Considering buying a commercial property, such as a warehouse or an office space? Maybe you’re looking to renovate an existing property or refinance your real estate debt. Whichever it is – a commercial real estate loan can be a great solution.

In this article, we will discuss everything that you need to know about commercial real estate financing, including rates, terms, and requirements, and we will take a look at the most popular types of commercial real estate loans that you can apply for in 2023.

What Is a Commercial Real Estate Loan?

A commercial real estate loan is a type of mortgage that businesses and individuals use to finance commercial spaces like offices, warehouses, or even income-producing properties. The average rates will vary across the different lenders and types of commercial real estate loans, starting from as low as 2.5% and going up to 14%+.

You can use a commercial real estate loan to purchase a property, renovate an existing location, or refinance real estate debt on a property you already own.

How Do Commercial Real Estate Loans Work?

Commercial real estate loans, also known as commercial property mortgages, work by letting individuals and business owners leverage the property to secure the loan. In other words, your lender will have a legal claim to the property until you pay off your loan. If you can’t pay back your debt obligations or default, your lender will be able to seize the property.

Securing a commercial real estate loan works similarly to other types of financing. You find a lender offering this specific product, ensure you meet their qualifications, and submit an application. If you’re approved, you’ll review the offered terms, then move forward with the offer if it fits your business and growth plan.

Just like a traditional residential mortgage, a portion of your payments on your commercial real estate loan will go towards equity in the property. You’ll also pay a portion towards interest for the lender. Over time, you’ll continue to build up equity in the property until you own it outright. Once this happens, you’ll have no other obligations to your lender.

Although commercial real estate loans work similarly to residential mortgage loans, there are some key differences that small business owners need to understand.

What Is the Difference Between a Commercial Real Estate Loan and a Residential Loan?

The main difference between a commercial real estate loan and a residential loan is the interest, which is generally higher for commercial loans. Commercial loans are also typically amortized in less time, ranging from 5 to 20 years, while the amortization period for residential loans can go up to 30 years.

| Commercial Real Estate Loan | Residential Loan |

|

|

In some cases, the amortization period on a commercial real estate loan can be longer than the term of the loan. Commercial loans also feature loan-to-value ratios within the 70% to 80% range, which is typically significantly lower than loan-to-value ratios on consumer mortgage loans.

What Is the Difference Between Commercial Real Estate Loans for Individuals v.s Entities?

Residential mortgages are most often made to individuals, while commercial real estate loans are typically made to business entities. This includes corporations, developers, limited partnerships, funds, and more. For many of these entities, their sole purpose may be to own and manage commercial real estate.

If you own or operate an entity interested in taking out a commercial real estate loan, know that lenders may require you and other owners to personally guarantee the loan. This is common if you haven’t been in business long or if your business doesn’t have the financial track record to qualify.

Sometimes, this type of guarantee may not be required, and the property itself will be the only means of recovery in the event of loan default. In this case, the commercial real estate loan is called a non-recourse loan. This means the lender has no other options to recover the funds in case of default aside from the property.

What Is the Meaning of Loan-To-Value Ratio (LTV)?

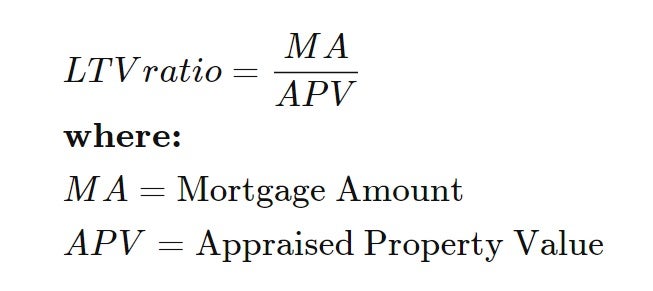

A loan-to-value ratio (LTV) is a figure that measures the value of the loan against the value of the property. Loan-to-value ratios are used in both consumer mortgages and commercial real estate loans. However, they tend to be higher in the former.

A good LTV ratio in commercial real estate falls into the 70% to 80% range. This means you’ll need to have at least a 20% to 30% percent down payment ready before approaching a lender.

Lenders calculate an LTV by dividing the amount of the loan by either the property’s appraised value or its purchase price – whichever is less. Ideally, you want a lower LTV as much as possible to show lenders that you have significant equity invested in the property, allowing you to appear less risky.

What Are the Main Types of Commercial Real Estate Loans?

There are 4 main types of commercial real estate loans that businesses can choose from, including:

| Type of Financing | Description |

| Term Loans | Term loans are what most people think of when they picture a business loan or any type of loan, for that matter. They provide a lump sum of capital you’ll repay over regular installments.

Term loans for commercial real estate financing have long repayment periods, typically up to 5 years or more. These loans also feature an amortization period that can sometimes be longer than the term of the loan. Funding amounts and interest rates can vary depending on the specific property you’re looking to finance, the amount of capital you have for a down payment, and your own financial criteria. |

| Small Business Administration (SBA) Loans | Small Business Administration (SBA) loans are government-backed. In other words, the government agrees to cover a portion of your outstanding balance in case you default. This gives lenders an extra layer of security – which translates to lower interest rates on your end.

SBA loans are ideal for financing commercial real estate because they feature low-interest rates and lengthy terms. Although SBA loans can be used to cover just about any type of business expense, they are especially common for real estate financing. Real estate investors are not eligible for SBA loans. To qualify for SBA funding, your business will have to meet a number of requirements, such as the SBA’s size standards. You’ll also have to meet the following criteria:

There are two main SBA loan programs that would allow you to secure commercial real estate financing. The first one is the SBA 7(a) loan, and the second one is the SBA 504 loan. |

| Business Line of Credit | One of the most common types of commercial real estate loans are business lines of credit. They’re a flexible financing option that is often compared to business credit cards, although lines of credit feature higher funding amounts and lower interest rates.

A business line of credit, especially one that is “revolving”, allows you to use and reuse borrowed capital. You’ll be granted a set credit limit, which you’ll be able to borrow from as needs arise. There’s no pressure to start using the funds right away, and you’ll only have to pay interest on what you borrow. As you pay off your balance, funds will become available to use again and again. The only downside is that business lines of credit don’t have a set repayment schedule, and interest rates can be higher than traditional term loans. Nevertheless, their inherent flexibility helps make up for these drawbacks. Business lines of credit are ideal when you don’t know the exact costs of a certain project or renovation. They can also be used to fund other types of business expenses, such as operating costs. |

| Bridge Loans | Bridge loans are a kind of short-term financing solution that provides an influx of cash until borrowers secure a more permanent type of financing. They’re frequently used by businesses and homeowners that need funds to purchase a property but are also waiting on another property to sell.

Bridge loans can help you cover cash flow gaps during times when financing is needed but not yet available. They’re also frequently used when a company has to repay one loan but hasn’t received the new, permanent loan yet. Bridge loans have short repayment terms, typically up to one year or less. They are not a long-term funding solution, such as a term loan or SBA loan. Instead, bridge loans are meant to mitigate cash flow gaps until a long-term solution comes into play or the immediate issue passes. You can use a bridge loan to cover the costs of purchasing a property as you wait for another property to sell or for another type of capital influx to kick in. This one of the common types of commercial real estate loans can also be used to smooth over the refinancing process as you wait for funds from your new loan to deposit. |

Commercial Real Estate Loans – Fees and Interest Rates

The typical interest rate for commercial real estate loans ranges between 5% and 11%, although the exact amount can vary depending on your own qualifications and the type of lender you work with. Like consumer mortgages, they typically come with fees that add to the total cost of the loan. These include appraisal, legal, loan application, and loan origination fees – among others.

Interest rates on commercial loans are also typically higher than mortgages or consumer residential loans.

You will also need to account for a down payment. Keep in mind that putting a larger amount of capital towards your down payment can help you secure lower interest rates and a lower monthly payment – all other factors being equal.

Relevant Fees

Most residential mortgages allow for early repayment. However, this isn’t the case for commercial real estate loans. Many commercial real estate loans come with restrictions on prepayment, also called prepayment fees. These are designed to preserve the lender’s yield on your loan.

Prepayment fees come into effect when you try and pay off the entire loan before its maturity date. If your contract allows for prepayment fees, you expect them to take either of the following forms.

- Prepayment Penalty: This type of prepayment penalty is typically the standard. It is calculated by multiplying the current outstanding balance by a specified prepayment penalty.

- Interest Guarantee: This arraignment entitles the lender to a specified amount of interest, even if the loan is paid off early.

- Lockout Period: The borrower is prohibited from paying off the loan before a specified period, such as the first five years.

In some cases, you may be able to get out of a real estate loan early through a process known as defeasance. This allows you to exchange U.S. Treasury-backed securities as a substitution for the loan’s original collateral.

In order to qualify, the securities must generate enough income to cover the remaining principal and interest on the loan. Nevertheless, lenders may still be able to charge penalties and fees for defeasance.

How Do You Qualify for a Commercial Real Estate Loan?

To qualify for a commercial real estate loan, be prepared to show the lender your business financials, personal/business credit scores, and financial history, as well as a down payment of at least 20% of the property’s value.

Different lenders will have different requirements for commercial real estate loans. If you’re applying for a commercial real estate loan at a bank, you should expect to have good credit, at least two years of business history, and a minimum of $250,000 in annual revenue.

Despite the differences among various lenders, solid credit, a high down payment, and a low loan-to-value ratio will almost always help you secure lower interest rates no matter what type of lender you work with.

It’s always best to be on the prepared side before you approach a lender. At a glance, here’s what you should expect to provide:

- Business financials, including balance sheets, bank statements, tax returns, profit and loss statements, debt to equity ratio, cash flow history and projections, and debt schedule

- Down payment of at least 20% or more of the property’s value

- Personal and business credit scores

- Legal documents, including business licenses and registrations

- Financial history, including bankruptcy or liens

Keep in mind that a higher down payment will help keep both your interest rates and your monthly payments low.

Steps to Take Before Applying for a Commercial Real Estate Loan

You shouldn’t enter the process blindly; There are a few pre-application questions that you should ask yourself, including:

- Am I looking to buy land, renovate an existing property, or purchase a new property?

- How much debt can my business safely take on?

- Do I have a solid understanding of all the costs associated with my plan?

- How long of a repayment period do I need?

- Do I have all the relevant documentation for the lender I’m applying with?

Depending on your financing needs and your criteria, you may choose to work with either a bank or an online lender.

Know that banks tend to have the strictest requirements and the slowest application processing times. However, they also offer favorable rates and can be a good fit if you qualify and you’re willing to wait. On the other hand, online lenders can be more flexible. They’re also much faster to work with and more efficient.

Some online lenders may be able to offer you commercial real estate loans even if you have bad credit. However, you’ll likely have to pay above-market rates in this case. Depending on your situation, you may want to consider holding off on financing until you build up your credit.

How to Get a Commercial Real Estate Loan

If you’re unsure of where to start looking for a commercial real estate loan or which type of lender to work with, it helps to use National Business Capital, a leading online business financing marketplace.

National automatically connects you with over 75 different lenders hours after applying. You’ll be able to browse multiple different personalized financing options to select the best fit. Plus, you’ll have an expert Business Financing Advisor at your side at each step of the way. Learn more about the financing solutions you could qualify for here.