As an entrepreneur, getting your ideas off the ground can be a challenging task without proper financing. In this article, we will discuss some effective ways to get startup funding for a new business.

Some businesses might need financing in order to scale and get to the next level of their growth, while others may need it at the initial stage of their development. No matter the case, the truth is that most entrepreneurs will need to seek funding at one point or another.

Unfortunately, it’s not always easy for new businesses to get their hands on capital. You have to know where to look and how to present your company to lenders and investors. It helps to have an idea of the requirements and a basic understanding of different lending options.

Even though getting startup funding for a new business is more challenging, it’s absolutely possible. We’re going over all your options for startup business loans, including the ins and outs to this type of financing.

What are the types of startup funding for a new business?

There are two main types of startup funding for a new business – equity and debt financing. Equity startup financing is the process of selling shares in exchange for capital without incurring debt, while debt financing refers to funding options that require the borrowing of money and paying it back with interest.

Each type comes with its own advantages and disadvantages, and determining which one would be the best option for your organization is the first place to start when looking for startup funding for a new business.

1. Equity Startup Financing

As we mentioned previously, Equity startup financing involves a company selling shares in exchange for capital. This type of financing features less of a financial burden because your business won’t have any debts to repay. It’s also great if your business hasn’t built up creditworthiness yet or if you don’t have a lengthy history.

Equity financing typically involves taking on partnerships with your investors. In other words, you may be able to go to them for advice and they may be able to offer additional resources to help you meet your goals.

Despite these benefits, equity financing can come with a few drawbacks. For starters, you’ll have to share your profits with your investors who own a stake in your company. Equity financing can also force you to relinquish some control of your company because you are essentially giving away ownership.

If you do bring on new partners, make sure their vision and management style line up with your own. Otherwise, you risk running into potential conflicts.

It’s also important to be wary of giving away too much equity. Doing so could potentially hurt your company’s valuation or ability to secure financing in the future.

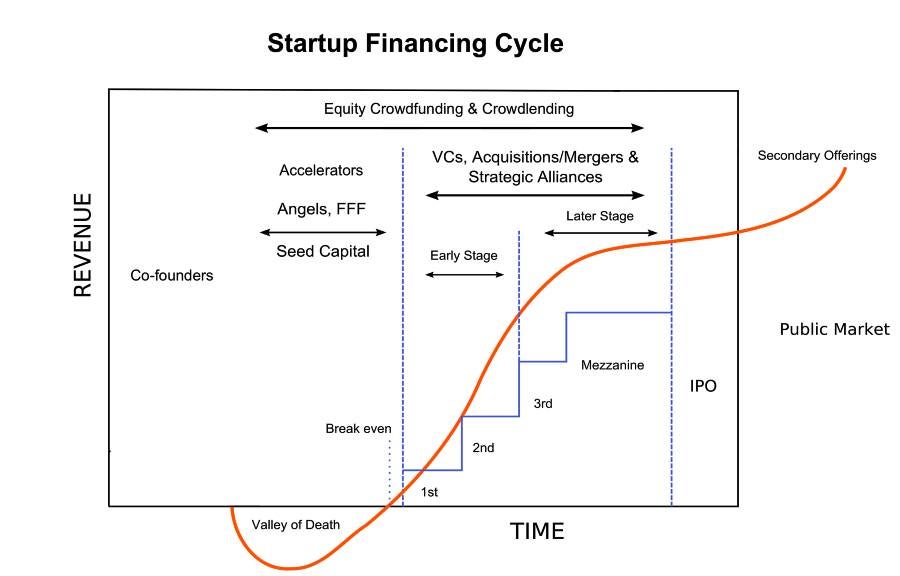

Startup Financing Cycle. Source: startupexplore.com

2. Debt Financing

When it comes to getting startup funding for a new business, there is also another option – debt financing. It involves a company borrowing money and agreeing to pay it back, with interest, over a certain period of time. Debt financing is typically a business loan, but it can also be a line of credit or another type of financing product.

The main benefit of debt financing is that it doesn’t require business owners to relinquish control of their company. Once the initial principal is paid off alongside interest, the business owner has no other obligations to the lender. Business loans can feature manageable, steady payments – allowing you to forecast your future expenses.

Plus, any interest you pay is typically tax-deductible.

For some businesses, especially startups, debt financing can be difficult to obtain. In order to evaluate each case carefully, lenders will need to review multiple business aspects such as:

- Revenue levels

- Credit score

- Business history

- Debt-to-equity ratio

However, you can expect greater leniency if you work with an online lender instead of a bank.

How can I secure startup business financing?

To secure startup business financing, the first step is to evaluate the different funding options that are typically available for companies: self-funding, investors and loans. Within these types of startup funding for a new business, you can also select from a variety of options, including startup loans, business line of credit, grants, crowdfunding, SBA microloans and more.

Nowadays, entrepreneurs have more options than ever before when it comes to securing startup business financing. Sometimes, business owners will even mix different funding solutions together in order to reach their goals. Here are some of the most popular ways to find capital.

1. Startup Loans

Loans are the first funding source most entrepreneurs think of when seeking startup funding.

If you have a fantastic credit score, a low debt-to-credit ratio, and a history of making on-time payments for all your expenses, you might be able to convince a bank to finance your startup. However, you will need a strong business plan or a proof of concept in order to demonstrate your business’s potential.

Unfortunately, banks are notorious for low approval rates, especially when it comes to startups. Even then, it could take weeks or months to find out if you’re approved, and for how much.

Online fintech lenders can be a better alternative than traditional banks when it comes to startup business loans. This is because they have higher approval rates and faster, more efficient application processes. This minimizes the work on your part, as you won’t have to perfect your business plan or sweat over projecting your profits before applying.

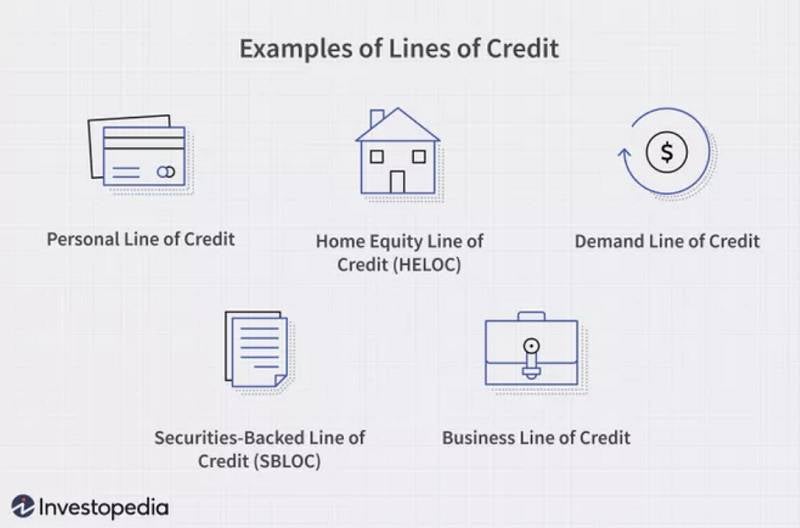

2. Business Line of Credit

Once you use up the funds from a business loan, you’ll have to apply for a new one in order to get more capital. This isn’t the case with a business line of credit.

A business line of credit, especially one that is “revolving”, allows you to seamlessly use and reuse borrowed capital so long as you continue to make payments.

It works by granting you a set credit limit, which you can borrow from as needs arise. There’s no pressure to start using the funds right away, and you only pay interest on the amount you borrow. As you pay down your balance, funds will become available to use again.

Business lines of credit are oftentimes compared to credit cards. However, although they work in a similar fashion, the former features higher funding amounts and lower interest rates. In other words, business lines of credit are ideal when you’re just starting your business and need access to flexible, ready-to-use capital on demand.

3. SBA Microloans

SBA Microloans have funding amounts up to $50,000 and are available through intermediary lenders. These intermediary lenders are nonprofit, community-based organizations that will guide you through the application process and help you secure your loan.

SBA loans are government-backed, which means the government agrees to secure your loan in case you are unable to repay it. This lowers risk for lenders, which in turn helps you secure lower interest rates and more favorable terms. For these reasons, SBA loans can be a great source of funding for small businesses, especially in comparison to traditional forms of financing.

In order to qualify for an SBA Microloan, you will need to meet the unique requirements of the intermediary in your specific region. They will make all the decisions when it comes to your application and the approval process. You can find a list of SBA-approved intermediary lenders in your area here.

4. Grants

Another way to get startup funding for your new business is through grants.

Grants are ideal because they’re essentially free money. You don’t need to pay back the funds or give up ownership when you win a grant. The downside is that grants only offer smaller funding amounts.

You can seek grants from the government or private enterprises. Grants can be difficult to hunt down and qualify for, but it could be worth the effort if you find the right fit. It helps to look for industry-specific grants or specialty grants geared toward groups like women, minorities and veterans.

You can check these articles for more information:

- Grants and Loans for Veterans and Their Families

- 7 Minority Grants for Small Businesses

- 15 Small Business Grants For Female Entrepreneurs

5. Crowdfunding

Platforms like Kickstarter and Indiegogo have opened up new ways for businesses to raise capital without the hassles of a traditional financing process.

With crowdfunding, you can raise small amounts of capital directly from many different investors to generate a larger pool of funds. Investors will typically receive stock or equity in exchange for funding your campaign. Crowdfunding is fast, straightforward, and a great way for people to get to know your startup.

In order for your crowdfunding campaign to be successful and reach its funding goal, you’ll need a compelling story to convey the “why” of your business to potential backers. Make sure to take the time to explain your business model, your products, and your place in the wider market.

Promotional work on your part is required to get the word out and compel potential investors to take the plunge.

Despite these benefits, crowdfunding does come with a few drawbacks. Most significantly, crowdfunding usually forces you to give away equity, which can create valuation problems or threaten your control over your own business.

6. Angel Investors

Other entrepreneurs who have built successful businesses are sometimes willing to invest a significant amount of money to help others get their startups off the ground. In exchange for a share in your company, you can access not only funding but also expert guidance.

Many angel investors have a history of helping startups grow. They typically have access to advanced market knowledge, industry contacts, and other resources you may not otherwise be able to get your hands on.

In exchange for all these perks, angel investors expect returns on the funding they put into your startup. Once you bring an angel investor on board, you’ll really need to focus your energy on making your business profitable.

Some angel investors may agree to a debt financing deal, but most will insist on equity. This can have its benefits, as you won’t be required to pay back funds and you’ll have a new, knowledgeable partner on board.

However, it does mean you’ll have to forfeit a portion of your company and profits. Just make sure you thoroughly consider the pros and cons before moving ahead.

7. Venture Capitalists

Venture capitalists, or venture capital firms, provide capital to startups with high growth potential in exchange for equity. They work similarly to angel investors, except that venture capitalists are typically investing another fund’s money. Plus, venture capitalists may or may not have as many resources as angel investors.

You can find venture capitalists at industry events, on LinkedIn, by networking with other professionals, and more.

Ideally, you want to find venture capitalists who share and believe in your vision. In order to get the attention of these investors, your business must stand out from the numerous others requesting funding. You’ll have to put together a stellar sales pitch and make sure your business plan is solid beforehand.

8. Friends and Family

If friends and family are on your side, they might be willing to help you reach your goals by investing in your startup. In fact, this is a common way to get startup funding for a new business. If you choose to go this route, just make sure you lay out the conditions of each offer in writing.

Is it a gift, or are you expected to pay back the amount within a given period of time? Even when you know someone well, it’s best to establish repayment schedules, like you would for a regular loan to avoid any misunderstandings.

9. Personal Savings

Believe it or not, over 90% of startups get going without the aid of outside funding. Entrepreneurs typically use their own savings to fund their business startup because it’s faster, oftentimes cheaper, and eliminates the hassle of dealing with third parties.

If you have a savings account, an investment account, or significant equity built up in your home, you may be able to tap into these resources to fund your startup. Although putting your personal savings towards your business can be risky, there are also ways to mitigate risk.

For example, you don’t need to use all your savings at once. Sometimes, mixing a portion of your money with a business loan or money from an investor can be a great way to reach your goals.

Even if you don’t have enough capital saved up to fund your startup, you still have other options. You can consider selling off possessions you don’t really need or making strategic investments to boost your savings.

You can also start your business as a small-scale side hustle while working your current job. Over time, you can grow your business until it’s successful enough to cover your full-time income – and then some.

How do I get funding for my startup in 2022?

To get funding for your startup in 2022, one of the most important steps that you will need to take is to show why your startup is worth the risk, no matter if you are applying for a business loan or selling shares of your company. Make sure that you have a detailed business plan with long-term financial projections, proven expertise within your industry, and a carefully managed personal credit score.

Lenders will want to know that your business has the potential to make money and generate a significant return. As you meet with banks, online lenders, or venture capitalists – your funding requests are more likely to be successful if you:

- Sharply define your skills in your chosen industry and position yourself as an expert

- Craft a detailed business plan with financial projections for the next 3 years

- Manage and monitor your personal credit score

- Establish a business credit file with a DUNS number

- Connect with suppliers who report to credit bureaus

- Invest in assets that can be used as collateral

- Research lender requirements, and gather the appropriate paperwork

Taking these extra steps not only makes your startup more attractive to lenders and investors but also establishes a foundation for success when getting startup funding for a new business. Your company will be strong from the outset and ready to grow as you put your startup funding to good use.

How can I qualify for a Startup Business Loan?

Although requirements may vary per lender, if you want to qualify for a startup business loan, make sure that you are ready to provide a business plan, liquidity of available assets, personal and business credit scores, legal documents, and business financials, among others.

For example, online lenders are known for being more lenient, and may not require as lengthy of a business history. Banks, on the other hand, tend to have the strictest requirements.

At a glance, you should still expect to provide the following:

- Business financials, including balance sheets, bank statements, tax returns profit and loss statements, debt to equity ratio, expense ratio, cash flow history and projections, and debt schedule

- Business plan

- Both personal and business credit scores

- Liquidity of available assets and availability of collateral

- Industry risk level and growth potential

- Legal documents, including business licenses and registrations

- Financial history, including bankruptcy or liens

Can I get small business startup loans with bad credit?

Yes, you can get small business startup loans with bad credit. However, your odds of approval will be lower. Plus, lenders will view you as more risky, and therefore charge you higher interest rates as a result.

If you’re looking to get a startup business loan with bad credit, working with online lenders or fintech companies would be your best bet. These lenders tend to offer the widest range of business funding solutions, and you may be able to find a product suitable for your situation.

If you are rejected for a startup business loan, you can still explore equity financing solutions – such as crowdfunding campaigns or angel investors. Otherwise, you may want to hold off on applying for financing until your credit score improves.

Getting startup funding for a new business

National Business Capital is an online business financing marketplace that helps all types of businesses, including startups, secure the funding they need to succeed. If you’re looking for a more efficient, all-encompassing approach to startup funding for a new business – National has solutions.

No matter what your qualifications are, National can help you get financing. There’s no minimum credit score requirement and business history requirements start at 6 months. This is ideal for startups, who are oftentimes turned away by banks because they haven’t built up enough business history or credit history. Best of all – National works fast to get your funds deposited in hours.

Start by filling out the 60-second application and an expert Business Financing Advisor will contact you from there. You’ll be matched with numerous offers from over 75 different lenders. Simply compare and pick the best fit!

Learn more about the financing options you could qualify for here.

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.