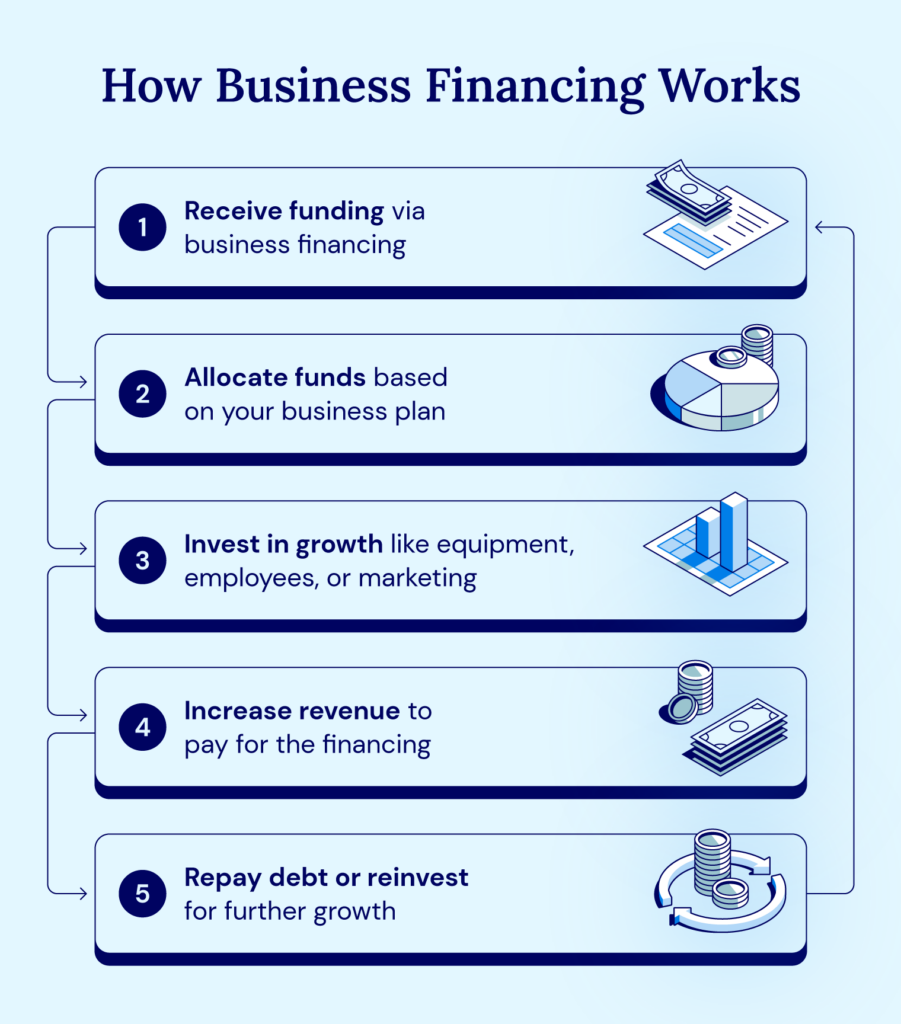

Business financing provides the money needed to start, run, and grow a business. At some point, almost every business will need a critical infusion of cash, which it often gets through business financing loans.

There are many types of business financing, including term loans, lines of credit, Small Business Administration (SBA) loans, and others. All are worth exploring because you never know which vehicle will be the best financing option for a business.

In this article, we’ll discuss the important topic of financing a business from different perspectives. We’ll define the term, discuss which situations call for additional financing, walk through the types of business financing, and give you the context needed to make the best choice for your particular circumstances.

Business Financing Definition

Business financing refers to various sources of capital that fuel the growth of businesses across all industries. For startups, small business financing often builds the foundation for success while revenue streams take shape; for established businesses, it’s often the missing ingredient required to scale operations and stay competitive.

Who Can Benefit From Business Financing?

In theory, almost anyone can benefit from business financing. This doesn’t necessarily mean you should rush out to get a loan right now, of course, but it’s worth considering how to get financing for a business if you:

- Are thinking about cash flow. All businesses need to manage their cash to meet expenses, manage debt, etc. With business financing, such as a short-term loan, you can quickly access capital to keep things moving smoothly.

- Need to replace critical equipment. Many industries rely on particular pieces of equipment to function, from backhoes and tractor-trailers to laser printers and CNC machines. This equipment will gradually wear out over time, and business finance can help pay to repair and replace whatever is broken.

- Have more demand than expected. If you’re lucky, you may release a product or service and be surprised at how much interest it garners. You can take advantage of this unexpected windfall if you can get financing for a business to scale your operations, increase your output, and handle any costs associated with shipping or running additional shifts.

- Encounter a sudden opportunity to grow. Though this is similar to the prior point, it’s worth calling out. There may be situations in which you unexpectedly have a chance to open a new location or acquire a competitor, in which case you can leverage financing to strengthen your position in a way that cash flow doesn’t support.

- Suddenly lose customers. On the flip side, you might be in a situation where a small handful of accounts drives much of your business. If one chooses to leave, business financing could provide the bridge needed to meet expenses while you close the gap.

You may never encounter these exact scenarios, but you will almost certainly encounter similar ones. If so, business financing could be what you need to survive or take the next step on the road to success.

12 Types of Business Financing

We mentioned above that there are many types of business financing, and in this section, we’ll cover some of the most important variants.

1. Debt Financing

As its name implies, debt financing means taking out a loan from an entity willing to offer you one.

You can get debt financing through sources such as:

- Loans

- Family members

- Credit cards

| Pros of Debt Financing | Cons of Debt Financing |

|

|

2. Term Loans

A term loan is one way of debt financing a small business, though it is also appropriate for enterprises of varying sizes. With a term loan, you receive a single lump sum of capital to be repaid in standard installments over time.

You can get term loans from sources such as:

- Banks

- Credit unions

- Private credit lenders

| Pros of Term Loans | Cons of Term Loans |

|

|

3. Lines of Credit

A business line of credit is a preset pool of debt financing you can access when and as needed.

There are many options for getting a line of credit, such as:

- Many major banks

- Private credit lenders

| Pros of Lines of Credit | Cons of Lines of Credit |

|

|

4. SBA Loans

One kind of debt financing specifically targeted at those interested in financing a small business is Small Business Association (SBA) loans. An SBA 7(a) loan is a popular SBA loan that can go up to $5 million; because the U.S. government at least partially covers it, it also tends to have lower interest rates.

Institutions offering SBA loans include:

- Banks

- Credit unions

- The Small Business Administration (SBA)

- Private credit lenders

- SBA-sponsored lenders

| Pros of SBA Loans | Cons of SBA Loans |

|

|

5. Equipment Financing

As you can probably guess, equipment financing is a type of business financing specifically for obtaining important equipment, such as furniture, computers, factory machines, and vehicles.

A list of funding sources for equipment financing consists of:

- Banks

- Credit unions

- Private credit lenders

| Pros of Equipment Financing | Cons of Equipment Financing |

|

|

6. Inventory Financing

Inventory financing can be a loan or a line of credit extended to companies to buy inventory, with that purchased inventory also serving as collateral.

Inventory financing is generally available through:

- Some banks

- Credit unions

- Private credit lenders

| Pros of Inventory Financing | Cons of Inventory Financing |

|

|

7. Invoice Factoring

One way of financing a small business is with invoice factoring, which involves selling a fraction of unpaid customer invoices to a ‘factoring company’ in exchange for a percentage (1%-5%) of the invoices’ total value. The factoring company will then collect the invoices, take a fee, and return the remaining value to the small business.

The list of invoice factoring sources is short because invoice factoring is a service offered only by particular, specialized companies.

| Pros of Invoice Factoring | Cons of Invoice Factoring |

|

|

8. Revenue-based Financing

Sometimes known as royalty-based financing, revenue-based financing is a method of financing a business that involves a lender offering upfront capital in exchange for a share of future gross revenue.

Revenue-based financing is available through private credit lenders that specialize in this approach. You can find these firms online if this option appeals to you.

| Pros of Revenue-based Financing | Cons of Revenue-based Financing |

|

|

9. Franchise Financing

Franchising refers to opening a business associated with an existing brand, such as Subway, Burger King, or IHOP. If you want to own a franchise, there are special franchise financing options available through the Small Business Administration that will allow you to buy equipment, bridge payroll gaps, open more locations, and cover any other business expenses. Otherwise, you could seek franchise financing through:

- Banks

- Credit unions

- Angel investors

- Private credit lenders

| Pros of Franchise Financing | Cons of Franchise Financing |

|

|

10. Working Capital Financing

Working capital financing is designed to help businesses cover day-to-day costs, not to finance equipment or expand. It is a popular option for businesses with highly cyclical or unpredictable revenue streams.

You can find working capital financing through:

- Specialized firms

- Banks

- The Small Business Administration (SBA)

- Private credit lenders

| Pros of Working Capital Financing | Cons of Working Capital Financing |

|

|

11. Equity Financing

Equity financing is a type of business financing in which some fraction of a company is traded in exchange for funds. Be aware, however, that this can come with serious downsides, described in the table below.

There are many sources of equity funding, including:

- Angel investors and venture capitalists

- Crowdfunding platforms

- Corporate partners

- Issuing an IPO to the public

| Pros of Equity Financing | Cons of Equity Financing |

|

|

12. Mezzanine Financing

Most commonly used for business expansion, mezzanine financing is meant to sit between the debt and equity ‘layers’ in your company’s financial structure. It can come in several forms, including preferred stock (convertible to equity), warrants (convertible to equity), or unsecured debt (meaning interest rates are higher).

Both preferred stock and warrants are worth watching out for as they can dilute your ownership, and many mezzanine financing contracts have ‘covenants’ restricting your ability to borrow more money or refinance your existing debts.

The sources of mezzanine financing include:

- Private equity firms

- Small business investment companies (SBICs)

| Pros of Mezzanine Financing | Cons of Mezzanine Financing |

|

|

Factors To Consider When Choosing Business Financing

At the end of the day, properly managing business financing boils down to optimizing how your business handles cash – including accounting for expenses, managing risks and exposure, and ensuring you have all the required paperwork. With that in mind, here are some important factors to track as you weigh your business financing options.

Operational Expenses

Your first and most basic task in keeping your business afloat is to meet all operational expenses, especially those related to paying your employees, purchasing raw materials or inventory, covering your bills, and so on.

Risk Management

In addition to having sufficient funds to handle everyday expenses, it’s also important to have access to extra capital to guard against emergencies or unexpected problems. There are many ways to do this, but some of the more common include a cash reserve, savings account, or business line of credit.

Long Term Goals

“You need money to make money” may be a cliche, but many of these old nuggets of wisdom stick around because they’re true. This one certainly is because you will need cash regardless of what line of business you’re in. As you think through your burn rate and investment requirements, consider how your current expenses will impact your long-term growth and plan accordingly.

Rate Structure (Fixed or Variable)

There are many types of business financing, and one important difference between them is whether the interest rate is fixed (remaining unchanged throughout the loan) or variable (which can fluctuate based on market conditions.)

Lump sum loans such as term and equipment loans are usually fixed, so if that’s what you’re in the market for, you should plan around consistent interest rates. If you want to take a chance on improving market conditions and the interest rate dropping, a variable-rate loan might make more sense.

Documentation

Finally, every business is in the paper business because, as an owner, you’ll need to keep track of many documents. These include:

- Know Your Customer (KYC) paperwork, which is required to prove your customers are legitimate

- Your business plan to help lenders assess your risk

- Financial statements showcasing the state of your company’s current finances

- Various legal documents like licenses, permits, and registrations

- Collateral documentation, which is important if you’re taking out certain kinds of secured loans

- Personal financial statements detailing what your personal finances look like

- References, or the people willing to vouch for you (this isn’t always necessary)

Benefits of Business Financing

As important as your cash flow is, it usually won’t be enough to cover everything; you may need more money to solve existing challenges and take advantage of sudden opportunities. That’s where business financing comes in, but it also brings with it many additional benefits, such as:

- Improved cash flow: Financing can help you even out revenue and bridge funding gaps.

- Growth and expansion: Most businesses need financing to help open new locations, acquire other businesses, and scale.

- Increased competitiveness: With the right financing, you can take advantage of opportunities, get new equipment, and otherwise better position yourself.

- Reduced risk: If you have access to financing, it’s less likely that a single bad quarter or setback will cause you to fail.

- More credibility: If a financial institution has deemed you worthy of receiving a substantial loan, that sends a powerful signal of creditworthiness.

- Access to expertise: Certain business financing options include experts who will help you run various aspects of your company.

- Tax benefits: Depending on the specific loans, there can be tax benefits like deductions that’ll make your business stronger.

There are many business financing products, including ones built for specific purposes (like equipment financing) and some with more general uses (like term loans.) Borrowers can tailor their approach to business financing to suit their unique needs, thus maximizing the benefits of every additional dollar.

With that in mind, let’s now turn to some avenues available for those seeking business financing.

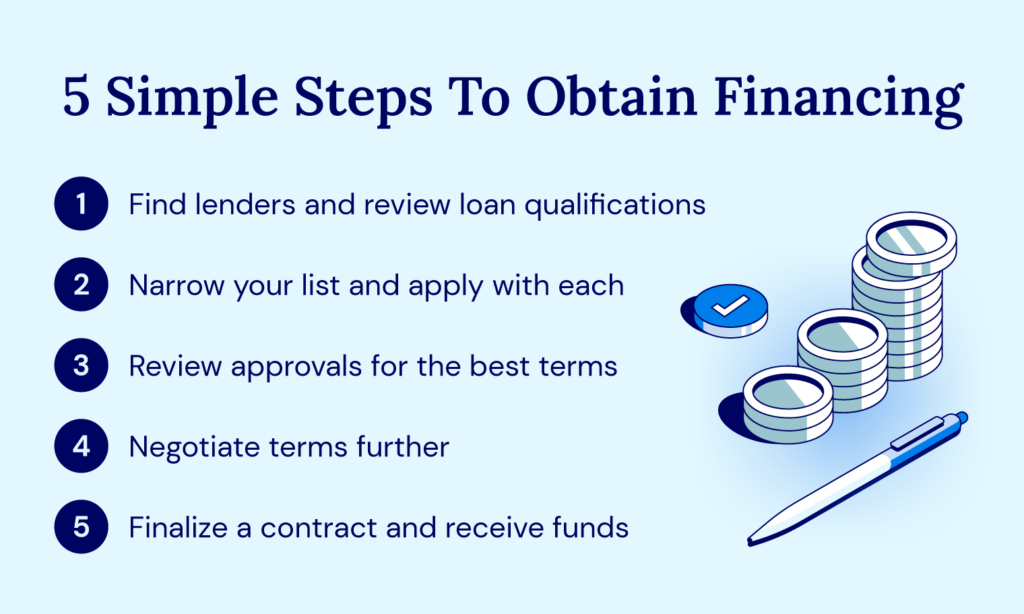

How To Obtain Business Financing

Many subtleties are involved in applying for business financing, but the basic procedure is the same whether you work with a bank, credit union, or non-bank lender.

In general, these are the steps you’ll need to take:

- Make a list of lenders

- Review the qualifications they look for

- Select the most promising lenders

- Apply to them

- Review the approvals

- Negotiate terms

- Finalize a contract

- Receive funding

Let’s flesh this out a bit. As indicated, the first step is to identify institutions that are willing to extend business financing. The standard options are banks and credit unions, of course, but you should also extend your search to include non-bank entities, such as private lenders. Each will have different loan qualifications, and it’s worth casting a wide net at this stage because you may meet one set of standards and not another. With that done, you need to apply to each lender, select the approvals that offer the best terms, use your position to negotiate even better terms (if that’s possible), and then finalize everything to receive funding.

Of the institutions that offer business financing, banks, and credit unions tend to have the strictest requirements and the most rigorous application processes. It’s not uncommon to wait weeks or even months for business financing to come through when going this route.

For their part, private lenders are usually quicker and more flexible, with business financing being approved in as little as 24 hours in some cases.

Importance of Business Financing

Business lending fuels growth in all industries. It allows startups to build their foundation while forming their revenue streams and established businesses to scale operations to stay competitive.

Without it, businesses would need to wait for their profit to cover the costs of growth. Here are a few of the many reasons that business financing is essential to U.S. commerce.

- Provides funding to start, expand, and scale operations

- Allows businesses to set plans into motion immediately

- Offers instant liquidity to streamline cash flow

- Helps support operations when experiencing a slowdown

- Creates a liquidity buffer as entrepreneurs finely tune their expenses to cover costs

Find the Best Business Financing Options With National Business Capital

If you’re wondering what type of business financing is best for you, you should work with National Business Capital, a private credit lender with a world-class advisory team, where you can compare personalized offers with expert guidance from a business advisor.

Learn more about business financing from National Business Capital by completing our application.

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.

Frequently Asked Questions

How Does a Business’s Credit History Impact Its Ability to Obtain Financing?

Your credit history captures how you’ve managed your credit accounts in the past and summarizes your “creditworthiness,” i.e., how likely you are to repay credit. For this reason, your business’s credit history is one of the most important factors a lender considers when determining whether to extend financing. Higher scores mean more favorable terms, while lower scores can prevent you from being approved altogether.