Table of contents

While most financing options ultimately serve the same function – helping a business with an influx of capital – they aren’t all created the same. Two of the more common options include debt and equity financing, both of which are entirely different.

So, what is the difference between debt financing and equity financing? Let’s break down each option with the potential benefits and drawbacks for small businesses.

What is debt financing?

Debt financing is simply borrowing capital from a lender, whether it’s a bank or a private credit lender. The main types are through a term loan, SBA loan, business line of credit, or cash flow financing (CFF).

While these four business financing options all can help kickstart a company’s working capital, each one offers its own share of benefits that might make more sense depending on the situation.

| Type of debt financing | What it does |

|---|---|

| Term loan | Cash flow financing gives you fast access to capital in exchange for an portion of future accounts receivable. The amount you receive from your lender will be less than the actual value of your receivables because of the portion your lender takes as payment, but if you need cash fast, this could be an avenue toward growth. |

| Business line of credit | Unlike a business credit card, a business line of credit allows you to draw physical cash at a moment’s notice. Most business lines of credit are revolving, meaning that when you repay the borrowed amount, you can draw the same funds again. |

| Cash flow financing | Cash flow financing gives you fast access to capital in exchange for a portion of future accounts receivable. The amount you receive from your lender will be less than the actual value of your receivables because of the portion your lender takes as payment, but if you need cash fast, this could be an avenue toward growth. |

| SBA loan | The SBA offers business loan options with competitive rates to business owners who meet its eligibility criteria. However, these criteria are very restrictive, and many businesses without strong financials might find it difficult to qualify. |

As you can see, you have several options when it comes to debt financing. But equity financing has its own share of options as well.

What is equity financing?

Equity financing is selling a portion of ownership in a business to secure capital. Unlike debt financing, equity financing doesn’t involve a loan or cash advance.

Instead, this form of business financing takes advantage of the equity already built into the company’s finances. You're offering equity in your company in exchange for funding – this means you’ll surrender a portion of ownership and potentially some control over your company, giving investors influence in strategic decisions and a share in future profits.

| Source of equity financing | What it does |

|---|---|

| Venture capital | Venture capital is often used in the early days of an emerging business. In return for partial ownership, the venture capitalist funds the business until eventually exiting, ideally having made a profit, and often after an acquisition by a larger company. |

| Private equity | Private equity is a form of financing in which an investment partnership buys a majority stake in a company, manages it for a period, and eventually sells it. This is an alternative financing method that usually doesn’t involve companies listed on the stock exchange. |

| Crowdfunding | Using websites like GoFundMe or Kickstarter, crowdfunding is a relatively new method of financing that allows new businesses to secure funding from a large group of people, like current customers, friends, family and so on. Some forms of crowdfunding allow investors to receive a share of ownership in the company. |

These three financing options can all help a company grow. But, in terms of benefits and risks, equity financing involves giving up a portion, and possibly control of, your business. That equity investor could be there temporarily or permanently, depending on your agreement. Let's take a deeper look at the differences between debt and equity financing.

For example, let’s say a company needs to raise $20 million to build a new warehouse with new equipment. It could potentially use equity financing or debt financing – or even a combination of the two – to secure those funds.

However, using equity financing would involve releasing some control over your growing business. The only major risk with debt financing is losing the collateral you put up in the event you default on the loan.

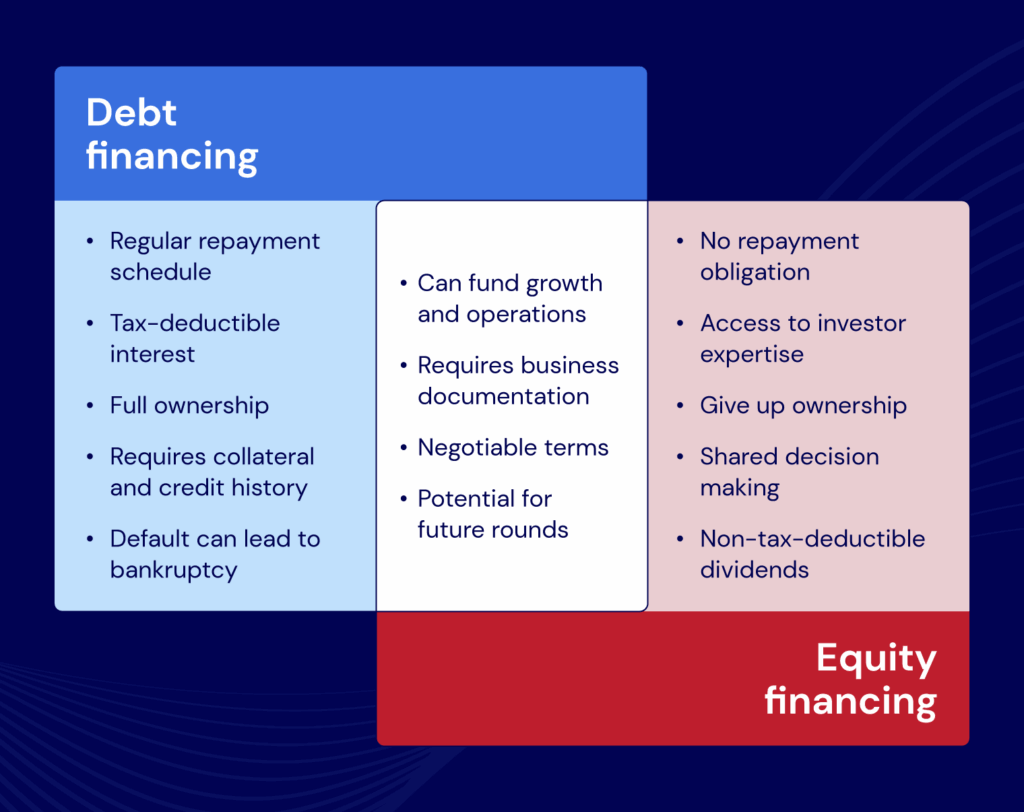

So what would the rest of the pros and cons of financing look like? And, ultimately, is debt or equity riskier?

| Type | Pros | Cons |

|---|---|---|

| Debt financing | • Faster funding • High borrowing limits • Maintain complete control over your business • A variety of financing options to choose from | • Need to meet the eligibility criteria of lenders • Required to repay the borrowed amountInterest rates make borrowing more expensive |

| Equity financing | • Debt-free funding • Potential to gain an experienced industry professional in your corner • Can secure high borrowing amounts depending on the investor | • Lose complete control over your business • It can be difficult to find an investor • Not necessarily beneficial for short-term needs |

How to decide between debt and equity financing

So, how do you make a decision when considering equity financing or a loan? Ultimately, the best decision will depend on your situation, the amount of risks you’re willing to take – and in what form, whether that’s added debt or a loss of complete ownership.

Let’s take a look at a hypothetical scenario of a company choosing between debt or equity financing: BuildRight Construction, a contractor with $6M annual revenue and 15% margins, needs $2.5M to purchase specialized equipment for larger commercial projects. With consistent cash flow from ongoing contracts and $1M yearly profits, they're weighing an equipment loan at 6.5% interest versus selling 12% equity at their $15M valuation.

Here's why debt financing makes sense to BuildRight:

| Comparison factor | Differences |

|---|---|

| Asset-backed security | • Debt advantage: The equipment itself serves as collateral, resulting in lower interest rates and favorable terms • Equity alternative: Giving up 12% ownership despite having tangible assets that naturally support lending |

| Tax and depreciation benefits | • Debt advantage: Both interest payments and equipment depreciation are tax-deductible, significantly reducing effective costs • Equity alternative: No comparable tax advantages, while still diluting ownership permanently |

| Industry-appropriate financing | • Debt advantage: Construction industry norms favor debt for equipment acquisition, with lenders understanding seasonal cash flows • Equity alternative: Construction companies typically command lower valuation multiples than tech firms, making equity disproportionately expensive |

| Growth cycle alignment | • Debt advantage: Loan payments directly align with the revenue generated by the new equipment over its useful life • Equity alternative: Investors would share in all future profits indefinitely, long after the equipment has paid for itself |

For BuildRight, financing equipment through debt preserves full ownership while leveraging industry-standard financing approaches, maintaining the family-owned business legacy, while enabling expansion into higher-value projects.

Find debt financing options that suit your needs

In making the decision between debt financing vs. equity financing, the benefits of each option will depend on the needs of your business and the situation you’re in. Any business financing solution will have its share of risks, so make sure you understand the details before you secure more capital.

As a private credit lender with some of the best expert business advisors in the industry, National Business Capital is fully equipped to help your business find the debt financing option with – that fits your needs – and NBC will guide you throughout the entire process.So, if you’re ready, fill out our digital application today and secure the best funding for your business.