Q1 2022 Small Business Growth Index

National’s quarterly report on small business-related economic trends. This report covers small business trends and findings for Q1 2022.

Executive Summary

The National Business Capital Small Business Index Growth Report is a quarterly report on small business-related economic trends. This report covers small business trends and findings for Q1 2022. Research was conducted utilizing open-source intelligence, public databases, and sources such as the Small Businesses Administration, NAICS Association, and U.S. Census Bureau, among other sources.

Insights from Joe Camberato, CEO of National Business Capital

Small Business Insights & Trends

Small Business Optimism & Uncertainty Index

Business Loans in 2022 - Q1

Unemployment by State - Q1 2022

Number of Firms by Industry

Total Amount of Small Businesses

Sources

Insights from Joe Camberato, CEO of National Business Capital

Insights from Joe Camberato, CEO of National Business Capital

“It’s time for business owners to be aware of what’s going on and make conscious decisions to prepare for the coming months.” — Joe Camberato, CEO of National Business Capital

At National Business Capital, we’re hearing constant and consistent talks about a recession. In all likelihood, this incoming recession will be very different from industry to industry, unlike the widespread downturn that characterized the 2008 financial crisis. While it’s important to be aware of what’s happening in the macro sense, you should also have a solid understanding of the micro perspective: you, your business, and what’s happening in your community. You might need to make changes in your operation, whereas the business owner down the block won’t have to because of the industry they operate within. Regardless, one of the biggest things that make business owners successful is the ability to anticipate where their business is going to be.

The higher rates haven’t necessarily trickled out yet; There’s more on the horizon. We’ll begin to feel the impact as we move forward, and we’ll almost certainly see a further increase in rates. Fewer businesses are interested in loans, but some of the most successful CEOs and entrepreneurs are beginning to solidify their financing relationships to prepare for the unexpected. They’re preparing for the next 6 to 12 months: “What happens if there is a downturn?” “What type of capital will I need?” “Where can I make cuts to save revenue?” Rather than be reactive, these successful individuals are taking a proactive approach in case of a sudden economic change to be able to move and adjust quickly.

Consumers are accustomed to and expecting further price hikes. If you’re experiencing price hikes, ensure your ROIs and margins are in check. Don’t be fearful of losing customers by raising prices; You need to make the decisions that keep your business profitable. You should adjust your prices accordingly in the short term to make sure your business is prepared for the long term.

I’ve always said, “The best time to get financing is when you don’t need it.” It’s crucial for businesses to have their financing relationships in order before anything changes, especially without the support of PPP and EIDL loans. Additionally, it’s important to have a financing relationship with both a bank lender and a non-traditional lender to ensure you have options at your disposal if you need to secure capital. You don’t want to seek out financing in the middle of an economic downturn or a downturn in your business; You want to have it behind you in case you need it. Remember: the business with the most capital in a downturn has the highest probability of making it through and, more importantly, has the best chance of thriving and outpacing its competition when they begin to tighten up.

Small Business Insights & Trends

Small Business Sentiment

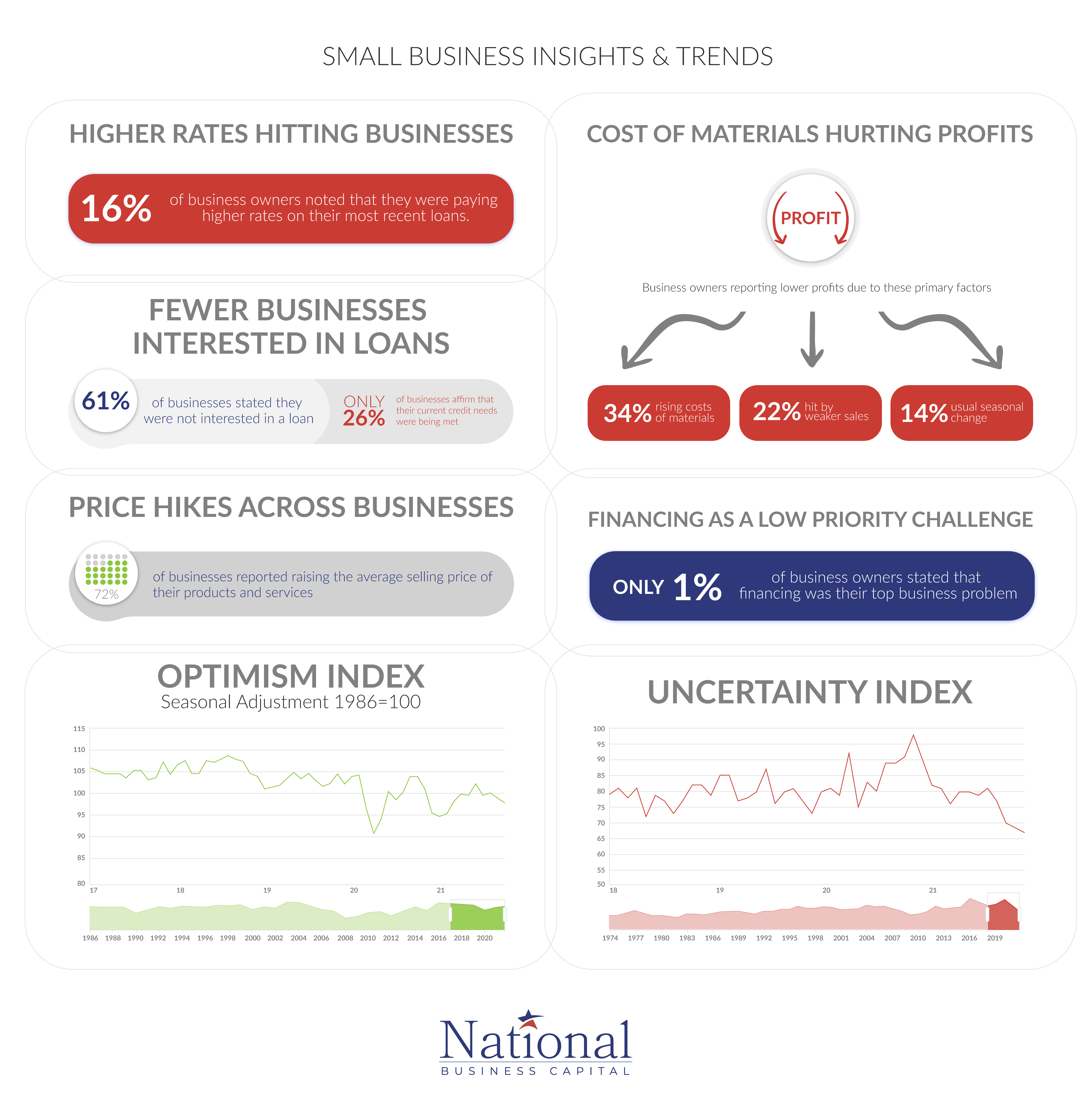

Higher Rates Hitting Businesses

With inflation concerns mounting, the Fed has made cooling the economy one of its top priorities. Interest rates effectively rose in March 2022 for the first time in over three years. More rate hikes are expected throughout 2022 – yet businesses are already feeling the squeeze. By the end of the first quarter of 2022, 16% of business owners noted that they were paying higher rates on their most recent loans. (1)

Fewer Businesses Interested in Loans

Higher rates have dampened demand for small business loans. This past quarter, 61% of businesses stated they were not interested in a loan, representing a 3% increase compared to the end of 2021. Nevertheless, only 26% of businesses affirm that their current credit needs were being met. (1)

Price Hikes Across Businesses

As a result of mounting inflation rates and lagging supply chain delays, businesses are finding their costs on the upswing. Many have been forced to raise prices in response. By the end of the first quarter of 2022, 72% of businesses reported raising the average selling price of their products and services. (1)

Cost of Materials Hurting Profits

One of the most impactful ways rising inflation is being felt is through the costs of materials. It’s becoming increasingly expensive for businesses to buy the products and raw materials they need to operate. Some fortunate players have been able to transfer additional costs over to their customers. However, this is not anyways the case.

Businesses are often the first to take a hit when the cost of materials rises – especially in the short run. Some may be unable to transfer the higher costs over to consumers, while others may see their sales dampen as a result of higher prices.

Out of all the business owners reporting lower profits, 34% cited rising costs of materials as the main factor. Another 22% stated they were hit by weaker sales, while 14% cited the usual seasonal change as the primary reason. (1)

Financing As a Low Priority Challenge

Business financing is becoming more expensive and slightly harder to obtain. Still, this doesn’t pose a serious challenge to small business owners, especially since financing is not a major priority for most. By the end of the first quarter, only 1% of business owners stated that financing was their top business problem.

This is likely due to the robust business financing climate in the previous years. Many business owners were able to secure financing at record low-interest rates in 2021 and 2020. It’s possible the benefits are still being felt up until now.

Small Business Optimism & Uncertainty Index

Small Business Optimism & Uncertainty Index

Optimism

Inflationary pressures are the number one concern of small business owners, with weak hiring rates being yet another difficulty. Even as businesses continue to pay more and offer higher salaries, nearly half reported struggling when it came to filling job openings. (2)

These factors have significantly dampened small business optimism. Small business optimism dropped throughout the first quarter of 2022.

Uncertainty

Uncertainty refers to the inability of businesses to anticipate the outcomes of future events. High uncertainty prevents businesses from being able to accurately plan ahead or forecast scenarios. It can result in businesses operating more conservatively or putting certain plans on hold.

By looking at the NFIB’s Uncertainty Index, it’s clear that businesses are facing a rise in uncertainty levels. This is measured by their responses to six questions from the monthly Small Business Economic Trends survey – specifically on the frequency of “don’t know” and “uncertain” answers.

Business Loans in 2022 - Q1

Business Loans in 2022 - Q1

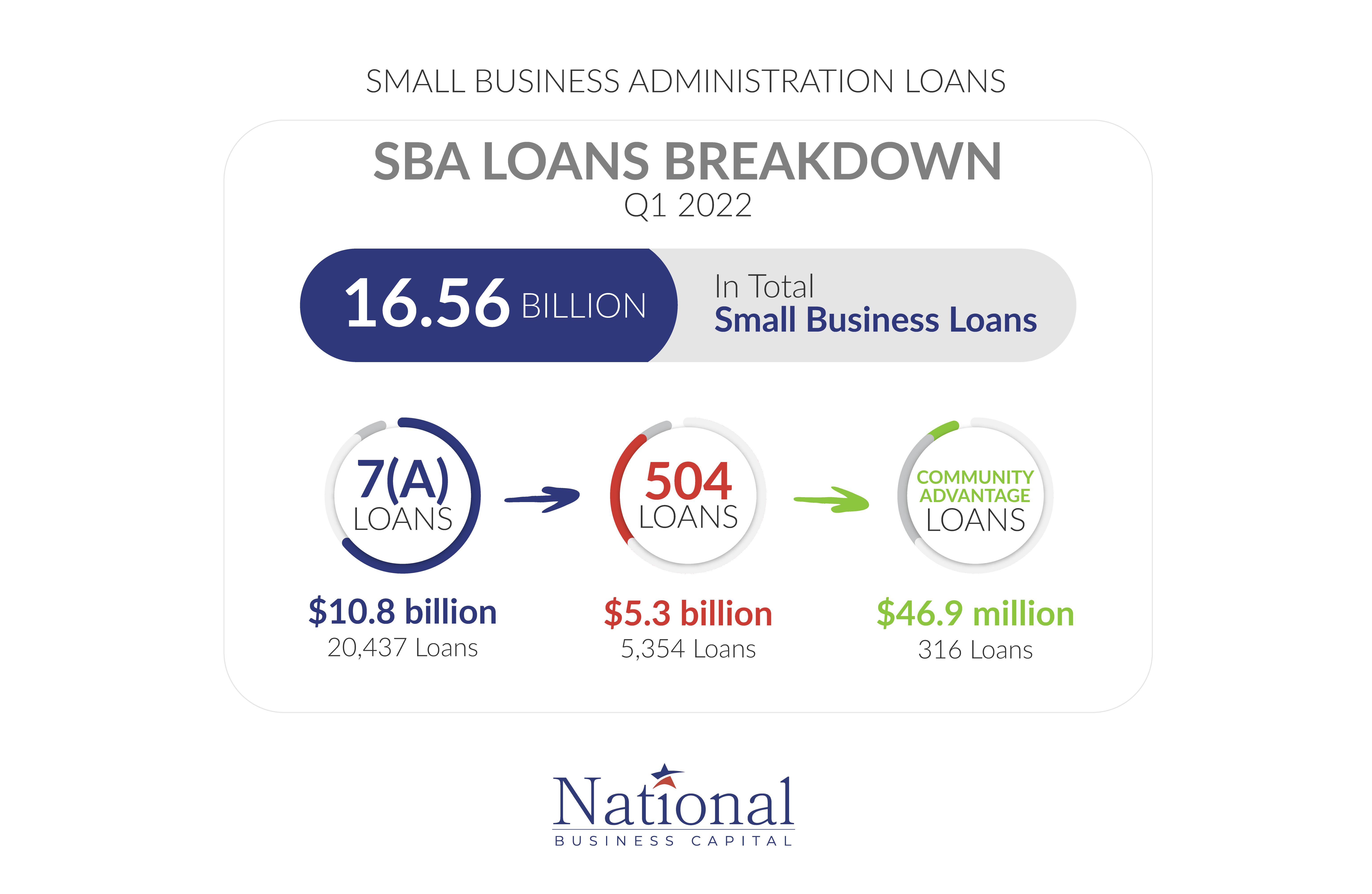

Small Business Administration (SBA) Loans

Small Business Administration (SBA) loans are one of the top financing choices for small businesses. They carry unique benefits such as low-interest rates, high funding amounts, long repayment terms, and inherent flexibility.

Businesses must show good credit, two years of business history, and meet the SBA’s size standards in order to qualify for SBA funding. Throughout the first quarter of 2022, a total of 26,107 SBA loans were approved.

The majority of loans issued were SBA 7(a) loans (20,437), followed by 504 loans (5,354) and Community Advantage (316).

SBA 7(a) loans

Sba 7(a) loans are a popular SBA financing product. They are ideal for financing real estate purchases, equipment purchases, short and long-term working capital needs, refinancing business debt, expansionary plans, buying materials, and more.

At the end of the first quarter of 2022, the SBA approved a total of $10.8 billion in 7(a) loans. (3)

SBA 504 loans

SBA 504 loans are another popular SBA loan type offering long-term, fixed-rate financing up to $5 million. 504 loans can be used to purchase major assets that promote business growth and job creation. At the end of the 1st quarter of 2022, the SBA approved $5.3 billion in 504 loans. (3)

Community Advantage

The SBA’s Community Advantage program provides assistance to small businesses in underserved markets, especially low to moderate-income communities. At the end of the 1st quarter of 2022, the SBA granted a total of $46.9 million in Community Advantage loans. (3)

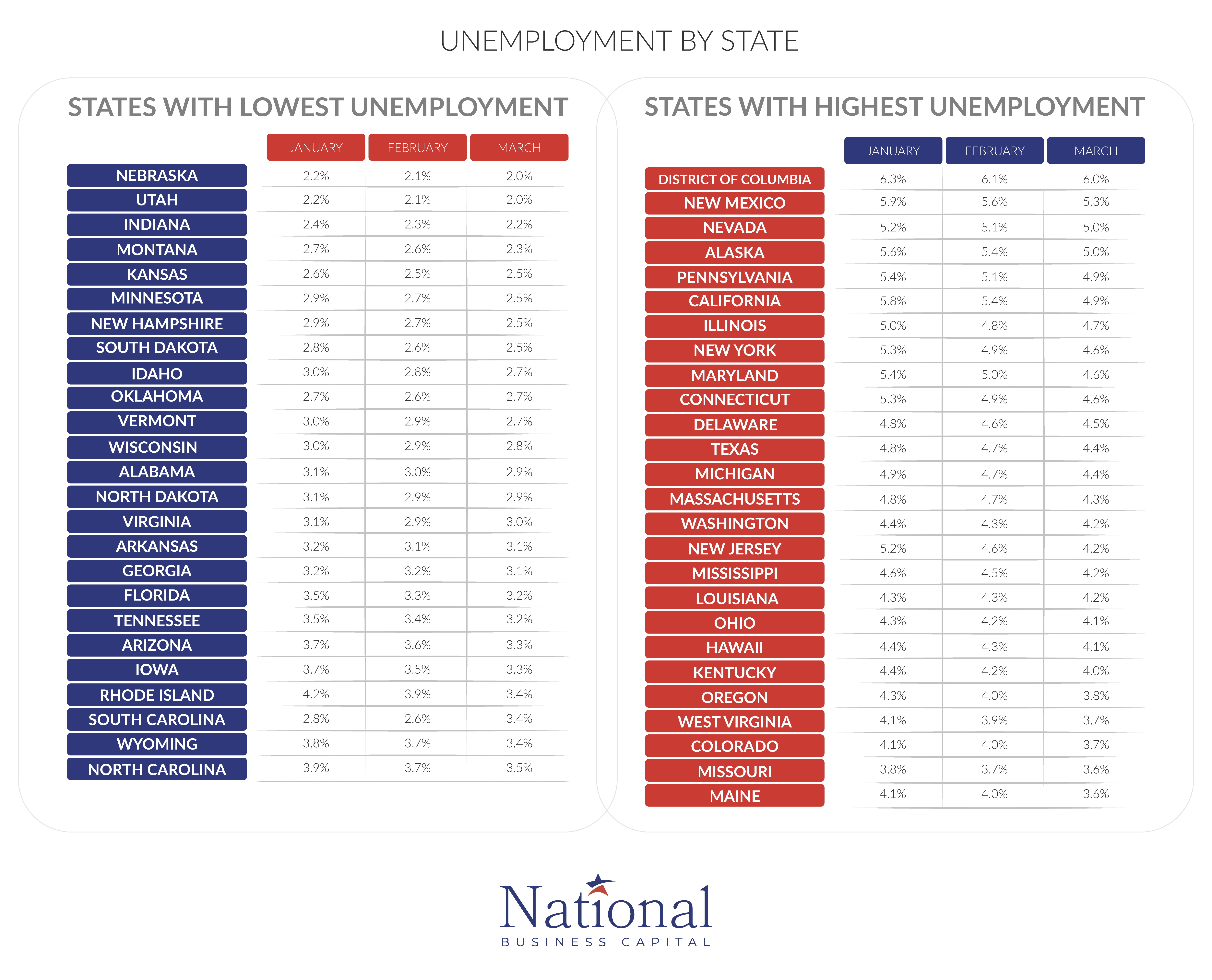

Unemployment by State - Q1 2022

Unemployment by State - Q1 2022

Unemployment rates continued to drop nationwide throughout the first quarter of 2022. By April 2022, unemployment was measured at 3.6% – nearing pre-pandemic lows. Low unemployment levels have been categorized by a struggle to find and retain workers. Even as businesses continue to offer higher salaries and other incentives, hiring remains a challenge. (4) (5)

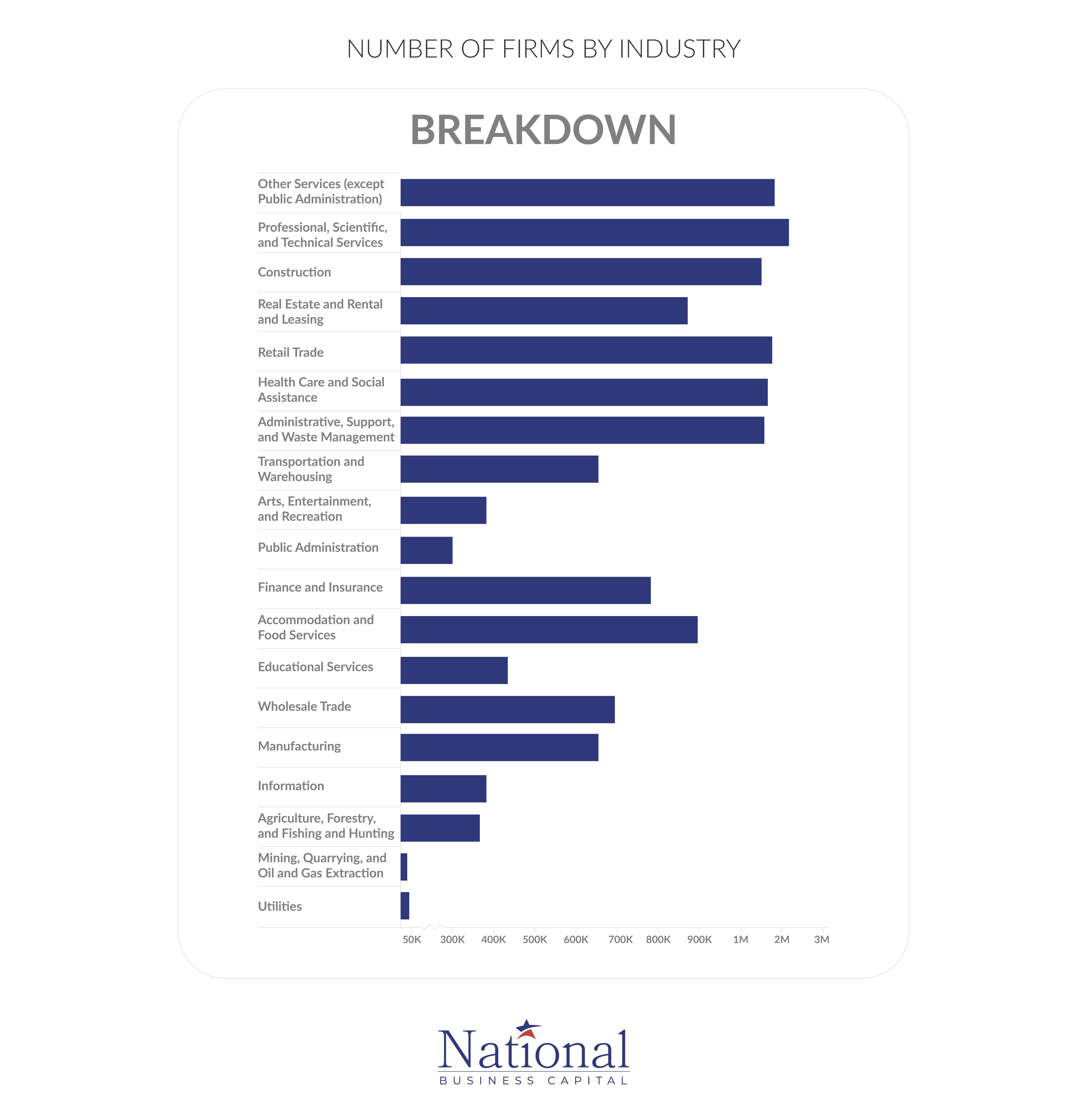

Number of Firms by Industry

Number of Firms by Industry

Professional Services, Construction, Healthcare, Waste Management, and Administrative industries continue to attract the most number of firms. (6)

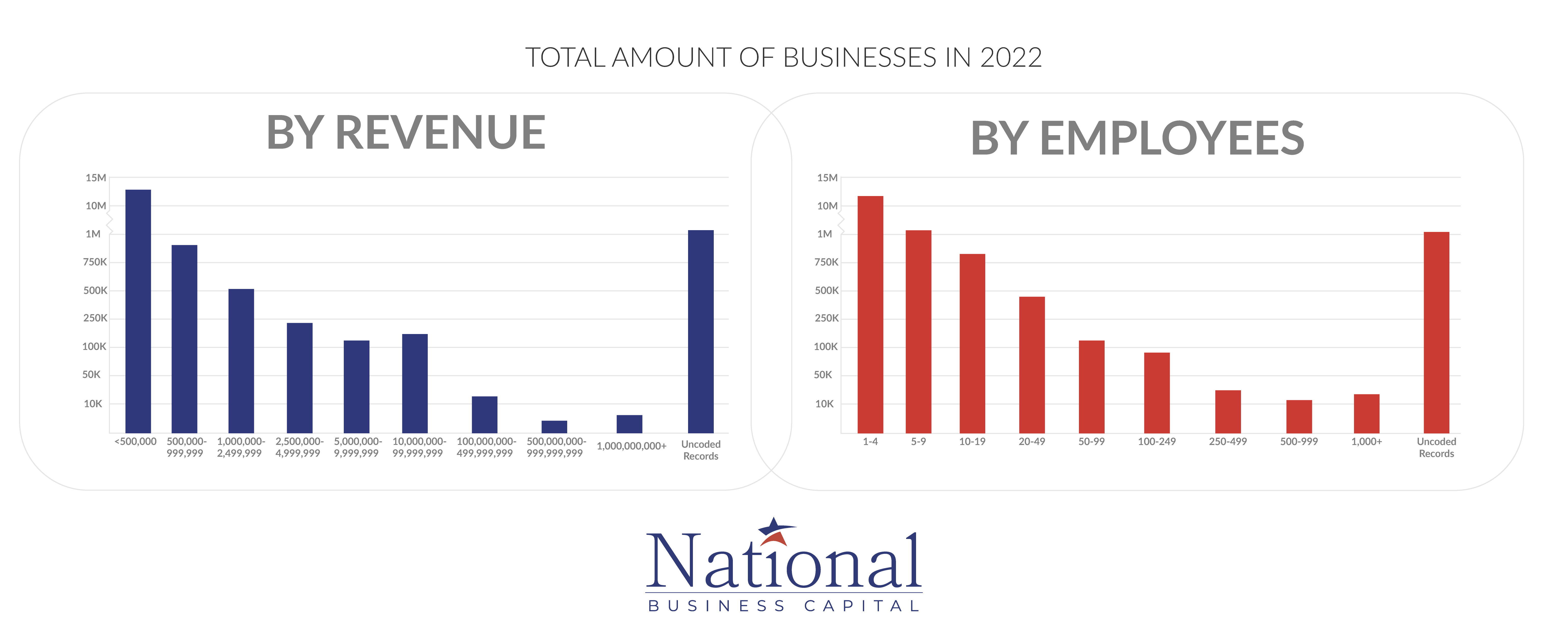

Total Amount of Small Businesses

Total Amount of Small Businesses

Despite strong economic recovery throughout 2021, it appears momentum is slowing. The US economy shrank by 1.5% in the first quarter of 2022 compared to the first three months of 2021, and small businesses are definitely feeling the impact. Many cite inflation and hiring difficulties as major concerns for the slowdown. (7)

Despite the contraction in economic growth observed in the first quarter of 2022, the number of small businesses, particularly those with 99 or fewer employees, actually grew when compared to the last quarter of 2021.

It’s possible that the slowing economy has yet to make its full impact on the small business front. On the other hand, there’s also a possibility that businesses are weathering the storm better than anticipated. What’s certain is that the next few months will test the resiliency of small businesses, especially as the Fed continues to raise interest rates.

Sources

Sources

- https://www.nfib.com/

- https://www.usnews.com/news/economy/articles/2022-05-10/inflation-worries-drive-optimism-about-the-future-to-record-low-among-small-businesses

- Data extracted from SBA weekly lending reports https://sba.gov/

- https://www.bls.gov/web/laus/laumstrk.htm

- https://www.ncsl.org/research/labor-and-employment/state-unemployment-update.aspx

- www.naics.com

- https://www.bea.gov/

National Business Capital

Accelerate your success with frictionless financing and expert advice that breaks down the barriers to growth for every entrepreneur.

Thrive with access to a business lending marketplace that’s built for entrepreneurs, by entrepreneurs. Experience a time-saving machine that cuts approval times from months to hours. Leverage an extensive network of over 75 lenders and teams of expert financing advisors to ensure you’ll always have access to the capital that best fits your business.

Working with NBC, gain a financing partner for the future, ensuring your business has the capital it needs to seize every opportunity and grow without limits.

National Business Capital. Grow to Greatness.

Ready to See Your Options?

Go from application to approval in hours, not days, with a streamlined process that merges high-tech with human-touch for high-efficiency financing.