Subordinated Debt

Access non-dilutive capital from market leaders in $100K to $10MM transactions without real estate or collateral.

Qualifying for Subordinated Financing

1+ Year in Business

$1M+ in Annual Revenue

What Is Subordinated Debt?

How Does Subordinated Debenture Work?

Subordinate vs. Senior Lenders

When to Consider Sub Debt Financing

How National Can Help M&A and Private Equity Groups

How National Can Help ABL & Factoring

Highlights of Subordinated Loans With National

What Do You Need to Apply?

What Is Subordinated Debt?

What Is Subordinated Debt?

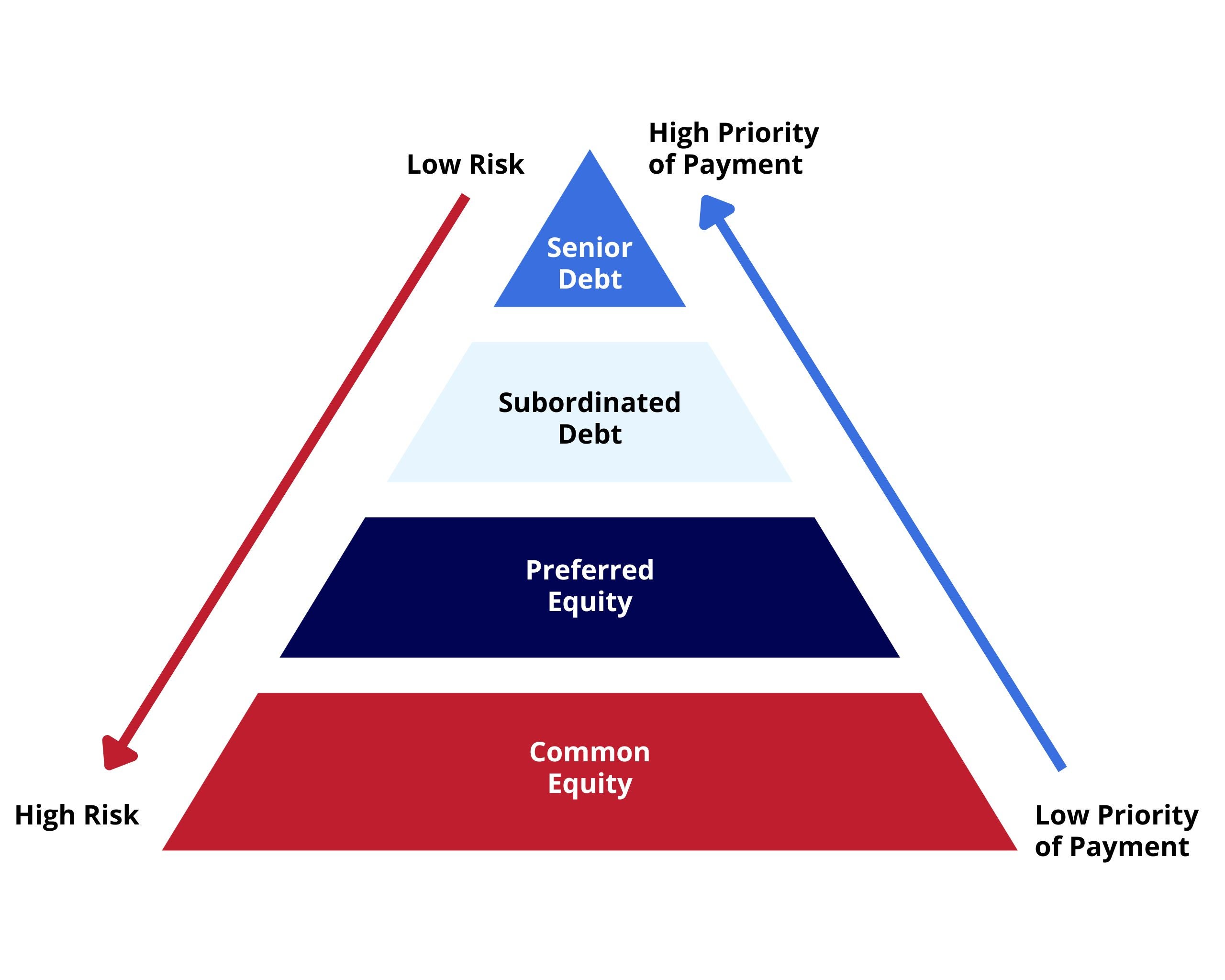

Subordinate debt is second-tier debt. The subordinate lender has a second lien position, whereas the senior lender retains the right to the first lien position.

The first position has the right to remain whole, meaning that they’re entitled to repayment before the second-tier lender.

Senior lenders are typically asset-based, while subordinated lenders can be any type of financial institution. Whether you’re a business owner, a private equity group, or a senior lender, subordinated debt financing is a powerful tool for accessing the capital necessary to complete transactions alongside a senior lender or to grow without having to pay off your senior lender.

How Does Subordinated Debenture Work?

How Does Subordinated Debenture Work?

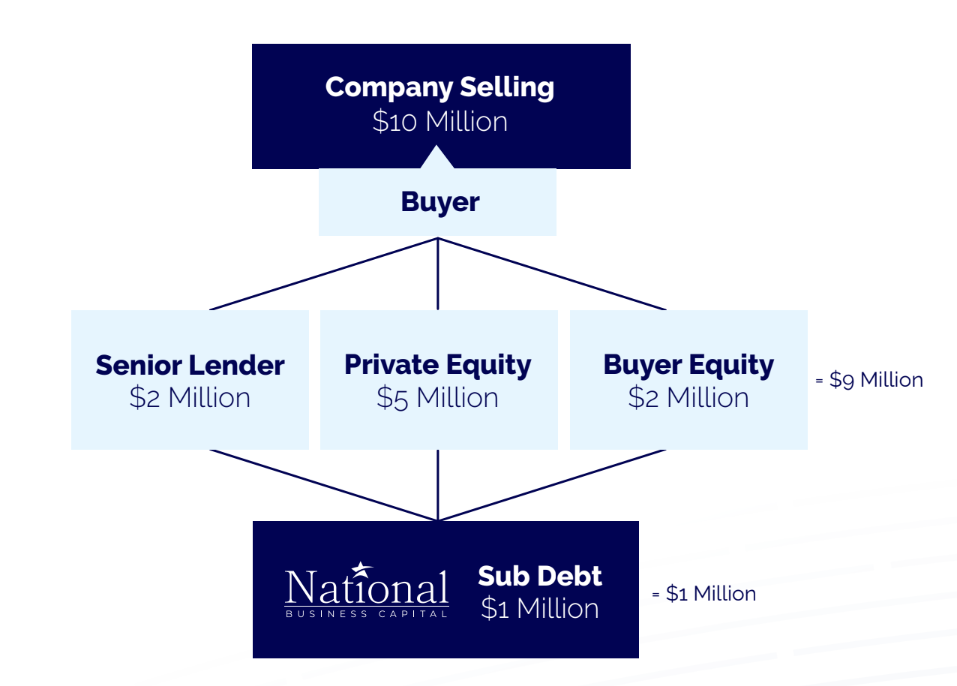

Subordinate lenders are called upon to provide additional capital for continued growth when a senior lender can’t extend more credit, or a capital gap is delaying the completion of a transaction.

In most cases, there’s a gap between how much capital the business needs to accomplish its goals and what they have on hand. This can result from numerous situations, like a senior lender or private equity firm being unwilling to offer additional funding, but the reasons are basically all the same – there’s a need for capital that the senior lender or private equity firm cannot fulfill, but the subordinate lender can.

Once the transaction is funded, the senior retains the right to first position, and the second lien position applies to the subordinated lender for the sub debt.

Subordinate vs. Senior Lenders

Subordinate vs. Senior Lenders

The difference between subordinated and senior lenders is their lien position. Senior lenders have the right to remain whole, meaning they have the first lien position.

Subordinated lenders fall into the second lien position and aren’t repaid until the senior lender is “made whole” in a default situation.

Senior lenders are typically asset-based, whereas subordinate lenders can be any financial institution. Subordinated lenders enter the transactions, not leveraging the company’s assets, and provide second-lien subordinated debt.

Businesses, senior lenders, and private equity groups can utilize subordinated debt to help push transactions across the finish line.

When to Consider Sub Debt Financing

When to Consider Sub Debt Financing

Sub debt is a powerful tool for entrepreneurs who are on the verge of completing large investments but don’t have every dollar they need to get the deal across the finish line.

This can happen for a variety of reasons, including shortfalls in collateral, insufficient buyer equity, and senior lenders being unwilling to offer additional capital to the business. Regardless of the reason, the business needs additional capital to complete its goals.

Here are a few situations where you should consider subordinate financing /sub debt:

- There is a need for an overadvance or more capital, but the senior lender is unwilling to provide additional capital.

- The business doesn’t have qualifying A/R, real estate, inventory, or other collateral to leverage.

- You’re trying to take on a new credit facility, and there is a gap.

- You’re trying to move senior financing off your balance sheet that’s no longer in the formula, or you popped a covenant.

How National Can Help M&A and Private Equity Groups

How National Can Help M&A and Private Equity Groups

Not only can we fuel successful transactions, but we can also help your client secure capital after the deal funds.

National Business Capital is a no-equity, non-mezzanine debt option.

The speed, simplicity, and power of our process make us uniquely capable of offering subordinated debt and ensuring transactions move across the finish line as swiftly and efficiently as possible.

How National Can Help ABL & Factoring

How National Can Help ABL & Factoring

Asset-based lenders and factoring companies can use subordinate debt as a method of managing their balance sheets.

Here are a few examples of when these lenders would call upon a subordinate debt lender.

- You’re trying to take on a new facility, but there’s a capital gap between the new facility amount and what’s owed to the senior lender. Using subordinated debt, your client can cover the capital gap, and you can take on the facility by gaining the first lien position.

- A client needs capital in excess of their current facility, but the senior lender is unwilling to provide the client with additional capital. The client can leverage subordinated debt to obtain their requested over advance, while the senior lender retains the right to first lien position.

- You have a client who is no longer in the formula. You notify the client of the change, but they don’t have the capital to cover their existing facility. Instead of taking a loss or unwanted risk, subordinated debt can bridge the gap to move the client off your books and satisfy all parties.

- If a prospective client applies for financing but has a first position lien against their assets, you can secure subordinated debt to repay the senior lender and move their facility onto your balance sheet.

Highlights of Subordinated Loans With National

Highlights of Subordinated Loans With National

National Business Capital is a market leader in $100K to $10MM transactions. If you need subordinate debt financing, there’s no better team than the expert Business Finance Advisors at National Business Capital.

- Approval Amount Based on Business Cash Flow

- No Personal Guarantee

- No Equity

- No Warrants

- No Covenants

What Do You Need to Apply?

What Do You Need to Apply?

National Business Capital makes subordinate debt financing easy by combining our 75+ lender marketplace and expert team to create a time-saving machine for entrepreneurs searching for the right lender.

To secure sub debt financing with National, you’ll need:

- Our Digital Application

- Prior Year’s Financials

- YTD Financials

- Prior Year’s Business Tax Return

- 6 Months of Business Bank Statements

Capital Without Compromise

Terms that allow you or your clients to Grow to Greatness.

Loan Size

$100K to $10MM

Terms

Up to 24 Months

Rates

Starting at 15%

Offer Sub Debt to Your Network

Partner with National and offer more business financing solutions to your clients.

Become a PartnerApply for Sub Debt

Own a business or looking to acquire one? Leverage sub debt and set your plans into motion.

Apply NowLearn More About National

Explore the team and process that's secured $2+ billion in financing.

Learn More$2+ Billion Financed

Since 2007, National Business Capital has accelerated business growth nationwide

Subordinated Debt FAQs

What Are Subordinated Loans?

A subordinated loan, also known as subordinated debt, junior debt, or junior security, is a form of borrowing where repayment is prioritized after the settlement of all primary loans, assuming there are sufficient remaining funds. In contrast, primary loans are classified as senior or unsubordinated debt, indicating their higher priority in repayment over subordinated loans.

Can Subordinated Debt Be Considered Equity?

Subordinated debt is a form of debt financing, meaning there is no equity transaction between the borrower and the subordinate lender. The financing doesn’t dilute stockholder value.

What Is Senior Debt and Subordinated Debt?

Senior debt describes the funds the tier 1 lender provides in the transaction. The senior lender usually enters the equation before the subordinate lender, and the senior lender’s debt is paid before the subordinated debt in a default situation.

The main difference between the two is the priority in which each lender is repaid during a default or liquidation event. Debt with a higher priority over other forms of debt is always considered the “senior debt” in that scenario.

What Is Subordinated Debt on a Balance Sheet?

Debt is listed as a liability on any balance sheet. The order is as follows:

- Current liabilities

- Senior debt

- Subordinated debt

Subordinated funds won’t decrease the business’s equity, so there’s no dilution of ownership.

What Are the Types of Subordinated Debt?

Subordinated debt is broken down into various types, ranked in order of repayment priority: high-yield bonds are at the top, followed by mezzanine debt (both with and without warrants), Payment in Kind (PIK) notes, vendor notes, and other debt obligations. A subordination scale can also depict this hierarchy, where high-yield bonds are the least subordinated, and vendor notes have the highest subordination.

Mezzanine debt is a hybrid form of financing that sits between secured senior debt and company equity in the capital structure. It’s subordinate to senior debt, entailing more risk but offering greater potential returns. Mezzanine financing often blends debt and equity characteristics with regular interest payments and an option to convert into equity under certain conditions.

Asset-backed securities frequently feature subordinated tranches, which rank lower in priority compared to senior tranches. These securities are financial instruments supported by asset pools, like loans, leases, credit card debts, royalties, or receivables. Tranching these assets divides risks and characteristics, attracting a wider investor base due to differentiated risk profiles.

Why Do Companies Use Subordinated Debt?

Subordinated debt offers an avenue to expand capital facilities without refinancing or taking out a new loan entirely. Since it’s subordinated, it won’t interfere with collateralized assets or senior facilities.

It allows for overadvances when senior lenders are unwilling to do so. For ABL and factorers, it offers a fast and efficient way to cover clients’ capital gaps and manage balance sheets.

Although subordinated debt often comes with higher interest rates, the benefits often outweigh the cost. Given the current interest rate environment, subordinated debt often presents a comparatively affordable option for capital funding.

Is Mezzanine Debt the Same as Subordinated Debt?

The predominant form of mezzanine debt is unsecured, subordinated debt, making them fundamentally similar in nature. However, the principal distinction lies in the fact that mezzanine debt typically involves debt paired with equity participation, a feature not commonly associated with subordinated debt.

Mezzanine debt can contain covenants, warrants, and other stipulations that can suddenly surprise business owners with a loss of ownership. For this reason, it’s recommended to explore alternative options to mezz debt before finalizing a contract.

Offer Sub Debt

If you are an advisor, senior lender, M&A, or PE Group, help more clients with sub debt financing options.