Table of contents

f you're applying for an SBA 7(a), SBA 504, or Economic Injury Disaster Loan (EIDL) loan, you need to take out hazard insurance on the assets you offer as collateral, like real estate, equipment, and vehicles.

In this article, you’ll learn what hazard insurance is, exactly what it covers, why the SBA needs you to have it, and how to arrange the right policy for your SBA loan or line of credit.

What is hazard insurance for an SBA loan?

Hazard insurance is a type of insurance policy you must take out on property and assets you provide as collateral on an SBA loan or line of credit. The policy protects the value of your assets in case an event like fire, vandalism, severe weather, or an earthquake damages or destroys them.

Mortgage lenders and commercial landlords often require tenants to take out this type of coverage, too.

When you're shopping around for hazard insurance, you'll probably see insurers refer to it as "commercial property insurance," which is the broader industry term that encompasses protection against various threats including fire, theft, vandalism, and natural disasters that could damage or destroy your business property and equipment. Use that term when you speak with brokers or search online to find the right type of coverage faster, as it's the standard terminology that insurance professionals use and will help you access more comprehensive policy options and competitive quotes.

The SBA’s rules for small business hazard insurance

To be valid, hazard insurance for SBA loans and lines of credit must check the following boxes:

- Replacement-cost limit: The coverage must be to the value of what it would cost to buy each asset new today, but, failing that, the maximum amount insurers will go to.

- Ten-day cancellation clause: Your insurer must notify the lender at least ten days before the cover ends.

For business real estate you pledge as an asset, your policy must contain a mortgagee clause. For personal property, you’ll need its equivalent: a Lender’s Loss Payable clause.

These clauses protect your lender if you’re applying for a 7(a) loan or the SBA or CDC (a nonprofit organization that helps arrange SBA loans) on a 504 loan.

In essence, they ensure that if something happens to your property, money can still be collected from the insurance company, even if you accidentally did something that would normally cancel your coverage.

Why does the SBA require insurance?

You need hazard insurance on an SBA loan or line of credit to financially protect the lender and the SBA if you default.

This is how it works: When you get an SBA loan or line of credit, the funds come from banks or credit unions that partner with the SBA, not the SBA itself.

If you default, your lender sells your collateral to recover the loss. If the sale doesn’t cover the balance, they come to you for the rest, because you signed a personal guarantee. If you can’t pay, the lender then goes to the SBA to recover part of the loss.

SBA loan hazard insurance protects lenders and the SBA by preserving the value of your assets, even if they’re damaged or destroyed. It also protects the borrower from owing more than the asset’s worth in these situations.

What causes of damage does hazard insurance cover?

Hazard insurance for small businesses covers the following types of damage and loss, both inside and outside your premises:

- Fire (and the smoke it generates)

- Explosions

- Lightning strikes

- Hail damage

- Wind damage

- Snowstorms and blizzards

- Theft

- Vandalism

- Damage from aircraft impacts and vehicle collisions

- Water damage (including fire-sprinkler leakage)

- Structural damage and building collapse

- Business interruption or lost income during forced closures

Always check with your insurer to confirm exactly what your hazard policy covers. Your lender will want to inspect your insurance documents as part of their standard due diligence process.

When do you need hazard insurance on an SBA loan?

The SBA’s hazard insurance requirements vary depending on the type of SBA loan or credit line you're applying for.

SBA 7(a) and SBA 504 loans

All SBA 7(a) and SBA 504 loans require hazard insurance that covers the full value of every single asset you pledge as security if your loan or line of credit is $50,000 or more. This new SBA level replaced the old breakpoint of $500,000 on May 31, 2025.

If you get your loan through the CDC and let your coverage lapse, the CDC can take out insurance for you and charge you for it.

Economic Injury Disaster Loans

You need to take out hazard cover equal to at least 80% of the value of loans greater than $250,000.

If your loan is less than $200,000, you don’t have to offer your primary residence as collateral, provided you have other assets worth at least the loan amount.

Microloans

You don’t need hazard insurance for an SBA Microloan.

Flood zone overlay

You’ll also need flood insurance for your SBA loan for each asset you offer as collateral in a FEMA-designated Special Flood Hazard Area where the National Flood Insurance Program (NFIP) is available. You don’t need flood insurance for assets outside these flood zones.

The coverage for each asset in a flood area must be the lower of:

- The outstanding principal balance on your loan

- The maximum coverage allowed by NFIP

The maximum allowed by the NFIP is $250,000 for building coverage and $250,000 for contents coverage for residential properties housing up to four families.

Your collateral might be personal property, like equipment or vehicles. If you stored them in a flood-prone building that you didn't use as collateral, your lender might not require flood insurance. If they say you don't need it, ask them to write down why they made this decision – usually because flood insurance wasn't available or cost too much.

As with hazard insurance, your flood insurance policy must include a ten-day cancellation clause. If your flood coverage lapses, you have 45 days to sort it out. If you don’t, the lender or CDC will arrange insurance on your behalf and charge you for it.

How to get hazard insurance for SBA loans

Follow these seven steps to get hazard insurance for your SBA loan:

- Get your lender’s checklist: Get in touch with the loan officer at your bank or CDC. Ask them for the exact wording of your mortgagee or Lender’s Loss Payable clause. Also, ask for the lender’s flood-zone determination for every address you pledge as collateral. This will help your broker draft the insurance policy.

- List every asset: Make a list of every building, vehicle, machine, tool, and more that you’re pledging as collateral. Estimate the “buy-new” price for each. Be careful not to underestimate the replacement costs because if your coverage limit is too low, your insurer will only pay up to that limit. You’ll then be personally responsible for paying the difference.

- Check the flood map: Using FEMA’s map view, type in each address and see whether it’s in zone A or V. If it is, then you'll need to take out a separate flood policy on top of your hazard insurance.

- Shop for cover: Get in touch with an insurance broker and ask for commercial property insurance with replacement-cost terms. Hand over the lender’s wording on the clause, together with your asset list. Ask your broker to add flood cover as necessary on individual assets.

- Check the policy: Make sure the coverage limit equals the total replacement value costs, the wording matches your mortgagee or Lender’s Loss Payable clause, and there’s a ten-day cancellation notification requirement.

- Sign the agreement: If you need one, check for the flood endorsement attachment, too. If you’re happy, pay the premium, ask for the Certificate of Insurance, and email it to the lender or CDC.

- Renew annually: Always keep up with your insurance payments and send your lender or CDC fresh certificates every year. If you want to sell an asset that secures the loan later on, you’ll need to negotiate that with your lender or CDC so that you can arrange a suitable replacement or pay down the loan balance accordingly.

Other SBA insurance requirements you need to know about

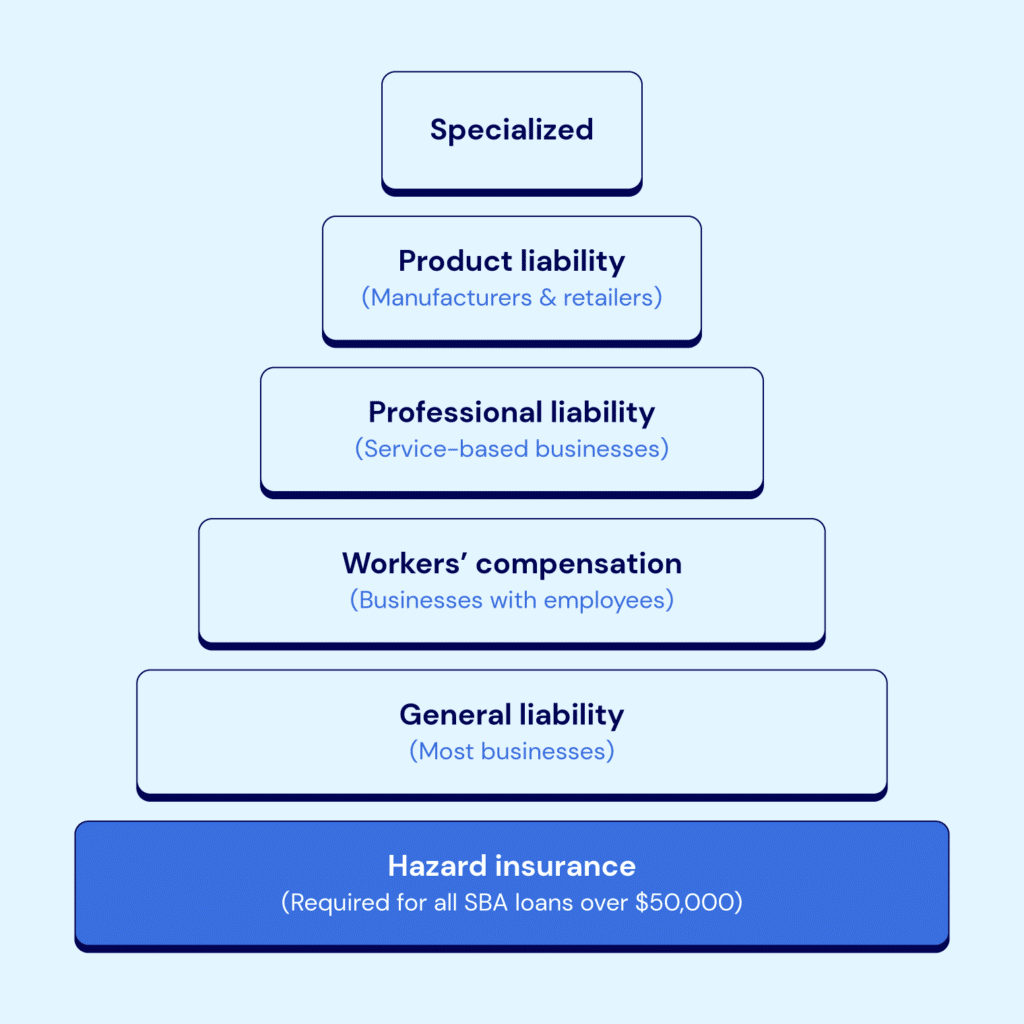

Some states may require you to take out additional insurance coverage to protect against natural hazards like earthquakes, hail, and wind. You may also need one or more of the following policies:

- General liability: Coverage if someone claims you caused them injury or damaged their property.

- Professional liability: Protection if someone sues you for negligence, bad advice, or misrepresentation.

- Product liability: Pays your legal costs, compensation, and recall expenses if your product causes damage or personal injury.

- Liquor liability/dram‐shop: Coverage for any injury or damage an intoxicated customer causes after leaving your premises.

- Workers’ compensation: Funds medical bills, lost wages, and disability benefits.

- Life insurance on key owners: Typical when a business relies on one or two principals to run it profitably.

- Builders risk policy: Protects materials and work‑in‑progress on construction or renovation projects. You'll need this if you're getting an SBA loan to finance the construction or significant renovation of a building.

- Equipment floater: Covers mobile tools and machinery that move between sites in case of theft or damage.

- Marine (vessel) insurance: If you pledge a boat as collateral, your policy must include pollution coverage, breach of warranty, indemnity, and protection.

SBA loan alternatives

On average, there’s a 90-day turnaround on an SBA loan. National Business Capital’s average turnaround time is 45 days, so you get funded in half the time by working with our team.

We can provide other types of business loans much faster if you need the capital now. For example, we can arrange funding of up to $250,000 within a few hours if you make a digital application to us and attach your six most recent bank statements. Funding of up to $15M is possible within seven days.

If that’s you, consider one of the following business financing options:

Cash flow financing

With cash flow financing, the amount you repay to your lender varies according to your revenue. The more you sell, the higher your repayment. If your sales take a temporary dip, your repayments go down, making it easier to manage your cash flow.

Cash flow financing is National Business Capital’s most requested product because of its flexible payment terms.

Clients put cash flow financing to a wide range of uses like opening pop-up locations to test new markets, taking stands at high-profile trade shows to attract new sales-ready customers, and paying for extra raw materials and staff overtime to ramp up production to meet growing demand.

Business term loans

Term loans pay a lump sum into your business bank account up front. You then make regular payments (weekly, bi-weekly, or monthly) over an agreed period until you clear the balance.

The two main types of business term loans are:

- Short-term loans: Paid back over a period of six months to three years, short-term loans are excellent for bridging gaps in cash flow, taking advantage of last-minute opportunities, and handling unexpected bills without having to tap into your capital reserves.

- Long-term loans: Paid back over a period of three to 25 years, long-term loans are ideal for purchasing competitors or consolidating higher-cost debt into one manageable monthly payment.

Business line of credit

With a business line of credit, you can borrow up to a predetermined maximum limit, like with a credit card.

You only pay interest on the balance, not on the limit, which can make a line of credit much cheaper than a standard term loan. Every time you make a repayment, your balance goes down and you can borrow what you’ve just paid back again straight away, as long as you don’t go over the maximum.

Lines of credit generally offer much higher spending limits than credit cards. Most lenders expect you to clear the balance in full within one to three years.

Business owners use lines of credit for a variety of reasons, including paying for seasonal marketing campaigns, buying inventory in bulk to secure a discount, and hiring extra staff to add capacity during peak periods.

Having access to a reserve of capital helps businesses stay agile and scale up.

Equipment financing

Equipment financing lets you buy or lease essential machinery, tools, and technology without depleting your capital. That means you have more headroom to meet your daily operating expenses.

There are two main ways to fund new equipment:

- Equipment leases: Leases are ideal for equipment that quickly becomes obsolete and doesn’t retain its value over time, like computer networks, software systems, and office technology. You can upgrade to newer equipment at the end of the lease and avoid the hassle of selling outdated equipment at the end of the term.

- Equipment purchases: Purchasing works best for equipment that remains useful and holds its value over time, like heavy machinery, commercial vehicles, and production-line equipment. You own the asset outright at the end of the term, strengthening your balance sheet and adding lasting value to your business.

Choose National Business Capital for your business financing needs

SBA loans are popular with business owners because they offer competitive interest rates, and you can repay over a period of up to 25 years. Apply for an SBA loan through National Business Capital and get funded in an average of 45 days compared with the industry average of 90 days. Find out more about our SBA loan service for businesses.National Business Capital has funded over $3B for our clients, earning us the title of market leader in $250,000 to $15M+ transactions. Speak to one of our finance experts today, tell us about your company and your plans for the future, and we'll show you exactly how we can help. Apply here and let’s get you funded.