Your retail business has untapped potential waiting to be unleashed. Retail business loans provide the financial fuel to transform your vision into reality, whether that means expanding your product offerings, opening prime locations that drive foot traffic, or building an e-commerce presence that competes with industry giants.

Retailers, like many SMBs, are turning away from traditional banks for help with finance. According to the U.S. Department of the Treasury, 37% of business owners now turn to private credit lenders, like National Business Capital, for funding solutions that offer faster approvals and more flexible terms.

The right funding doesn’t just solve immediate challenges—it positions you to seize growth opportunities that others can’t afford to chase. Read on to find out what retail loans are, their benefits, the different loans available, and how to choose the best retail financing option for your business with National Business Capital.

What are retail business loans?

Retail loans are commercial financial products that closely match the funding needs of shop and store owners. They provide retailers with the capital to cover their operating expenses, buy the latest inventory to stock their shelves, and fuel future business growth.

Popular retail store financing options include inventory loans, cash flow financing, business lines of credit, term loans, equipment financing, and SBA loans. We’ll explain each option later in this article.

How do retail business loans work?

The way you receive capital depends on the type of retail loan you choose.

The first option is an up-front sum of capital paid directly into your business account. The second is access to a line of credit that you can draw from whenever you need to.

You’ll repay your loan in one of two ways:

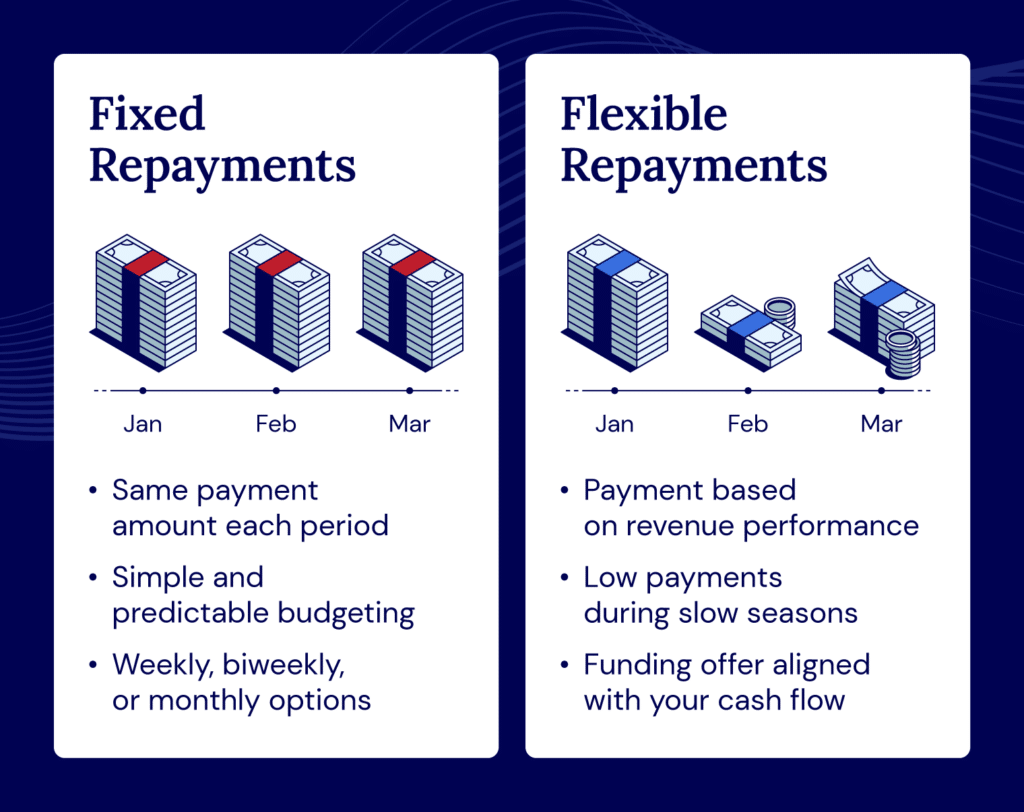

- Fixed repayments: You pay the same amount each week, second week, or month, making budgeting simple and predictable.

- Flexible repayments: Repayments are based on your revenue performance, so you repay more when it’s busier and less when it’s quieter.

You can apply for a retail business loan through a bank, credit union, private credit lender, or broker.

One standout advantage private credit providers like National Business Capital offer is a fast loan application process. For example, we can fund retail loans of up to $250,000 within hours if you apply online and send over your last six months’ bank statements. We can normally turn around a $5M loan or line of credit in seven days or less.

Speed matters in retail, as is getting the right financing to achieve growth goals. Ending up with financing that’s expensive and prohibitive to your growth can mean the difference between getting your hands on in-demand stock that you’ll sell in high volumes quickly and your competitors beating you to it.

To find out what retail loan options we can offer you, get in touch with National Business Capital.

How to qualify for a retail business loan

There are far more retail loan products and lenders now than 20 years ago. While this is great news, it makes finding the right lender and loan harder.

Whichever lender you choose, give them every reason to say yes. Here are five steps to strengthen your application:

Step 1: Put together a business plan and financials

Many lenders want a detailed and fully costed business plan explaining how you’ll grow your company profitably with the extra funding you’re applying for. Set out in detail how you’ll develop your products and services, attract more customers, and increase your sales over the next few years.

You should also prepare important financial statements for your lender, like:

- Sales forecasts: Show how much you’ll sell each year over the next three years, breaking down revenue by products and services, if possible, to show where your growth is coming from.

- Cash flow forecasts: Let lenders see how capital moves in and out of your business to reassure them that you’ll manage your funds carefully, even during quieter periods.

- Profit and loss forecasts: Demonstrate you’ll have enough capital left over at the end of each month to easily handle the repayments by providing three years’ profit and loss forecasts.

Explain the assumptions behind your forecasts, such as product costs and revenue fluctuations during the year. Lenders need to understand how you’ve calculated your forecasts and why they’re realistic.

Step 2: Be precise about how much you want

If you ask for too much, lenders will wonder why you want to take on more debt than you need. If you ask for too little, they’ll worry you’ll run out of capital and come back six months later, seeking more.

Stress test your financial forecasts so you’re confident you’re asking for the right amount. Try adjusting your sales forecasts down by 20% and your costs by 10% to see how that affects your cash flow and profitability.

Doing this shows lenders you can still manage the repayments, even if your business doesn’t perform exactly as expected. That makes you more credible and improves your chances of being approved.

Step 3: Get ready to apply

Your lender may return to you multiple times during the application process, asking for more information. Before you apply, make sure you have the following documents ready in case your lender needs to see them:

- Recent business bank statements (usually the last 6-12 months)

- Financial statements (like management accounts and balance sheets)

- Financial projections (revenue, profit and loss, cash flow)

- Tax returns (business and personal)

- Business registration documents, licenses, and relevant legal paperwork

The faster you respond to your lender’s requests, the quicker you’ll get an offer.

Step 4: Sort out your credit profile

Most lenders take your credit history into account when they’re assessing your application. There are steps you can take to improve your credit score, like:

- Pay all your bills promptly (including invoices from suppliers)

- Clear down outstanding balances on existing credit facilities wherever possible

- Regularly check your credit report for inaccuracies and dispute any errors you find

The cleaner your credit profile, the better your chances of getting approved.

Step 5: Decide on a lender and a loan

One way to damage your chances of securing finance is to make multiple loan applications in a short space of time.

Before you apply, find lenders who regularly offer finance to retailers. Compare their loan products and choose the one that best suits your business needs.

Another alternative is using a service like National Business Capital. We search the market for you, match you with lenders most likely to approve your application, and handle the process from start to finish.

Benefits of retail business loans

Retail business loans provide you with the extra capital you need so you have more control and flexibility to run and grow your business.

Here are six practical benefits of retail finance:

- Respond faster to client demand: You have the funds to restock your staple, popular products before you sell out of your current stock. That means you make more profit and always become the retailer customers trust to have what they’re looking for.

- Protect your liquidity: You have the capital you need to cover essential costs like payroll and rent without having to touch your capital reserves, even in quieter periods.

- Better buying power: Secure exclusive deals and priority access from your key suppliers by always having the capital ready to proceed with an order. Become the retailer that suppliers go to first with scarce, premium, or limited-edition products because you decide quickly and pay promptly.

- Cheaper borrowing: Lenders lower your borrowing costs when you reduce their risk by providing inventory, equipment, and other assets as collateral. That means you pay less interest, freeing up capital you can invest directly back into your business.

- Greater growth potential: Act now to grab more market share. Prove to a lender that your model is profitable, scalable, and worth backing. Saving up for another store, a remodel, or a big marketing campaign takes months or years and means you lose ground to faster-moving competitors in the meantime.

- Stay ahead of market trends: Viral trends like TikTok makeup tutorials, Instagram fashion drops, or Pinterest homeware tips are huge sales drivers. Have the funds ready to buy the stock everyone wants, so customers choose you and not rival retailers.

Types of retail business loans

There are various types of retail business loans available to store owners. Six of the most popular are:

| Use cases | Repayment structure | How long to pay back | |

|---|---|---|---|

| Business lines of credit | Flexible, short-term expenses, and managing cash flow and unexpected costs | Revolving, payments based on how much of the credit line you’ve used | Bi-weekly or monthly |

| Business term loans | Funding short-term projects and longer-term investments | Fixed installments repaid regularly | 6 months to 25 years |

| Inventory loan | Purchasing stock in time for seasonal peaks and major sales periods | Either regular repayments or a lump sum full repayment | Expected time to sell enough stock to make repayment |

| Cash flow financing | Maintain capital reserves between sales and expenses | Flexible payments tied to daily sales | 3 to 18 months |

| Equipment financing | Buying or leasing equipment for your store(s) or other premises | Fixed instalments, option to own available with equipment loan | Expected useful life span of equipment or machinery |

| SBA loan | Major strategic projects like opening new premises or launching a private label | Fixed installment repaid regularly at favorable rates | Up to 25 years |

Business lines of credit

Business lines of credit work like a credit card. You have a:

- Limit: The maximum amount you can borrow.

- Balance: The amount you’ve borrowed after repayments.

The main advantage lines of credit have over credit cards is that their limits are often much higher, so you have more to spend on your business. You usually have between one and three years to clear your balance fully.

You can use a line of credit to launch special events or seasonal promotions. Pay for extra staff and temporary displays you need now and settle all or part of the balance when sales come in.

Lines of credit are also useful for covering promotional activities like paying for billboard space to advertise a sale. Major retailers also use large business lines of credit to smooth out supply chain costs and respond to unexpected shifts in demand.

Business term loans

With a term loan, your lender transfers an upfront lump sum into your business checking account. You then repay it in regular installments over a fixed, agreed period.

There are two main types of business term loans available to retailers:

- Short-term loans (six months to three years): Ideal for projects where you expect a quick return on your investment, like starting a pop-up shop to test demand in a different market or running a seasonal marketing campaign.

- Long-term loans (three to 25 years): Better for strategic, long-term decisions like buying commercial premises or acquiring a competitor to grow market share.

Cash flow financing

As with term loans, you get an upfront sum of capital paid into your business account with cash flow financing. Unlike a term loan, your repayments aren’t fixed, so you pay more in busier months and less in quieter ones.

For example, a plant nursery could use cash flow financing to stock up on plants and landscaping supplies in the run-up to Spring.

In the slower months up until Spring, their repayments will be smaller, giving them the financial breathing room they need. When Spring does arrive, the stock is there, ready for customers to buy, sales go up, the loan gets repaid faster, and the nursery banks a healthy margin.

Business owners who work with National Business Capital request cash flow financing more than any other product.

Inventory loans

An inventory loan uses your inventory as collateral to give you working capital for any purpose. If you have a significant amount of stagnant inventory, inventory loans are a decent option to increase your access to capital. In most cases, the lender won’t cover 100% of your supplier invoice, so you’ll need to contribute the rest.

You can take out inventory loans as short-term loans or business lines of credit. The lender will set your repayment window based on how long they think it should realistically take you to sell enough stock to pay off the loan in full.

Equipment financing

If you need equipment and machinery for your retail store, consider equipment financing.

There are two types of equipment financing:

- Equipment purchase: Ideal for items you expect to use over the long term, like retail display fixtures, security systems, and HVAC installations. You’ll own the asset outright at the end of the term and may be able to claim depreciation to reduce your tax bill. (Check with your accountant for the current rules.)

- Equipment leasing: Better for equipment that goes out of date quickly and loses value, like digital signage and interactive kiosks. You never own the equipment, but upgrading is easier and you don’t have the hassle of reselling older kit at the end.

SBA loans

SBA loans and lines of credit are suitable for longer-term projects like:

- Building a warehouse and distribution network to get stock into your chain of stores

- Launching a private label that delivers you much higher profit margins than third-party labels

- Opening a flagship store in a high-traffic shopping area

SBA loans are popular because they offer lower interest rates and more favorable retail lending terms than standard bank or credit union loans. This is because the U.S. Small Business Administration (SBA) guarantees them, reducing a lender’s risk of loss.

Best uses for retail business loans

We’ve covered the many benefits retail finance offers that help grow your store and run your business better.

Put your retail loan to work with these ten powerful use cases to unlock the potential in your business:

- Bulk purchasing discounts: Place bigger orders with your supplier and pay them upfront. They’ll reward you with a meaningful discount so you make more on each sale.

- Seasonal preparedness: Stock up with summer dresses and sandals in Summer and backpacks and pencil cases for the back-to-school rush. Make sure you’ve got the products customers are looking for when demand peaks.

- Hiring new staff: Make your target audience feel valued and boost repeat visits by employing more sales associates to bring down checkout waiting times and product specialists to help customers find the right combination of items for their needs.

- Seize opportunities: Be the first to buy clearance and discontinued stock from your suppliers so you boost your profit margins and become the buyer they turn to first with special offers.

- Expand your product lines: Target bigger spenders by stocking eco-friendly products for buyers who prize sustainability or boutique brands for clients who value exclusivity. Find new ways to get more customers through your doors.

- Store remodeling: Invest in an improved store layout with the latest displays and interactive terminals to become a destination retail venue and increase the time customers spend in-store.

- Store expansion: Take the building next door or the floor upstairs so you have extra space to hold more stock on site, display more products on the sales floor, and serve more customers at the till.

- Team up with influencers: Retailers and influencers often share the same audience. Partner up with the influencers your target audience admires to spotlight products their followers want and give them a reason to visit your store.

- Online expansion: Reach customers day and night, across the country with a new or improved e-commerce site that lets people buy from you whenever it suits them.

- Customer loyalty programs: Develop and launch an app-based loyalty scheme for your customers that rewards loyal customers and encourages more frequent purchases.

Apply for retail business loans with National Business Capital

Get the flexibility you need to rapidly respond to industry trends, outcompete your rivals, and make sure you have the products customers want to buy from you in stock. Find the right business loan for your retail store at the best possible rate and on the most favorable terms.

National Business Capital has secured over $2.5B+ in funding. We’re the market leader in $100,000 and $5M fundings.

We built our success in becoming the go-to long-term funding partner for retailers who want to scale. National Business Capital will be here at every stage of your growth story, unlocking the funding you need every time to get to the next level. Tell us about your business, what you want to achieve, and we’ll explain exactly how we can help. Start your application today, and let’s get you funded.

Frequently asked questions

The amount of capital an LLC can borrow depends on the lender, the financial health and credit history of the business, and the planned use of the funds. Other factors that will affect an LLC’s application include revenue, profitability, and time in business.

Many lenders will require a credit score of 670 or above. Some private credit lenders can offer financing based on factors like cash flow stability instead of a credit score.

The monthly payment for a $1M varies based on several factors, particularly the interest rate and loan term. Assuming a term length of 3 to 5 years and interest rates of 6% to 12%, a monthly payment for a $1M loan could range from $20K to $33K or more.