventory needs during a busy season, such as November and December in retail.

- Repaying vendors: While not ideal, you could use the line of credit to repay your debts to vendors. This should be a worst-case scenario when you’re dealing with negative cash flow.

You’ll have many other potential ways to use the capital you’ve gained from a line of credit. The key is to be strategic about how you use it and be sure to pay it back on time.

Pros and cons of business lines of credit

A business line of credit has some elements that are both good and bad.

| Pros | Cons |

|---|---|

| • Immediate cash flow • Builds business credit • Lower interest rates than credit cards • Helps potentially increase your business line of credit limit • Ongoing access to funds | • Easy to overspend • Higher interest rates than traditional loans (if funds are kept outstanding for a full term) • Potential fees • Possible collateral requirements |

Where to get a business line of credit

If you’re looking to obtain a business line of credit, the good news is you have plenty of options. Let’s take a look at some of the primary types of lenders.

Private credit lenders

A private credit lender is basically any type of lender outside of banks, credit unions, and other more traditional lenders. Funding from these types of lenders usually requires some type of collateral – often in the form of business and personal assets or commercial real estate. This collateral offers security to the lender in case you can’t repay the loan.

Bank lenders

Bank lenders offer more traditional means of lending. You’ll need to meet a minimum credit score requirement, usually a minimum of around 700. You should also be prepared to provide financial information like accounts receivable, bank statements, profit and loss statements, tax returns, and proof of annual revenue.

SBA lenders

Small Business Administration (SBA) lenders provide lines of credit to small business owners. They offer short-term financing that provides funding to small businesses. The SBA loan is a business revolving credit, so you only have to take out what you need, and you’ll only pay interest on the funding you use.

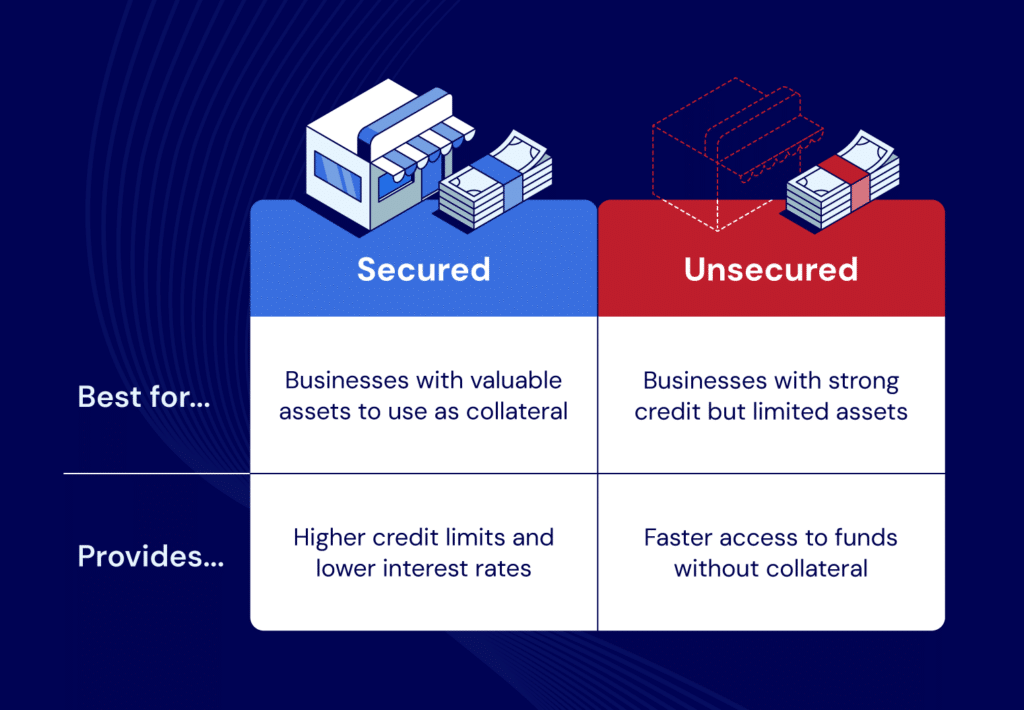

Secured vs. unsecured lines of credit

The biggest difference between a secured and unsecured line of credit is simple: collateral. Secured loans are just that – loans secured by collateral, which could be any type of business asset like inventory, receivables, or real estate. Because the loan is secured, it often comes with a lower interest rate.

On the flip side, unsecured lines of credit don’t require collateral, which also makes the funding process faster. Since the lender is taking on more risk without collateral, credit requirements for an unsecured line are more stringent. These loans also have a higher average interest rate than secured loans.

Get a business line of credit with National Business Capital

While this article serves as a starting point to help you understand the business line of credit requirements, you’ll likely have more questions once you begin the process of securing a loan.

If you’re in that position, National Business Capital has you covered. Our team of expert business advisors can answer your questions and guide you through the loan process to help you make the funding decision that works perfectly for you.

Reach out to us to discuss your options. Or, if you’re ready, go ahead and get the loan process started with our online application.

Frequently asked questions

The typical minimum credit score to qualify for a business line of credit is around 700.

Yes, just like any other business, an LLC can get either a secured or unsecured line of credit.

A $2M line of credit works like any other line of credit, but it obviously just involves much more funding. You’ll have access to up to $2M of capital, but you only take out what you need – and you’ll only pay interest on the amount you use.