Q3 2022 Small Business Growth Index

NBC’s quarterly report on small business-related economic trends. This report covers small business trends and findings for Q3 2022.

Executive Summary

The National Business Capital Small Business Index Growth Report is a quarterly report on small business-related economic trends. This report covers small business trends and findings for Q3 2022. Research was conducted utilizing open-source intelligence, public databases, and sources such as the Small Businesses Administration, NAICS Association, and U.S. Census Bureau, among other sources.

“I want to start off with the words that you should really think about: ‘No one was ever hurt by being prepared.’

Inflation is still happening, and it’s still up there. The cost of goods and materials isn’t any better either—it’s still fluctuating dramatically from week to week. If you’re a business that relies on these materials or goods, you have to be on top of your expenses and make adjustments when necessary. Regardless of the services you provide or the goods you sell, you need to remain profitable and not lose your shirt. The main thing, though, is that you need to be prepared mentally and financially for what could be around the corner.

There’s so much talk of a recession, but no one truly knows what’s going to happen. That’s the reality. Either way, it’s essential to prepare yourself and your business, but more importantly, you shouldn’t get wrapped up in the news. Facebook just laid off 11,000 workers—does that matter for the typical small business? You have to be careful about what pieces of information you’re using to make your decisions. At National, we’re seeing more and more business owners stick to their growth plans despite the uncertainty.

Compared to the 2008 recession, right after I started National, the current market is more irregular. We saw specific industries take a hit during that time, like construction, restaurants, and anyone tied to homes. Right now, it’s different from state to state and industry to industry, with some industries experiencing financial pressure on a case-by-case basis. You can have two businesses in the same industry and location—one person has managed the supply chain better, taken advantage of opportunities, and is profitable, whereas the other person was slow to act, hasn’t taken advantage of opportunities, and is in a much worse position.

The economic climate affects each business owner differently, so you need to focus on where you are and what opportunities are on the table for your business. Don’t ignore them—take advantage of them. Double down, stack as much profit as you possibly can, and don’t get wrapped up in what’s happening with someone in another industry, state, or down the block. If there’s something that’s working for you, focus on it. If it makes sense, invest in it. Assuming we find ourselves in a downturn, that’s the time to make the necessary adjustments, but there’s no money to be made by being scared.

Bottom line? Put yourself into your own situation, not the news. If everything is good in your bubble, then take advantage of every opportunity that comes your way. There’s gold out there—Sometimes, it’s just harder to find. Take out your pickaxe, and start digging. If you aren’t finding it, dig harder. The people that are focused on finding opportunities are doing well, and with a quick change in perspective, you can join them.”

Small Business Insights & Trends

SMALL BUSINESS SENTIMENT

Inflation Still Seen as Biggest Risk Amongst Small Businesses

Inflation has posed one of the biggest macroeconomic concerns for businesses and consumers alike. In September 2022, the consumer price index, a key measure of inflation, jumped 8.2% from last year.

|

|

|

||

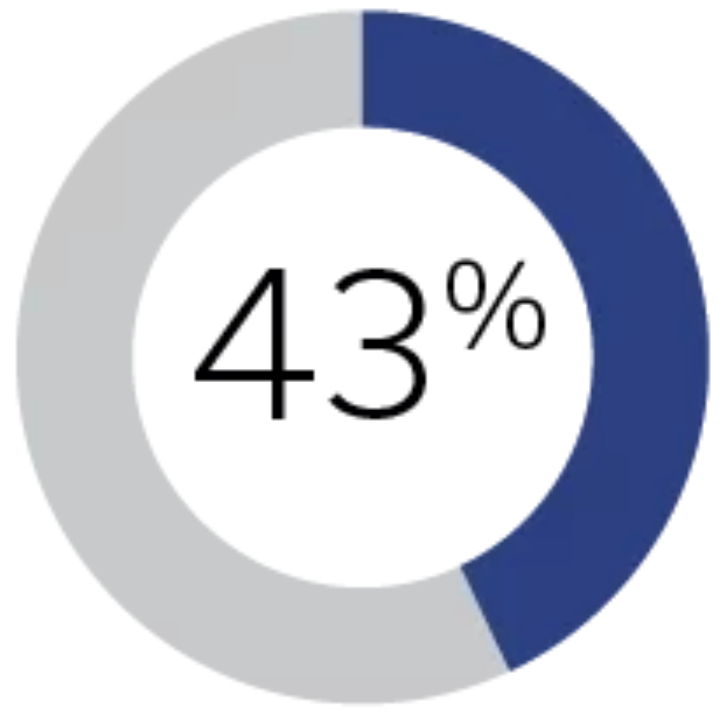

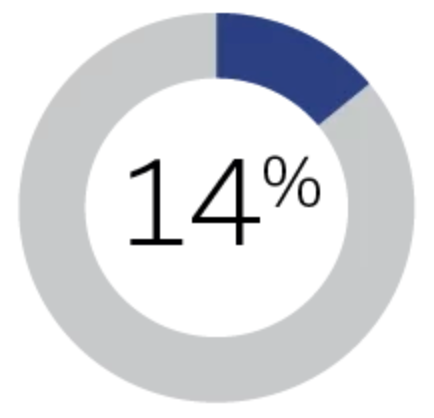

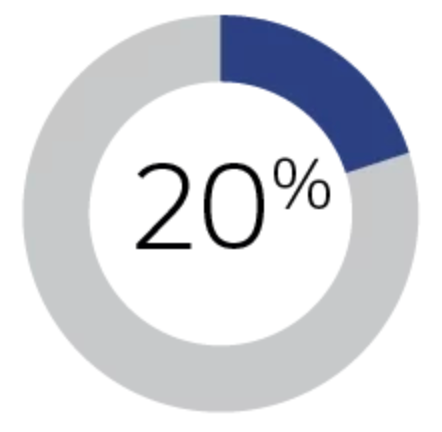

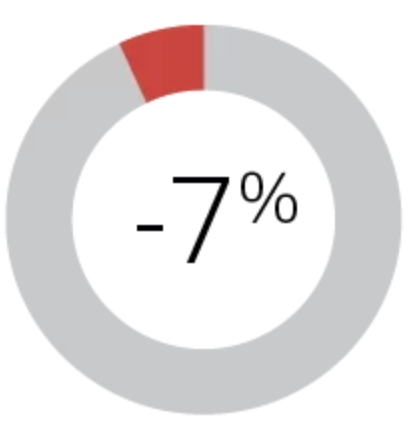

| Of small business owners cite inflation as their biggest risk, a 5% uptick from the previous quarter. | Of small businesses are expecting inflation to continue to rise in the coming months, even as the Fed plans further interest rate hikes. | Of small businesses believe inflation has reached its peak.1 | ||

Alongside rising prices, businesses are also feeling pressure to increase wages for employees to combat rising costs of living. Employee wages and salaries increased by 4.4% from September 2021 to September 2022.

The Majority of Small Businesses Owners Believe We’re in a Recession

The U.S. economy shrank for two consecutive quarters in the first half of 2022. Nevertheless, experts remained split on whether the economy was technically in a recession, as consumer demand and labor markets largely remained steady.

|

|

|||

|

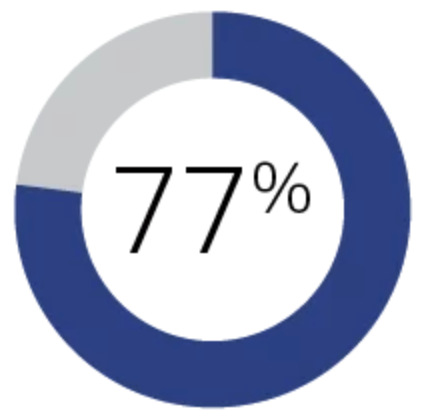

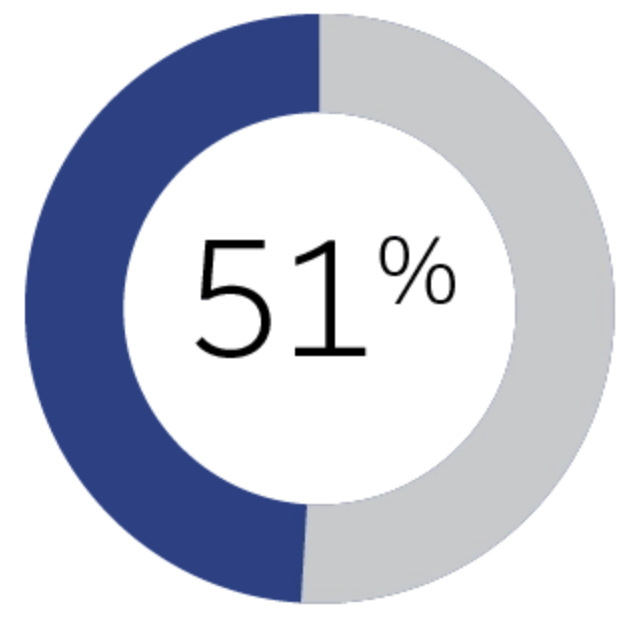

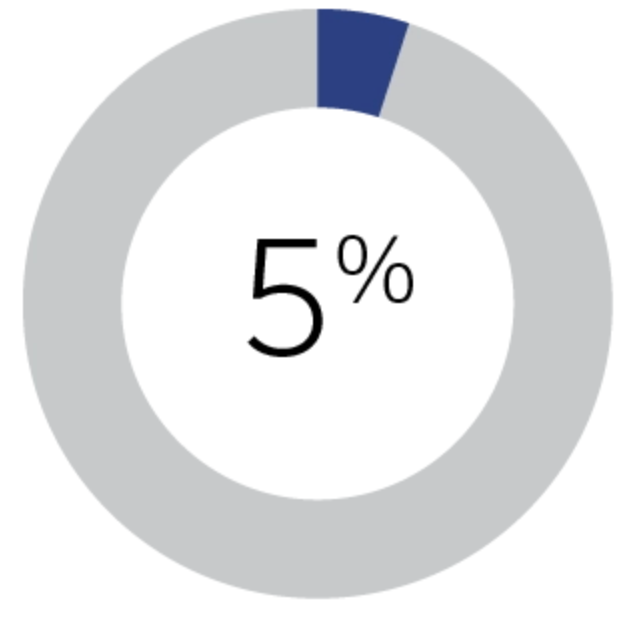

Of business owners agree with the statement that “we’re already in a recession”. |

Of business owners expect the economy to enter a recession before the end of the year.1 |

|||

The Majority of Small Businesses Owners Describe the Economy as “Poor”

GDP growth turned positive by 2.6% in Q3, which signaled some optimism. However, many businesses still remain concerned about the economy.

|

||||

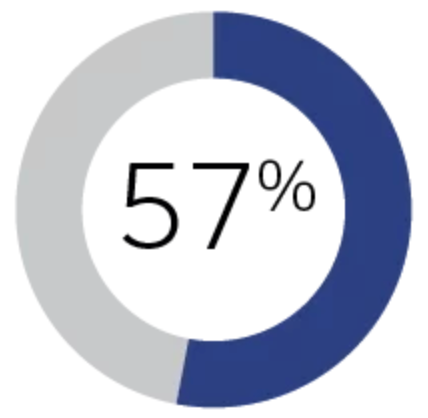

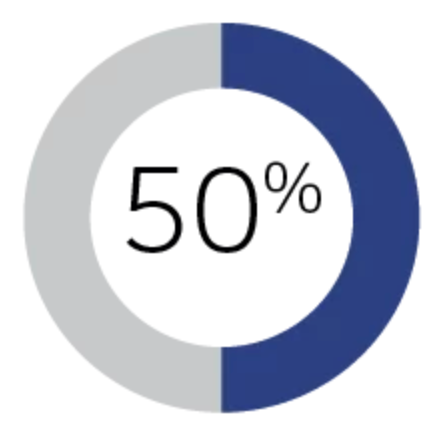

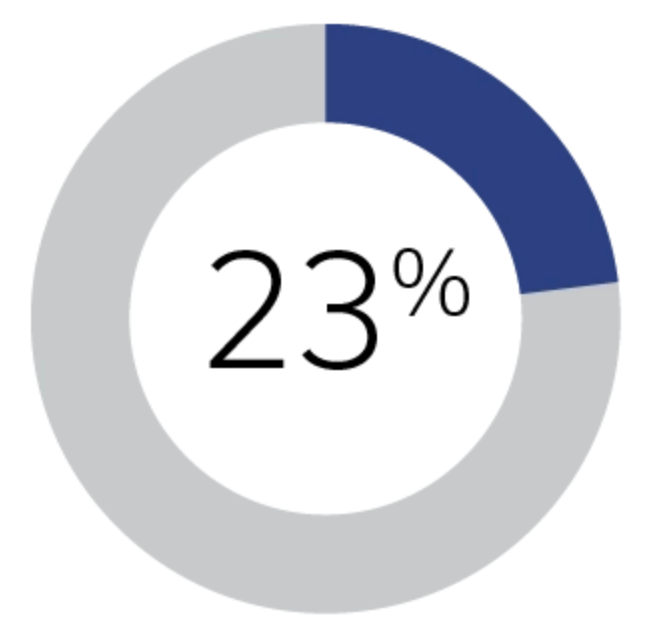

| Of surveyed small business owners describe the economy as in “poor” condition. Rising costs, tightening monetary policy, and labor shortages are all seen as risks contributing to a slowdown. | ||||

Hiring Still an Issue for Businesses

Labor shortages have posed a challenge for small businesses since the post-pandemic recovery. As economic growth slows, hiring remains a challenge.

|

|

|

||

|

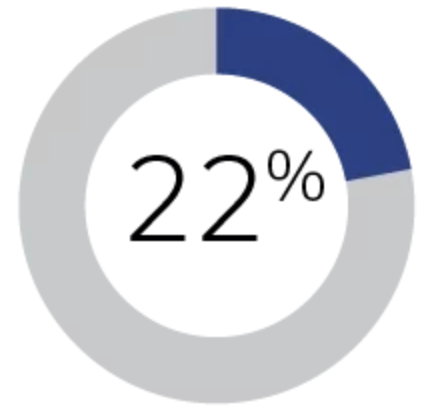

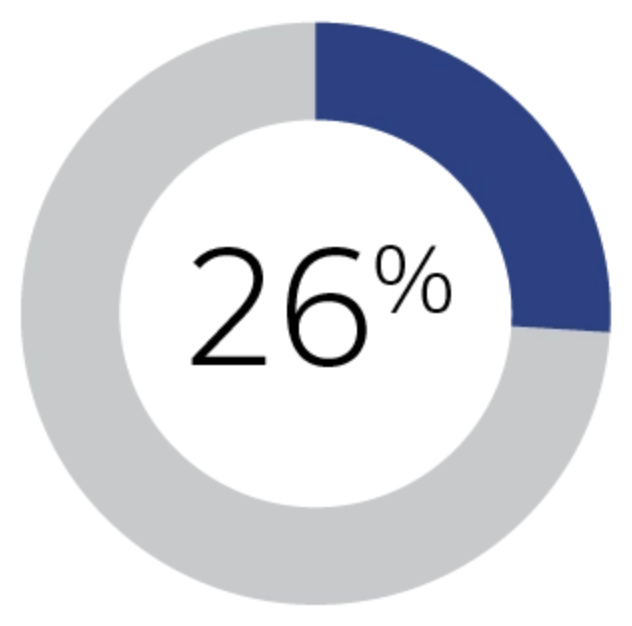

Of small businesses have seen hiring become even more difficult over the past quarter. |

Believe there’s been no change. |

Have found it easier to attract talent.1 |

||

Uncertainty Across Small Business Increases

Inflation, rising interest rates, and labor shortage challenges are making it increasingly difficult for businesses to plan for the future. The NFIB’s Uncertainty Index, which measures the inability of businesses to forecast important events, increased for the 3rd consecutive month in Q3, culminating in 73.2

When businesses are unable to reasonably anticipate the future, many have to put growth plans on hold or operate more conservatively. The inability to prepare can also expose businesses to risks arising from unforeseen events.

Vast Majority of Businesses Think it’s Not a Good Time to Expand

As business owners consider the probability of a recession in the coming months, many are pausing growth plans. Greater perceived uncertainty, difficulties hiring, and rising inflation are all causing businesses to turn their focus away from expanding.

|

||||

|

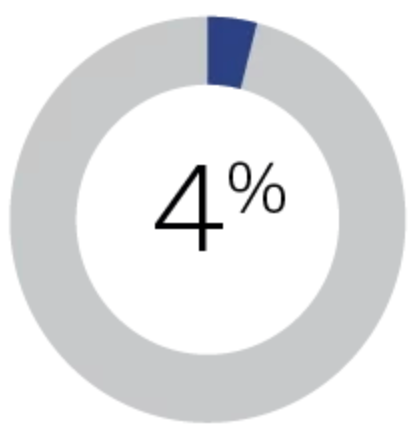

Out of all businesses surveyed, believed that it was a good time to expand within the next quarter.2 |

|

|

||

Borrowing Needs for Small Businesses Not Satisfied

Borrowing continues to become more difficult and expensive for businesses as the Fed moves forward with interest rate hikes.

|

||||

| Of small business owners found their borrowing needs were satisfied over the past 3 months—a 3% decline from the previous quarter. | ||||

Businesses Paying Higher Interest Rates

Businesses fortunate enough to have secured funding at low-interest rates have been able to enjoy a financial buffer. At this time, funding is becoming more costly across the board.

|

||||

| Of businesses stated they are paying higher interest rates compared to 3 months ago.2 | ||||

Despite the rising costs of borrowing, business owners still have options. Lines of credit are particularly helpful in this climate as they have adjustable rates and offer firms the flexibility to withdraw funds on an as-need basis.

Few Plans to Increase Inventories Over the Next Three Months

Consumer spending increased by 0.6% in September 2022 despite rising inflation and concerns around the current economic landscape. Although the jump was greater than anticipated, many businesses don’t expect the trend to last. Even in the face of solid sales, fewer businesses are expanding inventory moving forward.

|

||||

| Of surveyed businesses report plants to increase their inventory over the next 3 months— representing a 7% drop year-over-year. | ||||

Small Business Optimism Rose Slightly

Amidst a modest rebound in Q3 economic growth, business optimism increased slightly. The NFIB’s Small Business Optimism Index rose by 0.3 to 92.1 at the end of Q3. While the jump represents a slightly brighter outlook for small business owners, optimism nonetheless remains below the 48-month average of 98.2

Loans in 2022 – Q3

SMALL BUSINESS ADMINISTRATION LOANS FY22 TOTALS, AS OF Q3

Small Business Administration (SBA) loans are one of the most sought-after financing solutions. They offer business owners several benefits, including low-interest rates, high funding amounts, lengthy repayment terms, and more.

Despite their advantages, SBA loans are more difficult to acquire than other loan types. Businesses must have good credit, at least two years of business history, and meet the SBA’s size standards.

The top SBA loan programs include 7(a) loans, 504 loans, and Community Advantage Loans. By the end of Q3, the SBA approved a total of 57,650 loans for the year.3

SBA 7(a) Loans

Sba 7(a) loans are a popular financing product featuring large funding amounts of up to $5 million and terms as long as 25 years. SBA 7(a) loans are used for a large variety of business purposes including real estate purchases, working capital needs, and other growth-oriented investments.

By the end of Q3, the SBA approved a total of 47,679 7(a) loans amounting to $25.7 billion for the fiscal year.

504 Loans

SBA 504 loans are typically used to purchase major assets that promote business growth. These long-term, fixed-rate loans of up to $5 million can be used to fund real estate, equipment, and even franchise purchases.

By the end of Q3, the SBA approved a total of 9,254 504 loans amounting to $9.2 billion for the fiscal year.3

Community Advantage

The SBA’s Community Advantage program provides funding to small businesses in traditionally undeserved regions, especially low to moderate-income and minority communities.

By the end of Q3, the SBA approved a total of 717 Community Advantage loans amounting to $114 million for the fiscal year.3

Unemployment by State

Unemployment rates have remained near pre-pandemic lows nationwide throughout 2022. In September 2022, unemployment was reported at 3.5%, yet businesses are still struggling to attract and retain employees.

The pandemic and generous stimulus programs that followed have played a role in dissuading employees from returning to the workplace. The rise of remote work has also given employees more options than ever before, and many are unwilling to compromise on their newfound flexibility. As labor markets tighten, many businesses are also struggling to attract talent amidst generous offers from competitors.4,5

Number of Firms by Industry

Professional services, retail trade, healthcare, administrative, and other service industries continue to attract the most number of firms.6

Total Amount of Businesses 2022

In Q3, the U.S. economy beat growth expectations by expanding 2.6% – following two consecutive quarters of decline and widening concerns over a looming recession. While some businesses may be on the optimistic side, the overall outlook on the economy remains dampened.

At the same time, silver linings exist. Consumer spending and unemployment continue to hold steady into Q4. Even as tight labor markets pose a challenge for businesses, consumer demand remains strong. Entrepreneurs that are quick to respond to changing market conditions and implement adaptations when necessary may still be able to find opportunities in the market.6

Business Application Trends by State

The Northeast region harbors the largest increase of new business applications – with New York, New Jersey, and Pennsylvania leading.

Due to its business-friendly climate, Florida maintained the largest uptick in new business applications in a single state nationwide, growing by 51,586, or 2% month-over-month.

Despite a number of anti-business friendly legislation introduced in recent years and high taxes, new business applications in California grew by 43,323, or 4.1% in September.

Although Texas is known for its business-friendly policies, including no corporate state tax income, business applications in the state declined by 38,135, or 4.8% month-over-month.

References

National Business Capital

Accelerate your success with frictionless financing and expert advice that breaks down the barriers to growth for every entrepreneur.

Thrive with access to a business lending marketplace that’s built for entrepreneurs, by entrepreneurs. Experience a time-saving machine that cuts approval times from months to hours. Leverage an extensive network of over 75 lenders and teams of expert financing advisors to ensure you’ll always have access to the capital that best fits your business.

Working with NBC, gain a financing partner for the future, ensuring your business has the capital it needs to seize every opportunity and grow without limits.

National Business Capital. Grow to Greatness.

Ready to See Your Options?

Go from application to approval in hours, not days, with a streamlined process that merges high-tech with human-touch for high-efficiency financing.